AbbVie (ABBV) Raises Profit Outlook On Strong New Drug Sales

Table of Contents

Strong Performance of Key New Drugs Fuels Profit Increase

AbbVie's impressive profit increase is directly linked to the outstanding market performance of its newer medications. Two drugs, in particular, have been instrumental in driving this growth.

Rinvoq and Skyrizi Lead the Charge:

Rinvoq (upadacitinib) and Skyrizi (risankizumab) have significantly contributed to AbbVie's revenue surge. While precise sales figures may vary depending on the reporting period, both drugs have consistently demonstrated exceptional market penetration. Rinvoq, a JAK inhibitor, and Skyrizi, an interleukin-23 (IL-23) inhibitor, target a range of inflammatory diseases including rheumatoid arthritis, psoriatic arthritis, psoriasis, Crohn’s disease, and ulcerative colitis. This broad therapeutic application significantly expands their market potential.

- Superior Efficacy: Both Rinvoq and Skyrizi have shown superior efficacy in clinical trials compared to existing treatments, leading to faster symptom relief and improved patient outcomes.

- Improved Safety Profile: These drugs offer a comparatively improved safety profile, minimizing certain side effects associated with older treatments.

- Convenient Administration: The administration methods for both Rinvoq and Skyrizi are convenient for patients, contributing to better adherence to treatment plans.

Expanding Pipeline Strengthens Future Outlook:

Beyond Rinvoq and Skyrizi, AbbVie boasts a robust pipeline of promising drugs in various stages of development. This strong pipeline mitigates the risk associated with patent expirations and ensures continued growth for the company. Recent clinical trial successes and regulatory approvals for these candidates further solidify AbbVie's position as a leader in the biopharmaceutical industry.

- Ongoing Research and Development: AbbVie invests heavily in research and development, fostering innovation and ensuring a continuous stream of new treatments to address unmet medical needs. This commitment underlines the company's long-term growth strategy.

Revised Financial Projections Exceed Analyst Estimates

AbbVie's revised profit outlook significantly surpasses previous projections and analyst consensus. The company has provided updated guidance reflecting this positive performance.

- Adjusted Earnings Per Share (EPS): The revised EPS projections indicate a substantial increase compared to prior forecasts.

- Revenue Growth Projections: AbbVie's updated revenue growth projections highlight the strong momentum generated by its new drugs and the overall strength of its business.

- Market Reaction: The market reacted positively to this news, with AbbVie's stock price experiencing a notable increase following the announcement. This demonstrates investor confidence in the company's future prospects.

Implications for Investors and the Pharmaceutical Industry

AbbVie's remarkable performance holds significant implications for investors and the broader pharmaceutical landscape.

- Industry Impact: AbbVie's success reinforces the importance of innovation and the potential for significant returns in the biopharmaceutical sector. It highlights the value of investing in companies with strong R&D pipelines and successful new drug launches.

- Long-Term Investment Prospects: AbbVie's strong financial results and robust pipeline suggest promising long-term investment prospects for shareholders. However, careful consideration of potential risks is crucial.

- Potential Risks and Challenges: While the outlook is positive, investors should be mindful of potential challenges, including patent expirations for existing drugs, competitive pressures, and regulatory hurdles.

- Key Investment Considerations for AbbVie (ABBV):

- Strong and diverse drug pipeline.

- Market leadership in key therapeutic areas.

- Robust financial performance.

- Potential impact of future patent expirations.

Conclusion

AbbVie's raised profit outlook is primarily due to the exceptional sales performance of its newer drugs, especially Rinvoq and Skyrizi, exceeding expectations and signaling robust growth. This positive development has significant implications for investors and the pharmaceutical industry. The company's commitment to research and development, coupled with the success of its new drug launches, positions AbbVie (ABBV) favorably for continued success. Stay informed on the latest developments concerning AbbVie (ABBV) and its innovative new drug portfolio. Learn more about investing in leading pharmaceutical companies like AbbVie by conducting thorough research and consulting with a financial advisor. [Link to AbbVie Investor Relations] [Link to Financial News Source]

Featured Posts

-

Federal Investigation Millions Stolen Via Executive Office365 Intrusions

Apr 26, 2025

Federal Investigation Millions Stolen Via Executive Office365 Intrusions

Apr 26, 2025 -

Denmark Accuses Russia Of Spreading False Greenland News To Exacerbate Us Tensions

Apr 26, 2025

Denmark Accuses Russia Of Spreading False Greenland News To Exacerbate Us Tensions

Apr 26, 2025 -

Major Rail Disruptions In Amsterdam And The Randstad Track Failure Impacts

Apr 26, 2025

Major Rail Disruptions In Amsterdam And The Randstad Track Failure Impacts

Apr 26, 2025 -

Trump Envoy Witkoffs Moscow Arrival Interfax Report Details

Apr 26, 2025

Trump Envoy Witkoffs Moscow Arrival Interfax Report Details

Apr 26, 2025 -

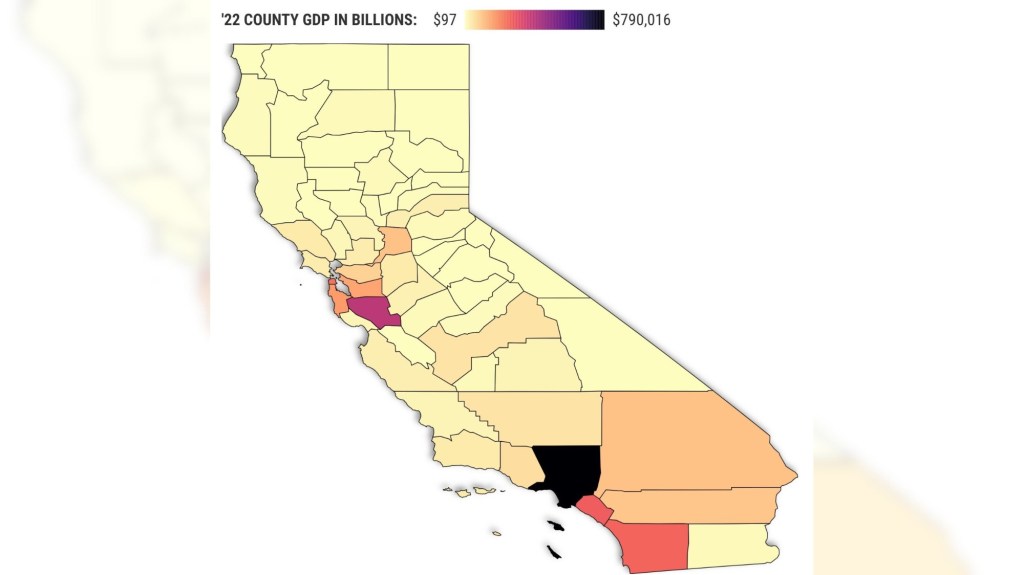

Californias Economy Now Larger Than Japans

Apr 26, 2025

Californias Economy Now Larger Than Japans

Apr 26, 2025

Latest Posts

-

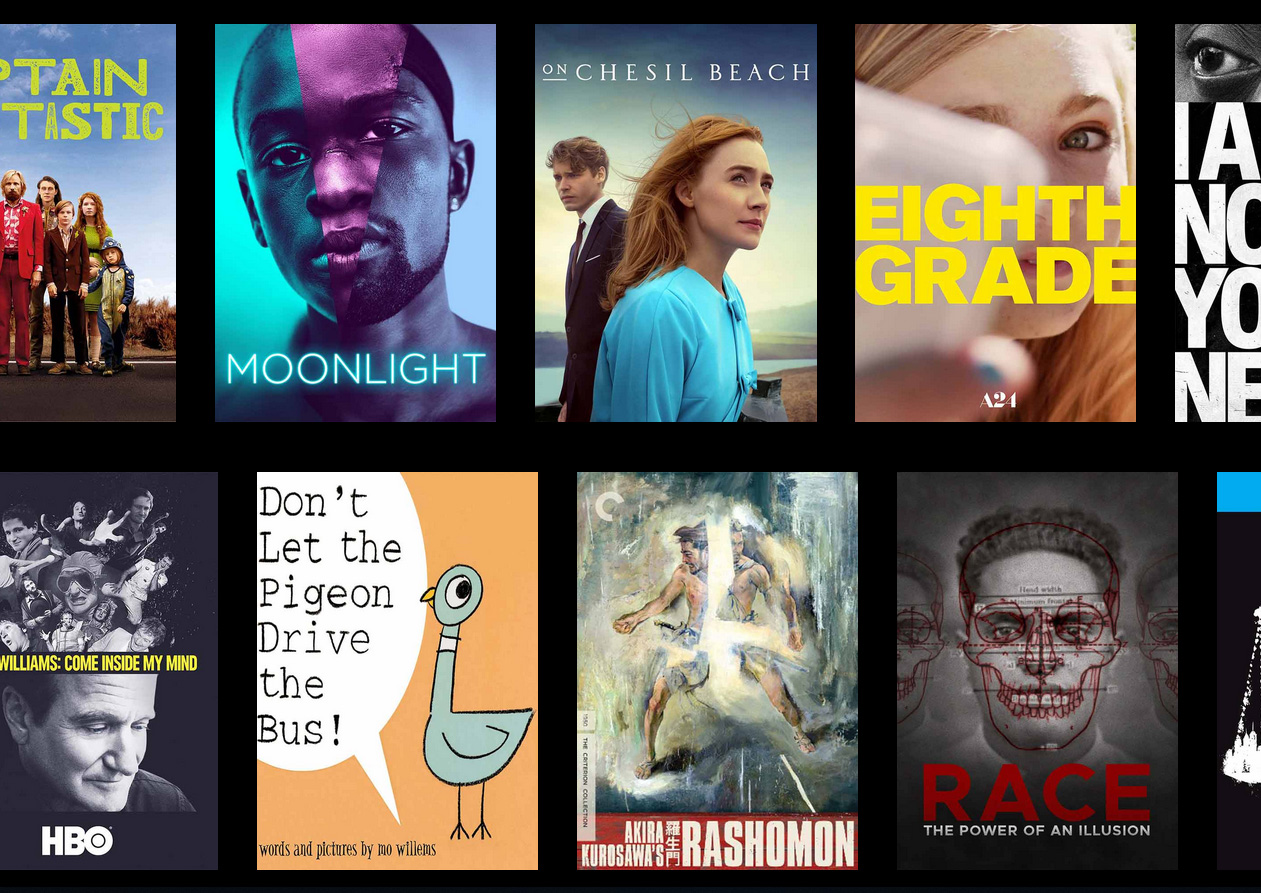

Kanopys Hidden Gems Free Movies And Tv Shows You Shouldnt Miss

Apr 27, 2025

Kanopys Hidden Gems Free Movies And Tv Shows You Shouldnt Miss

Apr 27, 2025 -

Unlock Kanopy Find Great Movies And Shows For Free

Apr 27, 2025

Unlock Kanopy Find Great Movies And Shows For Free

Apr 27, 2025 -

Free Kanopy Streaming Top Movies And Tv Shows To Watch Now

Apr 27, 2025

Free Kanopy Streaming Top Movies And Tv Shows To Watch Now

Apr 27, 2025 -

Best Free Movies And Shows On Kanopy A Curated List

Apr 27, 2025

Best Free Movies And Shows On Kanopy A Curated List

Apr 27, 2025 -

Dubai Return Svitolina Defeats Kalinskaya In First Round

Apr 27, 2025

Dubai Return Svitolina Defeats Kalinskaya In First Round

Apr 27, 2025