Analyzing Gibraltar Industries (NASDAQ: ROCK) Q[Quarter] Earnings: A Deep Dive

![Analyzing Gibraltar Industries (NASDAQ: ROCK) Q[Quarter] Earnings: A Deep Dive Analyzing Gibraltar Industries (NASDAQ: ROCK) Q[Quarter] Earnings: A Deep Dive](https://detroitgpferry.com/image/analyzing-gibraltar-industries-nasdaq-rock-q-quarter-earnings-a-deep-dive.jpeg)

Table of Contents

Revenue Analysis: Examining Gibraltar Industries' Top Line Performance

Gibraltar Industries' Q3 revenue performance provides a critical snapshot of its overall financial health. Analyzing this data allows investors to gauge the company's success in generating sales and its position within the market.

Year-over-Year Revenue Growth:

Gibraltar Industries' Q3 revenue showed a [Insert Percentage]% increase compared to the same quarter last year. This growth is significant, exceeding analyst expectations of [Insert Percentage]%.

- Key Revenue Drivers: Strong performance across multiple segments, particularly [mention specific high-performing segments, e.g., building products].

- Geographic Performance: Growth was witnessed in both domestic and international markets, with [mention specific regions and their performance].

- Market Share Changes: Gibraltar Industries appears to have maintained or slightly increased its market share in key segments. [Support with data or reference to industry reports].

[Insert Chart/Graph showing year-over-year revenue growth]

Segment Performance:

Analyzing Gibraltar Industries' revenue by segment provides a granular view of its business performance.

- Building Products: This segment demonstrated [growth/decline percentage]% growth, driven by [mention specific factors like increased demand or new product launches].

- Renewable Energy: The renewable energy segment showed [growth/decline percentage]% growth, reflecting [mention factors like government incentives or market trends].

- [Other segments, if applicable]: [Analyze each segment’s performance using similar structure]

Revenue Guidance:

Management's revenue guidance for Q4 and the full year [Insert Year] is [Insert details from the report]. This suggests [positive/cautious/neutral] outlook for the coming periods.

- Management expects continued growth in [mention specific segments].

- Potential challenges include [mention any challenges highlighted by management, such as supply chain issues or economic uncertainty].

Profitability and Margins: A Deep Dive into Gibraltar Industries' Financial Health

Analyzing profitability and margins is essential for understanding the efficiency and financial strength of Gibraltar Industries.

Gross Profit Margin Analysis:

Gibraltar Industries' Q3 gross profit margin stood at [Insert Percentage]%, showing a [increase/decrease] compared to the same quarter last year.

- Raw Material Costs: Fluctuations in raw material prices [positively/negatively] impacted the gross margin.

- Pricing Strategies: The company's pricing strategies appear to have been [effective/ineffective] in mitigating cost pressures.

- Manufacturing Efficiency: [Discuss any improvements or declines in manufacturing efficiency and their impact on the gross margin].

Operating Income and Net Income:

Gibraltar Industries reported an operating income of [Insert Amount] and a net income of [Insert Amount] in Q3.

- Operating Expenses: Operating expenses increased/decreased by [Insert Percentage]%, primarily due to [mention key factors].

- Interest Expenses: Interest expenses were [Insert Amount], reflecting [mention any changes in debt levels].

- Earnings Per Share (EPS): The company's EPS was [Insert Amount], [exceeding/meeting/missing] analyst expectations.

Return on Equity (ROE) and Return on Assets (ROA):

Gibraltar Industries' ROE and ROA are key indicators of its efficiency in using its assets and equity to generate profits. [Include data on ROE and ROA and compare to industry benchmarks or competitors].

Key Highlights and Future Outlook for Gibraltar Industries (NASDAQ: ROCK)

This section summarizes significant events and management's outlook for Gibraltar Industries.

Significant Events:

[Mention any significant events from Q3, such as acquisitions, divestitures, new product launches, or partnerships, and analyze their impact on the company's financials].

Management Commentary:

Management's commentary highlighted [summarize key points from management’s discussion and analysis]. Their outlook for the future appears to be [positive/cautious/neutral], based on their expectations for [mention key factors influencing their outlook].

Conclusion: Key Takeaways and Call to Action

Gibraltar Industries' Q3 earnings report reveals a [positive/mixed/negative] performance, with [summarize key findings regarding revenue, profitability, and future outlook]. Understanding these results is vital for investors seeking to make informed decisions about their investments in ROCK stock.

Stay updated on Gibraltar Industries Q3 earnings and deepen your understanding of ROCK stock performance by continuing to follow industry news and financial reports. Analyze Gibraltar Industries' future growth potential and consider incorporating this analysis into your broader investment strategy.

![Analyzing Gibraltar Industries (NASDAQ: ROCK) Q[Quarter] Earnings: A Deep Dive Analyzing Gibraltar Industries (NASDAQ: ROCK) Q[Quarter] Earnings: A Deep Dive](https://detroitgpferry.com/image/analyzing-gibraltar-industries-nasdaq-rock-q-quarter-earnings-a-deep-dive.jpeg)

Featured Posts

-

Byd Case Study Examining Their Leadership In Ev Battery Production

May 13, 2025

Byd Case Study Examining Their Leadership In Ev Battery Production

May 13, 2025 -

Campus Farm Animals A Living Textbook For Students Learning Life Cycles

May 13, 2025

Campus Farm Animals A Living Textbook For Students Learning Life Cycles

May 13, 2025 -

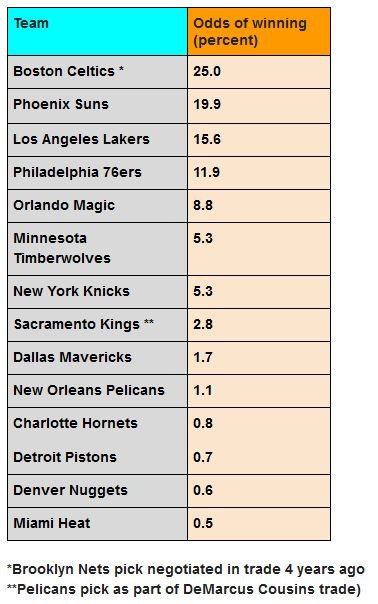

Nba Draft Lottery Okc Thunders Position Still Up In The Air

May 13, 2025

Nba Draft Lottery Okc Thunders Position Still Up In The Air

May 13, 2025 -

Ne Platit Alimenty Skandal Vokrug Syna Pevitsy Tatyany Kadyshevoy

May 13, 2025

Ne Platit Alimenty Skandal Vokrug Syna Pevitsy Tatyany Kadyshevoy

May 13, 2025 -

Marinika Tepi I Romi Srbi E Kra Targetiranja I Diskriminatsi E

May 13, 2025

Marinika Tepi I Romi Srbi E Kra Targetiranja I Diskriminatsi E

May 13, 2025

Latest Posts

-

How To Train Your Dragon Live Action Examining A Potential Point Of Contention

May 13, 2025

How To Train Your Dragon Live Action Examining A Potential Point Of Contention

May 13, 2025 -

The How To Train Your Dragon Live Action Remakes Almost Controversial Decision

May 13, 2025

The How To Train Your Dragon Live Action Remakes Almost Controversial Decision

May 13, 2025 -

How To Train Your Dragon Live Action A Near Miss Controversial Choice

May 13, 2025

How To Train Your Dragon Live Action A Near Miss Controversial Choice

May 13, 2025 -

How Close Did The How To Train Your Dragon Live Action Remake Come To A Controversial Decision

May 13, 2025

How Close Did The How To Train Your Dragon Live Action Remake Come To A Controversial Decision

May 13, 2025 -

Amazon Primes New Heist Movie Sequel Release Date And What To Expect

May 13, 2025

Amazon Primes New Heist Movie Sequel Release Date And What To Expect

May 13, 2025