$2.4 Billion Catalyst Deal: Honeywell Acquires Johnson Matthey's Key Unit

Table of Contents

Details of the Acquisition

The Acquired Assets

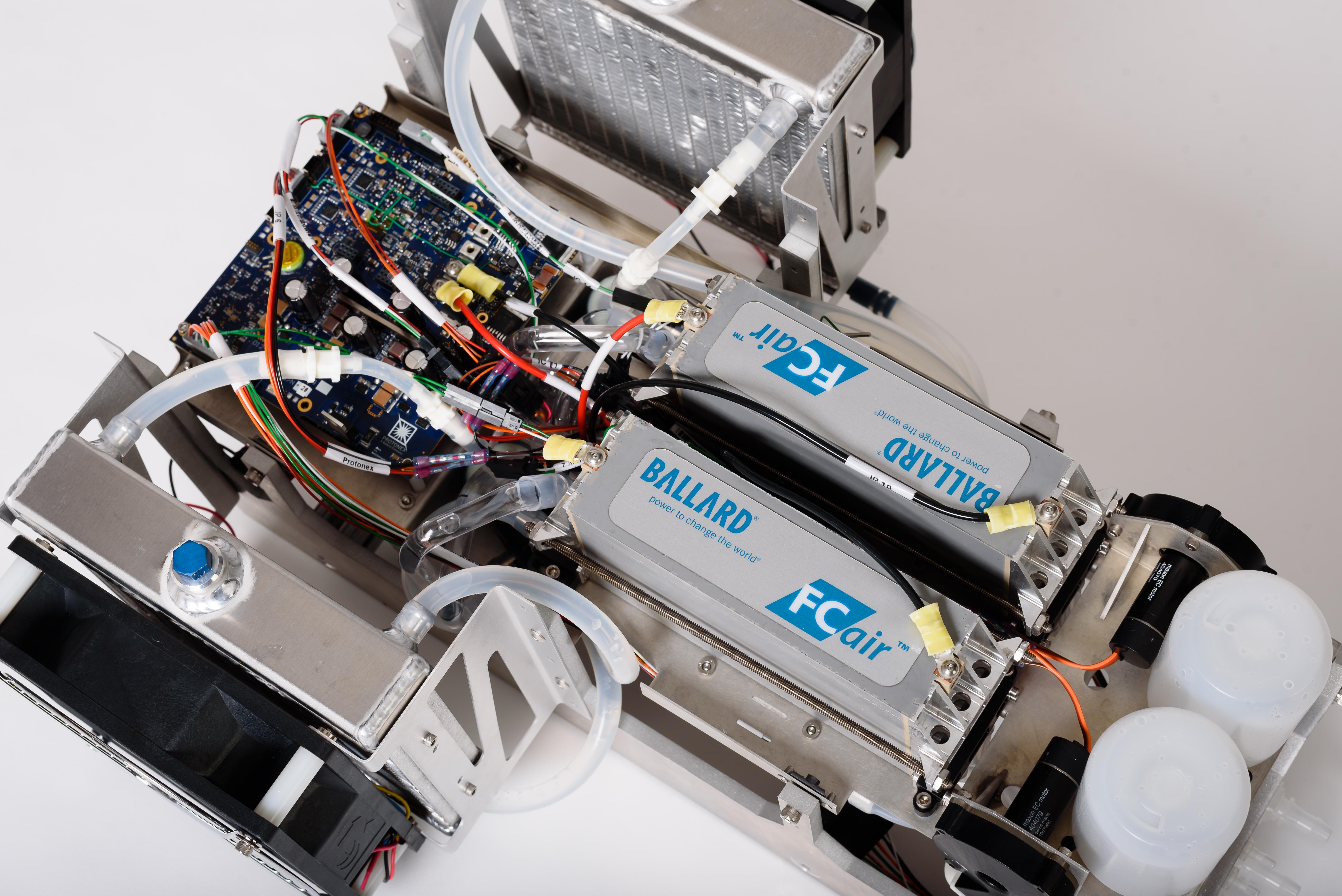

This $2.4 billion deal encompasses Johnson Matthey's entire catalyst technologies business, a leading player in the development and manufacturing of emission control catalysts and chemical catalysts. The acquired assets include:

- Automotive emission control catalysts: These are crucial components of catalytic converters, reducing harmful emissions from vehicles. This segment focuses heavily on precious metal catalysts, vital for efficient emission control.

- Chemical catalysts: These catalysts are used across various chemical processes, impacting numerous industries. Specific applications include refining, petrochemicals, and other large-scale industrial processes. This includes expertise in developing and manufacturing specialized catalysts for specific chemical reactions.

- Related intellectual property: The acquisition also includes valuable patents and technological know-how, further strengthening Honeywell's position in the field.

This acquisition grants Honeywell access to a wide range of technologies, including expertise in precious metal catalysts and advanced catalytic converter designs. Keywords: emission control catalysts, catalytic converters, chemical catalysts, precious metal catalysts.

Financial Terms and Structure

Honeywell agreed to pay $2.4 billion for Johnson Matthey's catalyst technologies business. The deal is structured as a cash transaction, subject to customary closing conditions, including regulatory approvals. The completion of the acquisition is expected to occur within a specific timeframe, subject to the successful completion of all necessary regulatory reviews and approvals. Keywords: acquisition price, deal completion, merger and acquisition.

Regulatory Approvals

The deal will undergo scrutiny from various regulatory bodies worldwide to ensure compliance with antitrust regulations and competition law. The process includes reviewing the potential impact on market competition, ensuring fair practices, and preventing monopolistic behavior. The timeline for securing these approvals will influence the overall deal completion date. Keywords: antitrust regulations, regulatory approvals, competition law.

Strategic Rationale for Honeywell

Market Expansion and Synergies

For Honeywell, this acquisition represents a significant expansion into the catalyst market. The deal creates significant synergies with Honeywell's existing businesses, especially within its Performance Materials and Technologies segment. This expanded portfolio allows Honeywell to serve a wider range of customers across various industries, increasing market share and strengthening its overall market presence. Keywords: market share, synergies, strategic growth, portfolio expansion.

Technological Advancements

The acquired technologies significantly boost Honeywell's R&D capabilities and innovation pipeline. Johnson Matthey's expertise in catalyst design and manufacturing will complement Honeywell's existing strengths, leading to the development of more efficient and sustainable technologies. This enhances Honeywell's technological leadership and positions it for future growth in the rapidly evolving catalyst market. Keywords: technology leadership, R&D, innovation, sustainable technologies.

Strengthened Competitive Position

By acquiring Johnson Matthey's catalyst technologies unit, Honeywell significantly strengthens its competitive position within the catalyst market. The acquisition consolidates Honeywell's market presence and provides a clear competitive advantage against major players in the industry. This strategic move contributes to industry consolidation and establishes Honeywell as a dominant force. Keywords: competitive advantage, market dominance, industry consolidation.

Impact on Johnson Matthey

Strategic Realignment

Johnson Matthey's decision to divest its catalyst technologies unit reflects its strategic refocusing on other areas of its business. This move aligns with the company's broader portfolio optimization strategy, allowing it to concentrate resources and investments on core growth areas. Keywords: strategic refocusing, portfolio optimization, divestment strategy.

Financial Implications

The $2.4 billion proceeds from the sale will contribute positively to Johnson Matthey's financial performance. The company plans to use the funds to strengthen its balance sheet, pursue further strategic investments, and enhance shareholder value through other strategic initiatives. Keywords: financial performance, shareholder value, return on investment.

Industry Implications

Market Consolidation

The Honeywell acquisition marks a significant step towards further consolidation in the catalyst market. This deal sets a precedent and could trigger further mergers and acquisitions in the industry, leading to a more concentrated market structure. Keywords: market consolidation, industry trends, competitive landscape.

Impact on Customers

The acquisition may lead to changes in customer relationships and supply chains. Honeywell will need to seamlessly integrate Johnson Matthey's customer base and ensure a smooth transition. However, the acquisition also offers the potential for enhanced product innovation and broader access to technologies for customers of both Honeywell and the former Johnson Matthey unit. Keywords: customer relationships, supply chain, product innovation.

Environmental Considerations

The deal's impact on environmental sustainability is substantial. Both companies are committed to developing and providing sustainable technologies aimed at reducing emissions and promoting environmental responsibility. This acquisition allows for further advancements in cleaner technologies, benefiting the environment and contributing to global sustainability efforts. Keywords: sustainable technology, environmental regulations, emissions reduction.

Conclusion: The Future of Honeywell and Catalyst Technologies After the $2.4 Billion Deal

The $2.4 billion acquisition of Johnson Matthey's catalyst technologies unit represents a pivotal moment for Honeywell and the broader catalyst market. This strategic move significantly enhances Honeywell's technological capabilities, expands its market reach, and strengthens its competitive position. The successful integration of the acquired technologies will be key to realizing the full potential of this deal. The acquisition also signals continued industry consolidation and the growing importance of sustainable catalyst technologies. Learn more about the Honeywell acquisition and stay informed about developments in the catalyst market by following both companies' news releases.

Featured Posts

-

Reporte Del Coe 9 Provincias En Alerta Amarilla 5 En Verde

May 23, 2025

Reporte Del Coe 9 Provincias En Alerta Amarilla 5 En Verde

May 23, 2025 -

The Future Of The Tush Push In The Nfl A Victory For Players

May 23, 2025

The Future Of The Tush Push In The Nfl A Victory For Players

May 23, 2025 -

Snaet Alaflam Fy Qmrt Qst Njah Qtryt

May 23, 2025

Snaet Alaflam Fy Qmrt Qst Njah Qtryt

May 23, 2025 -

Thqyq Fy Hjwm Washntn Mutlq Alnar Yusrkh Mn Ajl Alhryt Lflstyn

May 23, 2025

Thqyq Fy Hjwm Washntn Mutlq Alnar Yusrkh Mn Ajl Alhryt Lflstyn

May 23, 2025 -

Crawley Retains Englands Confidence A Look At His Recent Struggles

May 23, 2025

Crawley Retains Englands Confidence A Look At His Recent Struggles

May 23, 2025