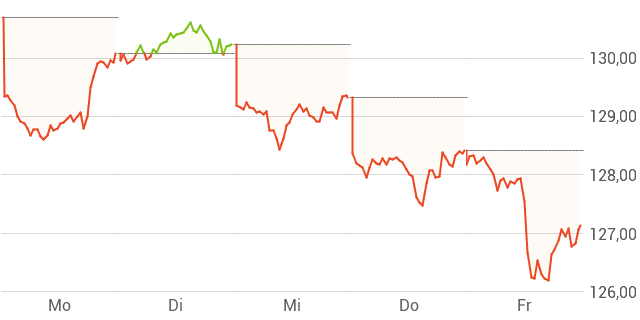

Amundi MSCI All Country World UCITS ETF USD Acc: A Guide To Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV)?

Net Asset Value (NAV) represents the intrinsic value of each share in the Amundi MSCI All Country World UCITS ETF USD Acc. Simply put, it's the total value of the ETF's underlying assets minus its liabilities, all divided by the number of outstanding shares. The ETF holds a portfolio of global stocks; the NAV reflects the combined worth of these holdings after deducting expenses and other liabilities.

The key difference between NAV and the market price is crucial. While NAV reflects the intrinsic value, the market price fluctuates based on supply and demand. This means that the market price of the ETF can trade at a premium or discount to its NAV.

- NAV reflects the intrinsic value of the ETF, based on the current market value of its underlying assets.

- Market price can fluctuate throughout the trading day due to supply and demand, potentially diverging from the NAV.

- Understanding the relationship between NAV and market price helps identify potential buying opportunities (when the market price is below NAV) or potential selling opportunities (when the market price is significantly above NAV).

How to Find the Amundi MSCI All Country World UCITS ETF USD Acc NAV?

Finding the daily NAV for the Amundi MSCI All Country World UCITS ETF USD Acc is straightforward. You can typically access this information from several sources:

- Amundi's official website: Amundi, the ETF provider, usually publishes daily NAV data on their investor relations page. Look for sections dedicated to ETF factsheets or fund details. [Insert hypothetical link here: e.g., www.amundi.com/nav-data]

- Financial news websites: Many reputable financial news sources, such as Bloomberg, Yahoo Finance, and Google Finance, provide real-time or delayed NAV data for ETFs. Search for the ETF ticker symbol.

- Brokerage platforms: If you hold the Amundi MSCI All Country World UCITS ETF USD Acc through a brokerage account, the NAV will typically be displayed on your account's holdings page.

NAV updates are usually provided daily, typically at the close of the market. It’s essential to check the NAV at the end of the trading day to ensure you have the most accurate information.

- Amundi Website (Example): [Insert screenshot example here if available, demonstrating where to find the NAV on Amundi's website.]

- Bloomberg Terminal (Example): [Insert screenshot example here if available, demonstrating where to find the NAV on Bloomberg.]

- Interactive Brokers (Example): [Insert screenshot example here if available, demonstrating where to find the NAV on Interactive Brokers platform.]

The Significance of NAV for Investment Decisions in the Amundi MSCI All Country World UCITS ETF USD Acc

Monitoring the Amundi MSCI All Country World UCITS ETF USD Acc NAV is vital for tracking your investment's performance. Changes in the NAV over time directly reflect the ETF's performance, excluding the effects of market price fluctuations.

- Regular NAV monitoring allows you to track the growth (or decline) of your investment.

- Comparing the NAV changes to benchmark indices (like the MSCI All Country World Index) helps assess the ETF's performance against its intended benchmark.

- Analyzing NAV trends provides insights into the overall investment strategy's success. A consistent upward trend suggests effective portfolio management, while significant deviations may warrant further investigation. You can calculate returns using the formula: [(Ending NAV - Beginning NAV) / Beginning NAV] * 100.

NAV and ETF Pricing

The relationship between NAV and the market price of the Amundi MSCI All Country World UCITS ETF USD Acc is dynamic. Sometimes the market price trades at a premium to the NAV (price > NAV), and sometimes at a discount (price < NAV). These premiums and discounts can be influenced by several factors:

- Supply and demand: High demand can drive the market price above the NAV, while low demand can push it below.

- Market sentiment: Overall market optimism or pessimism can impact the ETF's price relative to its NAV.

- Trading volume: High trading volume can sometimes lead to temporary discrepancies between price and NAV.

Understanding these discrepancies can inform your investment strategy. For example, buying when the market price is significantly below the NAV presents a potential opportunity, but remember to consider other factors before making investment decisions.

Conclusion

Understanding the Net Asset Value (NAV) of your Amundi MSCI All Country World UCITS ETF USD Acc holdings is fundamental for informed investment decisions. By regularly monitoring the NAV and understanding its relationship to market price, you can effectively track your portfolio’s performance, assess the ETF's investment strategy, and identify potential buying or selling opportunities. Start monitoring your Amundi MSCI All Country World UCITS ETF USD Acc NAV today! Remember that this information is for educational purposes and does not constitute financial advice. Always conduct thorough research and consider consulting a financial advisor before making investment decisions.

Featured Posts

-

Leistungstraeger In Essen Golz Und Brumme Als Vorbilder

May 24, 2025

Leistungstraeger In Essen Golz Und Brumme Als Vorbilder

May 24, 2025 -

Intimacy Growth And The New Album An Interview With Matt Maltese

May 24, 2025

Intimacy Growth And The New Album An Interview With Matt Maltese

May 24, 2025 -

Record Low Gas Prices Expected For Memorial Day Weekend

May 24, 2025

Record Low Gas Prices Expected For Memorial Day Weekend

May 24, 2025 -

Demnas Gucci Debut Expectations And Predictions For The Brand

May 24, 2025

Demnas Gucci Debut Expectations And Predictions For The Brand

May 24, 2025 -

Otsenite Svoi Znaniya O Filmakh S Olegom Basilashvili

May 24, 2025

Otsenite Svoi Znaniya O Filmakh S Olegom Basilashvili

May 24, 2025