Amundi DJIA UCITS ETF: NAV Explained

Table of Contents

What is Net Asset Value (NAV)?

Defining NAV

Net Asset Value (NAV) represents the value of an ETF's underlying assets minus its liabilities, all divided by the number of outstanding shares. Think of it like this: imagine a giant pie representing the ETF's total assets. The baker (the ETF management company) takes out a small slice for expenses (liabilities). The remaining pie is then divided equally among all the shareholders. Each slice represents a share's NAV.

NAV Calculation

Calculating the NAV involves a straightforward process:

- Determine the total market value of all assets: This includes the value of all the stocks, bonds, or other securities held within the ETF's portfolio.

- Subtract all liabilities: This includes management fees, expenses, and any other outstanding debts.

- Divide the result by the total number of outstanding shares: This gives you the NAV per share.

The Amundi DJIA UCITS ETF, like most ETFs, calculates its NAV daily, typically at the close of market trading.

- NAV vs. Market Price: The NAV differs from the market price, which is the price at which the ETF shares are actually trading on the exchange. These can differ due to market supply and demand.

- Influencing Factors: Several factors impact NAV fluctuations, primarily the performance of the underlying assets (in this case, the DJIA components) and the distribution of dividends from those assets.

- Importance for Investors: Understanding NAV is crucial for evaluating the ETF’s performance and making well-informed buy or sell decisions.

Amundi DJIA UCITS ETF and its NAV

The ETF's Composition

The Amundi DJIA UCITS ETF aims to replicate the performance of the Dow Jones Industrial Average. This index comprises 30 large, publicly-traded U.S. companies representing various sectors of the American economy. These include well-known names like Apple, Microsoft, and Nike. The ETF's portfolio closely mirrors the weighting of these companies within the DJIA.

NAV and the DJIA

The ETF's NAV should closely track the DJIA's performance. If the DJIA goes up, the NAV of the Amundi DJIA UCITS ETF should generally increase proportionally. However, minor discrepancies can and will occur.

- Expense Ratio Impact: The ETF's expense ratio (a small annual fee) slightly reduces the NAV over time.

- NAV vs. Market Price Discrepancies: Differences between NAV and market price can arise due to factors like trading volume and arbitrage opportunities. High trading volume usually keeps the market price closer to the NAV.

- Official NAV Data: Always refer to the Amundi ETF's official website for the most accurate and up-to-date NAV figures.

Using NAV to Make Informed Investment Decisions

Analyzing NAV Trends

Tracking the Amundi DJIA UCITS ETF's NAV over time provides valuable insights into its performance. Consistent upward trends indicate positive performance, while downward trends suggest the opposite. Analyzing these trends helps investors gauge long-term investment success.

Comparing NAV to Market Price

The difference between the NAV and the market price can signal potential buying or selling opportunities. If the market price falls below the NAV, it might suggest an undervalued ETF. Conversely, a market price significantly above the NAV may indicate an overvalued ETF.

- ETF Comparisons: NAV allows investors to compare the performance of different ETFs more effectively, focusing on the underlying asset values rather than just fluctuating market prices.

- Potential Returns: While not a perfect predictor, NAV helps estimate potential returns based on the value growth of the underlying assets.

- Limitations: NAV shouldn't be the sole factor in investment decisions. Other factors like market sentiment, economic conditions, and your individual investment goals are also important.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi DJIA UCITS ETF is fundamental to making sound investment choices. We've explored how NAV is calculated, its relationship to the DJIA's performance, and its application in investment analysis. By tracking NAV trends and comparing it to the market price, investors can gain valuable insights into the ETF's performance and identify potential opportunities. Understanding the Amundi DJIA UCITS ETF's NAV is crucial for successful investing. Continue your research and monitor the NAV regularly to make the best investment decisions for your portfolio.

Featured Posts

-

Shooting At Popular Southern Vacation Spot Prompts Safety Review

May 25, 2025

Shooting At Popular Southern Vacation Spot Prompts Safety Review

May 25, 2025 -

The Robuchon Monaco Restaurants Interior Design By Francis Sultana

May 25, 2025

The Robuchon Monaco Restaurants Interior Design By Francis Sultana

May 25, 2025 -

The Complete Guide To Jensons Fw 22 Extended Range

May 25, 2025

The Complete Guide To Jensons Fw 22 Extended Range

May 25, 2025 -

Analisis De Moda Los Mejores Atuendos Del Baile De La Rosa 2025

May 25, 2025

Analisis De Moda Los Mejores Atuendos Del Baile De La Rosa 2025

May 25, 2025 -

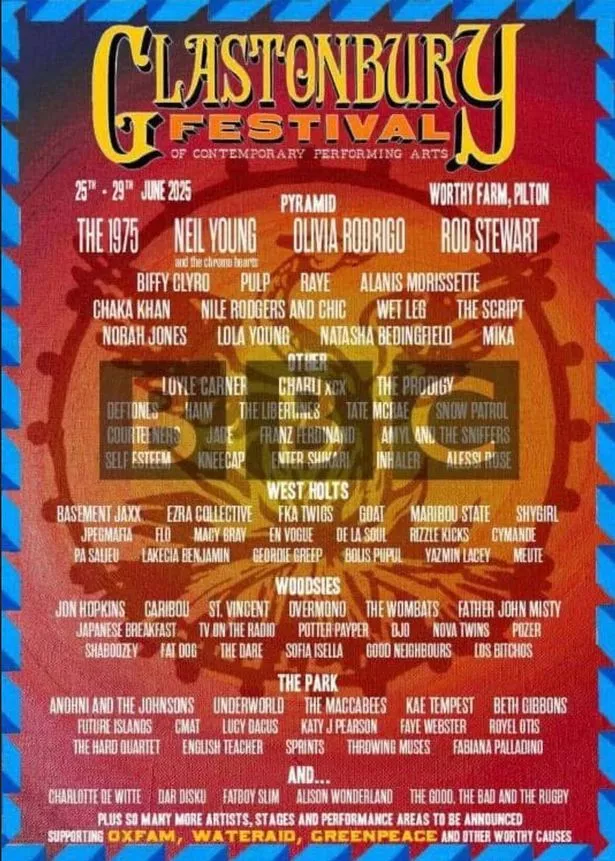

Leaked Glastonbury 2025 Lineup Confirmed Acts And Ticket Availability

May 25, 2025

Leaked Glastonbury 2025 Lineup Confirmed Acts And Ticket Availability

May 25, 2025