Analyzing Palantir Stock: Investment Outlook Before May 5th

Table of Contents

H2: Palantir's Recent Financial Performance and Key Metrics

Analyzing Palantir stock involves a deep dive into its financials. Understanding its revenue growth, profitability, customer base, and financial health is crucial for assessing its investment potential.

H3: Revenue Growth and Profitability

Palantir's revenue growth has been a point of both excitement and concern for investors. Recent quarterly and annual reports reveal a mixed bag. Let's break down some key figures:

- Q4 2023 Revenue: While specific numbers need to be updated closer to May 5th based on the latest reports, it's crucial to evaluate whether revenue surpassed or fell short of analyst expectations. A significant beat could signal strong market demand, while a miss could raise concerns.

- Operating Margins: Examining operating margins reveals Palantir's efficiency in managing costs and generating profit from its operations. Trends in this metric offer insights into the company's financial health.

- Net Income: The overall net income (profit or loss) provides the bottom-line picture of Palantir's financial performance. This is a crucial factor when analyzing Palantir stock for investment purposes.

H3: Customer Acquisition and Retention

Palantir's success hinges on its ability to secure and retain both government and commercial clients.

- Government Contracts: The company's reliance on government contracts is a double-edged sword. While it provides a stable revenue stream, it also exposes Palantir to the potential impact of shifting government priorities and budget constraints. Examining the pipeline of new government contracts is therefore critical when analyzing Palantir stock.

- Commercial Growth: Palantir's expansion into the commercial sector is key to its long-term growth. Assessing the success of these ventures and the acquisition of new clients in this sector is crucial for a comprehensive evaluation.

- Customer Retention Rates: High retention rates demonstrate the value Palantir offers to its customers and the stickiness of its products and services. This is a significant factor to assess when analyzing Palantir investment opportunities.

H3: Debt and Cash Position

A strong balance sheet is crucial for navigating economic uncertainty.

- Debt Levels: Analyzing Palantir's debt levels provides insights into its financial risk profile. High debt can limit financial flexibility.

- Cash Reserves: Substantial cash reserves offer Palantir a cushion against potential downturns and provide resources for strategic investments and acquisitions.

H2: Market Factors Affecting Palantir Stock

Analyzing Palantir stock requires considering broader market forces beyond the company's specific performance.

H3: Overall Market Sentiment and Economic Conditions

Macroeconomic factors significantly influence investor sentiment towards technology stocks.

- Interest Rates: Rising interest rates tend to negatively impact growth stocks like Palantir due to increased borrowing costs and decreased investor appetite for riskier assets.

- Inflation and Recessionary Fears: Economic uncertainty, fueled by inflation or recessionary fears, often leads to decreased investment in technology, affecting Palantir's stock price.

H3: Competition and Industry Landscape

Palantir operates in a competitive landscape with established players and emerging competitors.

- Key Competitors: Identifying and analyzing the strategies and market share of key competitors (such as AWS, Microsoft, etc.) is essential to understanding Palantir's position in the market and its potential for future growth.

- Competitive Advantage: Palantir's ability to maintain its competitive advantage through innovation and strategic partnerships will greatly influence its long-term prospects.

H3: Geopolitical Factors

Geopolitical events can significantly influence demand for Palantir's services, particularly in the government sector.

- Government Spending: Increased government spending on defense and intelligence could significantly benefit Palantir. Analyzing shifts in global geopolitical dynamics is therefore crucial.

- International Expansion: Success in international expansion can unlock significant growth opportunities but also introduces additional geopolitical risks.

H2: Future Outlook and Predictions for Palantir Stock

Predicting future stock performance is inherently challenging, but analyzing key factors can provide a reasoned outlook.

H3: Analyst Ratings and Price Targets

Consulting analyst reports and price targets provides a snapshot of the collective market sentiment.

- Consensus Estimates: While analyst opinions vary, it's useful to examine the average price target and buy/sell recommendations to gauge the overall outlook.

H3: Potential Catalysts for Stock Price Movement

Several upcoming events could impact Palantir's stock price before May 5th.

- Earnings Reports: The May 5th earnings report will likely be a significant catalyst, impacting the Palantir stock price significantly depending on the performance reported. Pay close attention to guidance for future quarters.

- New Product Launches or Partnerships: Any announcements of new products or strategic partnerships can boost investor confidence and positively impact the stock price.

H3: Risks and Potential Downsides

Investing in Palantir stock involves certain risks.

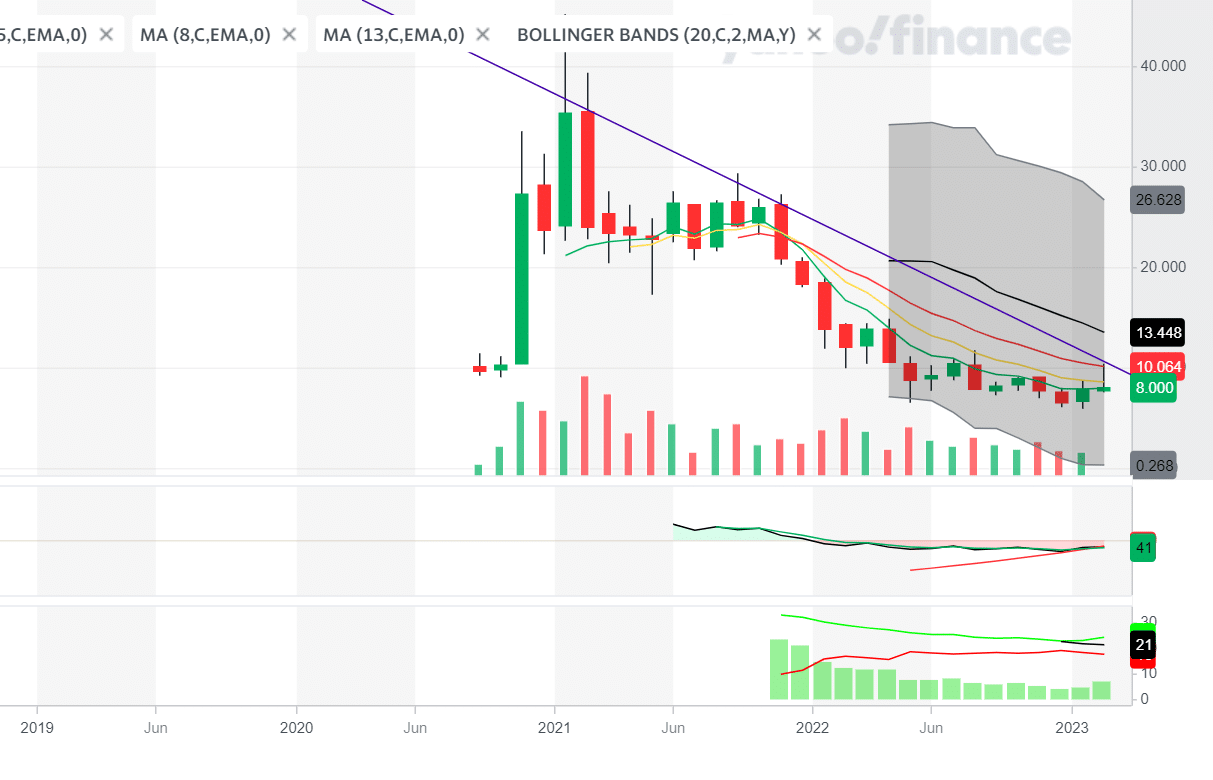

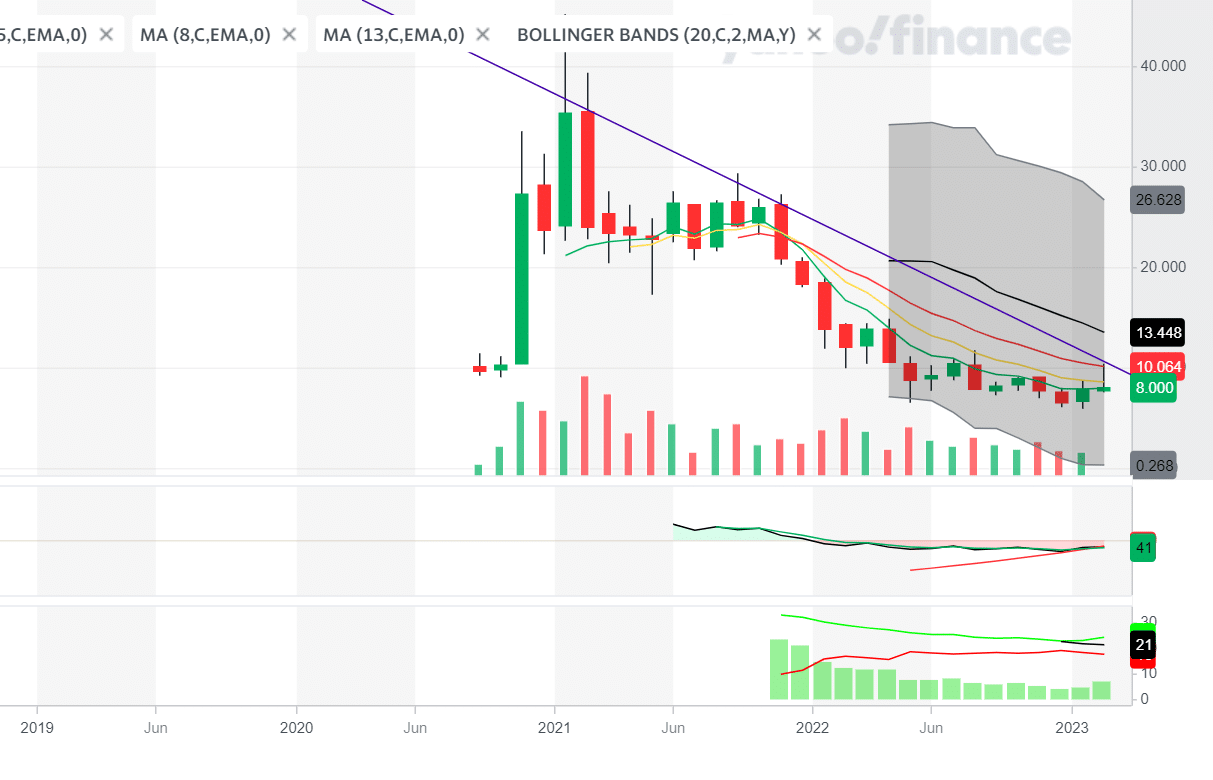

- Volatility: Palantir's stock price has been historically volatile.

- Dependence on Government Contracts: Over-reliance on government contracts exposes Palantir to budget cuts and changes in government priorities.

- Competition: Intense competition from established tech giants poses a considerable challenge to Palantir's long-term growth.

3. Conclusion

Analyzing Palantir stock requires a balanced assessment of its financial performance, market position, and future outlook. While Palantir possesses strong technology and a growing customer base, the company also faces challenges such as market volatility and competition. The upcoming May 5th date holds significant potential for news that could substantially impact the Palantir stock price. Therefore, a cautious approach is recommended, considering both the potential upsides and downsides. Before making any investment decisions, continue your own thorough analysis of Palantir stock, considering the factors discussed above and conducting your own independent research. Learn more about analyzing Palantir stock for your investment strategy to make informed decisions.

Featured Posts

-

Is Benson Boone Copying Harry Styles A Look At The Allegations

May 09, 2025

Is Benson Boone Copying Harry Styles A Look At The Allegations

May 09, 2025 -

Jayson Tatum Gets Roasted Tnts Hilarious Abc Promo For Lakers Vs Celtics

May 09, 2025

Jayson Tatum Gets Roasted Tnts Hilarious Abc Promo For Lakers Vs Celtics

May 09, 2025 -

Luis Enriques Psg Transformation How They Won The Ligue 1

May 09, 2025

Luis Enriques Psg Transformation How They Won The Ligue 1

May 09, 2025 -

Is Davids High Potential Morgans Greatest Weakness A New Theory

May 09, 2025

Is Davids High Potential Morgans Greatest Weakness A New Theory

May 09, 2025 -

Palantir Technology Stock Wall Streets Prediction Before May 5th

May 09, 2025

Palantir Technology Stock Wall Streets Prediction Before May 5th

May 09, 2025