Analyzing Uber's Recession Resistance: A Stock Market Perspective

Table of Contents

Uber's Business Model and Recession-Proof Characteristics

Uber's success in navigating economic uncertainty stems largely from its multifaceted business model and the essential nature of its services.

Diversified Revenue Streams

Uber's revenue isn't tied to a single service. Its diversified portfolio, encompassing Uber Rides, Uber Eats, Uber Freight, and other emerging segments, acts as a significant buffer against economic shocks. If one segment experiences a downturn, others can compensate.

- Impact of Diversification: During the 2020 pandemic, while ride-sharing declined, Uber Eats saw a surge in demand, demonstrating the benefits of diversification.

- Segmental Performance: Analyzing the relative contribution of each segment during previous economic slowdowns reveals the resilience of this diversified approach. While ride-sharing might be more sensitive to economic fluctuations, food delivery and freight services often remain relatively stable.

- Potential Vulnerabilities: However, this model isn't entirely risk-free. Over-reliance on any single segment, or unexpected downturns across multiple sectors, could still impact overall profitability.

Essential Service Nature

Uber provides essential services: transportation and food delivery. These are less susceptible to reductions in discretionary spending than luxury goods or entertainment services. People still need to get around and obtain food, even during economic hardship.

- Continued Demand: Historical data shows continued, albeit potentially reduced, demand for Uber's services during previous recessions.

- Comparison to Discretionary Spending: Unlike sectors heavily reliant on discretionary spending (e.g., travel and tourism), Uber benefits from a more inelastic demand curve.

- Price Elasticity: While price increases can impact demand, Uber's services generally maintain a level of demand even with price adjustments during economic downturns.

Cost-Cutting Measures and Operational Efficiency

Uber has consistently demonstrated an ability to adapt to economic challenges by implementing cost-cutting measures and improving operational efficiency.

- Cost-Cutting Strategies: Examples include streamlining operations, reducing marketing expenses, and optimizing driver allocation.

- Operational Efficiency Improvements: Technological advancements, like dynamic pricing and route optimization algorithms, contribute to significant cost savings.

- Impact of Technology: The use of data analytics and AI allows for better resource allocation and reduces operational inefficiencies, improving profitability during lean times.

Stock Market Performance and Valuation

Analyzing Uber's stock market performance and valuation provides crucial insights into its recession resistance.

Historical Stock Performance During Recessions

Uber's stock price has shown varying responses to past economic downturns. While it hasn't been completely immune to market volatility, its performance has often outpaced some sectors more directly impacted by recessions.

- Stock Price Movements: Charts and graphs comparing Uber's stock price against broader market indices (like the S&P 500) during previous recessions illustrate its relative resilience.

- Market Index Comparison: This comparative analysis reveals Uber's performance against similar companies and the overall market health during those periods.

- Investor Sentiment: Examining investor sentiment during those times reveals how market perceptions of Uber's resilience have evolved.

Valuation Metrics and Future Growth Potential

Assessing Uber's current valuation using metrics like the P/E ratio, revenue growth, and projected earnings helps gauge its future potential.

- Key Valuation Metrics: Analyzing these metrics provides a quantitative measure of Uber's financial health and investment attractiveness.

- Future Growth Projections: Analysts' projections for future revenue and earnings growth are critical in assessing the long-term investment potential of Uber stock.

- Risks and Challenges: It's crucial to consider potential risks to future growth, such as increased competition and regulatory hurdles.

Investor Sentiment and Market Expectations

Understanding investor sentiment and market expectations is essential for evaluating Uber stock's future trajectory.

- Analyst Ratings and Price Targets: Analyzing analyst ratings and price targets offers insights into market consensus regarding Uber's future performance.

- Influencing News and Events: Major news events, regulatory changes, and competitive pressures can significantly influence investor sentiment.

- Macroeconomic Factors: Broad macroeconomic conditions, such as interest rates and inflation, also impact investor confidence in Uber stock.

Risks and Challenges to Uber's Recession Resistance

Despite its strengths, Uber faces several potential challenges that could affect its recession resistance.

Competition and Market Saturation

The ride-sharing and food delivery markets are intensely competitive, with numerous players vying for market share.

- Key Competitors: Analyzing the strategies and market share of key competitors, such as Lyft, DoorDash, and regional players, is crucial.

- Market Share Trends: Monitoring market share trends helps gauge the competitive intensity and Uber's ability to maintain its position.

- Price Wars: The potential for price wars and their negative impact on profitability pose a significant risk.

Regulatory Uncertainty and Legal Challenges

Uber's operations are subject to significant regulatory scrutiny and legal challenges worldwide.

- Regulatory Hurdles: Navigating varying regulatory frameworks across different jurisdictions can be costly and complex.

- Ongoing Legal Battles: Ongoing legal battles related to driver classification and other issues can significantly impact profitability.

- Financial Implications: Negative legal outcomes can lead to substantial financial penalties and operational disruptions.

Economic Dependence on Consumer Spending

Uber's business model is intrinsically linked to consumer spending habits. A significant economic downturn could reduce demand for its services.

- Consumer Spending Trends: Monitoring consumer spending trends provides insights into the potential impact of economic slowdowns.

- Reduced Demand: A severe recession could lead to a substantial decline in demand for both ride-sharing and food delivery services.

- Adaptability to Change: Uber's ability to adapt to changes in consumer behavior and maintain profitability during such times is critical.

Analyzing Uber's Recession Resistance: A Stock Market Perspective – Key Takeaways and Call to Action

This analysis reveals that Uber's diversified business model, the essential nature of its services, and its cost-cutting measures contribute significantly to its recession resistance. However, intense competition, regulatory uncertainty, and its dependence on consumer spending pose substantial risks. Understanding Uber's recession resistance is crucial for informed investment decisions. Conduct further research into Uber's stock and consider its role in your portfolio strategy, based on your individual risk tolerance and investment goals. Remember to carefully analyze Uber's stock performance and assess its resilience within the context of broader macroeconomic factors before making any investment decisions.

Featured Posts

-

Late Game Meltdown Costs Knicks Playoff Berth Against Clippers

May 17, 2025

Late Game Meltdown Costs Knicks Playoff Berth Against Clippers

May 17, 2025 -

Disappointment And Anger Over Fortnites Latest Shop Update

May 17, 2025

Disappointment And Anger Over Fortnites Latest Shop Update

May 17, 2025 -

Wayrl Wydyw Mdah Ne Tam Krwz Ke Jwtwn Pr Kywn Chrhayy

May 17, 2025

Wayrl Wydyw Mdah Ne Tam Krwz Ke Jwtwn Pr Kywn Chrhayy

May 17, 2025 -

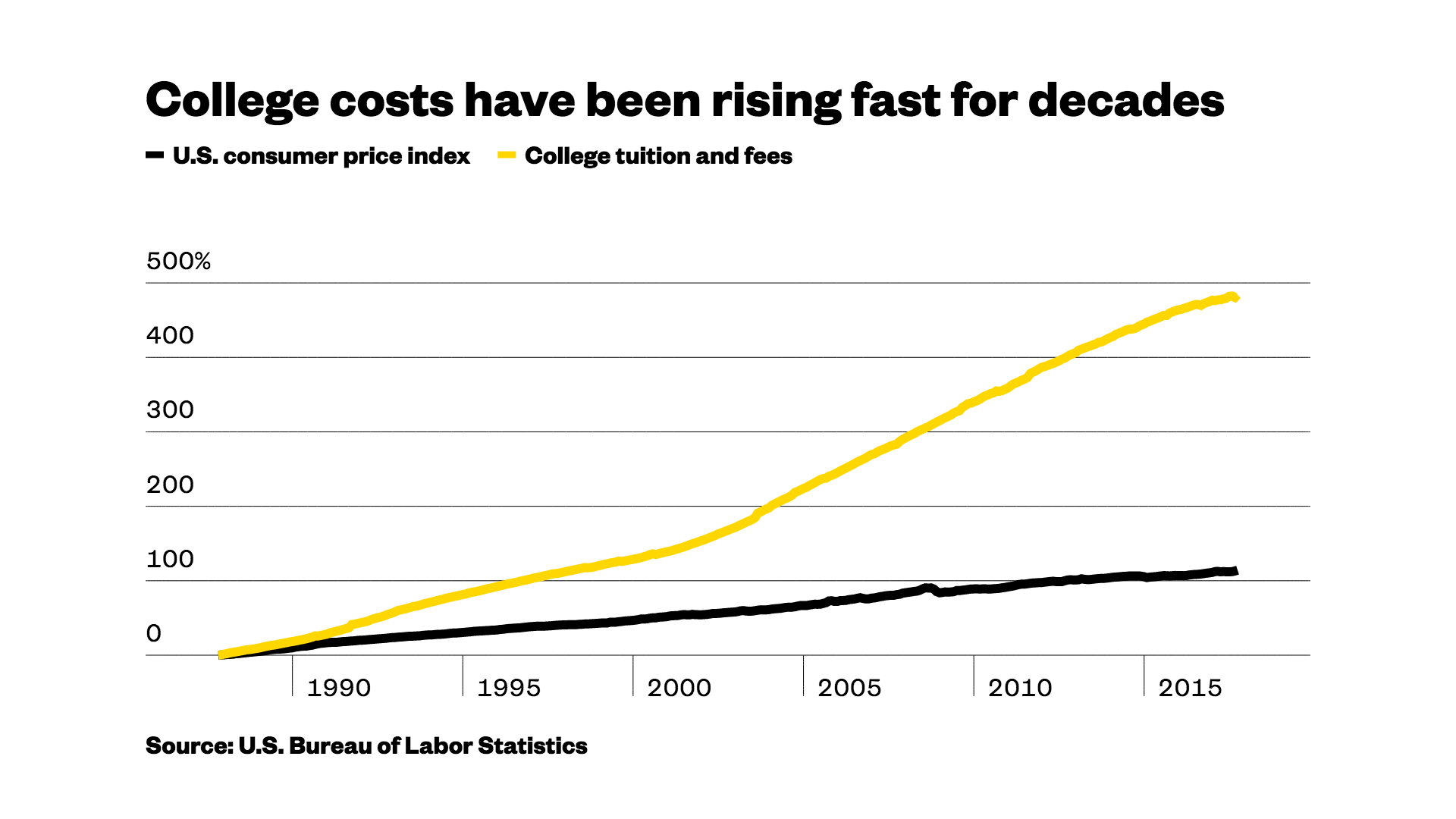

Survey Reveals Parental Concerns About College Tuition Decreasing Yet Student Loans Still Prevalent

May 17, 2025

Survey Reveals Parental Concerns About College Tuition Decreasing Yet Student Loans Still Prevalent

May 17, 2025 -

Condo Crack Crisis Seaweed Breakthroughs And Company Failures Daily News Summary

May 17, 2025

Condo Crack Crisis Seaweed Breakthroughs And Company Failures Daily News Summary

May 17, 2025

Latest Posts

-

Hornets Vs Celtics Game Prediction Expert Picks And Betting Odds

May 17, 2025

Hornets Vs Celtics Game Prediction Expert Picks And Betting Odds

May 17, 2025 -

Cavaliers Vs Celtics Prediction Will Boston Bounce Back

May 17, 2025

Cavaliers Vs Celtics Prediction Will Boston Bounce Back

May 17, 2025 -

Equip Yourself For The Finals Find Official Boston Celtics Merchandise At Fanatics

May 17, 2025

Equip Yourself For The Finals Find Official Boston Celtics Merchandise At Fanatics

May 17, 2025 -

Nepal First 24 Hour News

May 17, 2025

Nepal First 24 Hour News

May 17, 2025 -

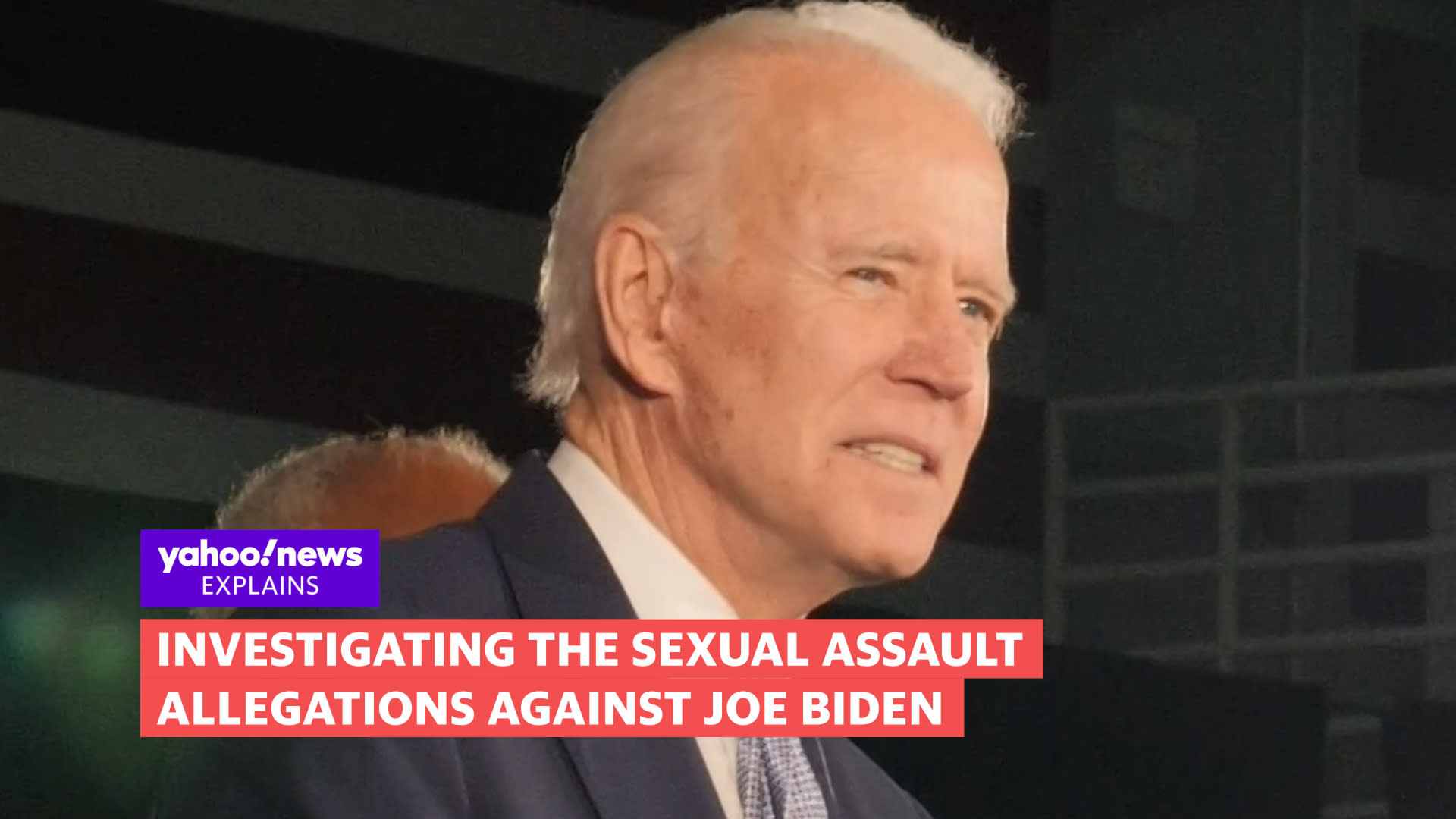

Analyzing The Effect Of Sexual Misconduct Allegations On Donald Trumps Presidential Win

May 17, 2025

Analyzing The Effect Of Sexual Misconduct Allegations On Donald Trumps Presidential Win

May 17, 2025