1,050% Price Hike: AT&T Sounds Alarm On Broadcom's VMware Acquisition

Table of Contents

AT&T's Concerns and the 1,050% Price Hike Claim

AT&T has voiced strong concerns about Broadcom's planned acquisition of VMware, claiming it could lead to a staggering 1,050% price increase for certain networking services. This dramatic assertion has fueled intense debate within the industry.

-

Specific Networking Services Impacted: The potential price hike primarily targets networking services reliant on Broadcom's networking chips and specific VMware software integrations crucial for data centers and cloud infrastructure. This includes vital components for network virtualization, virtual machine management, and network security.

-

Methodology Behind the 1050% Claim: While the exact methodology behind AT&T's calculation remains somewhat opaque, it's understood to be based on an extrapolation of current pricing models and projected cost increases following the merger, potentially examining specific contracts and analyzing Broadcom's historical pricing practices.

-

AT&T's Statement: AT&T's statement expressed deep concern, emphasizing the potential for monopolistic practices and the detrimental effects on competition within the industry. A spokesperson stated (paraphrased), "The proposed acquisition poses a significant threat to fair competition and could lead to exorbitant price increases for our customers, fundamentally altering the cost landscape of essential networking services."

-

Impact on AT&T's Service Pricing and Profitability: The potential price increase from Broadcom could directly impact AT&T's own service pricing and profitability. They may be forced to absorb increased costs or pass them on to their clients, potentially leading to a loss of competitiveness.

Broadcom's Response and Defense of the Acquisition

Broadcom has vigorously defended its acquisition of VMware, refuting AT&T's claims of exorbitant price increases.

-

Broadcom's Justification: Broadcom argues the acquisition will bring significant synergies and efficiencies, ultimately benefiting customers through innovation and improved product offerings. They emphasize the combined strength of their technologies.

-

Cost Savings and Efficiencies: Broadcom highlights potential cost savings and operational efficiencies resulting from the merger. They suggest that economies of scale will allow them to optimize production and distribution, potentially leading to lower long-term costs.

-

Counter-Arguments to AT&T: Broadcom disputes AT&T's 1,050% figure, arguing it is an unrealistic and unsubstantiated exaggeration. They claim their pricing strategies will remain competitive and aligned with market norms.

-

Commitment to Fair Pricing and Competition: Broadcom maintains its commitment to fair pricing and robust competition, asserting that the acquisition will foster innovation and ultimately benefit consumers.

Regulatory Scrutiny and Antitrust Concerns

The Broadcom-VMware merger faces intense regulatory scrutiny due to significant antitrust concerns.

-

Regulatory Bodies Involved: Agencies like the Federal Trade Commission (FTC) in the US and the European Commission are actively reviewing the deal, examining its potential impact on competition within the networking and virtualization markets.

-

Likelihood of Block or Modification: The likelihood of the acquisition being blocked or substantially modified remains uncertain. Regulatory bodies will weigh the potential benefits against the risk of reduced competition and increased prices.

-

Precedent Set by Previous Mergers: The outcome will be influenced by precedents set by previous large tech mergers and acquisitions, with regulators increasingly scrutinizing deals that could stifle competition.

Implications for Businesses and Consumers

The Broadcom-VMware merger has significant implications for businesses and consumers alike.

-

Increased IT Costs and Reduced Profitability: Businesses reliant on VMware and Broadcom technologies face the prospect of significantly increased IT costs, potentially impacting profitability and competitiveness.

-

Cloud Computing Costs and Infrastructure: The merger could lead to higher cloud computing costs and limitations in infrastructure choices for businesses.

-

Indirect Consumer Impacts: Increased costs for businesses could indirectly translate into higher prices for consumers across various goods and services.

-

Mitigation Strategies for Businesses: Businesses can explore alternative virtualization and networking solutions to mitigate the impact of potential price increases. This may involve a greater investment in open-source technologies or a shift towards alternative providers.

Conclusion

AT&T's alarming claim of a 1,050% price increase following the Broadcom VMware acquisition has highlighted the potential for significant upheaval in the tech market. Broadcom's response, while defending the deal, hasn't fully allayed concerns regarding market competition and pricing. Regulatory scrutiny will play a crucial role in determining the ultimate outcome. The potential impact on businesses, through increased IT costs, and on consumers, through indirect price increases, is substantial. The Broadcom VMware acquisition remains a significant development with far-reaching consequences.

Call to Action: Stay informed about the ongoing developments in the Broadcom-VMware acquisition. This deal has far-reaching consequences, impacting the pricing of crucial networking and virtualization technologies. Continue to follow the news and regulatory decisions to understand the full impact of this massive merger and its potential consequences for your business. Further research into the Broadcom VMware acquisition and its impact on pricing is crucial for all businesses involved in the tech sector.

Featured Posts

-

T Hanatos Apo Bullying I Tragiki Istoria Toy Baggeli Giakoymaki

May 20, 2025

T Hanatos Apo Bullying I Tragiki Istoria Toy Baggeli Giakoymaki

May 20, 2025 -

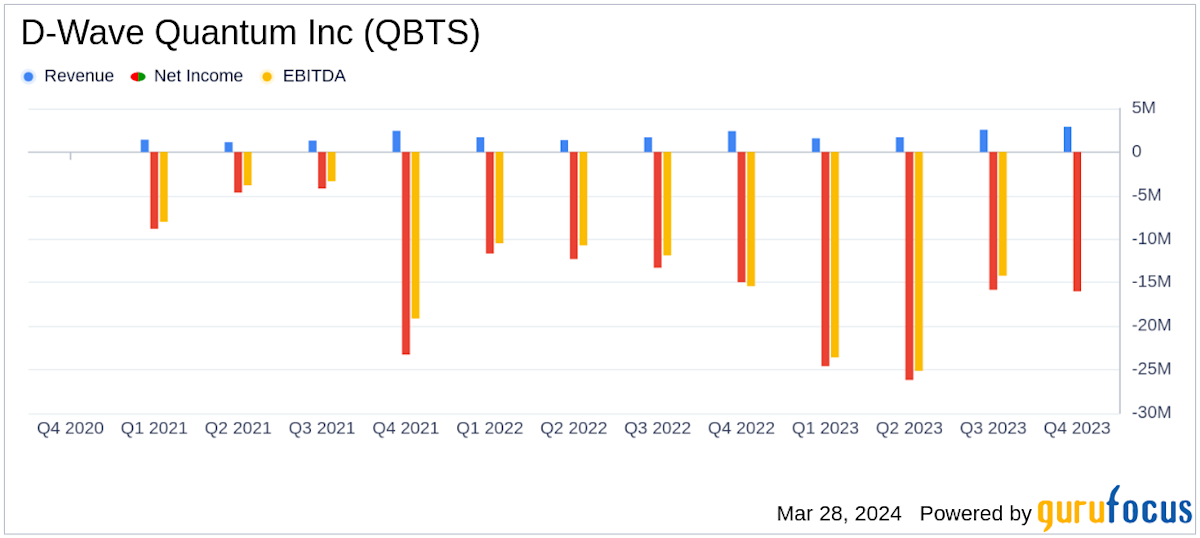

Exploring The Reasons For D Wave Quantum Qbts S Stock Market Performance This Week

May 20, 2025

Exploring The Reasons For D Wave Quantum Qbts S Stock Market Performance This Week

May 20, 2025 -

Thousands Owe Hmrc Are You One Of Them

May 20, 2025

Thousands Owe Hmrc Are You One Of Them

May 20, 2025 -

Snls 50th Season Finale Record Breaking Ratings And Highlights

May 20, 2025

Snls 50th Season Finale Record Breaking Ratings And Highlights

May 20, 2025 -

Eurovision 2025 Meet The Top 5 Contenders

May 20, 2025

Eurovision 2025 Meet The Top 5 Contenders

May 20, 2025