5 Key Steps To Success In The Private Credit Industry

Table of Contents

Building a Strong Network and Reputation

Success in the private credit industry hinges on your network and reputation. Building strong, lasting relationships and establishing yourself as a credible expert are paramount.

Networking Strategies

Effective networking is crucial for securing deals and gaining valuable insights. This involves:

- Develop relationships with key players: Cultivate connections with sponsors, investors, fund managers, and other influential figures in private debt. Attend industry conferences like SuperReturn and IPF to expand your network.

- Build your professional brand: Publish articles in relevant industry publications, present at conferences, and participate in webinars to showcase your expertise in private credit networking and alternative lending relationships.

- Leverage LinkedIn: Optimize your LinkedIn profile to highlight your experience and expertise in private credit. Actively engage with industry professionals, join relevant groups, and participate in discussions.

Establishing Credibility

Credibility is earned through consistent performance and transparent communication. Demonstrate your expertise by:

- Highlighting successful past deals: Showcase your track record of successful investments and portfolio performance in your private credit activities. Quantify your successes whenever possible.

- Showcasing strong analytical skills and risk management capabilities: Highlight your proficiency in credit underwriting techniques and your ability to assess and mitigate risk in alternative lending.

- Maintaining ethical standards: Build trust by adhering to the highest ethical standards and fostering transparency in all your dealings within the private credit market.

Mastering Due Diligence and Risk Assessment

Thorough due diligence and robust risk management are fundamental to success in the private credit industry.

Thorough Due Diligence Processes

Implementing rigorous due diligence processes is vital for identifying potential risks and ensuring sound investment decisions. This includes:

- Developing a comprehensive checklist: Create a detailed checklist covering financial statement analysis, legal reviews, operational assessments, and background checks on borrowers in your private credit due diligence.

- Employing advanced analytical tools: Utilize sophisticated analytical tools to identify potential risks and assess the creditworthiness of borrowers in alternative lending.

- Conducting thorough background checks: Verify information provided by borrowers and conduct comprehensive background checks to assess their creditworthiness and identify any red flags.

Effective Risk Management Strategies

Effective risk management involves mitigating potential losses through diversification and robust legal frameworks. Key strategies include:

- Structuring deals to minimize risk exposure: Negotiate favorable terms and conditions, including strong collateralization and covenant protections.

- Implementing strong collateralization: Secure loans with high-quality collateral to minimize potential losses in case of default.

- Regularly monitoring portfolio performance: Continuously monitor your private debt portfolio performance, adjusting strategies as needed to mitigate risk and maximize returns.

Understanding and Navigating Regulatory Compliance

Staying informed about and adhering to regulations is crucial for operating legally and ethically in the private credit industry.

Staying Updated on Regulations

The regulatory landscape for private credit is constantly evolving. To remain compliant, you need to:

- Regularly review compliance guidelines: Stay abreast of changes in regulations from relevant regulatory bodies, both domestically and internationally.

- Consult with legal counsel: Seek guidance from experienced legal counsel to ensure compliance with all applicable regulations for private credit and alternative lending.

- Stay informed about industry best practices: Monitor industry developments and best practices to proactively identify and address potential compliance risks.

Building a Compliant Operations Framework

A robust compliance framework is essential for mitigating regulatory risk. Key elements include:

- Developing clear policies and procedures: Establish comprehensive policies and procedures for all aspects of your business, covering areas such as loan origination, underwriting, and portfolio management.

- Conducting regular internal audits: Conduct regular internal audits and compliance reviews to identify and address any potential weaknesses in your private credit compliance framework.

- Maintaining detailed records and documentation: Maintain meticulous records and documentation to demonstrate compliance with all relevant regulations.

Leveraging Technology and Data Analytics

Technology and data analytics are transforming the private credit industry. Embracing these advancements is crucial for gaining a competitive edge.

Utilizing Data-Driven Decision Making

Data-driven decision-making enhances investment selection and portfolio management.

- Use data analytics to identify market trends and opportunities: Leverage data analytics to identify promising investment opportunities and anticipate market shifts within the private credit market.

- Develop predictive models: Use advanced analytics to develop predictive models for assessing risk and forecasting portfolio performance.

- Utilize technology to automate processes: Employ technology to automate repetitive tasks, freeing up time for higher-value activities like private credit analytics and client relationship building.

Embracing Technological Advancements

Staying abreast of technological advancements is essential for optimizing operations and client service.

- Invest in software and tools: Invest in software and tools that streamline data management, reporting, and communication within your private credit operations.

- Explore the use of AI and machine learning: Explore the use of AI and machine learning to enhance investment analysis, risk assessment, and portfolio management.

- Utilize technology to enhance client communication: Use technology to improve communication with clients and provide better service in your private debt operations.

Building and Maintaining Strong Client Relationships

Strong client relationships are the cornerstone of long-term success in the private credit industry.

Providing Exceptional Client Service

Exceptional client service fosters trust and loyalty. Key elements include:

- Maintaining open and transparent communication: Keep clients informed of developments and address their queries promptly and thoroughly.

- Providing timely and accurate reporting: Provide clients with timely and accurate reports on their investments.

- Addressing client concerns promptly and efficiently: Respond quickly and effectively to client concerns, resolving issues in a satisfactory manner.

Understanding Client Needs

Understanding client needs allows you to tailor your services to meet their specific requirements. This involves:

- Developing a deep understanding of client objectives and risk tolerance: Take the time to understand each client's unique circumstances, goals, and risk profile.

- Offering customized investment solutions: Develop customized investment strategies and solutions to meet individual client needs in private credit client management.

- Maintaining a strong focus on client satisfaction: Prioritize client satisfaction and build long-term relationships through consistent, high-quality service.

Conclusion

Success in the private credit industry requires a multifaceted approach. By focusing on building strong networks, mastering due diligence, navigating regulatory compliance, leveraging technology, and nurturing client relationships, you can significantly improve your chances of achieving your goals. The path to success in the private credit industry is paved with diligent planning, continuous learning, and adaptation to the ever-evolving market dynamics. Start building your path to success today – begin exploring the opportunities available within the private credit market and utilize these five steps to help guide you to achieve your ambitions in the dynamic world of private debt.

Featured Posts

-

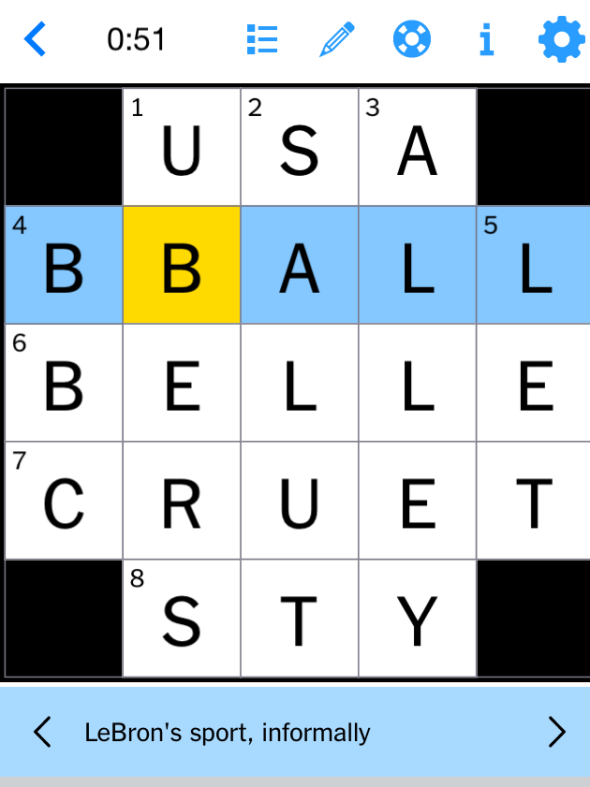

March 24 2025 Nyt Mini Crossword Complete Answers And Hints

May 20, 2025

March 24 2025 Nyt Mini Crossword Complete Answers And Hints

May 20, 2025 -

Hmrc Child Benefit Understanding And Responding To Official Communications

May 20, 2025

Hmrc Child Benefit Understanding And Responding To Official Communications

May 20, 2025 -

D Wave Quantum Qbts Reasons Behind Mondays Significant Stock Price Fall

May 20, 2025

D Wave Quantum Qbts Reasons Behind Mondays Significant Stock Price Fall

May 20, 2025 -

D Wave Quantum Qbts Stock Performance Impact Of Kerrisdale Capitals Report

May 20, 2025

D Wave Quantum Qbts Stock Performance Impact Of Kerrisdale Capitals Report

May 20, 2025 -

Support Grows For Mick Schumachers Cadillac Bid F1 Champion Weighs In

May 20, 2025

Support Grows For Mick Schumachers Cadillac Bid F1 Champion Weighs In

May 20, 2025

Latest Posts

-

D Wave Quantum Qbts Analyzing The Reasons For The Recent Stock Increase

May 20, 2025

D Wave Quantum Qbts Analyzing The Reasons For The Recent Stock Increase

May 20, 2025 -

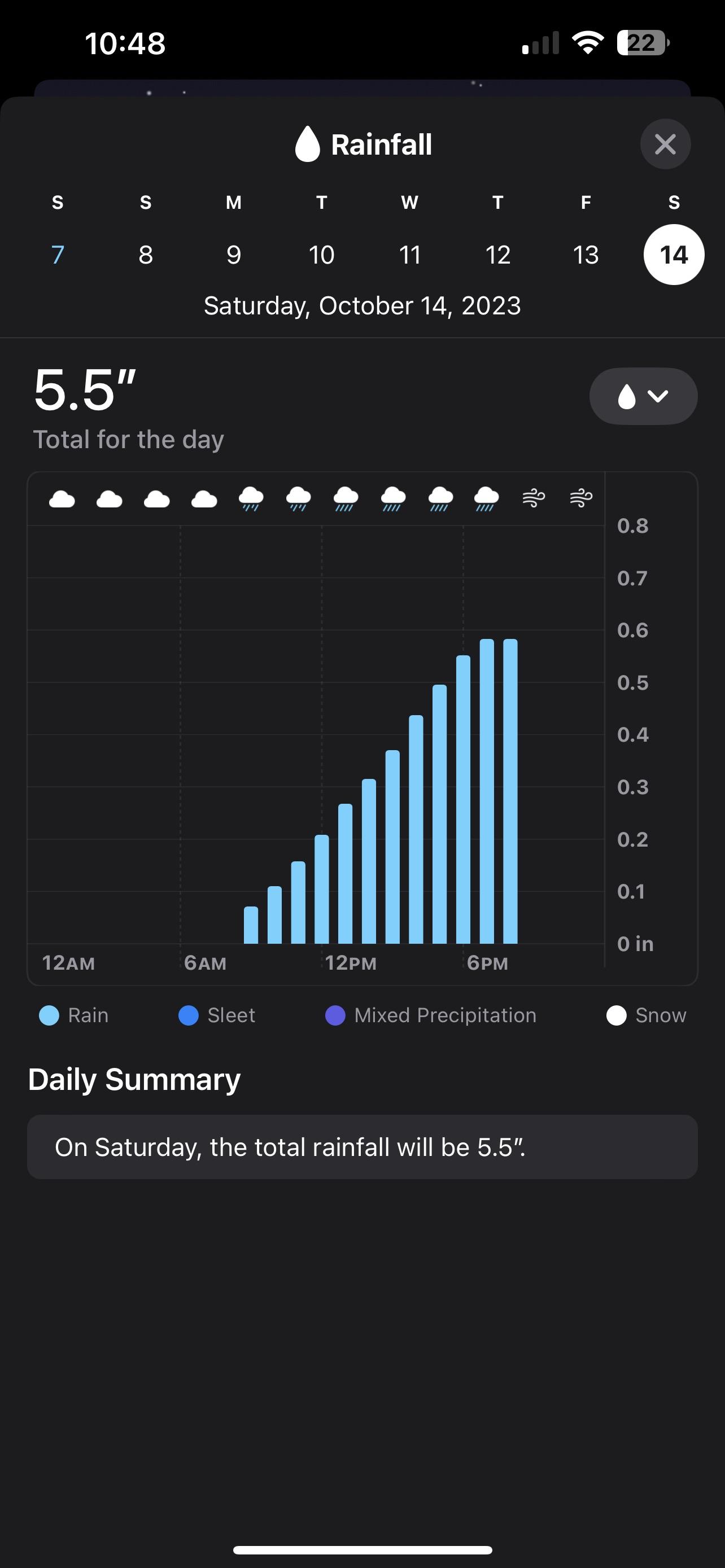

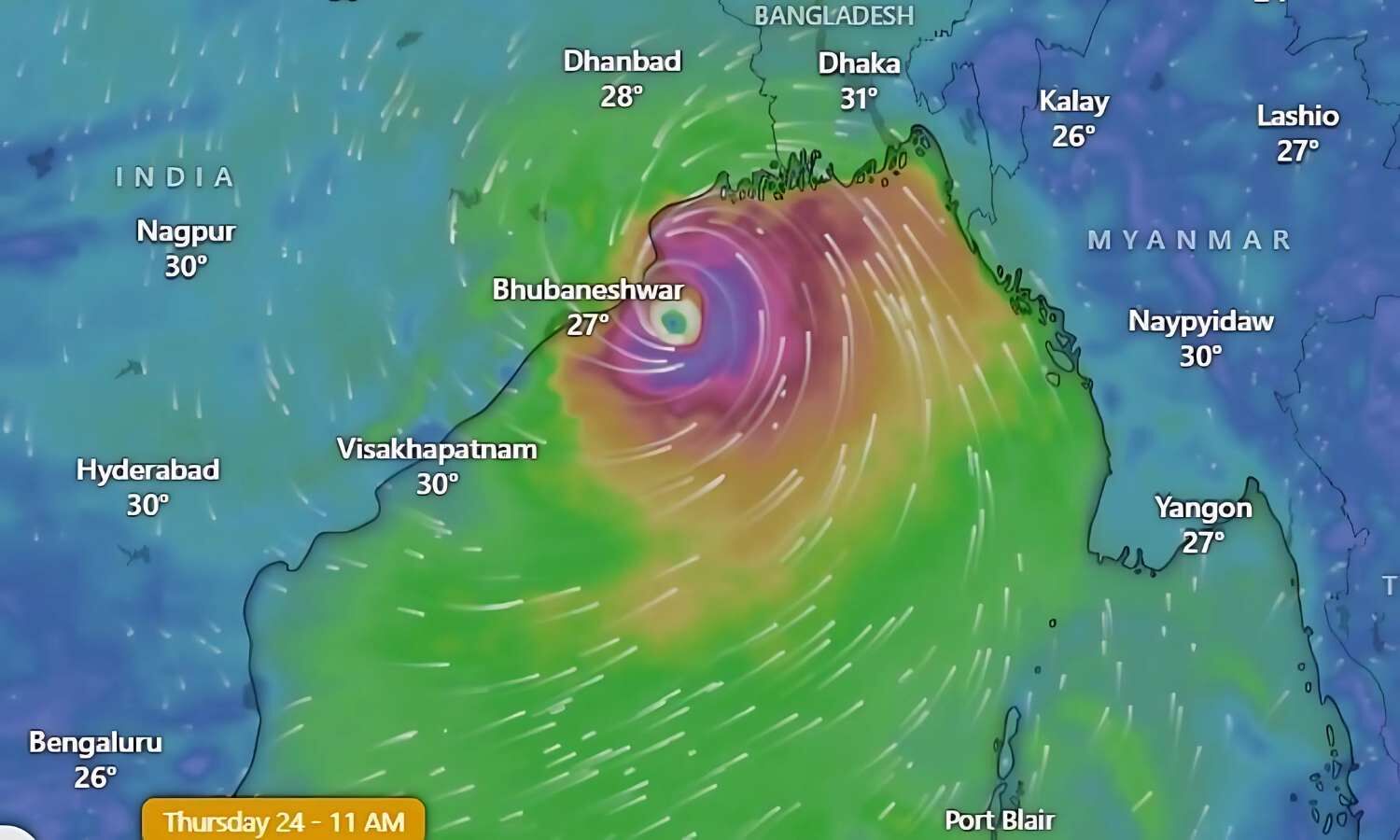

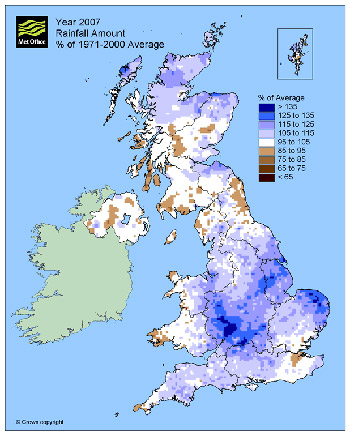

Rain Predictions The Most Up To Date Schedule

May 20, 2025

Rain Predictions The Most Up To Date Schedule

May 20, 2025 -

Pinpointing Rain Latest Updates On Shower Timing

May 20, 2025

Pinpointing Rain Latest Updates On Shower Timing

May 20, 2025 -

Investigating The Reasons For D Wave Quantum Inc Qbts Stocks Increase

May 20, 2025

Investigating The Reasons For D Wave Quantum Inc Qbts Stocks Increase

May 20, 2025 -

Updated Rain Forecast Predicting Periods Of Rainfall

May 20, 2025

Updated Rain Forecast Predicting Periods Of Rainfall

May 20, 2025