Analyzing NCLH Stock: What Are Hedge Funds Doing?

Table of Contents

Hedge Fund Positions in NCLH Stock: A Deep Dive

Understanding the positions of major hedge funds in NCLH stock is crucial for gauging market sentiment. Analyzing recent 13F filings offers a glimpse into their investment strategies. These filings reveal the holdings of institutional investors, providing valuable data for informed investment decisions. By examining these filings, we can identify trends and patterns in hedge fund activity concerning NCLH.

-

Analyzing Changes in Positions: We need to look at the percentage changes in NCLH holdings from quarter to quarter. Have prominent hedge funds been increasing their stakes (buying), decreasing their positions (selling), or maintaining a consistent level of investment (holding)? A significant shift in either direction can signal a change in market outlook.

-

Top Hedge Fund Holdings: Let's identify the top 10 hedge funds with the largest NCLH holdings. This allows us to see which institutional players have the most significant influence on the stock's price. (Note: Specific data on current hedge fund holdings would need to be sourced from recent 13F filings at the time of publication. This section would be populated with that real-time data).

-

Overall Hedge Fund Ownership: Determining the total percentage of NCLH stock owned by hedge funds gives a broader perspective on institutional confidence in the company. A high percentage can indicate significant institutional backing, while a low percentage might suggest a lack of interest.

Interpreting Hedge Fund Activity: Bullish or Bearish Signals?

Interpreting hedge fund activity requires careful consideration of various factors. Simply identifying whether they are buying or selling isn't enough; we must consider why. Are their actions indicative of a bullish (positive outlook) or bearish (negative outlook) sentiment towards NCLH stock?

-

Market Sentiment: The overall market sentiment plays a key role. If the broader market is experiencing a downturn, even increased buying in NCLH by hedge funds might not be a purely bullish signal. It could simply be a shift in portfolio allocation.

-

Risk and Reward: Investing in NCLH, based on hedge fund activity, involves assessing both the potential rewards and risks. While hedge fund buying can suggest growth potential, it doesn't eliminate inherent risks within the cruise industry.

-

Alternative Interpretations: Hedge fund behavior isn't always straightforward. Their actions might be driven by hedging strategies (reducing risk), portfolio rebalancing (adjusting asset allocation), or other sophisticated investment approaches not directly reflecting their view on NCLH's long-term prospects.

NCLH Stock Performance and Industry Outlook

Analyzing NCLH's financial performance alongside the overall cruise industry outlook is vital for understanding hedge fund activity. Strong financial performance can attract investors, while a negative industry outlook may lead to selling.

-

Key Financial Metrics: Examining NCLH's revenue, earnings per share (EPS), debt levels, and cash flow provides crucial insights into the company's financial health. (Specific data would be included here).

-

Upcoming Catalysts: Factors like new ship launches, expansion into new markets, or strategic partnerships can significantly influence NCLH's stock price. These upcoming events need to be considered.

-

Industry Outlook: The overall health of the cruise industry significantly impacts NCLH. Factors like fuel prices, global economic conditions, and changes in consumer travel preferences all influence the industry's outlook and consequently, NCLH’s stock.

Risks and Considerations for NCLH Investors

Investing in NCLH, or any stock within the cruise industry, carries inherent risks. Understanding these risks is crucial for making informed investment decisions.

-

Major Risks: These include economic downturns, geopolitical instability, health crises (like pandemics), increased fuel prices, intense competition, and regulatory changes.

-

Mitigation Strategies: Investors can mitigate some risks through diversification, thorough due diligence, and setting realistic investment goals.

-

Due Diligence: Before investing in NCLH stock, extensive research and careful consideration of all potential risks are essential.

Conclusion: Analyzing NCLH Stock: Your Next Steps

Analyzing NCLH stock requires a comprehensive approach, considering both bullish and bearish perspectives. While hedge fund activity provides valuable insight, it's just one piece of the puzzle. The overall industry outlook, NCLH's financial performance, and inherent market risks must all be considered. This analysis of NCLH stock and hedge fund activity aims to provide a starting point for your own research. Begin your own analysis of NCLH stock today, informed by the insights into hedge fund activity presented here. Remember to consult additional resources and conduct thorough due diligence before making any investment decisions.

Featured Posts

-

Charles Barkley And Ru Pauls Drag Race A Surprising Relationship

Apr 30, 2025

Charles Barkley And Ru Pauls Drag Race A Surprising Relationship

Apr 30, 2025 -

Minnesotas Big Win Edwards Stellar Performance Sinks Brooklyn

Apr 30, 2025

Minnesotas Big Win Edwards Stellar Performance Sinks Brooklyn

Apr 30, 2025 -

Navigating The Complexities Of The Chinese Automotive Market Lessons From Bmw And Porsche

Apr 30, 2025

Navigating The Complexities Of The Chinese Automotive Market Lessons From Bmw And Porsche

Apr 30, 2025 -

Kamala Harris Planned Political Comeback Dates And Expectations

Apr 30, 2025

Kamala Harris Planned Political Comeback Dates And Expectations

Apr 30, 2025 -

Summer 2025 Your Guide To The Best Slides

Apr 30, 2025

Summer 2025 Your Guide To The Best Slides

Apr 30, 2025

Latest Posts

-

German Coalition Formation Conservatives And Social Democrats In Talks

Apr 30, 2025

German Coalition Formation Conservatives And Social Democrats In Talks

Apr 30, 2025 -

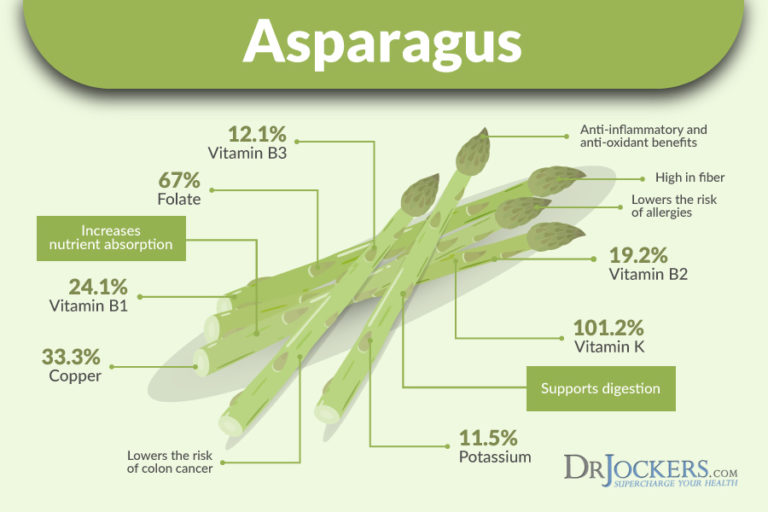

Is Asparagus Good For You Exploring The Nutritional Powerhouse

Apr 30, 2025

Is Asparagus Good For You Exploring The Nutritional Powerhouse

Apr 30, 2025 -

Germany Conservatives And Social Democrats Enter Coalition Negotiations

Apr 30, 2025

Germany Conservatives And Social Democrats Enter Coalition Negotiations

Apr 30, 2025 -

Asparagus A Deep Dive Into Its Health Benefits

Apr 30, 2025

Asparagus A Deep Dive Into Its Health Benefits

Apr 30, 2025 -

Understanding The Health Impacts Of Asparagus Consumption

Apr 30, 2025

Understanding The Health Impacts Of Asparagus Consumption

Apr 30, 2025