ABN Amro Bonus Scheme Under Investigation By Dutch Regulator

Table of Contents

Main Points: Unpacking the ABN Amro Bonus Scheme Investigation

2.1 Details of the ABN Amro Bonus Scheme Under Investigation

Structure of the Bonus Scheme:

ABN Amro's bonus scheme, like many in the financial industry, is complex, rewarding employees based on a combination of individual, team, and overall company performance. Key features likely included:

- Individual Performance: Bonuses tied to individual targets, often linked to sales figures, client acquisition, or specific project milestones.

- Team Performance: Bonuses awarded based on the collective success of a department or team, encouraging collaboration and shared responsibility.

- Company-Wide Performance: A component of the bonus linked to ABN Amro's overall financial performance, aligning employee incentives with the bank's strategic goals.

- Metrics and Targets: Specific, measurable, achievable, relevant, and time-bound (SMART) goals were likely set to determine bonus eligibility and payouts. These targets varied depending on the employee's role and responsibilities. The total bonus pool and average bonus amounts are currently undisclosed but are central to the AFM investigation.

Allegations and Concerns Raised by the AFM:

The AFM's investigation into the ABN Amro bonus scheme stems from concerns surrounding:

- Potential Misalignment of Incentives: Allegations suggesting that the bonus structure may have incentivized excessive risk-taking, potentially jeopardizing the bank's stability.

- Lack of Transparency: Concerns regarding the clarity and transparency of the bonus scheme's criteria and calculations, potentially leading to unfair or inconsistent payouts.

- Insufficient Risk Management: Allegations that the bonus system failed to adequately account for and mitigate the risks associated with certain activities.

- Non-Compliance with Regulations: The AFM may be investigating potential breaches of Dutch and EU regulations pertaining to executive compensation and risk management. Specific regulations under scrutiny remain undisclosed at this time.

Potential Regulatory Breaches:

The investigation could uncover violations of several key regulations, including:

- EU Directives on Capital Requirements: Regulations governing the capital adequacy of banks and the management of risk. Non-compliance could result in significant fines.

- Dutch Banking Legislation: Specific national laws and regulations governing executive compensation and the overall governance of financial institutions.

- AFM Guidelines on Remuneration: Guidelines and best practices issued by the AFM to promote responsible and ethical remuneration practices within the Dutch banking sector.

Potential penalties for non-compliance range from substantial financial fines to reputational damage and even legal action against senior executives.

2.2 Impact on ABN Amro and Stakeholders

Stock Market Reaction:

Since the commencement of the investigation, ABN Amro's share price has experienced volatility. While initial reactions were negative, further impacts depend on the outcome of the investigation and any remedial actions taken by the bank. Analyst ratings and investor confidence will likely be significantly impacted.

Employee Morale and Public Perception:

The investigation has undoubtedly impacted employee morale, with uncertainty surrounding bonuses and potential repercussions. The reputational damage to ABN Amro, especially concerning its corporate culture and ethics, could affect employee retention and recruitment efforts.

ABN Amro's Response to the Investigation:

ABN Amro has publicly stated its commitment to cooperating fully with the AFM's investigation. The bank has also initiated internal reviews of its bonus scheme and implemented several measures to enhance transparency and strengthen risk management. The details of these changes are yet to be fully disclosed.

2.3 Wider Implications for the Dutch Banking Sector

Industry-Wide Impact:

The ABN Amro case has set a precedent for increased regulatory scrutiny of bonus schemes across the Dutch banking industry. Other banks are now likely reviewing their compensation structures to ensure compliance and avoid similar investigations.

Lessons Learned:

The investigation highlights the critical need for:

- Robust Risk Management Frameworks: Comprehensive systems to assess and mitigate risks associated with bonus structures.

- Transparent and Fair Compensation Policies: Clearly defined criteria, transparent calculations, and equitable distribution of bonuses.

- Strong Corporate Governance: Effective oversight and accountability mechanisms to ensure compliance with regulations and ethical standards.

Conclusion: Understanding the ABN Amro Bonus Scheme Investigation

The investigation into the ABN Amro bonus scheme is a significant event with far-reaching consequences. The outcome will not only impact ABN Amro's financial health and reputation but will also shape the future of bonus schemes and regulatory practices within the Dutch banking sector. It underscores the crucial need for responsible compensation practices and robust risk management within the financial industry. Stay informed about developments in the "ABN Amro Bonus Scheme Under Investigation" by following reputable financial news sources and regulatory updates. Understanding this case is key to navigating the evolving landscape of ethical banking practices and regulatory compliance in the Netherlands.

Featured Posts

-

Mntkhb Amryka Thlath Njwm Ysharkwn Lawl Mrt Tht Qyadt Bwtshytynw

May 21, 2025

Mntkhb Amryka Thlath Njwm Ysharkwn Lawl Mrt Tht Qyadt Bwtshytynw

May 21, 2025 -

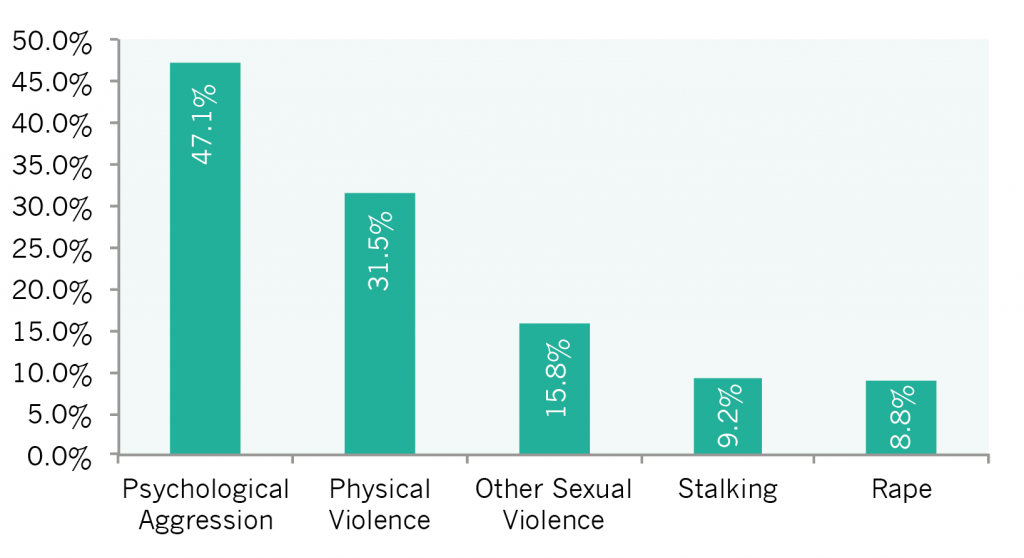

Femicide A Deep Dive Into The Causes And Statistics Of Violence Against Women

May 21, 2025

Femicide A Deep Dive Into The Causes And Statistics Of Violence Against Women

May 21, 2025 -

Good Morning America Backstage Turmoil Leads To Job Cut Fears

May 21, 2025

Good Morning America Backstage Turmoil Leads To Job Cut Fears

May 21, 2025 -

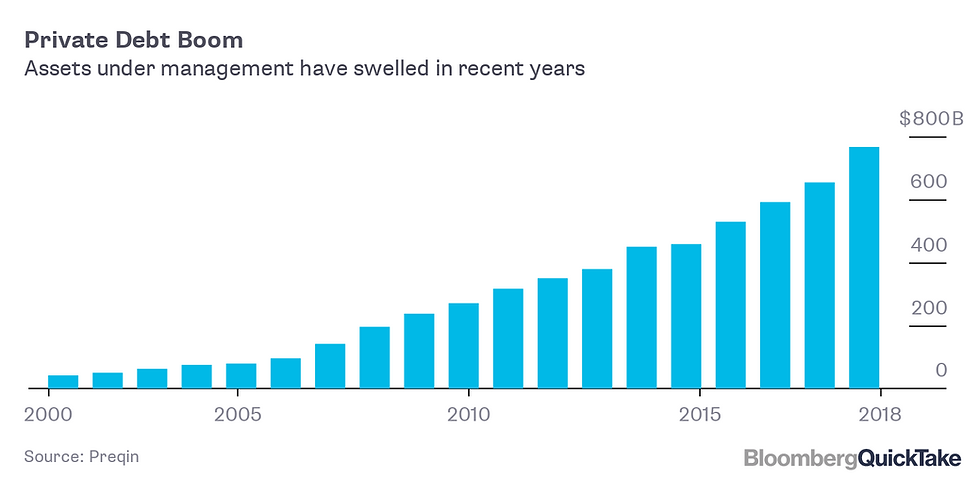

5 Essential Tips For Success In The Private Credit Job Market

May 21, 2025

5 Essential Tips For Success In The Private Credit Job Market

May 21, 2025 -

Clisson Debat Sur Le Port De Symboles Religieux Au College

May 21, 2025

Clisson Debat Sur Le Port De Symboles Religieux Au College

May 21, 2025

Latest Posts

-

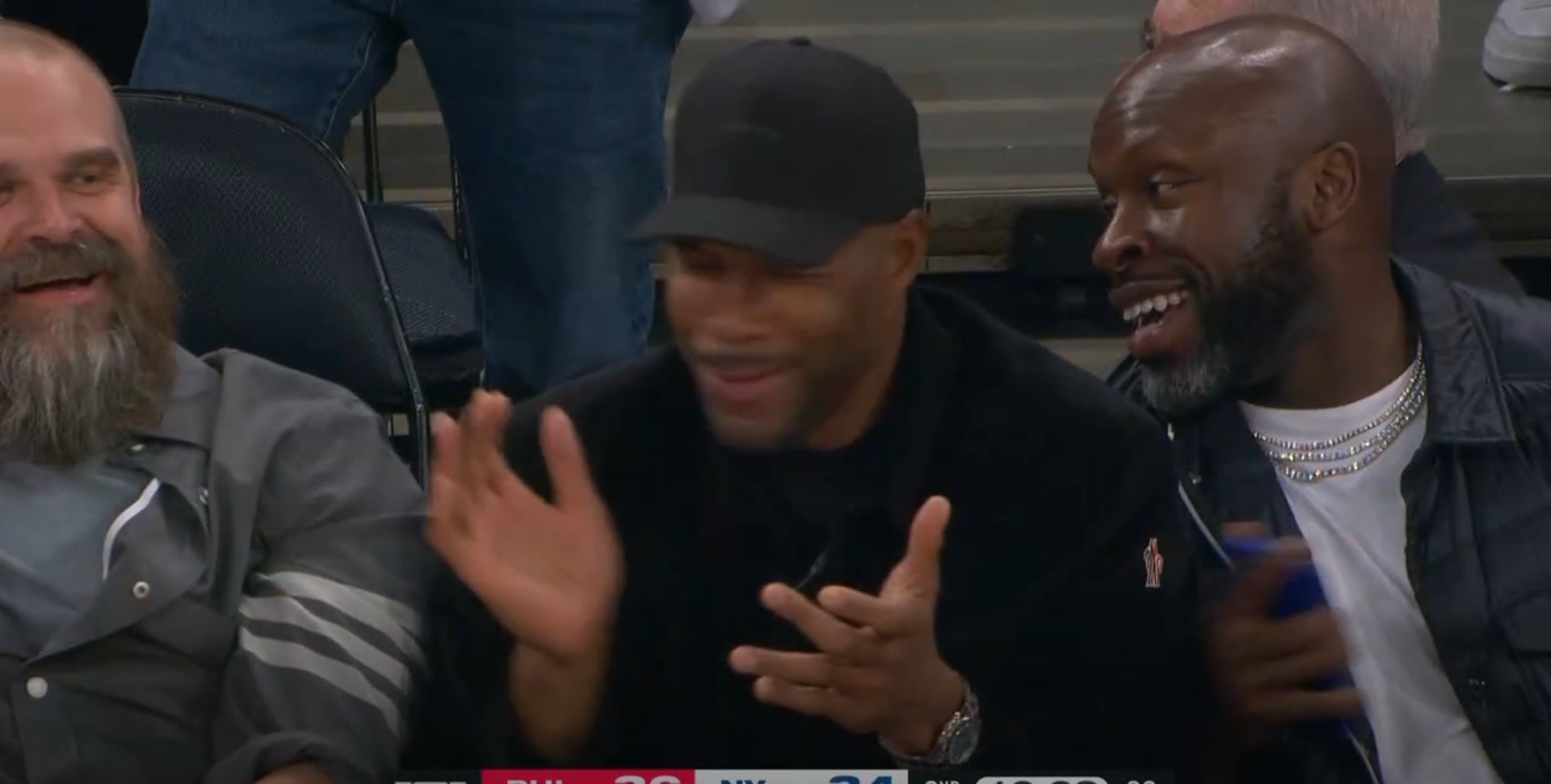

Did Michael Strahan Outmaneuver The Competition A Look At His Recent Interview

May 21, 2025

Did Michael Strahan Outmaneuver The Competition A Look At His Recent Interview

May 21, 2025 -

Major Corruption Conviction Shakes The Navy Former Second In Command Sentenced

May 21, 2025

Major Corruption Conviction Shakes The Navy Former Second In Command Sentenced

May 21, 2025 -

Will Abc News Show Survive Recent Layoffs

May 21, 2025

Will Abc News Show Survive Recent Layoffs

May 21, 2025 -

Analyzing Michael Strahans Big Interview A Ratings War Perspective

May 21, 2025

Analyzing Michael Strahans Big Interview A Ratings War Perspective

May 21, 2025 -

Four Star Admiral Burke Found Guilty Of Bribery

May 21, 2025

Four Star Admiral Burke Found Guilty Of Bribery

May 21, 2025