2026 Retirement Of CFP Board CEO: A New Era For Financial Planning?

Table of Contents

Review of the Current CFP Board Leadership and Accomplishments

The current CEO's tenure has been instrumental in shaping the financial planning landscape. Their accomplishments have significantly impacted the profession's standards, ethics, and public perception. Key initiatives focused on strengthening the CFP certification, improving financial planning standards, and increasing public trust in financial advisors.

-

Successful Programs and Initiatives: The implementation of updated ethical guidelines, the enhancement of continuing education requirements for CFP professionals, and successful public awareness campaigns significantly boosted the credibility and recognition of the CFP designation.

-

Quantifiable Results: The number of certified financial planners (CFP professionals) has increased substantially under the current leadership, reflecting the growing demand for qualified financial advisors. Furthermore, independent surveys show a significant improvement in public trust in CFP professionals.

-

Challenges Faced: Navigating evolving regulatory environments and adapting to technological advancements in financial planning have presented ongoing challenges. The need for improved diversity and inclusion within the CFP professional ranks also remains a key area for continued focus.

Potential Challenges and Opportunities Arising from the Leadership Change

Any leadership transition, including the CFP Board CEO retirement, presents inherent challenges. Maintaining momentum on existing initiatives, ensuring a smooth handover of responsibilities, and navigating potential internal shifts are key considerations. However, this transition also presents significant opportunities for innovation and improvement within the CFP Board.

-

Areas for Improvement: The next CEO could spearhead efforts to enhance technology adoption within the CFP Board's operations and for CFP professionals, promoting greater accessibility and efficiency. Furthermore, focusing on diversity and inclusion initiatives is crucial for broadening the scope and representation within the financial planning industry.

-

Strengthening the CFP Certification: Opportunities exist to further strengthen the value proposition of the CFP certification, perhaps through the development of specialized certifications or expanding the curriculum to address emerging areas of financial planning, like sustainable investing.

-

Impact on Practitioners: The CFP Board leadership change will likely influence the professional development resources available to CFP professionals and shape the future regulatory environment impacting their practice.

The Search for a New CFP Board CEO and the Selection Process

The search for a new CFP Board CEO will likely be rigorous and thorough. The ideal candidate will possess a unique blend of leadership, regulatory expertise, and a deep understanding of the financial planning industry. The selection process itself needs to be transparent and inclusive to maintain public trust and ensure the best possible outcome.

-

Desired Skills and Experience: The next CEO will need strong leadership qualities, proven experience in managing complex organizations, a comprehensive understanding of financial regulations, and the ability to develop and implement strategic plans for the future.

-

Importance of Diversity and Inclusion: The selection process should prioritize diversity and inclusion, actively seeking out candidates from diverse backgrounds and perspectives to reflect the increasingly diverse client base of CFP professionals.

-

Impact on Future Direction: The chosen CEO will significantly shape the future direction of the CFP Board, influencing its priorities, initiatives, and overall strategic trajectory.

The Future of Financial Planning Post-CEO Retirement

The CFP Board CEO retirement will undoubtedly influence the future of financial planning. The incoming CEO's vision and priorities will play a crucial role in shaping the industry's trajectory, impacting the role of financial advisor certification, the adoption of new technologies, and the evolving regulatory landscape.

-

Influence of the New CEO: The new CEO's leadership will determine the future focus of the CFP Board – whether it be increased regulatory compliance, technological innovation, or expanding access to financial planning services.

-

Emerging Trends: The rise of robo-advisors, the increasing importance of sustainable and ESG investing, and advancements in fintech are all shaping the future of financial planning. The CFP Board must adapt and address these changes proactively.

-

Regulatory Changes: Evolving regulations at both the national and international levels will continue to impact financial advisors. The CFP Board's response to these changes will be critical for maintaining the high standards of CFP professionals.

Conclusion: Embracing the New Era After the CFP Board CEO Retirement

The CFP Board CEO retirement in 2026 presents both challenges and opportunities for the financial planning profession. While a leadership transition always carries risks, it also offers a chance for renewal, innovation, and growth. The selection of a new CEO is crucial, and the process must prioritize finding a leader with the vision and skills to guide the CFP Board into the future. By embracing the changes and proactively addressing the challenges, the financial planning industry can ensure it continues to provide valuable services to clients and maintains its position as a trusted profession.

To stay informed about the CFP Board CEO transition and the future of financial planning, follow the CFP Board's official announcements and publications. Prepare for the changes in financial planning by staying abreast of industry trends and technological advancements. Remember to stay informed about the future of CFP certification and its ongoing relevance in the evolving financial landscape. Visit the CFP Board website for the latest updates: [Insert CFP Board Website Link Here].

Featured Posts

-

Hario Poterio Pramogu Parkas Sanchajuje Ka Zinome Apie 2027 Metu Atidaryma

May 03, 2025

Hario Poterio Pramogu Parkas Sanchajuje Ka Zinome Apie 2027 Metu Atidaryma

May 03, 2025 -

Overwhelming Public Trust In South Carolinas Elections 93

May 03, 2025

Overwhelming Public Trust In South Carolinas Elections 93

May 03, 2025 -

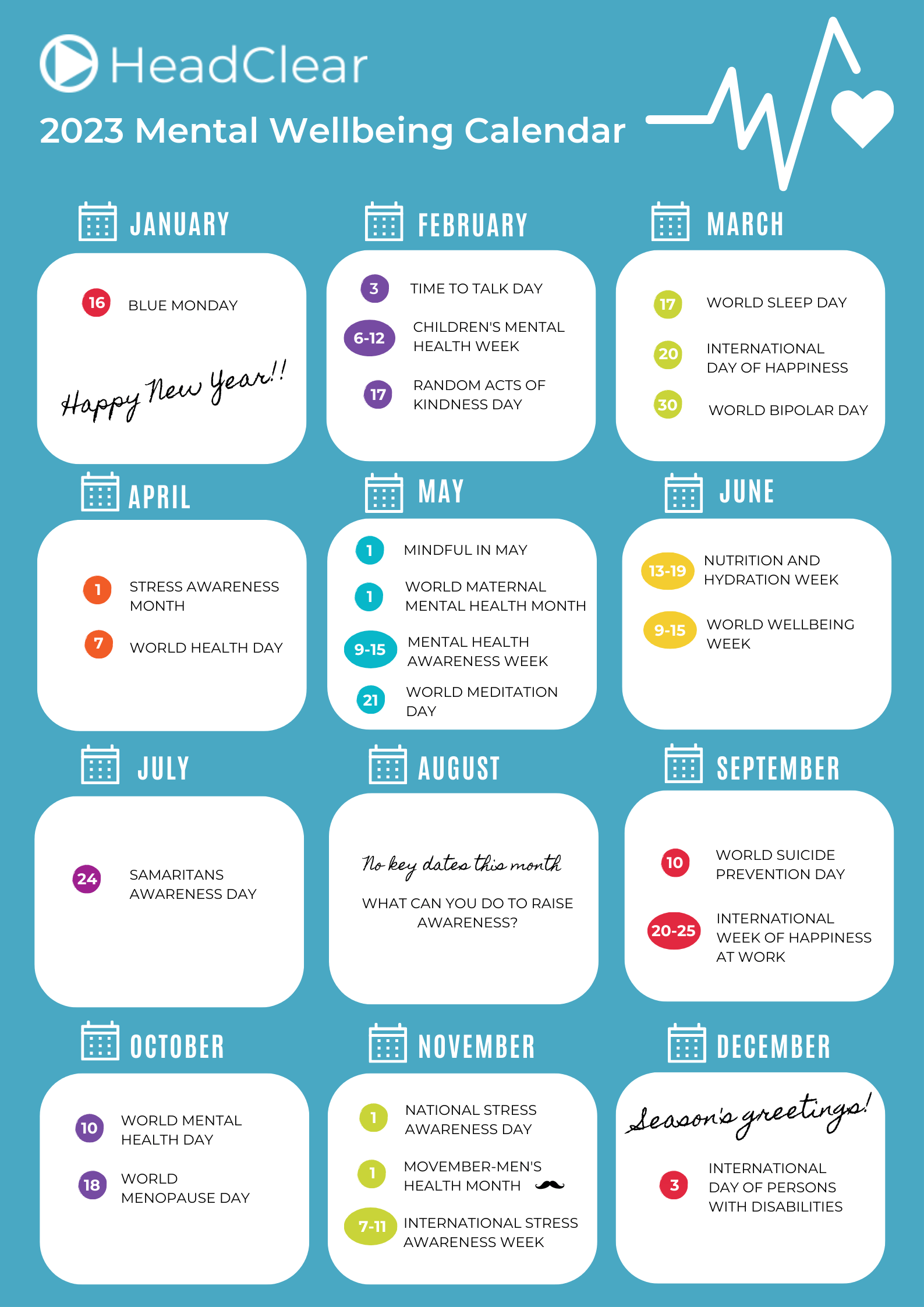

Investing In Childhood A Critical Investment In Future Mental Wellbeing

May 03, 2025

Investing In Childhood A Critical Investment In Future Mental Wellbeing

May 03, 2025 -

Chto Skazala Zakharova O Makronakh Podrobnosti Situatsii

May 03, 2025

Chto Skazala Zakharova O Makronakh Podrobnosti Situatsii

May 03, 2025 -

Analysis Of Revised Energy Policies Guido Fawkes Report

May 03, 2025

Analysis Of Revised Energy Policies Guido Fawkes Report

May 03, 2025

Latest Posts

-

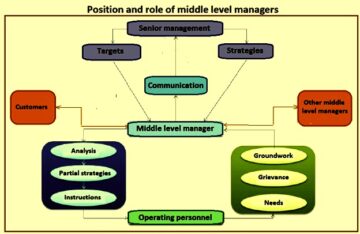

The Critical Role Of Middle Managers In Organizational Effectiveness And Employee Development

May 04, 2025

The Critical Role Of Middle Managers In Organizational Effectiveness And Employee Development

May 04, 2025 -

The Undervalued Asset How Middle Managers Drive Company Performance And Employee Satisfaction

May 04, 2025

The Undervalued Asset How Middle Managers Drive Company Performance And Employee Satisfaction

May 04, 2025 -

Analyzing The Key Issues In Singapores Upcoming General Election

May 04, 2025

Analyzing The Key Issues In Singapores Upcoming General Election

May 04, 2025 -

Singapore Election 2024 What To Expect From The Polls

May 04, 2025

Singapore Election 2024 What To Expect From The Polls

May 04, 2025 -

Singapores Ruling Party Faces Its Biggest Election Challenge Yet

May 04, 2025

Singapores Ruling Party Faces Its Biggest Election Challenge Yet

May 04, 2025