Amsterdam Stock Market: AEX Index At Over One-Year Low Following 4%+ Drop

Table of Contents

Causes of the AEX Index Decline

Several interconnected factors contributed to the sharp decline in the AEX Index. Understanding these causes is crucial for assessing the current situation and predicting future market movements.

Global Economic Uncertainty

The current global economic climate is characterized by significant uncertainty. This instability directly impacts the AEX Index, a barometer of the Dutch economy.

- Global Inflation: Persistently high inflation rates in many countries are forcing central banks to aggressively raise interest rates. This impacts borrowing costs for businesses, hindering investment and economic growth.

- Interest Rate Hikes: The ripple effect of interest rate hikes by major central banks, including the European Central Bank (ECB), is dampening economic activity globally, impacting investor confidence and causing a sell-off in many markets, including Amsterdam.

- Geopolitical Risks: Ongoing geopolitical instability, such as the war in Ukraine and escalating tensions in other regions, contributes to market volatility and uncertainty, leading investors to seek safer havens, thus impacting the AEX index.

- Recession Fears: Growing concerns about a potential global recession are further dampening investor sentiment, leading to a decline in stock prices across various markets, including the Amsterdam Stock Exchange.

Performance of Specific AEX Companies

The decline in the AEX Index isn't solely attributable to global factors. The underperformance of several key AEX companies also played a significant role.

- Sector-Specific Impacts: Certain sectors, such as energy and technology, have been disproportionately affected. Fluctuations in energy prices and concerns about slowing technological growth have impacted the performance of companies within these sectors listed on the AEX.

- Company Earnings: Disappointing earnings reports from several prominent AEX companies have further eroded investor confidence and contributed to the sell-off. Analyzing individual company performances reveals specific challenges faced by businesses within the Dutch market.

- AEX Companies' Stock Performance: The decreased stock prices of leading AEX companies directly translate to the overall index decline. A detailed sector analysis would highlight the most impacted industries.

Investor Sentiment and Market Volatility

Investor confidence is a crucial driver of stock market performance. The current negative market sentiment has played a substantial role in the AEX index’s downturn.

- Market Volatility: The increased market volatility reflects the uncertainty and fear among investors. This volatility makes trading more risky, leading to increased uncertainty and further contributing to price drops.

- Trading Volume: While increased trading volume can sometimes indicate strong market activity, in this case, the high volume reflects the panic selling and a general lack of confidence in the market.

- Investor Confidence: The overall decline in investor confidence in both the Dutch and global economy is a significant factor contributing to the AEX index's drop.

Impact of the AEX Drop on the Dutch Economy

The sharp decline in the AEX Index has significant implications for the Dutch economy.

Consequences for Dutch Businesses

The downturn will likely have a cascading effect on Dutch businesses.

- Reduced Investment: Companies may postpone or cancel investment plans due to the challenging economic climate and reduced access to capital.

- Job Market: Depending on the duration and severity of the economic slowdown, job losses are a potential consequence, particularly in sectors heavily reliant on investor confidence and market activity.

- Economic Growth: The decline in the AEX Index is a clear indicator of reduced economic activity and potentially slower economic growth for the Netherlands.

Government Response and Policy Implications

The Dutch government will likely need to respond to this market downturn.

- Economic Stimulus: The government might implement economic stimulus packages to boost economic activity and support businesses.

- Fiscal Policy: Fiscal policy adjustments, such as tax cuts or increased government spending, might be considered to counteract the negative economic impact.

- Monetary Policy: Coordination with the ECB on monetary policy might be crucial in stabilizing the market and preventing a deeper economic downturn.

AEX Index Outlook and Future Predictions

Predicting future market movements is always challenging, but analyzing current trends and expert opinions offers some insights.

Analyst Forecasts and Predictions

Financial analysts offer varying forecasts for the AEX index.

- Market Forecast: While some predict a potential recovery in the coming months, others warn of further declines depending on the evolution of global economic conditions.

- AEX Index Prediction: The range of predictions highlights the uncertainty surrounding the AEX index's future trajectory.

- Stock Market Outlook: A cautious outlook is warranted, given the prevailing global economic uncertainties.

Opportunities and Risks for Investors

The current situation presents both risks and opportunities for investors.

- Investment Opportunities: While risky, the downturn may create opportunities for long-term investors to acquire assets at discounted prices.

- Risk Management: Effective risk management strategies, including portfolio diversification, are crucial during periods of market volatility.

- Long-Term Investment: A long-term investment perspective might be beneficial for those willing to weather the short-term fluctuations. (Disclaimer: This information is for educational purposes only and is not financial advice.)

Conclusion: Navigating the Amsterdam Stock Market's Recent Dip – AEX Index Analysis and Next Steps

The significant drop in the AEX Index is a consequence of a confluence of factors, including global economic uncertainty, the performance of individual AEX companies, and declining investor sentiment. The impact on the Dutch economy could be substantial, potentially affecting businesses, employment, and overall growth. While the future of the AEX Index remains uncertain, analysts offer a range of predictions, highlighting both risks and potential opportunities for investors. Stay informed about the latest developments in the AEX Index and the Amsterdam Stock Market by regularly checking reputable financial news sources and conducting thorough research before making any investment decisions. Understanding the nuances of the AEX Index and the broader Amsterdam Stock Market is key to navigating the current volatile environment and making informed investment decisions.

Featured Posts

-

Muere Eddie Jordan Ultima Hora

May 25, 2025

Muere Eddie Jordan Ultima Hora

May 25, 2025 -

Kyle Walker And Annie Kilner A New Ring A New Chapter

May 25, 2025

Kyle Walker And Annie Kilner A New Ring A New Chapter

May 25, 2025 -

Actress Mia Farrows Dire Prediction American Democracys 3 4 Month Countdown

May 25, 2025

Actress Mia Farrows Dire Prediction American Democracys 3 4 Month Countdown

May 25, 2025 -

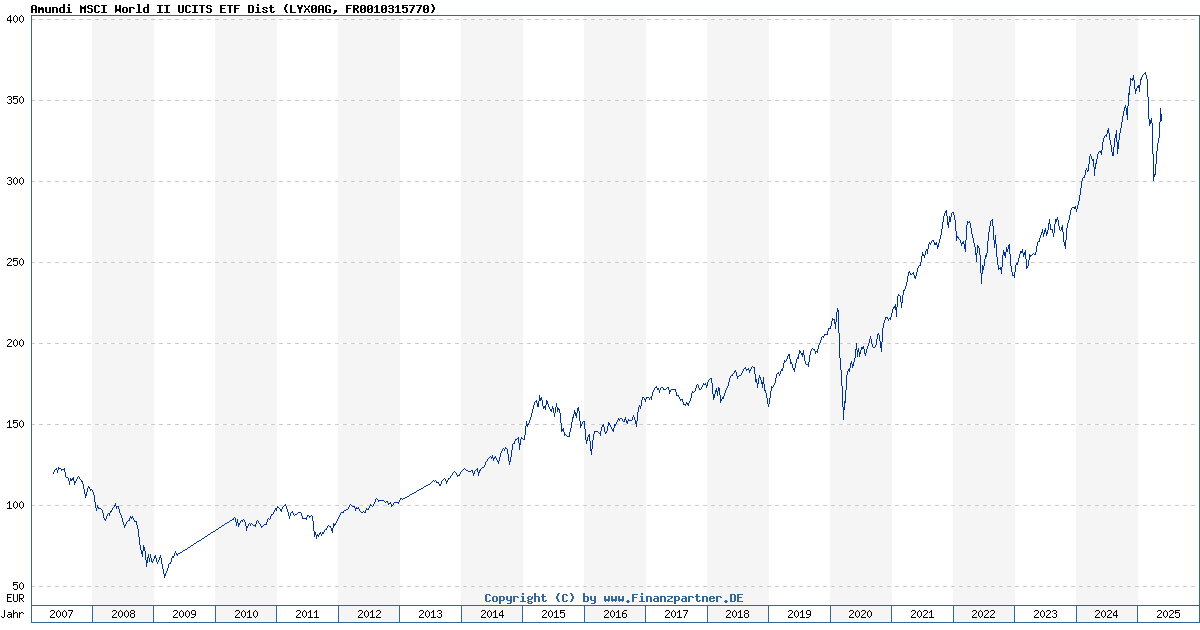

Tracking The Net Asset Value Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 25, 2025

Tracking The Net Asset Value Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist

May 25, 2025 -

Soerloth Un La Liga Firtinasi Ilk 30 Dakikada 4 Gol

May 25, 2025

Soerloth Un La Liga Firtinasi Ilk 30 Dakikada 4 Gol

May 25, 2025