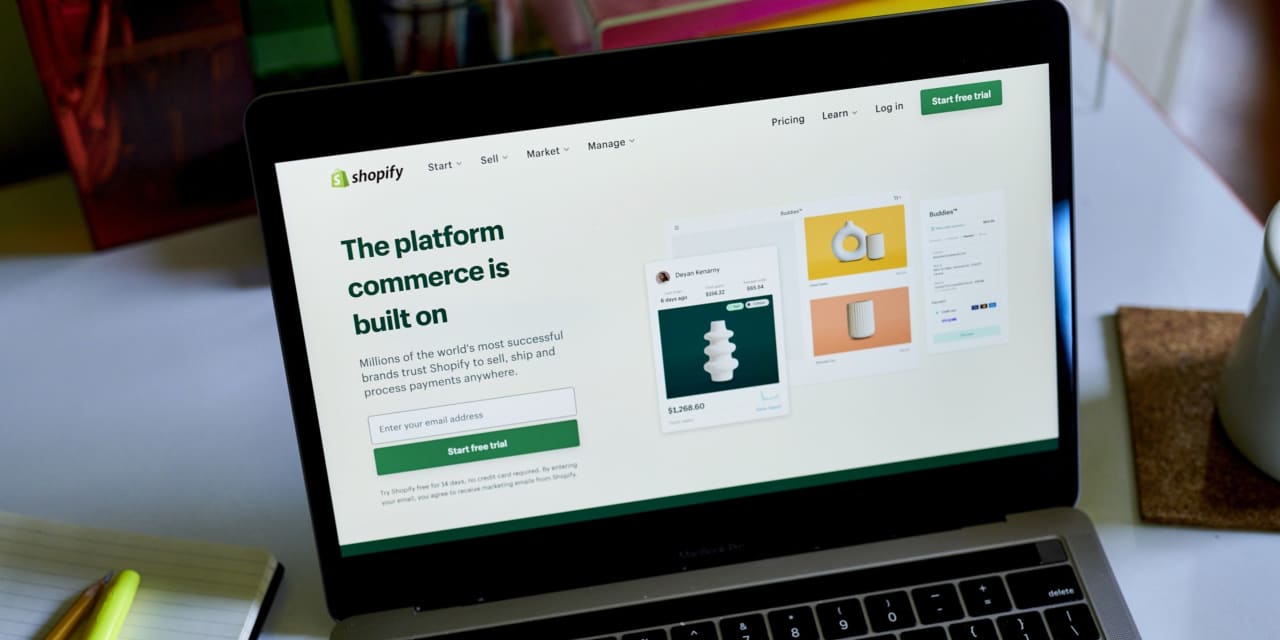

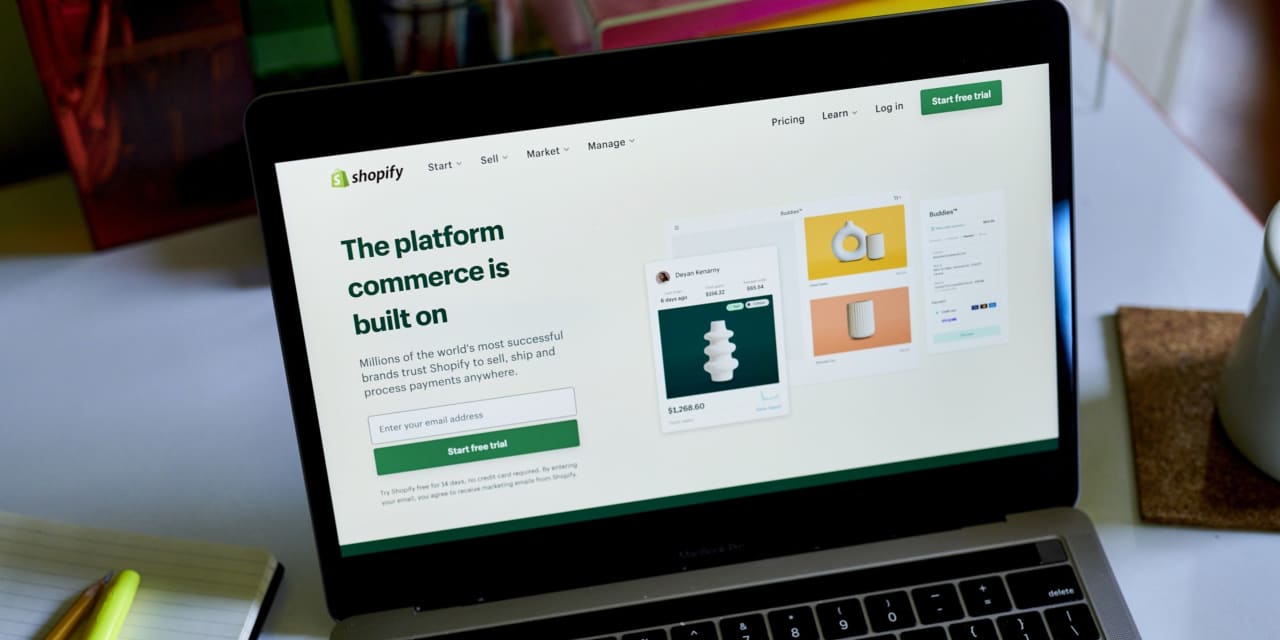

14%+ Shopify Stock Spike Following Nasdaq 100 Inclusion Announcement

Table of Contents

Understanding the Nasdaq 100 Inclusion and its Impact

The Nasdaq 100 is a market index composed of the 100 largest non-financial companies listed on the Nasdaq Stock Market. Inclusion in this prestigious index is a significant achievement, signifying a company's size, market capitalization, and overall financial health. The process of inclusion involves rigorous evaluation based on several factors, including market capitalization, trading volume, and financial performance. Companies that meet these stringent criteria are then added to the index, usually triggering a positive market response.

A company's inclusion in the Nasdaq 100 typically results in several positive impacts:

- Increased investor interest and trading volume: The index's inclusion often attracts the attention of a broader range of investors, leading to increased trading activity and higher liquidity.

- Potential for increased institutional investment: Large institutional investors, such as mutual funds and pension funds, often track the Nasdaq 100, leading to increased investment in the newly included companies.

- Enhanced market visibility and brand recognition: Being part of the Nasdaq 100 provides significant brand recognition and enhances the company's market visibility among both retail and institutional investors.

- Improved liquidity for Shopify stock: Inclusion usually makes the stock easier to buy and sell, reducing price volatility. This improved liquidity benefits both buyers and sellers.

Analyzing the Shopify Stock Price Surge

The announcement of Shopify's inclusion in the Nasdaq 100 was swiftly followed by a substantial increase in its stock price. [Insert chart/graph illustrating the price increase here]. While the index inclusion was a major catalyst, other factors likely contributed to this surge:

- Strong Q[Insert Relevant Quarter] earnings report: Positive financial results often boost investor confidence and drive up stock prices. Shopify's strong performance in the [quarter] likely amplified the positive impact of the Nasdaq 100 inclusion.

- Positive market sentiment towards e-commerce: The overall positive sentiment towards the e-commerce sector, fueled by continued growth in online shopping, contributed to the increased demand for Shopify stock.

- Growing adoption of Shopify's platform: The increasing number of businesses using Shopify's e-commerce platform reflects the company's market dominance and strengthens its future prospects.

- Strategic partnerships and acquisitions: Shopify's strategic initiatives, including partnerships and acquisitions, further enhance its competitive position and attract investor interest.

Long-Term Implications for Shopify and Investors

The inclusion in the Nasdaq 100 marks a significant milestone for Shopify, and its long-term prospects remain positive. However, investors should also consider potential risks:

- Potential for continued growth in the e-commerce sector: The continued expansion of the e-commerce market provides ample opportunities for Shopify's continued growth.

- Competition from other e-commerce platforms: Competition from other e-commerce platforms remains a key risk factor for Shopify.

- Economic factors influencing the stock market: Broader economic conditions and market volatility can impact Shopify's stock performance.

- Shopify's long-term growth strategy: Shopify’s ability to adapt and innovate will be crucial to maintaining its leadership position.

Whether to buy, sell, or hold Shopify stock depends on individual investment goals and risk tolerance. Thorough research and diversification are crucial components of any investment strategy.

Alternative E-commerce Stocks to Consider

While Shopify is a leading player in the e-commerce space, investors might also consider diversifying their portfolios with other publicly traded e-commerce companies.

- [Competitor 1]: This company holds a significant market share and is known for [key feature]. [Link to relevant resource]

- [Competitor 2]: [Competitor 2] has shown strong recent performance, driven by [key factor]. [Link to relevant resource]

- [Competitor 3]: [Competitor 3] offers a unique approach to e-commerce with its focus on [unique feature]. [Link to relevant resource]

Conclusion: Riding the Wave of the Shopify Stock Spike

The inclusion of Shopify in the Nasdaq 100 has resulted in a significant spike in its stock price, driven by increased investor interest, positive market sentiment, and the company's strong performance. Understanding the dynamics of the market index and the factors influencing Shopify's stock price is crucial for informed investment decisions. While the future holds both opportunities and challenges, Shopify’s position within the Nasdaq 100 signals its potential for continued growth. Conduct thorough research and consider your own investment goals before making any decisions regarding Shopify stock or other e-commerce investments. Remember that this article is for informational purposes only and does not constitute financial advice.

Featured Posts

-

Kentucky Derby Jockey Penalized 62 000 And Suspended For Whip Infringement

May 14, 2025

Kentucky Derby Jockey Penalized 62 000 And Suspended For Whip Infringement

May 14, 2025 -

Parker Mc Collums Bold Claim Targeting George Straits Reign

May 14, 2025

Parker Mc Collums Bold Claim Targeting George Straits Reign

May 14, 2025 -

Captain America Brave New World Online Streaming Platforms And Availability

May 14, 2025

Captain America Brave New World Online Streaming Platforms And Availability

May 14, 2025 -

Captain America Brave New World A New Dawn For The Mcu After Years Of Darkness

May 14, 2025

Captain America Brave New World A New Dawn For The Mcu After Years Of Darkness

May 14, 2025 -

Country Music Legend George Strait Stops At Dairy Queen For A Selfie

May 14, 2025

Country Music Legend George Strait Stops At Dairy Queen For A Selfie

May 14, 2025

Latest Posts

-

Could This Be Manchester Uniteds Biggest Transfer Coup Yet

May 14, 2025

Could This Be Manchester Uniteds Biggest Transfer Coup Yet

May 14, 2025 -

Walmart Recall Alert Igloo Coolers May Cause Fingertip Amputations

May 14, 2025

Walmart Recall Alert Igloo Coolers May Cause Fingertip Amputations

May 14, 2025 -

Manchester Uniteds Summer Transfer Window A Look At Potential Signings

May 14, 2025

Manchester Uniteds Summer Transfer Window A Look At Potential Signings

May 14, 2025 -

Safety Notice Igloo Coolers Recalled By Walmart Nationwide

May 14, 2025

Safety Notice Igloo Coolers Recalled By Walmart Nationwide

May 14, 2025 -

Aldi Issues Recall For Shredded Cheese Potential Steel Contamination Risk

May 14, 2025

Aldi Issues Recall For Shredded Cheese Potential Steel Contamination Risk

May 14, 2025