8% Stock Market Jump On Euronext Amsterdam: Impact Of Trump's Tariff Delay

Table of Contents

Understanding the Initial Market Reaction

Immediate Impact on Key Indices

The announcement triggered an immediate and substantial positive reaction across Euronext Amsterdam's key indices. The AEX Index, a benchmark for the Amsterdam Stock Exchange, saw an 8% jump, its largest single-day gain in several years. Sector-specific indices also experienced significant increases. For example, the technology sector showed a particularly strong surge, reflecting the sensitivity of this sector to trade uncertainties. (Insert chart or graph showing AEX index movement here). The volume of trades executed during this surge significantly exceeded average daily trading volumes, indicating heightened investor activity and a rush to capitalize on the perceived positive shift in market sentiment. This contrasts sharply with the subdued trading experienced in the weeks leading up to the tariff delay announcement, when uncertainty prevailed. Initial reactions from market analysts were overwhelmingly positive, with many citing the relief factor as the primary driver of the surge.

- Percentage increase: The AEX Index surged by 8%, with technology and manufacturing sectors experiencing even higher percentage gains.

- Volume of trades: Trading volumes were significantly higher than average, indicating a strong response to the news.

- Comparison to previous fluctuations: This was the largest single-day gain for the AEX Index in over three years.

- Analyst reactions: Many analysts described the jump as a "relief rally," reflecting the reduction in uncertainty regarding US-EU trade relations.

The immediate psychological impact was undeniable. Investor confidence, previously shaken by the threat of escalating trade tensions, experienced a sharp rebound. Short-term traders, quick to react to market volatility, heavily contributed to the surge, driving up trading volumes and amplifying the initial price increases.

Analyzing the Role of Trump's Tariff Delay

The Tariff Delay and its Significance

President Trump's announcement involved a delay on certain tariffs slated to be imposed on European goods. (Specify the types of goods and the duration of the delay here, citing official sources). This delay, however temporary, provided a significant reprieve for European businesses that were bracing for substantial economic impacts.

- Pre-existing concerns: European businesses, particularly in sectors like automotive and manufacturing, faced substantial challenges due to the threatened tariffs. These tariffs threatened to disrupt supply chains, increase production costs, and potentially lead to job losses.

- Avoided negative effects: The delay avoided the immediate implementation of these potentially devastating tariffs, offering a lifeline to many businesses.

- Geopolitical implications: The delay, although temporary, suggests a potential easing of trade tensions between the US and the EU, offering a glimmer of hope for improved bilateral relations.

The automotive and manufacturing sectors were among the most positively affected, as these industries were heavily targeted by the initially threatened tariffs. However, it's crucial to recognize that the uncertainty remains. The delay is temporary, and the threat of future tariffs continues to loom large.

Long-Term Implications for Euronext Amsterdam

Sustained Growth or Temporary Relief?

Whether this 8% jump represents sustained growth or a temporary relief rally remains to be seen. Several factors could influence the long-term trajectory of Euronext Amsterdam.

- Sustaining positive trends: Continued positive economic data within the Eurozone, robust global economic growth, and further de-escalation of trade tensions could sustain the positive market sentiment.

- Potential for correction: Renewed trade tensions, a global economic slowdown, or negative economic data from the Eurozone could trigger a market correction, potentially wiping out some or all of the recent gains.

- Influence of global events: Geopolitical instability in other regions, unexpected economic shocks, or shifts in global monetary policy can all impact the performance of Euronext Amsterdam.

The outlook is complex. While the tariff delay offers short-term relief, sustained growth will depend on a multitude of interwoven factors beyond just US trade policy. A balanced perspective is necessary, acknowledging both optimistic and pessimistic scenarios.

Investor Sentiment and Strategic Decisions

How Investors Should Respond

The 8% jump on Euronext Amsterdam highlights the importance of carefully managing risk in a volatile market environment. Investors should consider several key factors:

- Diversification: Diversifying investments across different asset classes and geographic regions is crucial to mitigate risk.

- Risk management: Employing strategies like stop-loss orders can help limit potential losses during market corrections.

- Buy, sell, or hold: The decision to buy, sell, or hold specific assets depends on individual investor risk tolerance and investment goals. Thorough due diligence and consideration of long-term investment strategies are essential.

While the market’s positive response to the tariff delay is encouraging, caution remains warranted. Investors should approach the market with a balanced perspective, monitoring developments closely and adjusting their strategies accordingly.

Conclusion

The 8% stock market jump on Euronext Amsterdam represents a significant short-term reaction to President Trump's decision to delay certain tariffs. While this delay has provided immediate relief and boosted investor sentiment, the long-term impact remains uncertain. The sustainability of this positive trend hinges on several factors, including the continued easing of trade tensions, robust global economic growth, and the absence of unforeseen negative economic shocks. Investors should maintain a balanced perspective, continue monitoring the situation on Euronext Amsterdam and the broader global economic landscape, and adjust their investment strategies accordingly. Understanding the impact of trade wars and tariff policies on investments is crucial in navigating the complexities of the modern financial markets. Stay informed and adapt your approach to capitalize on opportunities presented by fluctuations in the Euronext Amsterdam stock market.

Featured Posts

-

Atletico Madrid Barcelona Canli Mac Yayini Ve Detayli Bilgiler Fanatik

May 25, 2025

Atletico Madrid Barcelona Canli Mac Yayini Ve Detayli Bilgiler Fanatik

May 25, 2025 -

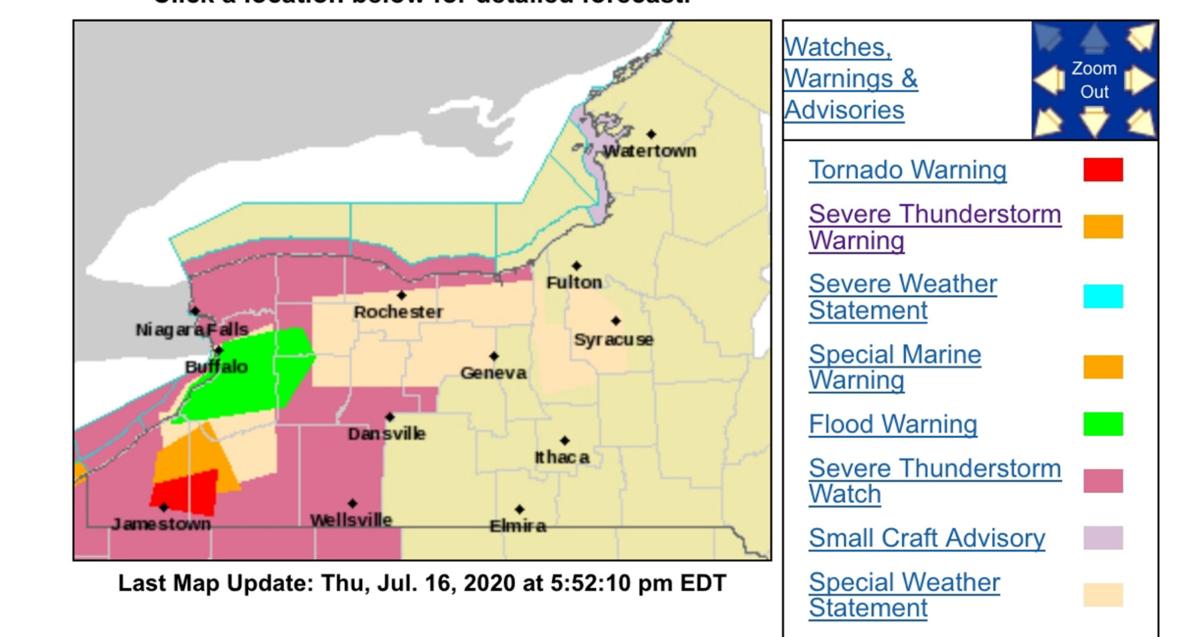

Urgent Flash Flood Warning Issued For Bradford And Wyoming Counties

May 25, 2025

Urgent Flash Flood Warning Issued For Bradford And Wyoming Counties

May 25, 2025 -

Country Property For Under 1m A Buyers Perspective

May 25, 2025

Country Property For Under 1m A Buyers Perspective

May 25, 2025 -

Vervolg Op Snelle Marktbeweging Europese Aandelen Tegenover Wall Street

May 25, 2025

Vervolg Op Snelle Marktbeweging Europese Aandelen Tegenover Wall Street

May 25, 2025 -

Carlos Alcaraz And Aryna Sabalenka Dominate At The Italian Open

May 25, 2025

Carlos Alcaraz And Aryna Sabalenka Dominate At The Italian Open

May 25, 2025