Analysis: Reliance's Earnings And Their Effect On India's Large-Cap Sector

Table of Contents

Reliance Industries' Q3 Earnings: A Deep Dive

Reliance Industries' Q3 earnings report offers a window into the financial health of not just the company, but also a significant portion of the Indian economy. Analyzing key figures provides crucial context for understanding its influence on the broader market. Let's dissect the numbers:

- Revenue Growth: Reliance reported a revenue of [Insert Actual Revenue Figure] for Q3, representing a [Insert Percentage]% year-on-year growth. This growth can be largely attributed to [mention specific contributing factors, e.g., strong performance in the telecom sector, increased demand for petrochemicals].

- Profit Margins: The company achieved a profit margin of [Insert Percentage]%, a [increase/decrease] compared to the previous quarter. This fluctuation can be attributed to [mention reasons for the change, e.g., fluctuating oil prices, increased competition].

- Segment-wise Performance:

- Refining: The refining segment showed [growth/decline] due to [mention factors like global crude oil prices and refining margins].

- Petrochemicals: This sector witnessed [growth/decline] primarily driven by [mention factors such as demand, pricing, and production].

- Telecom (Jio): Jio's performance continues to be a significant driver of growth, showcasing [mention subscriber growth, ARPU, and any significant partnerships].

- Unexpected Results: [Mention any significant surprises or deviations from analyst expectations in the earnings report].

Impact on the Indian Stock Market's Large-Cap Index

Reliance's stock price movements significantly correlate with the performance of India's large-cap index, notably the Nifty 50. Given its substantial weight in the index, any positive or negative news regarding Reliance tends to have a cascading effect on the overall market sentiment.

- Post-Earnings Reaction: Following the Q3 earnings announcement, Reliance's stock price experienced a [Percentage]% change, causing [mention the impact on the Nifty 50 and other relevant large-cap indices].

- Market Sentiment: Trading volume and market volatility [increased/decreased] post-announcement, reflecting [positive/negative] investor sentiment.

- Comparison to Peers: Compared to other large-cap companies within the Nifty 50, Reliance’s performance [outperformed/underperformed/was in line with] the average, highlighting its relative strength or weakness within the sector.

Sector-Specific Effects: Analyzing Ripple Effects

Reliance's influence extends beyond its own stock price; its performance significantly impacts related sectors, creating a ripple effect throughout the Indian economy.

- Energy Sector: Fluctuations in Reliance's refining and petrochemicals businesses directly affect other players in the energy sector, influencing their stock prices and market share.

- Telecom Sector: Jio's performance as a major telecom player has a noticeable impact on competitors, affecting their pricing strategies and market penetration.

- Retail Sector: Reliance Retail’s growth and expansion influence the competitive landscape of the retail sector, impacting smaller players and potentially influencing consumer spending patterns.

Future Outlook and Investment Implications for Large-Cap Investors

Predicting future performance is always challenging, but analyzing Reliance's Q3 earnings provides some insights for investors.

- Reliance's Future: Based on the current trends and market conditions, Reliance is projected to [mention potential growth areas and challenges].

- Investment Strategies: For investors interested in the large-cap sector, diversifying investments across sectors and understanding the inherent risks associated with individual large-cap stocks remains crucial.

- Risks Assessment: The potential risks associated with investing in Reliance include [mention factors such as global economic slowdown, regulatory changes, and competitive pressures].

- Long-Term Growth: Despite these risks, the long-term growth prospects for Reliance and the broader Indian large-cap sector remain promising due to [mention underlying factors like India's economic growth potential and the expanding middle class].

Conclusion: Reliance's Earnings and Their Continued Influence on India's Large-Cap Sector

Reliance Industries' Q3 earnings have underscored its continuing dominance and influence on India's large-cap sector. The company’s financial health directly impacts the overall market sentiment and the performance of related sectors. Understanding Reliance's performance is paramount for any investor looking to navigate the complexities of the Indian stock market. Stay updated on Reliance's future performance and its effects on the Indian large-cap sector by subscribing to our newsletter, following us on social media, or checking back regularly for further analysis of Reliance's earnings and their effect on India's large-cap sector.

Featured Posts

-

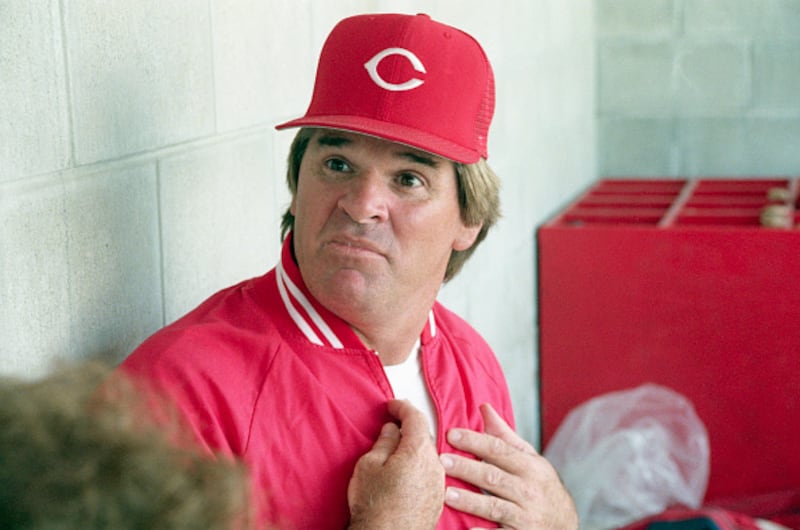

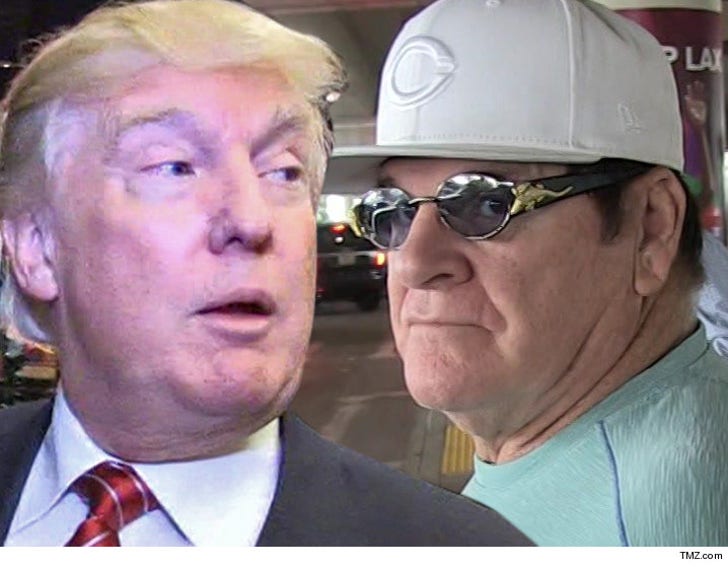

Pete Rose Pardon Trumps Posthumous Gesture Explained

Apr 29, 2025

Pete Rose Pardon Trumps Posthumous Gesture Explained

Apr 29, 2025 -

The End Of Ryujinx Nintendo Contact Leads To Development Halt

Apr 29, 2025

The End Of Ryujinx Nintendo Contact Leads To Development Halt

Apr 29, 2025 -

Pete Rose Presidential Pardon Trumps Statement And Potential Impact

Apr 29, 2025

Pete Rose Presidential Pardon Trumps Statement And Potential Impact

Apr 29, 2025 -

The Grim Truth About Retail Sales What It Means For Canadian Interest Rates

Apr 29, 2025

The Grim Truth About Retail Sales What It Means For Canadian Interest Rates

Apr 29, 2025 -

Donald Trump On Pete Rose Mlb Criticism And Pardon Promise

Apr 29, 2025

Donald Trump On Pete Rose Mlb Criticism And Pardon Promise

Apr 29, 2025