Analyzing Palantir's 30% Price Decrease: Is It A Buying Opportunity?

Table of Contents

Understanding the 30% Price Drop: Reasons and Contributing Factors

The 30% plunge in Palantir stock isn't an isolated event; it's a confluence of factors impacting both the company specifically and the broader market.

Market Sentiment and the Broader Tech Sell-off

The tech sector has experienced a significant sell-off recently, driven by several macroeconomic trends. This negative market sentiment has undoubtedly impacted Palantir stock.

- Rising Interest Rates: The Federal Reserve's aggressive interest rate hikes to combat inflation have increased borrowing costs, making growth stocks like Palantir less attractive to investors.

- Inflation Concerns: Persistent inflation erodes purchasing power and makes investors more cautious about investing in high-growth, often unprofitable, companies.

- Recession Fears: Concerns about a potential recession are leading investors to shift towards more defensive investments, further impacting growth-oriented tech companies.

[Insert relevant chart showing correlation between tech sector performance and Palantir stock price.]

Palantir's Financial Performance and Recent Earnings Reports

Palantir's recent financial performance has also played a role in the share price decline. While the company continues to show revenue growth, certain aspects of its earnings reports might have disappointed some investors.

- Profitability Concerns: While Palantir is showing revenue growth, its path to profitability remains a key concern for investors. A slower-than-anticipated progress towards profitability could impact investor confidence.

- Growth Rate Slowdown: Some analysts have pointed to a slight slowdown in Palantir's revenue growth rate compared to previous quarters. This deceleration might have contributed to the sell-off.

- Guidance: Management's guidance for future quarters might have been less optimistic than what the market anticipated, influencing investor sentiment negatively.

[Insert data points from Palantir's recent earnings reports, including revenue figures, net income (or loss), and key performance indicators.]

Geopolitical Factors and Their Influence on Palantir's Business

Geopolitical instability can significantly impact Palantir's business, as it relies heavily on government contracts, particularly in the defense and intelligence sectors.

- International Conflicts: Escalating geopolitical tensions can impact government spending on technology and defense, potentially affecting Palantir's contract pipeline.

- Regulatory Uncertainty: Changes in government regulations or policies could impact Palantir's ability to secure or maintain contracts.

- Competition: Increased competition in the data analytics market from established tech giants could also influence Palantir's ability to secure new contracts.

"Geopolitical uncertainty is a significant factor impacting the overall tech landscape, and Palantir is not immune," says [Name of Market Analyst], a senior analyst at [Financial Institution].

Evaluating Palantir's Long-Term Growth Potential and Valuation

Despite the recent price drop, assessing Palantir's long-term prospects is crucial to determining if this presents a buying opportunity.

Assessing Palantir's Competitive Advantage and Market Position

Palantir holds a strong competitive advantage in the big data analytics market, built on its:

- Proprietary Technology: Palantir's Foundry platform offers a unique and powerful solution for data integration, analysis, and visualization.

- Strong Government Relationships: Its deep relationships with government agencies provide a steady stream of revenue and valuable data sets.

- Growing Commercial Business: Palantir is actively expanding its commercial business, targeting diverse sectors like finance, healthcare, and manufacturing.

[Insert a comparison table of Palantir against its key competitors, highlighting its strengths and weaknesses.]

Analyzing Palantir's Future Revenue Streams and Projections

Palantir's revenue streams are diverse, with significant potential for growth in both government and commercial sectors.

- Government Contracts: Continued strong relationships with government agencies should ensure a consistent revenue stream.

- Commercial Expansion: Penetration into new commercial markets holds significant growth potential.

[Insert revenue projections from reputable financial analysts or Palantir's own forecasts (with a clear disclaimer stating the potential for bias).]

Determining Palantir's Fair Value and Intrinsic Worth

Determining Palantir's fair value is complex, requiring a range of valuation methods. Using a discounted cash flow (DCF) analysis and a comparative company analysis, we can estimate a range of potential valuations.

- Discounted Cash Flow (DCF): A DCF analysis projects future cash flows and discounts them back to present value, giving an estimate of intrinsic worth.

- Comparable Company Analysis: Comparing Palantir's valuation metrics (e.g., Price-to-Sales ratio) to those of its competitors helps to assess its relative valuation.

[Include a brief explanation of the chosen valuation method and its limitations. Note that any valuation provided is an estimate and not a guarantee.]

Is Palantir Stock a Buy, Sell, or Hold? Assessing the Risk and Reward

The decision to buy, sell, or hold Palantir stock depends on weighing the potential risks and rewards.

Weighing the Risks Associated with Investing in Palantir

Investing in Palantir involves significant risks:

- Market Volatility: The tech sector is inherently volatile, and Palantir stock price can fluctuate significantly.

- Dependence on Government Contracts: A significant portion of Palantir's revenue comes from government contracts, which can be subject to budget cuts or political changes.

- Competition: The data analytics market is becoming increasingly competitive.

Assessing the Potential Rewards and Returns on Investment

Despite the risks, the potential rewards are significant:

- High Growth Potential: Palantir's innovative technology and expanding market presence offer considerable growth potential.

- Disruptive Technology: Palantir's platform has the potential to disrupt traditional data analytics methods.

- Current Low Price: The recent price drop may present a compelling entry point for long-term investors.

Providing a Recommendation Based on the Analysis

Based on our analysis, we recommend a hold on Palantir stock. While the current price may represent a discount compared to its potential, the risks associated with the company and the broader market remain significant. Further monitoring of financial performance and market trends is recommended before considering a buy.

Conclusion: Analyzing Palantir's 30% Price Decrease: A Final Verdict and Call to Action

The 30% drop in Palantir stock price is a complex event resulting from a combination of market-wide factors and company-specific concerns. While Palantir's long-term growth potential remains significant, substantial risks exist. Our analysis suggests a hold strategy, pending further developments.

Key Takeaways:

- The recent price drop in Palantir stock is attributable to broader tech sector weakness and company-specific concerns.

- Palantir possesses a strong competitive advantage, but profitability and revenue growth remain key factors to watch.

- Investing in Palantir involves significant risk, despite potential high rewards.

Call to Action: Conduct your due diligence on Palantir stock before making any investment decisions. Carefully consider your investment strategy regarding Palantir and its potential risks. Further research on Palantir's future prospects is recommended, and consulting with a financial advisor is strongly advised before making any investment decisions regarding Palantir stock or any other security.

Featured Posts

-

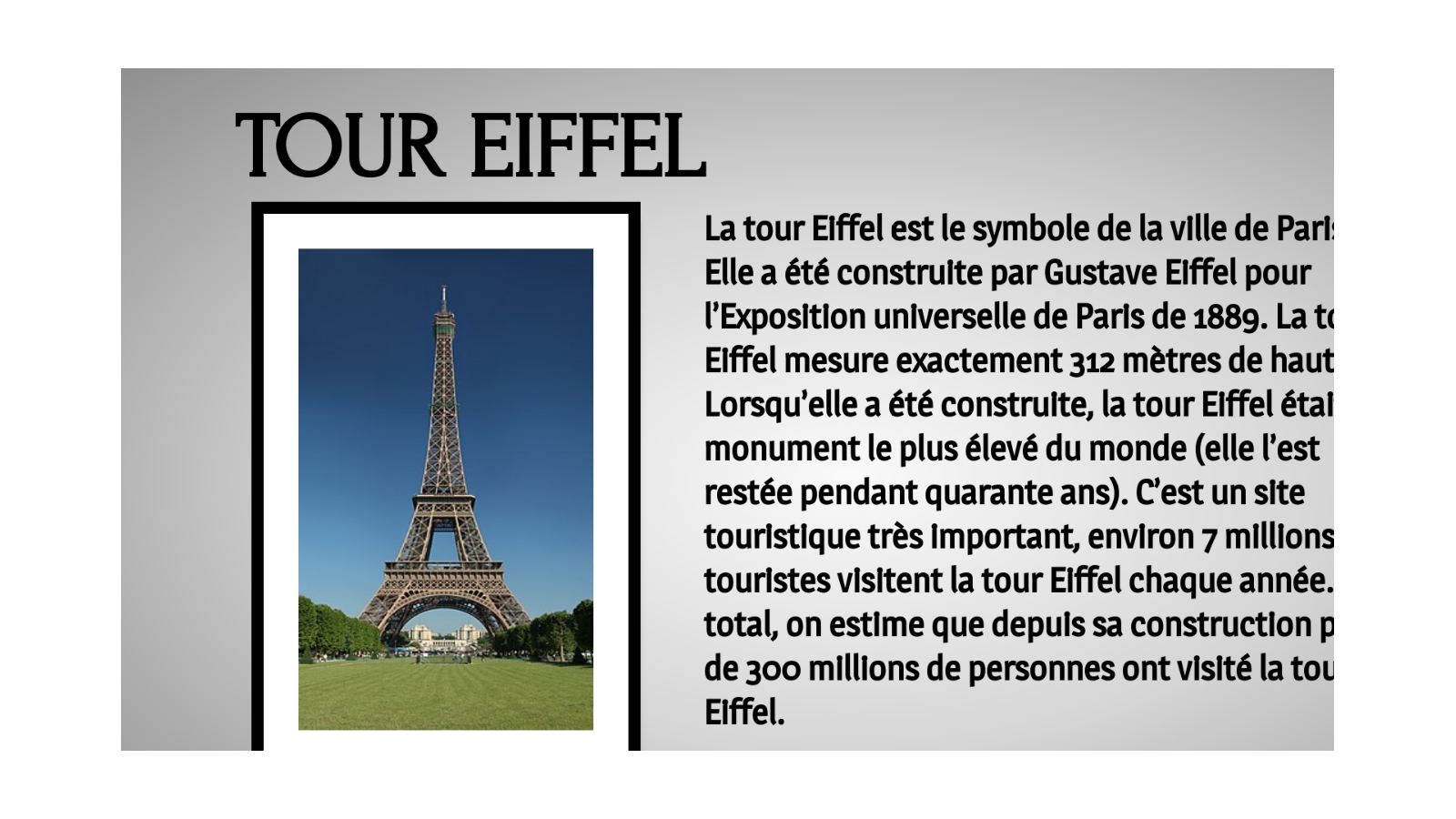

Dijon Revele Le Role Crucial De Melanie Eiffel Dans La Construction De La Tour Eiffel

May 09, 2025

Dijon Revele Le Role Crucial De Melanie Eiffel Dans La Construction De La Tour Eiffel

May 09, 2025 -

Elizabeth Line Accessibility Addressing Wheelchair User Gaps

May 09, 2025

Elizabeth Line Accessibility Addressing Wheelchair User Gaps

May 09, 2025 -

5 Theories On Davids Identity In High Potential Unraveling The He Morgan Brother Mystery

May 09, 2025

5 Theories On Davids Identity In High Potential Unraveling The He Morgan Brother Mystery

May 09, 2025 -

Nyt Strands Game 366 Solutions And Clues For Tuesday March 4

May 09, 2025

Nyt Strands Game 366 Solutions And Clues For Tuesday March 4

May 09, 2025 -

The Future Of Apple Ai Innovation And Market Dominance

May 09, 2025

The Future Of Apple Ai Innovation And Market Dominance

May 09, 2025