Amsterdam Exchange Down 2% Following Latest Trump Tariff Announcement

Table of Contents

The Impact of Trump's Tariff Announcement on European Markets

President Trump's latest tariff announcement, targeting key European industries, sent shockwaves through European markets, with the Amsterdam Exchange bearing the brunt of the immediate impact. These tariffs, specifically targeting [insert specific industries and details of the tariffs announced, e.g., agricultural products and certain manufactured goods], directly affect Dutch businesses heavily involved in these sectors.

- Direct Impact on Dutch Businesses: Companies in the Netherlands heavily reliant on trade with the US, particularly in [mention specific affected sectors, e.g., agricultural exports, manufacturing], face immediate challenges. Increased costs from tariffs reduce competitiveness and profitability, potentially leading to job losses and reduced investment.

- Retaliatory Tariffs from the EU: The European Union is likely to respond with retaliatory tariffs, escalating the trade war and further harming businesses on both sides of the Atlantic. The potential for such retaliatory measures adds another layer of uncertainty to the already volatile market.

- Strained Trade Relations: The ongoing trade disputes between the US and the EU are seriously damaging trade relations, creating an atmosphere of distrust and hindering economic growth on both continents. This uncertainty makes long-term planning extremely difficult for businesses and investors.

- Global Trade Disruption: The escalation of trade tensions disrupts global supply chains, creating bottlenecks and increasing costs for consumers worldwide. This uncertainty impacts businesses that rely on international trade networks and compromises global economic stability.

Amsterdam Exchange's Response and Market Volatility

The Amsterdam Exchange's 2% drop reflects the immediate market reaction to the news. The AEX index, for example, closed at [insert closing price] after opening at [insert opening price], representing a significant decline.

- Sharp Decline in Stock Prices: Key indices on the Amsterdam Exchange experienced substantial losses, with [mention specific examples of affected sectors and companies]. This highlights the vulnerability of the Dutch market to external economic shocks.

- Increased Trading Volume: Trading volume increased significantly as investors reacted swiftly to the news, either selling off assets to limit losses or attempting to capitalize on short-term opportunities in a volatile market.

- Negative Investor Sentiment: The prevailing sentiment among investors and market analysts is one of concern and uncertainty. Many are anticipating further market fluctuations and are adopting a more cautious approach to investment.

- Potential for Further Fluctuations: The market remains highly volatile, and the potential for further price swings in the coming weeks and months is significant. The situation demands close monitoring and agile adjustments in investment strategies.

The Broader Global Economic Implications

The impact of Trump's tariffs extends far beyond the Amsterdam Exchange and Europe. The escalating trade war creates significant uncertainty in the global economy.

- Ripple Effect on Global Markets: Other global markets are also feeling the repercussions of this trade dispute, with indices across Asia and the Americas experiencing declines. The interconnectedness of the global economy means that shocks in one region quickly spread to others.

- Impact on Global Supply Chains: The disruptions to international trade affect global supply chains, leading to delays, increased costs, and potential shortages of goods. Consumers worldwide may experience higher prices as a result.

- Recession Risk: The escalating trade war increases the risk of a global recession. Continued uncertainty and decreased international trade can significantly dampen economic growth.

- Alternative Strategies: Businesses and investors need to develop alternative strategies to mitigate the risks of the trade war. This might include diversifying supply chains, seeking new markets, and adjusting investment portfolios to minimize exposure to vulnerable sectors.

Safeguarding Investments Amidst Market Uncertainty

Navigating this period of market uncertainty requires a proactive approach to investment management.

- Risk Management: Implement robust risk management strategies to protect your portfolio. This includes diversifying investments across different asset classes and geographic regions.

- Portfolio Diversification: Don't put all your eggs in one basket. Diversify your portfolio to reduce exposure to any single sector or region vulnerable to trade disputes.

- Long-Term Investment Planning: Maintain a long-term perspective and avoid making impulsive decisions based on short-term market fluctuations. Stick to your investment plan.

- Financial Planning: Consult with a financial advisor to review your financial plan and adjust your strategy to address the increased risks in the current market climate.

Conclusion

The 2% drop in the Amsterdam Exchange following President Trump's latest tariff announcement underscores the significant impact of trade disputes on global markets. The volatility experienced highlights the need for careful risk management and strategic investment planning. The interconnected nature of the global economy means that these events have far-reaching consequences.

Call to Action: Stay informed on developments impacting the Amsterdam Exchange and global markets. Monitor the ongoing effects of Trump tariffs and adjust your investment strategies accordingly to navigate the uncertainty surrounding the Amsterdam Exchange and other global markets. Understanding the complexities of the global trade landscape is crucial for making sound investment decisions during this period of heightened economic volatility.

Featured Posts

-

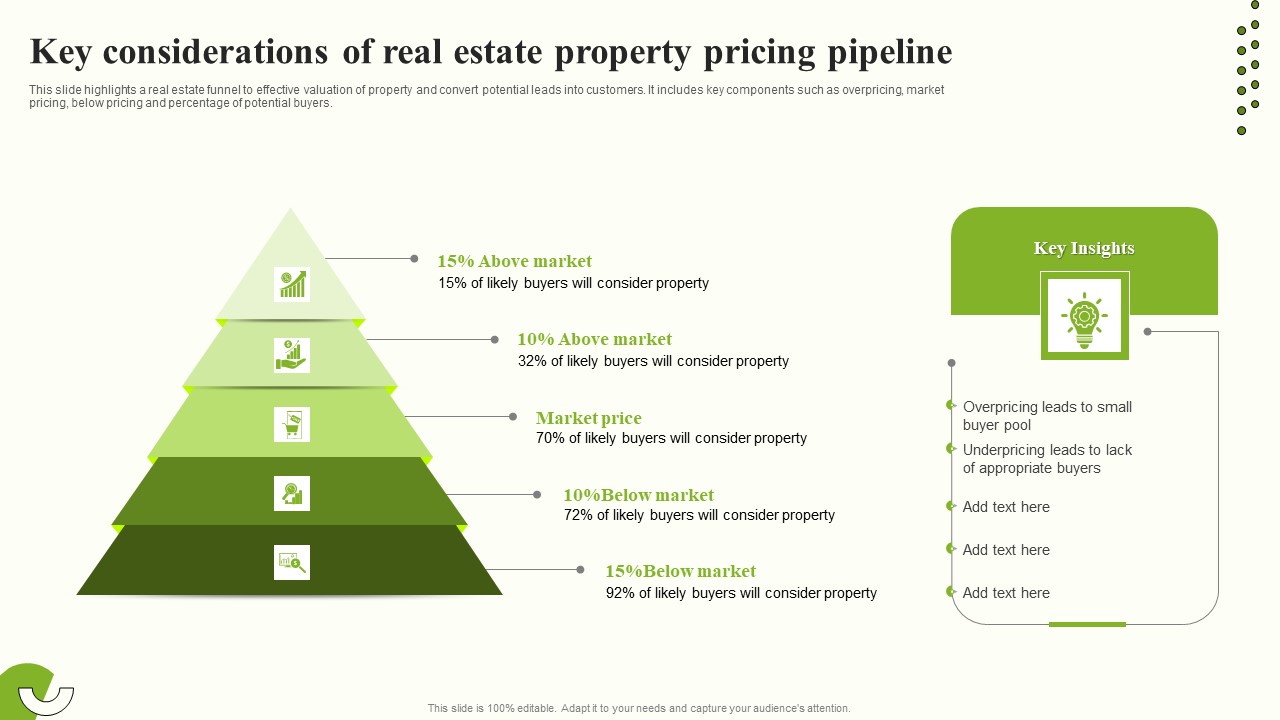

Escape To The Country Real Estate And Property Considerations

May 24, 2025

Escape To The Country Real Estate And Property Considerations

May 24, 2025 -

Konchita Vurst Yiyi Prognozi Peremozhtsiv Yevrobachennya 2025

May 24, 2025

Konchita Vurst Yiyi Prognozi Peremozhtsiv Yevrobachennya 2025

May 24, 2025 -

One Womans Pandemic Escape The Role Of Seattles Green Spaces

May 24, 2025

One Womans Pandemic Escape The Role Of Seattles Green Spaces

May 24, 2025 -

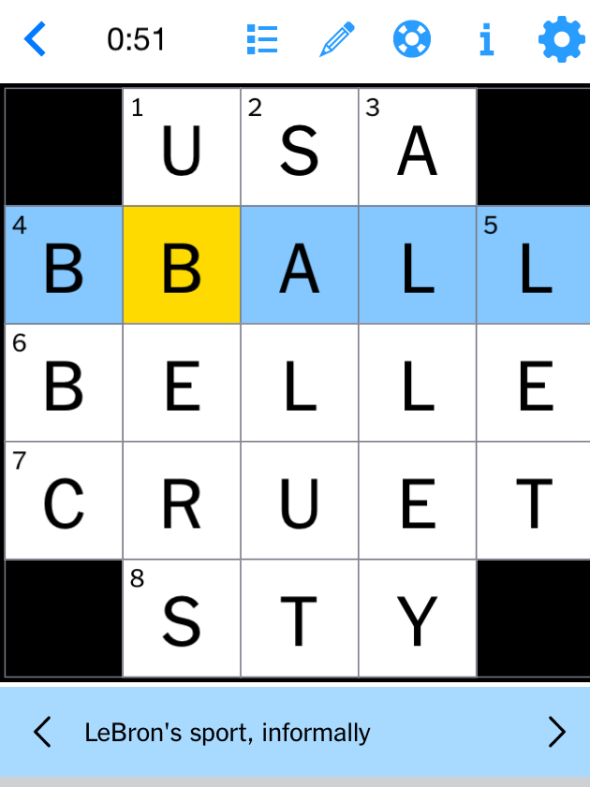

Nyt Mini Crossword April 8 2025 Tuesday Clues And Solutions

May 24, 2025

Nyt Mini Crossword April 8 2025 Tuesday Clues And Solutions

May 24, 2025 -

Is An Escape To The Country Right For You A Self Assessment

May 24, 2025

Is An Escape To The Country Right For You A Self Assessment

May 24, 2025