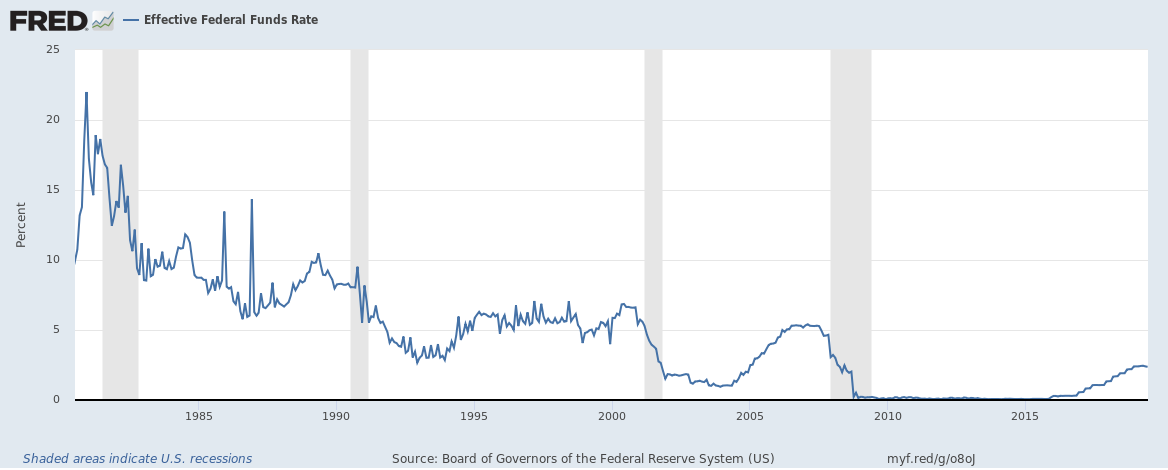

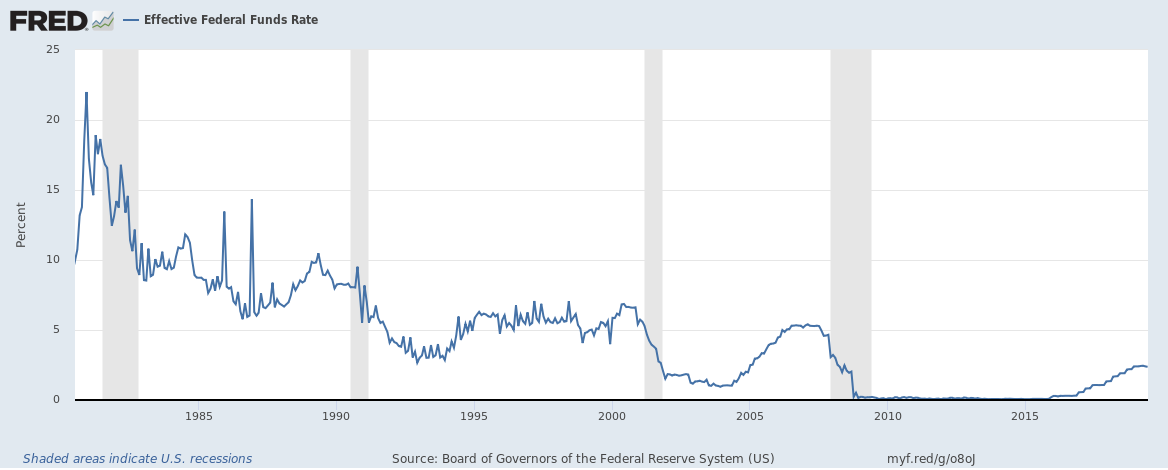

Analyzing The Fed's Decision To Hold Off On Rate Cuts

Table of Contents

Inflation Remains a Key Concern

The Fed's primary mandate is price stability, and persistent inflation remains a significant obstacle. The current inflation rates, while showing signs of cooling, are still considerably above the Fed's target of 2%. This deviation from the desired level is a critical factor in the Fed's decision to hold off on rate cuts.

- Current inflation rates: While the headline inflation rate has decreased from its peak, core inflation – which excludes volatile food and energy prices – remains stubbornly high.

- Core inflation stickiness: The persistence of core inflation suggests underlying inflationary pressures within the economy, indicating that further actions might be needed to bring inflation back to the target.

- Inflation indicators: Key inflation indicators like the Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) index are closely monitored by the Fed to gauge the effectiveness of monetary policy. Continued elevated readings in these indices would likely support a more hawkish approach.

High inflation pressures the Fed to maintain a hawkish stance, meaning a reluctance to lower interest rates. Rate cuts, if implemented prematurely, could risk exacerbating inflation and undermining the central bank's credibility.

Labor Market Strength and Wage Growth

The surprisingly robust labor market presents another challenge to the Fed's consideration of rate cuts. Low unemployment and high job openings indicate a tight labor market, which can fuel wage growth and further contribute to inflationary pressures.

- Unemployment rate statistics: The unemployment rate remains historically low, suggesting a strong demand for labor.

- Wage growth data: Significant wage growth, while positive for workers, can contribute to a wage-price spiral, where rising wages lead to higher prices, which in turn lead to even higher wage demands.

- Wage-price spiral scenarios: The Fed is acutely aware of the potential for a wage-price spiral and is actively monitoring wage growth data to assess this risk.

A robust labor market, while generally positive for the economy, fuels inflation and discourages rate cuts. The Fed needs to carefully assess the balance between maintaining employment levels and controlling inflation.

Assessment of Economic Growth and Risks

The Fed's decision to hold off on rate cuts is also shaped by its assessment of the current economic growth trajectory and associated risks. While economic growth has been resilient, there are concerns about potential slowdowns or even a recession.

- GDP growth projections: The Fed's projections for GDP growth have been revised downwards, reflecting the uncertainty in the global economic outlook.

- Potential economic slowdowns or recessions: The risk of a recession, fueled by high interest rates and geopolitical instability, is a significant consideration for the Fed.

- Geopolitical risks: Ongoing geopolitical events and global supply chain disruptions add further complexity to the economic outlook and influence the Fed's decision-making process.

The Fed needs to carefully balance the need to cool inflation with the risk of triggering a recession by prematurely raising interest rates. This delicate balancing act significantly influences their monetary policy decisions.

The Impact of Recent Economic Data

The Fed's decision was heavily influenced by recent economic data releases. Stronger-than-expected employment reports and persistent inflation readings likely contributed to the decision to pause rather than cut rates.

- Specific reports: Recent employment reports showing strong job creation and consumer confidence indices indicating relatively high levels of consumer optimism have played a role in the Fed's assessment.

- Data points supporting or contradicting rate cut expectations: The recent data largely contradicted expectations of rate cuts, reinforcing the need for a cautious approach.

These data points were instrumental in shaping the Fed's overall assessment of the economy and their decision to maintain the current interest rate policy.

Future Outlook and Potential Scenarios

The future trajectory of interest rates remains uncertain, contingent upon upcoming economic data and the Fed's evolving assessment of inflation and economic growth.

- Potential for future rate hikes or further pauses: Depending on upcoming economic data, future rate hikes or further pauses are both possible scenarios.

- Likelihood of a recession: The risk of a recession remains a key concern, influencing the Fed's future policy decisions.

- Impact on various asset classes: The Fed's decisions have significant implications for various asset classes, impacting stock and bond markets.

Several scenarios are possible, ranging from a continued pause in rate changes to further rate hikes if inflation remains stubbornly high. Closely monitoring economic indicators will be crucial in forecasting the future course of monetary policy.

Conclusion: Understanding the Fed's Decision to Hold Off on Rate Cuts

The Fed's decision to hold off on rate cuts reflects a complex interplay of factors, primarily persistent inflation, a robust labor market, and the assessment of economic growth risks. This decision has significant implications for investors and the broader economy. Understanding the rationale behind the "Fed's decision to hold off on rate cuts" is crucial for informed financial planning. Staying informed about upcoming economic data releases and the Fed's future policy decisions is paramount. For deeper analysis, consider consulting resources like the Federal Reserve's website and reputable financial news outlets to stay updated on the evolving economic landscape and its implications for the Fed's future monetary policy.

Featured Posts

-

Stephen King Weighs In Comparing Stranger Things To It

May 09, 2025

Stephen King Weighs In Comparing Stranger Things To It

May 09, 2025 -

Metas 168 Million Payment The Whats App Spyware Cases Lasting Impact

May 09, 2025

Metas 168 Million Payment The Whats App Spyware Cases Lasting Impact

May 09, 2025 -

Sensex Surges 1 400 Points Nifty 50 Above 23 800 Top 5 Reasons For Todays Market Rise

May 09, 2025

Sensex Surges 1 400 Points Nifty 50 Above 23 800 Top 5 Reasons For Todays Market Rise

May 09, 2025 -

Jayson Tatum Ankle Injury Updates On Celtics Stars Condition

May 09, 2025

Jayson Tatum Ankle Injury Updates On Celtics Stars Condition

May 09, 2025 -

9 Maya Kiev Bez Chasti Soyuznikov Ukrainy

May 09, 2025

9 Maya Kiev Bez Chasti Soyuznikov Ukrainy

May 09, 2025