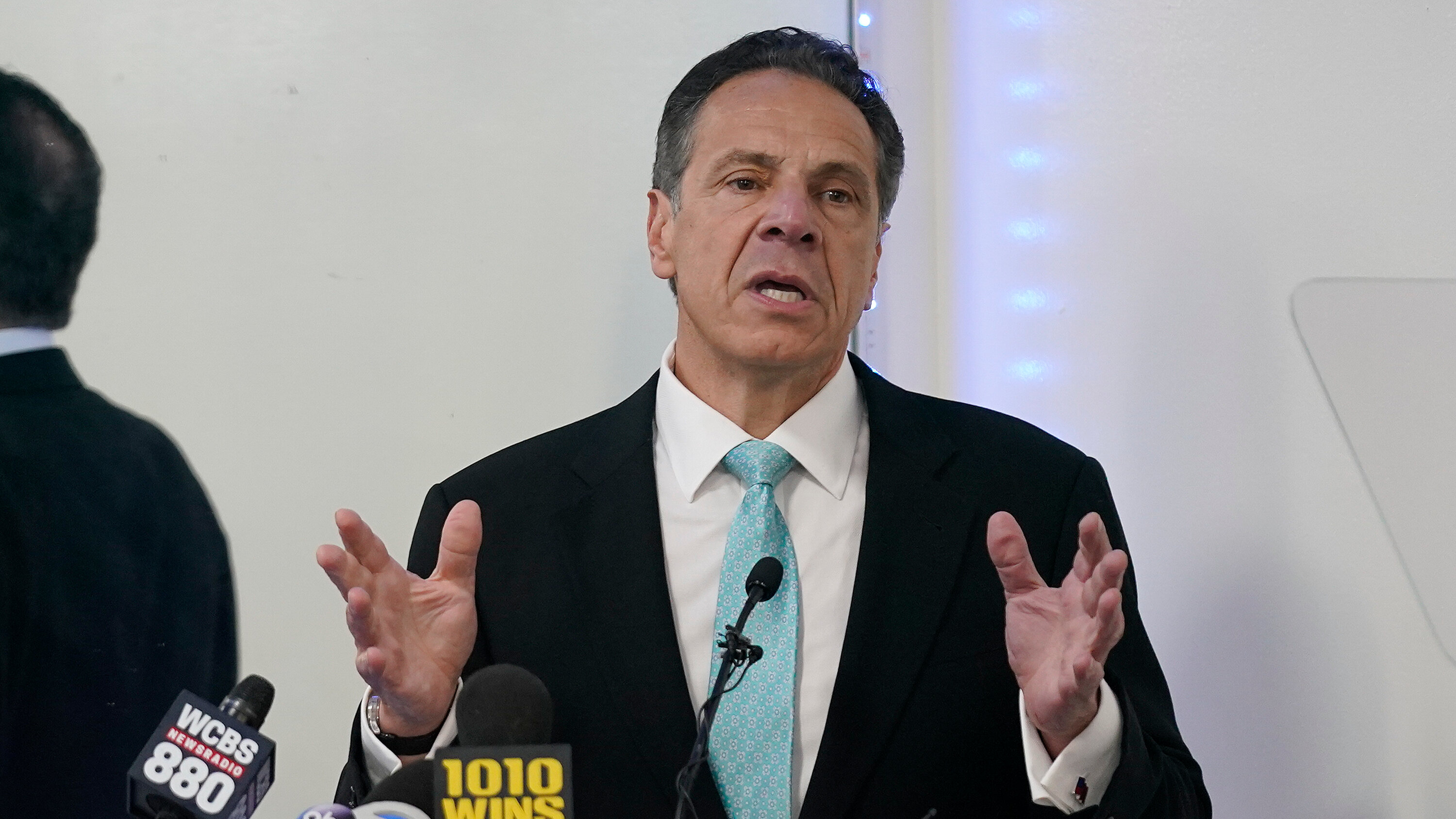

$3 Million In Undisclosed Stock: Examining Andrew Cuomo's Nuclear Investment

Table of Contents

The Nature of the Investment: Details on Cuomo's Nuclear Stock Portfolio

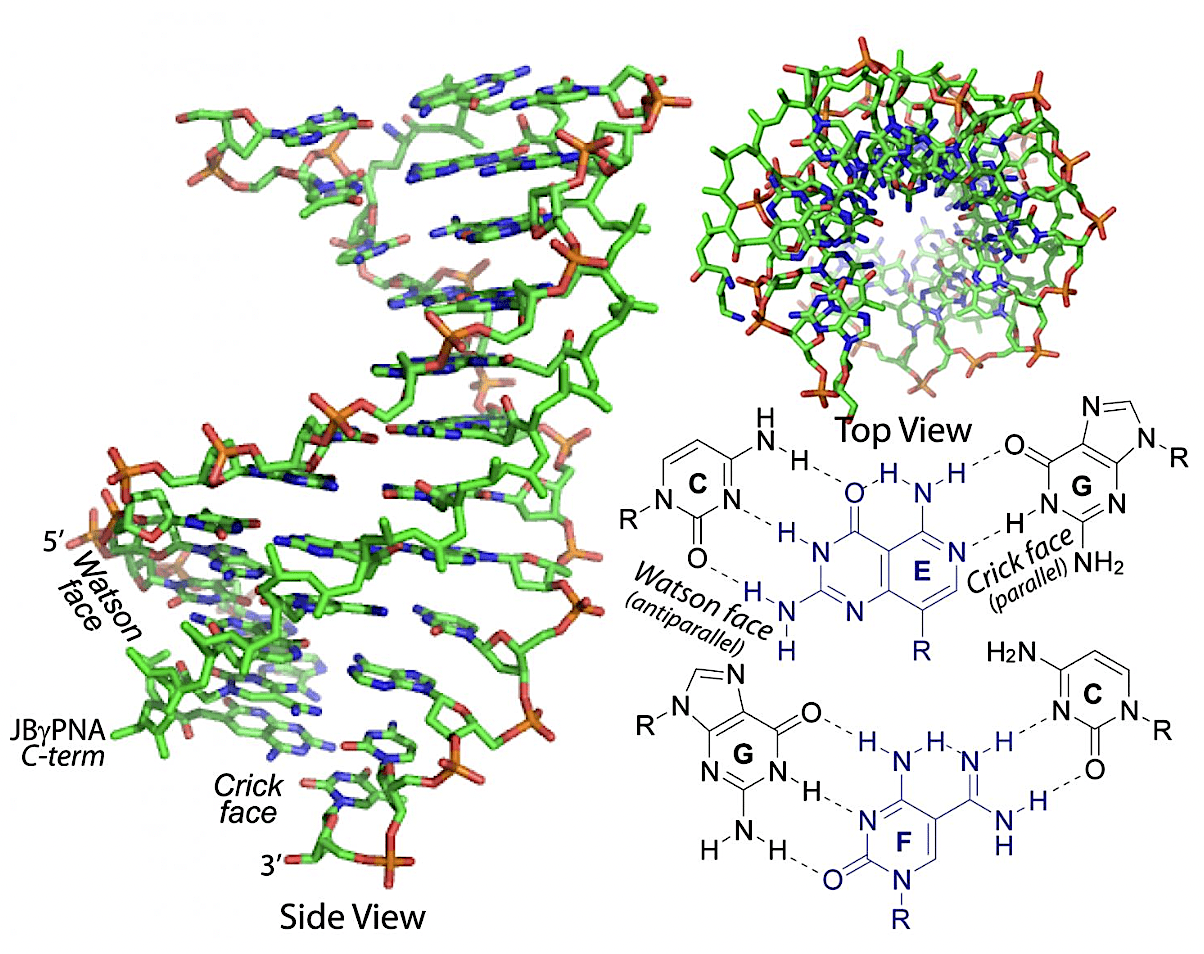

Andrew Cuomo's $3 million investment in nuclear energy stocks represents a significant financial stake in a sector with potential connections to his past political roles. While the exact breakdown of his portfolio remains partially opaque due to delayed disclosure, available information suggests investments spanning various facets of the nuclear energy industry. This likely includes companies involved in uranium mining, the development and manufacturing of nuclear reactors, and potentially, companies engaged in nuclear waste management.

The timeframe of the investment and the specific investment strategy employed by Cuomo remain unclear. Further investigation is needed to determine whether this was a long-term strategic investment or a more speculative venture. To fully understand the implications, more detailed information is crucial. Ideally, this would include:

- Company Names and Ticker Symbols: Publicly accessible information on the specific companies in which Cuomo invested is needed for a complete picture.

- Investment Strategy: Understanding whether the investment was a long-term hold, a short-term trade, or part of a diversified portfolio is essential for assessing potential conflicts of interest.

- Portfolio Percentage: The percentage of Cuomo's overall investment portfolio dedicated to nuclear energy stocks helps gauge the significance of this particular investment.

The nuclear energy sector, while crucial for some nations' energy needs, carries inherent risks and uncertainties. Fluctuations in energy prices, regulatory changes, and public perception can significantly impact the value of these investments. Therefore, understanding the potential for growth or risk in Cuomo's investment is critical for a full assessment.

Ethical Concerns and Conflicts of Interest: Transparency and Governance Issues

The ethical concerns surrounding Cuomo's nuclear stock investment stem from the potential conflict of interest arising from his past influence on New York's energy policy. As governor, he had considerable power to shape regulations and initiatives impacting the nuclear energy sector. This raises questions about whether his investment decisions were influenced by his political position, and vice versa.

The delayed disclosure of the investment further exacerbates the ethical concerns. The lack of transparency undermines public trust and raises serious questions about his commitment to upholding the highest standards of ethical conduct expected of a public official. Key ethical concerns include:

- Potential for Undue Influence: Did Cuomo's investment influence his decisions regarding nuclear energy policy in New York? This is a critical question requiring investigation.

- Violation of Public Trust: The delayed disclosure represents a clear breach of public trust and the expectation of transparency from elected officials.

- Comparison to Similar Cases: Analyzing similar cases of conflicts of interest involving politicians and their investments provides a valuable context for evaluating the severity of Cuomo's actions.

The legal ramifications of the delayed disclosure remain to be seen, but it underscores the need for stricter regulations and stronger enforcement mechanisms to ensure accountability in government.

Public Reaction and Media Coverage: Examining the Response to Cuomo's Nuclear Stock Investment

The disclosure of Cuomo's nuclear stock investment was met with a mixed reaction. Opposition parties strongly criticized the investment, highlighting the potential conflicts of interest and the lack of transparency. They argued that this undermined public trust and called for a thorough investigation. Conversely, some of Cuomo's supporters defended him, suggesting that the investment was legal and did not necessarily indicate unethical behavior.

News articles and public statements regarding the investment have been widely varied, reflecting the polarized political climate. Key media outlets have published detailed analyses, raising questions about Cuomo's actions and calling for increased transparency in government. (Specific articles and statements should be cited here, with links).

The impact on Cuomo's public image and political career remains to be seen, but the controversy undoubtedly damages his credibility and raises concerns about his fitness for public office. The broader implication is a further erosion of public trust in government and the need for a renewed focus on ethical conduct among elected officials.

Implications for Future Regulations and Transparency in Government

The Cuomo case highlights the urgent need for stricter regulations and increased transparency regarding financial disclosures for public officials at all levels. Current regulations may be inadequate in preventing and detecting potential conflicts of interest. Proposed reforms could include:

- More Stringent Disclosure Requirements: Mandating more detailed and comprehensive disclosures of assets and investments, including blind trusts, would enhance transparency.

- Independent Ethics Oversight: Establishing an independent ethics body to oversee the financial activities of public officials would provide greater accountability.

- Increased Public Access: Improving public access to financial records of elected officials through online databases could foster greater transparency.

The ongoing debate about ethics and transparency in government underscores the importance of continuous reform. Stronger regulations, independent oversight, and increased public access to information are crucial for restoring and maintaining public trust.

Conclusion: Understanding the Significance of Cuomo's $3 Million Nuclear Investment

Andrew Cuomo's $3 million investment in undisclosed nuclear stocks raises significant ethical concerns and highlights critical issues of transparency in government. The potential conflict of interest, coupled with the delayed disclosure, has eroded public trust and necessitates a thorough review of current regulations and practices. The lack of transparency surrounding the investment underscores the need for stricter regulations regarding financial disclosures for public officials.

Stay informed about the ongoing debate surrounding Andrew Cuomo’s nuclear investment and demand greater transparency in government. Understanding the complexities of undisclosed stock holdings and their potential conflicts of interest is crucial for a healthy democracy. We must advocate for stricter regulations and increased oversight to prevent similar situations from occurring in the future and rebuild public faith in our elected officials.

Featured Posts

-

Gambling On Catastrophe The Los Angeles Wildfires And The Future Of Disaster Betting

May 05, 2025

Gambling On Catastrophe The Los Angeles Wildfires And The Future Of Disaster Betting

May 05, 2025 -

Chunk Of Golds 2025 Kentucky Derby Prospects A Comprehensive Guide

May 05, 2025

Chunk Of Golds 2025 Kentucky Derby Prospects A Comprehensive Guide

May 05, 2025 -

Tioga Downs Announces Plans For 2025 Racing Season

May 05, 2025

Tioga Downs Announces Plans For 2025 Racing Season

May 05, 2025 -

Singapore Votes Ruling Party Faces Crucial Election Test

May 05, 2025

Singapore Votes Ruling Party Faces Crucial Election Test

May 05, 2025 -

Lawsuit Against Trump Order Targeting Perkins Coie Successful

May 05, 2025

Lawsuit Against Trump Order Targeting Perkins Coie Successful

May 05, 2025

Latest Posts

-

2025 Playoffs Capitals Announce New Initiatives In Partnership With Vanda Pharmaceuticals

May 05, 2025

2025 Playoffs Capitals Announce New Initiatives In Partnership With Vanda Pharmaceuticals

May 05, 2025 -

Capitals 2025 Playoffs Push New Initiatives Unveiled With Vanda Pharmaceuticals

May 05, 2025

Capitals 2025 Playoffs Push New Initiatives Unveiled With Vanda Pharmaceuticals

May 05, 2025 -

Calgary Flames Wolf Playoff Predictions And Calder Trophy Outlook In Nhl Com Interview

May 05, 2025

Calgary Flames Wolf Playoff Predictions And Calder Trophy Outlook In Nhl Com Interview

May 05, 2025 -

Analysis Stanley Cup Playoffs Ratings And The Four Nation Tournament

May 05, 2025

Analysis Stanley Cup Playoffs Ratings And The Four Nation Tournament

May 05, 2025 -

Lower Stanley Cup Ratings International Competitions Influence

May 05, 2025

Lower Stanley Cup Ratings International Competitions Influence

May 05, 2025