$16.3 Billion: Record April Revenue For U.S. Customs Duties

Table of Contents

Factors Contributing to Record U.S. Customs Duties Revenue in April

Several interconnected factors contributed to the record-high April revenue from U.S. Customs duties. Understanding these elements is crucial to analyzing the current state of US trade and predicting future trends in import taxes.

Increased Import Volume

A significant driver of the increased Customs revenue is a substantial rise in import volume across various sectors. Strong consumer demand, fueled by a healthy economy and pent-up demand after previous years of uncertainty, has led to a surge in imports of consumer goods, ranging from electronics and apparel to furniture and home goods. Furthermore, while reshoring initiatives aim to bring manufacturing back to the US, the transition is gradual, and many businesses still rely heavily on imported components and finished goods. This reliance on imports, coupled with global supply chain adjustments that are still ongoing, contributed to the high import volume.

- Strong consumer demand: Robust consumer spending powered a significant increase in imported goods.

- Reshoring initiatives: While reshoring is underway, the impact on overall import volume has been minimal so far.

- Global supply chain adjustments: Ongoing adjustments to global supply chains continue to influence import patterns.

Data comparing April 2024 import volumes to previous years clearly illustrates the significant increase. For example, preliminary data suggests a 15% year-over-year increase in total import volume, a key indicator of the substantial rise in U.S. Customs duties.

Higher Tariff Rates on Specific Goods

The imposition and increase of tariffs on specific goods have also played a crucial role in boosting Customs revenue. Recent tariff increases, particularly those imposed under Section 301 on Chinese goods and other trade actions targeting specific countries, directly increased the amount of duties collected on those imported products.

- Impact of Section 301 tariffs on Chinese goods: These tariffs continue to impact the cost of many imported goods from China.

- Tariffs imposed on other countries: Tariffs imposed on goods from other nations further contributed to the increased revenue.

- Analysis of the effectiveness of these tariffs: The effectiveness of these tariffs in achieving their stated goals remains a subject of ongoing debate.

Strengthening U.S. Dollar

The strengthening of the U.S. dollar against other major currencies during the period also influenced the level of U.S. Customs duties collected. A stronger dollar means that imported goods become cheaper in dollar terms, but the value of the duty remains the same, leading to a higher percentage of duty relative to the price.

- Dollar's impact on the cost of imported goods: While the goods themselves may be cheaper, the duty remains a fixed percentage of the imported value.

- Relationship between currency exchange rates and customs duties: Fluctuations in exchange rates directly affect the total amount collected in U.S. Customs duties.

- Forecasts for future exchange rates and their impact on duties: Future exchange rate movements will continue to influence future U.S. Customs revenue.

Implications of the Record $16.3 Billion in U.S. Customs Duties

The record $16.3 billion in U.S. Customs duties revenue has wide-ranging implications across the economy.

Impact on the U.S. Budget Deficit

The substantial increase in Customs revenue significantly impacts the U.S. budget deficit. This influx of funds could potentially lead to a reduction in the deficit, providing the government with more resources for various spending initiatives or potentially even contributing to tax cuts.

- Reduction in the federal budget deficit: The higher revenue offers a potential tool to manage the national debt.

- Potential for increased government spending or tax cuts: The additional revenue could influence policy decisions on government spending.

- Long-term fiscal implications: The long-term effect of this increased revenue on the national fiscal situation needs further analysis.

Effects on Businesses and Consumers

Higher tariffs directly affect businesses that import goods, leading to increased costs. These increased costs are often passed onto consumers in the form of higher prices for imported goods and products containing imported components. This can lead to reduced consumer spending and potential economic slowdowns.

- Increased costs for businesses: Businesses face higher expenses due to increased import costs.

- Higher prices for consumers: Consumers ultimately bear the brunt of increased tariffs via higher prices.

- Potential for reduced consumer spending: Higher prices can lead to decreased consumer demand.

Global Trade Implications

The record increase in U.S. Customs Duties has significant implications for global trade relations. Other countries may respond with retaliatory measures, potentially escalating trade tensions and disrupting global supply chains.

- Impact on bilateral trade agreements: The increased duties could affect negotiations and agreements with trading partners.

- Potential for trade wars: Retaliatory measures from other countries could lead to trade wars.

- Influence on global supply chains: The situation may further disrupt already fragile global supply chains.

Conclusion

The record $16.3 billion in April U.S. Customs duties revenue highlights significant changes in global trade dynamics and their impact on the American economy. This surge, driven by increased import volume, higher tariffs, and a stronger dollar, has major implications for the U.S. budget, businesses, consumers, and international trade relations. Understanding these factors and their consequences is crucial for navigating the evolving landscape of U.S. Customs Duties and import taxes. Stay informed about future developments in U.S. Customs Duties to make informed business decisions and understand the ongoing shifts in the global trade market.

Featured Posts

-

Families Ordeal The Ongoing Gaza Hostage Crisis

May 13, 2025

Families Ordeal The Ongoing Gaza Hostage Crisis

May 13, 2025 -

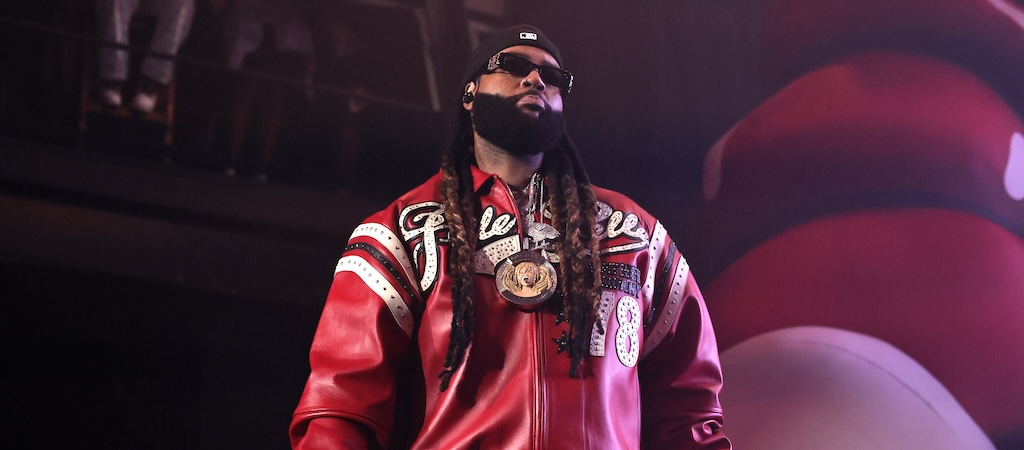

Partynextdoor And Tory Lanez Resolving The Apparent Diss Through An Apology

May 13, 2025

Partynextdoor And Tory Lanez Resolving The Apparent Diss Through An Apology

May 13, 2025 -

Doom The Dark Ages Confirmed Global Release Dates And Times

May 13, 2025

Doom The Dark Ages Confirmed Global Release Dates And Times

May 13, 2025 -

Olympus Has Fallen Vs White House Down A Comparative Analysis

May 13, 2025

Olympus Has Fallen Vs White House Down A Comparative Analysis

May 13, 2025 -

Luchshie Filmy Dzherarda Batlera Subyektivniy Reyting

May 13, 2025

Luchshie Filmy Dzherarda Batlera Subyektivniy Reyting

May 13, 2025

Latest Posts

-

Consumer Alert Nationwide Recall Of Walmart Tortilla Chips And Jewelry Kits

May 14, 2025

Consumer Alert Nationwide Recall Of Walmart Tortilla Chips And Jewelry Kits

May 14, 2025 -

Major Recall Shark Ninja Pressure Cookers Pose Burn Injury Risk

May 14, 2025

Major Recall Shark Ninja Pressure Cookers Pose Burn Injury Risk

May 14, 2025 -

Man Utds Strong Interest In Championship Star Price And Rivals Revealed

May 14, 2025

Man Utds Strong Interest In Championship Star Price And Rivals Revealed

May 14, 2025 -

Baby Product Recall Walmart Issues Nationwide Warning For Unstable Dressers

May 14, 2025

Baby Product Recall Walmart Issues Nationwide Warning For Unstable Dressers

May 14, 2025 -

Urgent Recall Great Value Product Pulled From Shelves In Michigan

May 14, 2025

Urgent Recall Great Value Product Pulled From Shelves In Michigan

May 14, 2025