Amsterdam Stock Index Plunges Over 4%, Reaching Year-Low

Table of Contents

Causes of the Amsterdam Stock Index Plunge

The sharp drop in the Amsterdam Stock Index wasn't an isolated event but rather a reflection of converging global and domestic pressures. Several key factors contributed to this year-low plunge.

Global Economic Uncertainty

Global economic uncertainty played a significant role in the AEX's decline. Rising inflation rates across major economies, coupled with aggressive interest rate hikes by central banks to combat inflation, created a challenging environment for investors.

- High Inflation: Persistent inflation erodes purchasing power and increases the cost of borrowing, dampening economic growth and investor confidence.

- Rising Interest Rates: Increased interest rates make borrowing more expensive for businesses, potentially slowing investment and hindering economic expansion. This directly impacts corporate profitability and consequently stock prices.

- Geopolitical Tensions: The ongoing war in Ukraine, alongside other geopolitical uncertainties, fuels market volatility and discourages investment in riskier assets, leading to capital flight from emerging markets and affecting even stable markets like the Netherlands.

- Weakening Global Growth Forecasts: Major international organizations have lowered their growth forecasts for the coming year, contributing to a more pessimistic outlook among investors. This uncertainty directly impacts investor sentiment towards the AEX.

These global factors combined to create a climate of fear and uncertainty, impacting investor confidence and causing a sell-off in the Amsterdam Stock Exchange.

Sector-Specific Downturns

The AEX plunge wasn't uniform across all sectors. Specific sectors within the Amsterdam Stock Exchange experienced significantly steeper declines than others.

- Technology Sector: The tech sector, often highly sensitive to interest rate hikes and economic slowdowns, suffered disproportionately. Companies reliant on future growth and expansion saw their valuations significantly impacted. For instance, [mention specific tech company and its stock performance].

- Energy Sector: While energy prices remain high, concerns about future demand and the transition to renewable energy sources negatively affected certain energy companies listed on the AEX.

- Financial Sector: Banks and financial institutions also felt the pressure, as economic uncertainty increases the risk of loan defaults and reduces profitability.

Investor Sentiment and Market Volatility

Negative investor sentiment and heightened market volatility significantly exacerbated the AEX's decline. Fear and uncertainty drove significant sell-offs.

- Increased Trading Volume: The sharp drop was accompanied by increased trading volume, indicating a rush to sell assets and secure profits before further losses.

- Panic Selling: As the index fell, panic selling intensified, creating a self-fulfilling prophecy where further declines fueled more selling pressure.

The combination of global headwinds, sector-specific weaknesses, and heightened investor fear resulted in the AEX's dramatic plunge.

Consequences of the Amsterdam Stock Index Drop

The significant drop in the AEX has wide-ranging consequences for various stakeholders in the Dutch economy.

Impact on Dutch Companies

The AEX decline directly impacts Dutch companies listed on the exchange.

- Reduced Company Valuations: The drop in share prices translates to lower company valuations, making it more difficult for them to raise capital through equity financing.

- Decreased Investment: Reduced investor confidence can lead to lower investment in Dutch businesses, hindering growth and expansion.

- Potential Job Losses: In the long term, decreased investment and economic slowdown could lead to job losses and increased unemployment in various sectors.

- Example: [Mention a specific example of a company affected and the consequences for it].

Investor Losses and Market Confidence

The AEX's decline has resulted in significant losses for investors holding Dutch equities.

- Portfolio Losses: Investors experienced substantial portfolio losses, impacting their investment returns and potentially altering their long-term investment strategies.

- Erosion of Market Confidence: The dramatic plunge eroded investor confidence in the Dutch market, possibly leading to capital flight and reduced investment in the future.

Government Response and Economic Outlook

The Dutch government may need to implement measures to mitigate the impact of the AEX decline.

- Potential Economic Stimulus: The government might consider fiscal stimulus measures to boost economic growth and support struggling businesses.

- Regulatory Measures: Policy adjustments may be needed to address specific issues impacting particular sectors.

- Economic Outlook: The outlook for the Dutch economy remains uncertain, with the AEX's performance being a crucial indicator of future economic growth.

Understanding the Amsterdam Stock Index Fall and What's Next

The sharp 4%+ drop in the Amsterdam Stock Index (AEX) to a new year-low was driven by a confluence of factors including global economic uncertainty, sector-specific weaknesses, and heightened market volatility. This resulted in substantial losses for investors and poses challenges for Dutch companies and the overall economy. The severity of this year-low underscores the need for careful monitoring of global economic trends and the AEX Index. The future trajectory of the AEX and the Dutch economy remains uncertain, requiring careful observation and analysis.

To stay informed about the Amsterdam Stock Index and navigate the fluctuations of the Dutch Stock Market, subscribe to our updates, follow reputable financial news sources, and consult with a financial advisor for personalized guidance on your investment strategy. Understanding the AEX Index is crucial for making informed investment decisions regarding the Dutch market.

Featured Posts

-

Will Ronan Farrow Help Mia Farrow Stage A Hollywood Comeback

May 24, 2025

Will Ronan Farrow Help Mia Farrow Stage A Hollywood Comeback

May 24, 2025 -

From Bishop To Viral Sensation A Tik Tokers Unexpected Pope Leo Story

May 24, 2025

From Bishop To Viral Sensation A Tik Tokers Unexpected Pope Leo Story

May 24, 2025 -

Serious Car Crash Leads To Road Closure And Hospitalization

May 24, 2025

Serious Car Crash Leads To Road Closure And Hospitalization

May 24, 2025 -

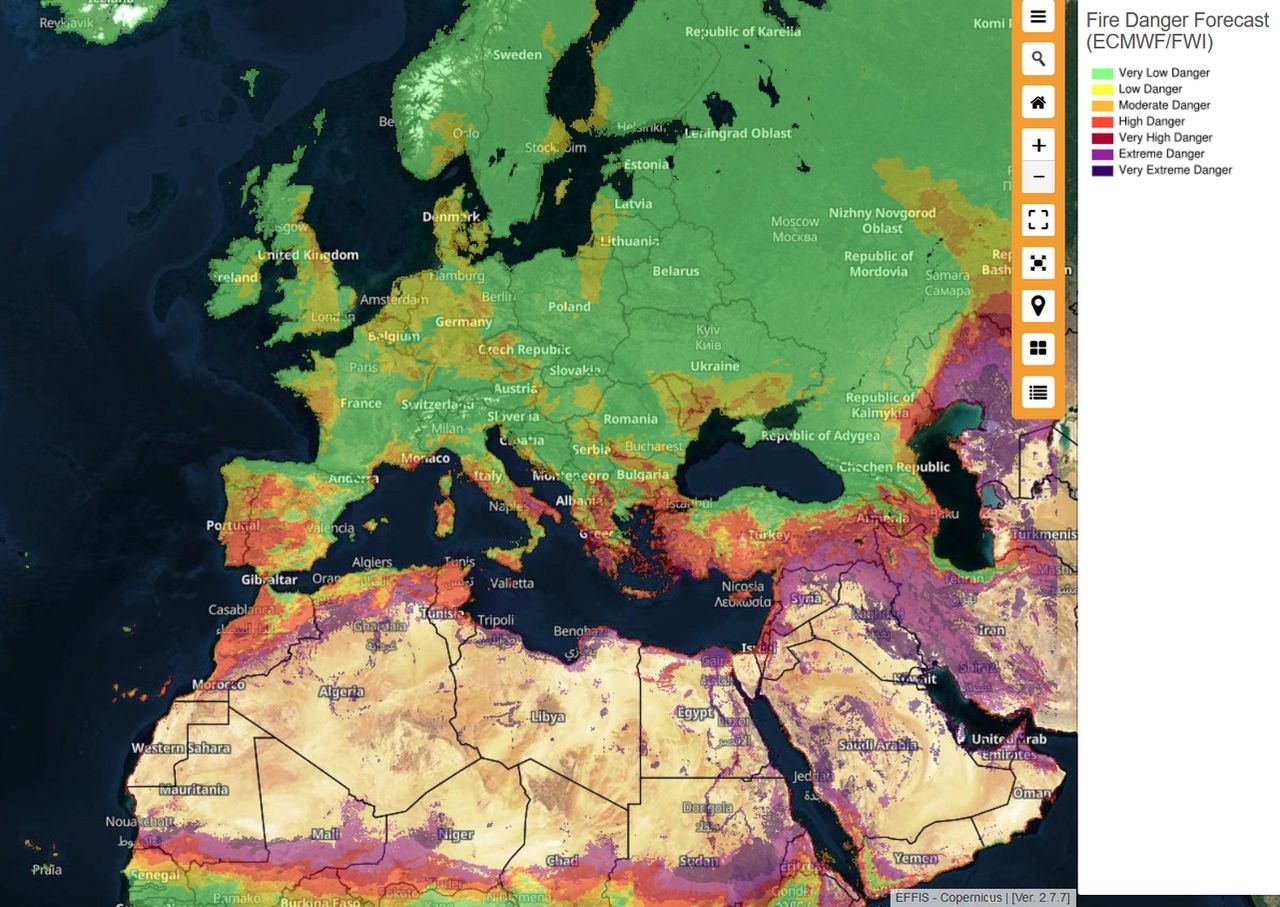

Global Forest Loss Reaches Record High Wildfires Fuel Destruction

May 24, 2025

Global Forest Loss Reaches Record High Wildfires Fuel Destruction

May 24, 2025 -

Airplane Safety Understanding The Statistics Of Close Calls And Accidents

May 24, 2025

Airplane Safety Understanding The Statistics Of Close Calls And Accidents

May 24, 2025