7% Stock Market Plunge In Amsterdam: Trade War Anxiety Takes Toll

Table of Contents

Understanding the 7% Drop in the Amsterdam Stock Market

The sharp decline in the Amsterdam stock market is primarily attributed to the intensifying global trade war and its ripple effects on the Dutch economy.

The Role of Trade War Uncertainty

The ongoing trade disputes, particularly between the US and China, have created considerable uncertainty for businesses globally. This uncertainty directly impacts Dutch businesses, many of which rely heavily on international trade. The Netherlands, with its large port of Rotterdam and significant export-oriented industries, is particularly vulnerable to disruptions in global trade flows.

- Sectors Heavily Affected: The technology sector, heavily reliant on global supply chains, experienced significant losses. The agricultural sector, a key component of the Dutch economy, also suffered due to potential export restrictions and tariff increases.

- Companies Experiencing Significant Losses: [Insert names of specific companies and the percentage of their stock value decrease – replace bracketed information with actual data]. This highlights the widespread impact of the trade war on individual businesses.

- Statistical Data: [Insert relevant statistics, e.g., percentage drop in export volumes, decrease in investor confidence indices, etc. – replace bracketed information with actual data]. These figures underscore the severity of the situation.

Beyond Trade Wars: Other Contributing Factors

While trade war anxieties are the dominant factor, other elements contributed to the market plunge. The global economic slowdown, characterized by weakening growth in major economies, has exacerbated the negative sentiment. Further adding to the uncertainty is the ongoing Brexit situation, which continues to create volatility in European markets.

- Interplay of Factors: The combination of trade war uncertainty, global economic slowdown, and Brexit uncertainty created a perfect storm, leading to investor panic and a sharp sell-off.

- Expert Opinions: [Insert quotes from financial analysts regarding the interplay of these factors and their outlook for the Amsterdam stock market – replace bracketed information with actual quotes].

- Market Trends Visualization: [Include a chart or graph visually representing the Amsterdam stock market's performance in the past few weeks or months. Clearly label axes and data sources].

Analyzing the Economic Impact on the Netherlands

The 7% stock market plunge in Amsterdam has significant implications for the Netherlands, both in the short and long term.

Short-Term Consequences

The immediate impact is visible in decreased consumer confidence, a decline in business investment, and a potential rise in unemployment. The government is likely to implement measures to mitigate the economic fallout.

- Impact on Industries: [Provide bullet points detailing the potential short-term consequences for specific industries, e.g., tourism, manufacturing, etc. Replace bracketed information with details.]

- Government Response: The Dutch government may announce fiscal stimulus packages or other measures to boost the economy and alleviate the impact of the market downturn. [Specify any announced government responses if applicable].

Long-Term Implications

Prolonged uncertainty stemming from the trade war could significantly hamper Dutch economic growth and its long-term competitiveness. This uncertainty could discourage foreign investment, further hindering economic recovery. The Dutch economy may undergo structural changes as businesses adapt to the new global trade landscape.

- Long-Term Growth: The potential long-term consequences include slower GDP growth, reduced employment opportunities, and a shift in economic focus. [Provide details and potential scenarios based on economic models and expert predictions].

- Foreign Investment: The current climate may deter foreign direct investment, hindering long-term economic expansion and innovation.

Strategies for Investors Navigating Market Volatility

The current market volatility underscores the importance of robust risk management and diversified investment strategies.

Risk Management and Diversification

Investors should prioritize risk management by diversifying their portfolios across different asset classes, geographical regions, and sectors. This reduces the impact of any single event on their overall investments.

- Risk Mitigation Strategies:

- Diversification: Spread investments across stocks, bonds, real estate, and other assets.

- Hedging: Use financial instruments to protect against potential losses.

- Stop-loss orders: Set automatic sell orders to limit potential losses.

Long-Term Investment Planning

Rather than panicking and selling assets, investors should stick to a long-term investment strategy. This requires patience, staying informed, and adapting to changing market conditions.

- Stay Informed: Continuously monitor economic news and market trends.

- Seek Professional Advice: Consulting a financial advisor is crucial for developing a personalized investment strategy tailored to individual risk tolerance and financial goals.

Looking Ahead: Future Predictions and Outlook for the Amsterdam Stock Market

Predicting the future of the Amsterdam stock market is challenging, but several potential scenarios exist. A resolution to the trade war could lead to a rapid market recovery. However, prolonged uncertainty could result in further volatility. Government policies and global events will play a significant role in shaping the market's trajectory.

- Potential Scenarios: [Discuss possible scenarios, including best-case, worst-case, and most likely outcomes. Back up predictions with data and expert opinions].

- Positive Indicators: [Mention any positive economic signs, such as improvements in global trade talks or positive domestic economic data, that might indicate a potential market rebound].

Conclusion

The 7% plunge in the Amsterdam stock market, largely driven by trade war anxiety, highlights the interconnectedness of global markets and the importance of robust investment strategies. The short-term consequences include decreased consumer confidence and potential job losses, while the long-term implications could impact Dutch economic growth and competitiveness. Investors should prioritize risk management, diversification, and long-term planning to navigate this volatile period. Stay informed about the Amsterdam stock market and the evolving trade war situation to make informed investment decisions. Understand the risks associated with investing during times of high market volatility. Consider seeking professional financial advice to develop a robust investment strategy that mitigates potential losses stemming from future Amsterdam stock market plunges.

Featured Posts

-

Humoriste Transformiste Zize En Spectacle A Graveson 4 Avril

May 25, 2025

Humoriste Transformiste Zize En Spectacle A Graveson 4 Avril

May 25, 2025 -

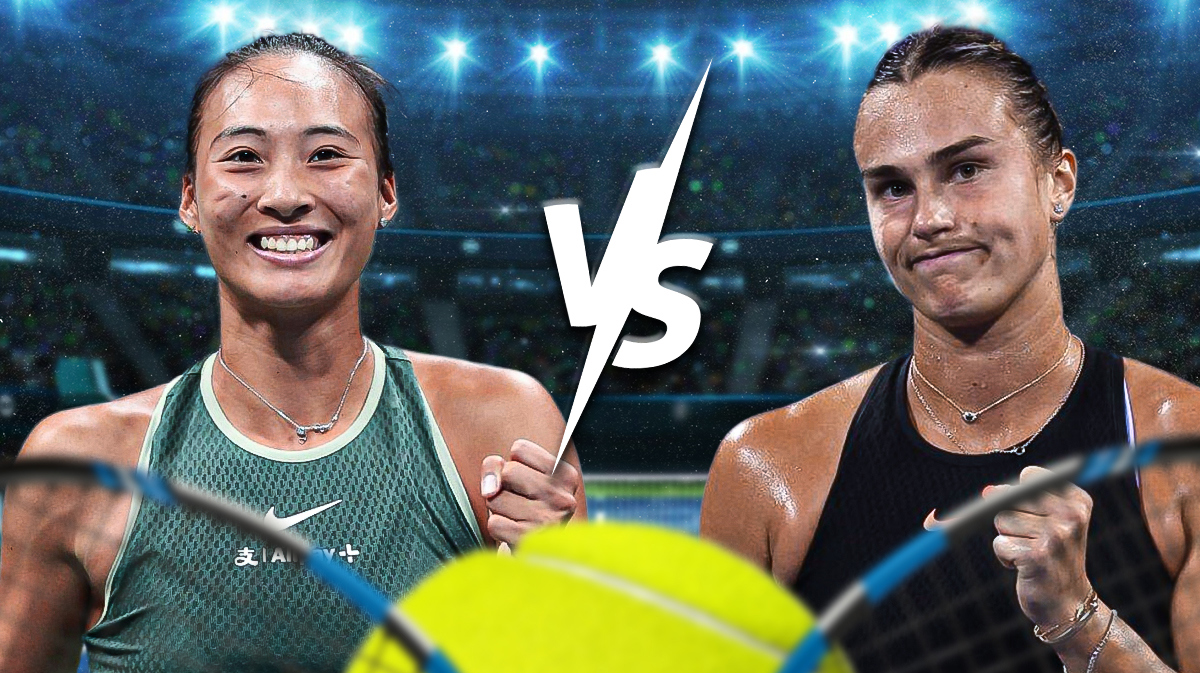

Zheng Qinwen Defeats Sabalenka For First Time Advances To Italian Open Semis

May 25, 2025

Zheng Qinwen Defeats Sabalenka For First Time Advances To Italian Open Semis

May 25, 2025 -

Kerings September Sales Demnas Gucci Influence

May 25, 2025

Kerings September Sales Demnas Gucci Influence

May 25, 2025 -

Former French Pm Disagrees With Macrons Decisions

May 25, 2025

Former French Pm Disagrees With Macrons Decisions

May 25, 2025 -

Investigating Price Gouging Claims After La Fires

May 25, 2025

Investigating Price Gouging Claims After La Fires

May 25, 2025