Analysis: How The Opposition Aims To Save $9 Billion In Australia's Budget

Table of Contents

Targeting Government Waste and Inefficiency

The Opposition's plan to achieve $9 billion in Australian Budget savings hinges significantly on tackling perceived government waste and inefficiency. This involves a multi-pronged approach focused on enhancing accountability and streamlining operations. Keywords associated with this section include Government Waste, Inefficiency, Spending Review, Audit, and Accountability.

- Comprehensive Spending Review: The Opposition proposes a comprehensive review of all government spending, scrutinizing every department and program. This includes a detailed line-by-line examination of budgets to identify areas ripe for cuts.

- Streamlining Procurement: A major focus is on reforming government procurement processes. The goal is to eliminate redundancies, negotiate better deals with suppliers, and ensure value for money in all government contracts. This could involve implementing stricter tendering processes and leveraging bulk purchasing power.

- Strengthened Audit Functions: Increased scrutiny of departmental budgets and enhanced internal audit functions are central to this strategy. Independent audits will be used to identify areas of inefficiency and wasteful spending. Increased penalties for mismanagement will also act as a deterrent.

- Examples of Targeted Programs: While specific details are still emerging, the Opposition has hinted at potential cuts to certain grant programs, departmental administrative costs, and potentially overlapping initiatives across different government agencies. Transparency in identifying these programs will be key to building public trust.

- Overcoming Bureaucratic Resistance: A significant challenge lies in overcoming potential resistance from within the bureaucracy. Deep-rooted processes and entrenched interests may hinder the implementation of reforms aimed at reducing government waste.

Reforming Welfare and Social Security Programs

Proposed reforms to welfare and social security programs are a controversial aspect of the Opposition's $9 billion Australian Budget savings plan. Keywords for this section include Welfare Reform, Social Security, Centrelink, Austerity Measures, and Job Seeker Payment.

- Stricter Eligibility Criteria: The Opposition suggests stricter eligibility criteria for various welfare programs, potentially leading to a reduction in the number of recipients. This may involve tightening income and asset tests, and potentially introducing stricter work requirements.

- Impact on Vulnerable Populations: This aspect of the plan has drawn significant criticism. Critics argue that stricter eligibility criteria could disproportionately affect vulnerable populations, exacerbating existing inequalities and potentially pushing individuals into poverty.

- Balancing Economic and Social Considerations: The challenge lies in balancing economic necessity with social responsibility. The Opposition will need to demonstrate that proposed cuts are both fiscally responsible and do not unduly harm vulnerable Australians.

- Increased Administrative Costs: Implementing stricter eligibility checks could paradoxically increase administrative costs in the short term, potentially offsetting some of the intended savings.

- International Comparisons: Examining welfare reform strategies in other countries can provide valuable insights and lessons. However, direct comparisons should be approached cautiously, as different contexts require tailored approaches.

Reducing Spending on Defence and Infrastructure

Cuts to defence and infrastructure are also being considered as part of the Opposition's plan to achieve $9 billion in Australian Budget savings. Keywords relevant here include Defence Spending, Infrastructure Projects, Cost-Cutting, and Project Management.

- Review of Defence Projects: Specific defence projects, particularly those experiencing cost overruns or delays, are likely to be subjected to rigorous review. This could result in budget reductions or even project cancellations.

- Infrastructure Project Scrutiny: Similarly, infrastructure projects will be examined for potential cost savings. This may involve renegotiating contracts, streamlining project timelines, and prioritizing projects based on economic impact and strategic importance.

- Long-Term Consequences: Critics warn that significant cuts in these areas could have long-term negative consequences for national security and economic development. Reduced defence spending could compromise national security, while infrastructure cuts could hinder economic growth.

- Alternative Funding Models: Exploring alternative funding models, such as public-private partnerships, could help mitigate the impact of budget cuts while still delivering necessary infrastructure projects. However, these models also carry their own set of risks.

- Geopolitical Implications: Defence spending cuts need to be carefully considered within the broader geopolitical context. Australia's strategic alliances and regional security considerations must be factored into any decisions.

Increasing Tax Revenue through Improved Compliance

Improving tax compliance is another key element of the Opposition's strategy to achieve $9 billion in Australian Budget savings. Keywords here are Tax Revenue, Tax Compliance, Tax Avoidance, ATO, and Revenue Leakage.

- Enhanced Auditing: Increased scrutiny of tax returns and enhanced auditing capabilities are central to the plan. This will likely involve targeting high-wealth individuals and multinational corporations suspected of tax avoidance or evasion.

- Stronger Penalties for Non-Compliance: Implementing stricter penalties for non-compliance will act as a deterrent, encouraging greater tax compliance. This could involve higher fines and more aggressive prosecution of tax evasion cases.

- Impact on Businesses and Individuals: Increased scrutiny could negatively affect businesses and individuals, particularly those with complex financial situations. This could lead to increased compliance costs and potentially discourage investment.

- International Comparisons: Comparing Australia's tax compliance rate with other OECD countries can help identify areas for improvement and inform the design of more effective compliance measures.

- Cost-Effectiveness of Measures: The cost of implementing these measures must be weighed against the potential increase in tax revenue. Investing heavily in tax enforcement might not be cost-effective if the increase in revenue is relatively small.

Conclusion

The Opposition's proposed $9 billion in Australian Budget savings represents a significant undertaking, with potential implications for various sectors of the Australian economy and society. While their plan addresses concerns about government waste and aims to increase efficiency, the proposed cuts to welfare and potentially defence and infrastructure require careful consideration of the social and economic ramifications. The success of their strategy heavily depends on the feasibility of implementing the proposed reforms and achieving projected increases in tax revenue through improved compliance.

Call to Action: Understanding the complexities of the Opposition's plan to save $9 billion in the Australian Budget is crucial. Stay informed about the upcoming budget debates and continue your research into the potential effects of these proposed Australian budget savings. Follow our blog for further analysis and updates on Australian fiscal policy and the ongoing debate surrounding Australian budget savings.

Featured Posts

-

April 12 2025 Lotto Draw Results Check If You Won

May 03, 2025

April 12 2025 Lotto Draw Results Check If You Won

May 03, 2025 -

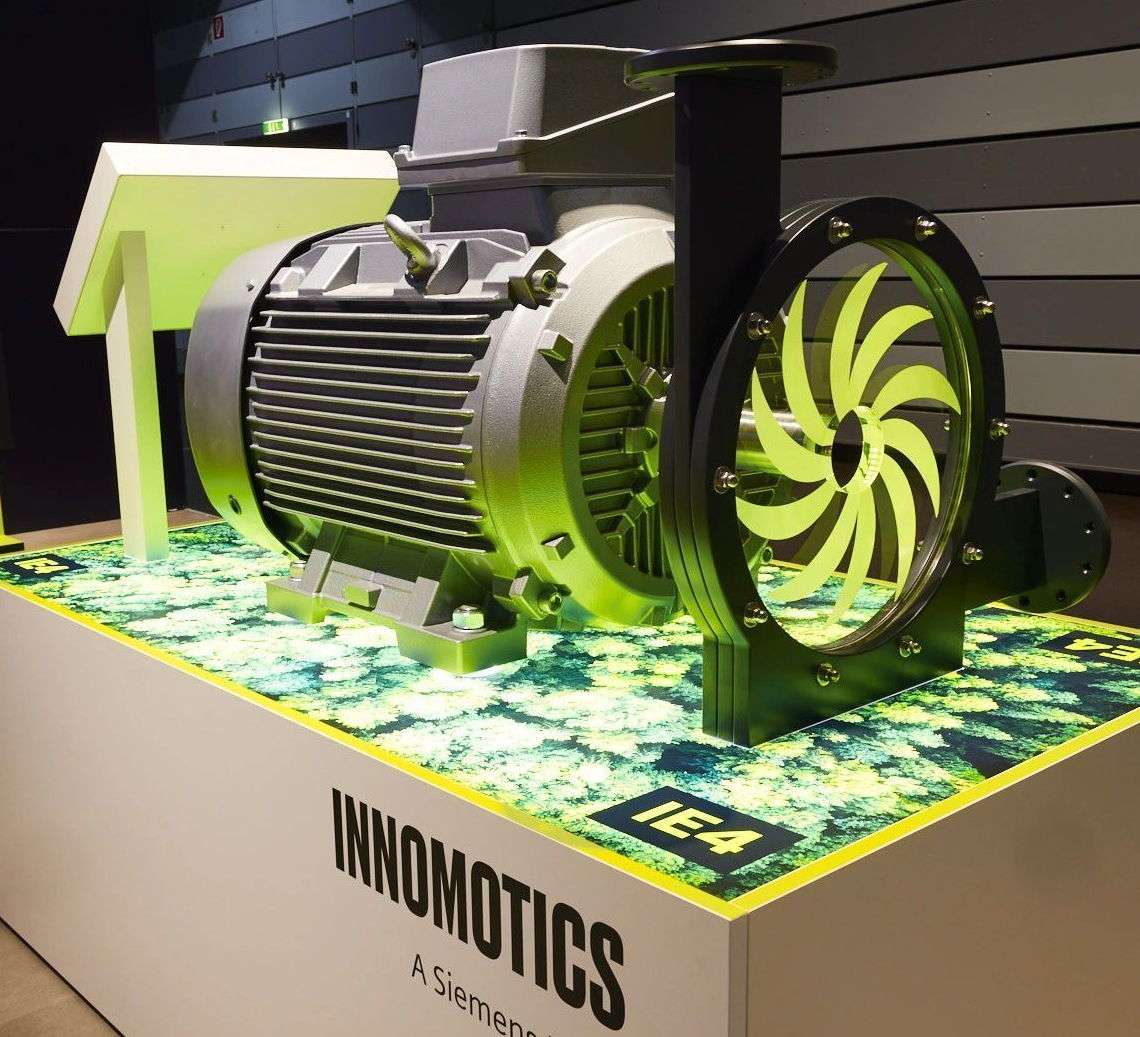

Innomotics Eneco And Johnson Controls A Massive Leap Forward In Heat Pump Technology

May 03, 2025

Innomotics Eneco And Johnson Controls A Massive Leap Forward In Heat Pump Technology

May 03, 2025 -

Israil Meclisi Nde Esir Yakinlari Ve Guevenlik Goerevlileri Arasindaki Arbede Ayrintilar Ve Gelismeler

May 03, 2025

Israil Meclisi Nde Esir Yakinlari Ve Guevenlik Goerevlileri Arasindaki Arbede Ayrintilar Ve Gelismeler

May 03, 2025 -

Jeffrey Dean Morgan On Negans Fortnite Role An Exclusive Interview

May 03, 2025

Jeffrey Dean Morgan On Negans Fortnite Role An Exclusive Interview

May 03, 2025 -

Sistema Penitenciario 7 Vehiculos Nuevos Para Mejorar El Transporte De Reclusos

May 03, 2025

Sistema Penitenciario 7 Vehiculos Nuevos Para Mejorar El Transporte De Reclusos

May 03, 2025

Latest Posts

-

Turning Trash Into Treasure An Ai Powered Poop Podcast From Mundane Documents

May 04, 2025

Turning Trash Into Treasure An Ai Powered Poop Podcast From Mundane Documents

May 04, 2025 -

How Norways Top Investor Nicolai Tangen Responded To Trumps Tariffs

May 04, 2025

How Norways Top Investor Nicolai Tangen Responded To Trumps Tariffs

May 04, 2025 -

Nicolai Tangen And The Impact Of Trumps Tariffs On Global Investment

May 04, 2025

Nicolai Tangen And The Impact Of Trumps Tariffs On Global Investment

May 04, 2025 -

Norways Nicolai Tangen Navigating Trumps Tariffs

May 04, 2025

Norways Nicolai Tangen Navigating Trumps Tariffs

May 04, 2025 -

The Electric Vehicle Arms Race China Vs America Who Will Win

May 04, 2025

The Electric Vehicle Arms Race China Vs America Who Will Win

May 04, 2025