$555.8 Million Bitcoin Buy: Strategy's Bold Market Move

Table of Contents

Deciphering the $555.8 Million Bitcoin Buy: Who, What, and Why?

This massive Bitcoin investment raises several crucial questions. Understanding the players involved, their strategic motivations, and the market conditions at the time of purchase is vital to comprehending the significance of this event.

Identifying the Investor(s):

Pinpointing the exact investor(s) behind the $555.8 million Bitcoin buy remains challenging. However, several possibilities exist, each with distinct motivations:

- Large Institutional Investors: Hedge funds, asset management firms, and pension funds are increasingly allocating resources to Bitcoin, viewing it as a potential inflation hedge and a diversification tool within their portfolios. The sheer size of the purchase points towards a significant player with substantial capital.

- Corporations: Some large companies, such as MicroStrategy and Tesla, have already embraced Bitcoin as a strategic asset, accumulating significant holdings. This purchase could represent a similar move by another major corporation looking to secure its long-term financial future.

- High-Net-Worth Individuals (HNWIs): Wealthy individuals often seek alternative investments to diversify their portfolios and protect against market volatility. Bitcoin’s potential for high returns, despite its inherent risks, makes it an attractive option for this demographic.

The motivations for such a large-scale investment likely include:

- Portfolio Diversification: Adding Bitcoin to a diverse portfolio can potentially reduce overall risk and improve returns.

- Long-Term Bullish Outlook: Many investors believe Bitcoin’s price will continue to appreciate over the long term, making it a compelling long-term investment.

- Inflation Hedge: Bitcoin's limited supply and decentralized nature are seen by some as a hedge against inflation.

Analyzing the Investment Strategy:

The strategic rationale behind this purchase warrants careful examination. Was this a single, decisive move, or a series of strategic transactions?

- Dollar-Cost Averaging (DCA): This strategy involves spreading investments over time, mitigating the risk of purchasing at a market peak. The $555.8 million buy could be the result of a long-term DCA strategy, with this being a significant tranche.

- Market Timing: While risky, some investors attempt to time the market, buying assets when they believe the price is low and selling when it is high. This substantial investment might indicate a belief in Bitcoin's immediate or near-term upward potential.

- Risk Mitigation: Large investors often employ sophisticated risk mitigation strategies. For example, the purchase could be part of a broader strategy that includes hedging against other market segments.

The Market Context: Bitcoin's Position at the Time of Purchase:

Understanding Bitcoin’s market position before the $555.8 million purchase is crucial.

- Bitcoin Price at the Time: The price of Bitcoin at the time of the purchase will inform us about the investor's risk tolerance. A lower price would suggest a potentially more aggressive approach.

- Market Volatility: The level of market volatility leading up to the investment provides context for the investor's confidence and risk assessment.

- Regulatory Announcements: Any regulatory changes or announcements around the time of the purchase could have influenced the decision, either positively or negatively.

- Technological Developments: Significant upgrades or breakthroughs in Bitcoin's underlying technology could also justify a large investment.

Impact and Implications of the $555.8 Million Bitcoin Buy

This massive purchase has far-reaching implications for Bitcoin's future, both in the short term and long term.

Short-Term Market Effects:

The immediate effect of such a significant investment is likely to be:

- Price Fluctuations: A large buy order can cause a sudden price increase, potentially triggering a short-term rally.

- Increased Trading Activity: The news itself generates more interest and trading activity, further influencing price volatility.

- Potential for Short-Term Price Rallies: The sheer size of the investment can attract other investors, leading to a self-reinforcing upward price movement.

Long-Term Implications for Bitcoin Adoption:

The $555.8 million Bitcoin buy could accelerate institutional adoption of Bitcoin in several ways:

- Increased Institutional Confidence: Large-scale investments by reputable institutions can signal growing confidence in Bitcoin as a viable asset class.

- Potential for Future Large-Scale Investments: This move might encourage other institutions to follow suit, further increasing Bitcoin's market capitalization.

- Effect on Bitcoin's Overall Market Cap: The influx of capital could significantly contribute to Bitcoin's market cap, solidifying its position as a leading cryptocurrency.

Risks Associated with Such a Large Bitcoin Investment:

Despite the potential for high rewards, significant risks are inherent in such a large investment in a volatile asset like Bitcoin:

- Market Corrections: The cryptocurrency market is prone to sharp corrections. This large investment could be negatively impacted by a sudden and significant price drop.

- Regulatory Uncertainty: Changes in regulatory landscapes around the world could significantly impact Bitcoin's price and overall adoption.

- Potential Security Breaches: Although Bitcoin's blockchain is secure, the exchanges and wallets holding Bitcoin are vulnerable to hacking and theft.

Comparing this $555.8 Million Bitcoin Buy to Other Notable Institutional Investments:

This $555.8 million Bitcoin buy is not an isolated event. Comparing it to other notable institutional investments highlights trends and strategies:

- MicroStrategy's Bitcoin Purchases: MicroStrategy's aggressive Bitcoin accumulation serves as a precedent, demonstrating the viability of a corporate Bitcoin strategy.

- Tesla's Bitcoin Investment: Tesla's initial investment and subsequent partial sale showcases the dynamic nature of corporate cryptocurrency holdings.

Analyzing these previous investments, including their outcomes, offers valuable insights into potential risks and returns associated with such large-scale commitments.

Conclusion:

The $555.8 million Bitcoin buy represents a bold and significant market move. This analysis reveals the potential impact of such large-scale investments, covering short-term market effects, long-term implications for Bitcoin adoption, and the inherent risks involved. Understanding the dynamics behind this purchase is crucial for navigating the evolving landscape of cryptocurrency investment. Understanding the strategy behind the $555.8 million Bitcoin buy is crucial for navigating the complex world of cryptocurrency. Stay informed, do your research, and consider how this bold market move might shape your own Bitcoin strategy.

Featured Posts

-

Stream Untucked Ru Pauls Drag Race Season 17 Episode 6 Free Online

Apr 30, 2025

Stream Untucked Ru Pauls Drag Race Season 17 Episode 6 Free Online

Apr 30, 2025 -

Beyonce And Jay Z Keeping Sir Carter Out Of The Public Eye

Apr 30, 2025

Beyonce And Jay Z Keeping Sir Carter Out Of The Public Eye

Apr 30, 2025 -

Download Google Slides Free Android I Os And Web App

Apr 30, 2025

Download Google Slides Free Android I Os And Web App

Apr 30, 2025 -

Aljdyd Hwl Srf Meashat Abryl 2025 13 Mlywn Mwatn

Apr 30, 2025

Aljdyd Hwl Srf Meashat Abryl 2025 13 Mlywn Mwatn

Apr 30, 2025 -

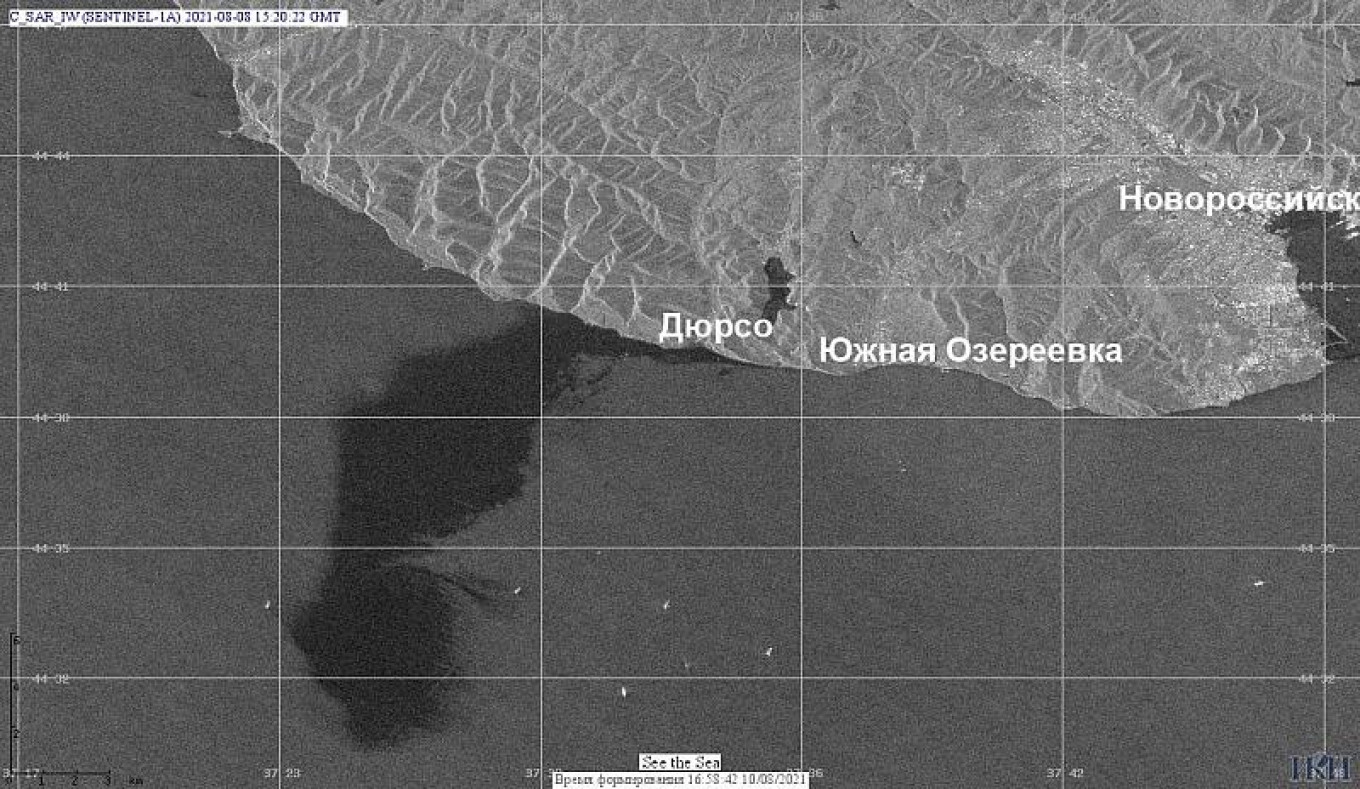

Environmental Emergency Russia Shuts Black Sea Beaches After Oil Spill

Apr 30, 2025

Environmental Emergency Russia Shuts Black Sea Beaches After Oil Spill

Apr 30, 2025

Latest Posts

-

Mercks 1 Billion Investment A New Us Factory For Key Drug Production

Apr 30, 2025

Mercks 1 Billion Investment A New Us Factory For Key Drug Production

Apr 30, 2025 -

Extensive Black Sea Beach Closures Following Russian Oil Spill

Apr 30, 2025

Extensive Black Sea Beach Closures Following Russian Oil Spill

Apr 30, 2025 -

Russias Black Sea Beaches Closed After Large Oil Spill

Apr 30, 2025

Russias Black Sea Beaches Closed After Large Oil Spill

Apr 30, 2025 -

Environmental Emergency Russia Shuts Black Sea Beaches After Oil Spill

Apr 30, 2025

Environmental Emergency Russia Shuts Black Sea Beaches After Oil Spill

Apr 30, 2025 -

Major Oil Spill Forces Closure Of 62 Miles Of Russian Black Sea Beaches

Apr 30, 2025

Major Oil Spill Forces Closure Of 62 Miles Of Russian Black Sea Beaches

Apr 30, 2025