Amsterdam Exchange Down 2%: Impact Of Trump's Latest Tariff Increase

Table of Contents

Understanding the Tariff Increase and its Global Implications

Details of Trump's Latest Tariff Increase

Trump's latest tariff increase targets a range of goods, primarily focusing on [Specify targeted goods, e.g., steel, aluminum, agricultural products]. The increase, averaging [Percentage increase, e.g., 25%], affects key trading partners including [Affected countries, e.g., the European Union, China]. This move represents a further escalation of trade tensions that have been simmering for months. The official announcement can be found on [Link to official source confirming tariff increase].

Global Market Reaction

The news triggered immediate ripples across global markets. The New York Stock Exchange saw a [Percentage] drop in early trading, while the London Stock Exchange experienced [Percentage] volatility. Many analysts view these reactions as a clear sign of growing investor concern about the long-term implications of escalating trade wars.

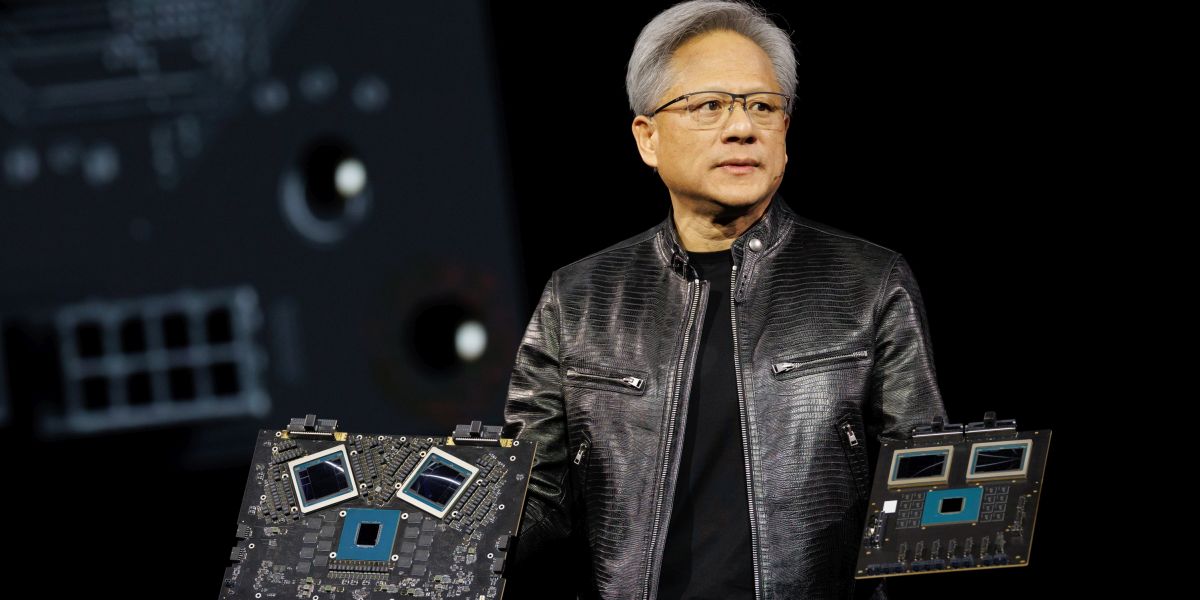

- Impacted Industries: The automotive, technology, and agricultural sectors are particularly vulnerable, facing increased production costs and potential disruptions to supply chains.

- Global Supply Chain Disruptions: The ripple effect is expected to impact global supply chains, leading to delays, higher prices, and potential shortages of various goods.

- Official Source: [Insert direct link to official government source confirming the tariff increase].

Amsterdam Exchange's Specific Vulnerabilities

Sectoral Impact

The Amsterdam Exchange's decline is particularly pronounced in several key sectors. The technology sector, representing [Percentage]% of the exchange's market capitalization, experienced a [Percentage]% drop. The manufacturing and agricultural sectors also saw significant losses, indicating a direct impact from the tariffs. Data from [Source: Financial data provider] clearly illustrates this sectoral vulnerability.

Dutch Economic Dependence

The Netherlands' significant reliance on international trade, particularly with the US and EU member states, makes its economy acutely sensitive to shifts in global trade policies. This dependence amplified the negative impact of Trump's tariff increase on the Amsterdam Exchange.

- Sectoral Performance Charts: [Insert graphs or charts illustrating the performance of specific sectors, clearly labeled and sourced].

- Affected Companies: Key companies such as [Company names] listed on the Amsterdam Exchange reported significant declines in their stock prices.

- Expert Commentary: "[Quote from a relevant financial expert or analyst regarding the situation and its impact on the Amsterdam exchange]."

Potential Long-Term Effects on the Amsterdam Exchange

Investor Sentiment and Confidence

The 2% drop reflects a significant erosion of investor confidence. Continued trade uncertainty could lead to further market fluctuations and potentially deter foreign investment in the Netherlands. This uncertainty increases the risk of a prolonged period of low growth.

Government Response and Mitigation Strategies

The Dutch government is likely to implement various mitigation strategies, potentially including [Mention potential government responses, e.g., financial aid for affected businesses, trade negotiations]. The effectiveness of these measures will play a crucial role in shaping the long-term outlook for the Amsterdam Exchange.

- Future Scenarios: Possible scenarios range from a gradual recovery to a more sustained period of economic weakness, depending on the trajectory of trade relations and the effectiveness of government intervention.

- Long-Term Economic Implications: The long-term economic implications for the Netherlands could include reduced GDP growth, increased unemployment, and potential shifts in trade partnerships.

- Areas of Resilience: Despite the challenges, sectors like [mention resilient sectors, e.g., renewable energy, healthcare] may offer areas of resilience within the Dutch economy.

Comparing the Amsterdam Exchange's Reaction to Other Markets

Comparative Analysis

Compared to other major European exchanges, the Amsterdam Exchange's reaction to the tariff increase was [Describe the relative magnitude of the drop compared to other exchanges – e.g., more pronounced, less severe]. A comparative analysis reveals [Explain what this comparison tells us about the Netherlands' vulnerability].

Diversification Strategies

Companies listed on the Amsterdam Exchange are likely to reassess their diversification strategies. This may involve exploring new markets, shifting production to other regions, or developing alternative supply chains to mitigate the risks associated with future tariff increases.

- Comparative Table: [Insert a table comparing percentage drops in various stock markets across the globe, clearly showing the Amsterdam Exchange's performance in context.]

- Mitigation Strategies: Diversification strategies could include sourcing materials from alternative suppliers, investing in automation to reduce labor costs, and lobbying for governmental support.

Conclusion: Analyzing the Amsterdam Exchange's Response to Tariffs

The 2% drop in the Amsterdam Exchange directly reflects the impact of Trump's latest tariff increase. The Netherlands' economic dependence on trade, coupled with the specific vulnerabilities of certain sectors, amplified the negative consequences. Long-term implications include potential economic slowdown, investor uncertainty, and the need for strategic adjustments by both businesses and the government. To understand the ongoing situation fully, it's crucial to monitor the Amsterdam Exchange closely and track the impact of tariffs on the Amsterdam Exchange's performance in the coming weeks and months. Stay updated on the Amsterdam Exchange’s performance through reliable financial news sources to stay informed about this evolving situation.

Featured Posts

-

Jonathan Groff Could Just In Time Lead To A Historic Tony Award Win

May 24, 2025

Jonathan Groff Could Just In Time Lead To A Historic Tony Award Win

May 24, 2025 -

Demna At Gucci Examining The Impact Of The New Creative Director

May 24, 2025

Demna At Gucci Examining The Impact Of The New Creative Director

May 24, 2025 -

Person Rushed To Hospital Following Serious Road Crash

May 24, 2025

Person Rushed To Hospital Following Serious Road Crash

May 24, 2025 -

3 Burc Icin Mayis Ayinda Askin Ruezgari Esiyor

May 24, 2025

3 Burc Icin Mayis Ayinda Askin Ruezgari Esiyor

May 24, 2025 -

Onrust Op Wall Street Impact Op De Aex En Nederlandse Economie

May 24, 2025

Onrust Op Wall Street Impact Op De Aex En Nederlandse Economie

May 24, 2025