Amsterdam Stock Market Plunges 7%: Trade War Fears Fuel Sharp Opening Drop

Table of Contents

Trade War Fears as the Primary Catalyst

The precipitous drop in the Amsterdam Stock Market is directly linked to the intensifying global trade war. Recent escalations, including [insert specific example of new tariffs or trade restrictions, e.g., the announcement of new tariffs on Dutch agricultural exports to Country X], have injected considerable uncertainty into the market. This uncertainty is severely impacting investor confidence and triggering widespread sell-offs.

- Specific examples of trade actions impacting Dutch businesses: The new tariffs on Dutch cheese exports to the US are expected to cost Dutch dairy farmers millions of euros in lost revenue. Similarly, the imposition of trade barriers on Dutch semiconductor manufacturers is already impacting their production schedules and export capabilities.

- Vulnerable sectors of the Dutch economy: Export-oriented industries, including agriculture, technology, and manufacturing, are particularly vulnerable to the consequences of the trade war. These sectors represent a significant portion of the Netherlands' GDP and their struggles will have a ripple effect throughout the economy.

- Statistics on trade volume changes or potential losses: Preliminary estimates suggest a potential 5% decrease in Dutch export volume in the next quarter, translating to a projected loss of [insert estimated figure] in revenue for affected businesses.

Impact on Key Amsterdam Stock Market Indices

The AEX Index bore the brunt of the market downturn, plummeting by 7% in the opening hours of trading. This represents the largest single-day drop in the index in [insert timeframe, e.g., the last five years]. The widespread selling pressure was evident across various sectors.

- Precise figures illustrating the AEX Index drop: The AEX Index closed at [insert closing value], a significant decrease from its previous closing value of [insert previous closing value].

- Mention the performance of individual, high-profile companies within the AEX: Major companies like [insert names of specific companies and their percentage drops] experienced significant losses, reflecting the broader market panic.

- Compare the AEX's performance to other major European indices: While other European markets also experienced declines, the drop in the Amsterdam Stock Market was significantly steeper, indicating a particularly strong negative impact on investor sentiment towards Dutch assets.

Investor Sentiment and Market Volatility

The market plunge has triggered a wave of risk aversion among investors. The uncertainty surrounding the trade war's trajectory has led to a significant increase in selling pressure.

- Increased selling pressure in the market: High trading volumes coupled with a strong downward trend indicate considerable panic selling. Many investors are opting to liquidate their holdings to minimize potential losses.

- Mention any significant shifts in investor confidence: Investor confidence has plummeted, with many analysts predicting further volatility in the short term. This lack of confidence is hindering investment and potentially delaying crucial business decisions.

- Discuss potential strategies investors are employing to mitigate risk: Investors are employing various risk mitigation strategies, including hedging against further market declines, diversifying their portfolios, and increasing their cash holdings to protect against further losses.

Economic Implications for the Netherlands

The stock market plunge carries significant economic implications for the Netherlands. The decreased investor confidence and potential slowdown in export-oriented sectors could impact various aspects of the national economy.

- Potential impact on GDP growth: The current situation could lead to a significant reduction in GDP growth for the next quarter, potentially jeopardizing the Netherlands' economic outlook for the year.

- Effects on consumer confidence and spending: The market volatility is likely to negatively affect consumer confidence, leading to reduced spending and a potential slowdown in overall economic activity.

- Possible government responses to the economic downturn: The Dutch government may need to consider implementing fiscal stimulus measures to mitigate the economic consequences of the market downturn and bolster consumer confidence.

Long-Term Outlook and Predictions

The long-term outlook for the Amsterdam Stock Market remains uncertain. While a market rebound is possible, several factors could prolong the downturn.

- Factors that could lead to a market rebound: A resolution to the trade war, increased government intervention to support the economy, or positive economic indicators could potentially trigger a market recovery.

- Risks that could prolong the downturn: Further escalation of the trade war, continued uncertainty, and decreased consumer spending could prolong the market slump.

- Predictions from financial analysts: Analysts hold differing opinions, with some predicting a slow recovery and others expressing concerns about a more prolonged period of economic weakness.

Conclusion:

The 7% plunge in the Amsterdam Stock Market represents a significant event, directly attributable to escalating trade war fears. The impact extends beyond the AEX Index, affecting investor sentiment, key economic sectors, and the overall economic health of the Netherlands. The situation underscores the profound interconnectedness of global markets and highlights the vulnerability of even strong economies to geopolitical uncertainty. Stay updated on the evolving situation in the Amsterdam Stock Market and make informed decisions regarding your investments. Monitor the Amsterdam Stock Market closely to navigate the complexities of the current global trade landscape.

Featured Posts

-

The Complete Guide To Jensons Fw 22 Extended Range

May 25, 2025

The Complete Guide To Jensons Fw 22 Extended Range

May 25, 2025 -

Trumps Decision Impact Of The Nippon U S Steel Deal On The Global Market

May 25, 2025

Trumps Decision Impact Of The Nippon U S Steel Deal On The Global Market

May 25, 2025 -

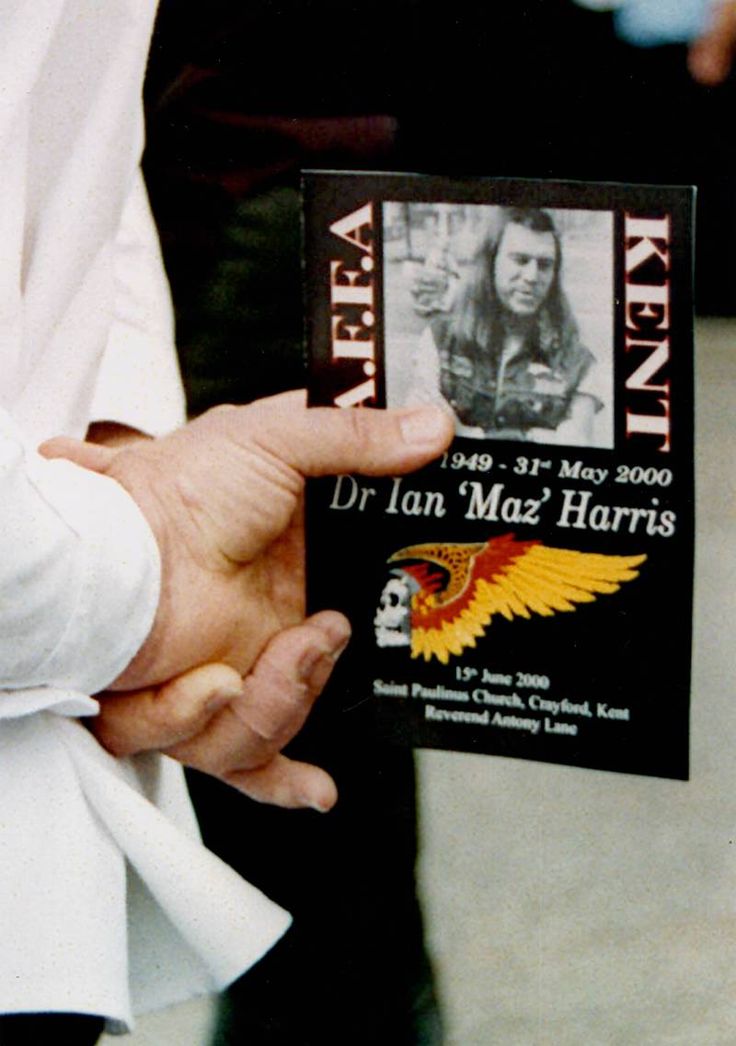

Hundreds Of Hells Angels Honour Beloved South Shields Biker

May 25, 2025

Hundreds Of Hells Angels Honour Beloved South Shields Biker

May 25, 2025 -

From Across The Miles A Dc Love Story Cut Short

May 25, 2025

From Across The Miles A Dc Love Story Cut Short

May 25, 2025 -

Best Of Bangladesh Event In Netherlands Over 1 500 Expected

May 25, 2025

Best Of Bangladesh Event In Netherlands Over 1 500 Expected

May 25, 2025