Are High Stock Market Valuations A Cause For Concern? BofA Weighs In

Table of Contents

BofA's Current Assessment of Market Valuations

BofA regularly publishes reports and statements evaluating market conditions, closely monitoring metrics like the Price-to-Earnings (P/E) ratio and the cyclically adjusted price-to-earnings ratio (Shiller PE ratio) to gauge market valuations. These ratios compare a company's stock price to its earnings per share, providing insights into whether a stock (and the market as a whole) is overvalued or undervalued.

-

BofA's Stance: While BofA's specific stance on valuations fluctuates based on current market conditions, their reports often highlight concerns about elevated valuations in certain sectors. They frequently caution against complacency, emphasizing the potential for market corrections. They generally avoid blanket statements declaring the entire market as "overvalued" or "undervalued," instead focusing on a nuanced, sector-by-sector analysis.

-

Sectors in Focus: BofA's analyses often pinpoint specific sectors experiencing particularly high valuations, possibly indicating higher risk. Conversely, they might also highlight undervalued sectors representing potential opportunities. Past reports have focused on technology stocks and the impact of interest rate changes on valuations in various sectors.

-

Caveats and Qualifiers: BofA consistently emphasizes the limitations of valuation metrics. They acknowledge that macroeconomic factors, technological advancements, and unexpected events can significantly influence market dynamics, rendering simple valuation models imprecise. Their analysis always includes caveats and acknowledges the inherent uncertainties in market forecasting.

Factors Contributing to High Stock Market Valuations

Several factors contribute to the current high stock market valuations. Understanding these factors is crucial for assessing the sustainability of these valuations.

-

Low Interest Rates and Quantitative Easing: Historically low interest rates have driven down the discount rate used in discounted cash flow valuations, making future earnings appear more valuable. This, coupled with quantitative easing programs, has injected significant liquidity into the market, boosting asset prices.

-

Investor Sentiment and Market Psychology: Positive investor sentiment, often driven by technological innovation and strong corporate earnings, fuels demand, pushing stock prices higher. This positive feedback loop can lead to market exuberance and potentially unsustainable valuations. Fear of missing out (FOMO) also plays a significant role.

-

Technological Advancements and Innovation: Rapid technological advancements, particularly in sectors like artificial intelligence and renewable energy, create expectations of strong future growth, justifying higher valuations for companies in these sectors. However, this also introduces significant risk due to the rapid pace of innovation and potential for disruption.

Potential Risks Associated with High Valuations

Investing in a market characterized by high stock market valuations presents significant risks.

-

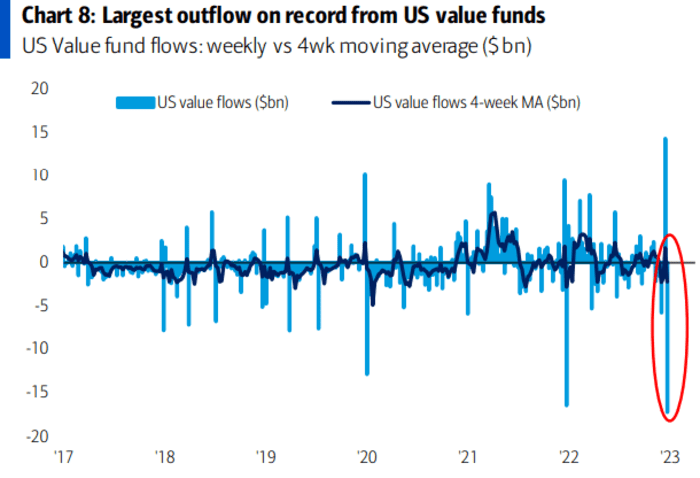

Market Corrections: High valuations often precede market corrections, where prices fall sharply. The probability of a correction increases as valuations become more stretched.

-

Impact of Rising Interest Rates: Rising interest rates directly impact valuations by increasing the discount rate used in financial models. This can lead to a reassessment of future earnings, causing stock prices to decline.

-

Mitigation Strategies: Investors can mitigate risks by diversifying their portfolios, focusing on companies with strong fundamentals and sustainable competitive advantages, and employing hedging strategies to protect against market downturns.

BofA's Recommendations for Investors

BofA's recommendations for investors typically emphasize caution and a focus on risk management.

-

Portfolio Adjustments: BofA often suggests a more cautious approach, possibly recommending reducing exposure to sectors with high valuations and increasing allocation to more defensive assets.

-

Sector Selection: Their sector recommendations tend to be dynamic, shifting based on market conditions and economic forecasts. They may advise against concentrated positions in high-valuation sectors and favoring sectors with stronger fundamentals.

-

Diversification and Risk Management: BofA consistently emphasizes the importance of diversification to mitigate risk. They strongly advocate for a well-diversified portfolio and a thorough understanding of individual investment risks.

Conclusion: Navigating High Stock Market Valuations – BofA's Guidance and Your Next Steps

BofA's analysis consistently highlights the risks associated with high stock market valuations, urging investors to proceed with caution. While opportunities may exist, the potential for market corrections remains a significant concern. Understanding BofA's perspective, along with a thorough review of other market analysis, is crucial for informed investment decision-making. Carefully consider your investment strategy in the context of high stock market valuations. Learn more about BofA's market analysis and manage your investment risk effectively by consulting with a financial advisor and conducting your own thorough research. Don't underestimate the importance of understanding these high stock market valuations before making any significant investment moves.

Featured Posts

-

Po 25 Rokoch Thomas Mueller Odchadza Z Bayernu Mnichov

May 12, 2025

Po 25 Rokoch Thomas Mueller Odchadza Z Bayernu Mnichov

May 12, 2025 -

Play Baba Yaga Your John Wick Las Vegas Adventure Awaits

May 12, 2025

Play Baba Yaga Your John Wick Las Vegas Adventure Awaits

May 12, 2025 -

Astronauts Nine Month Space Stay A Cbs News Report

May 12, 2025

Astronauts Nine Month Space Stay A Cbs News Report

May 12, 2025 -

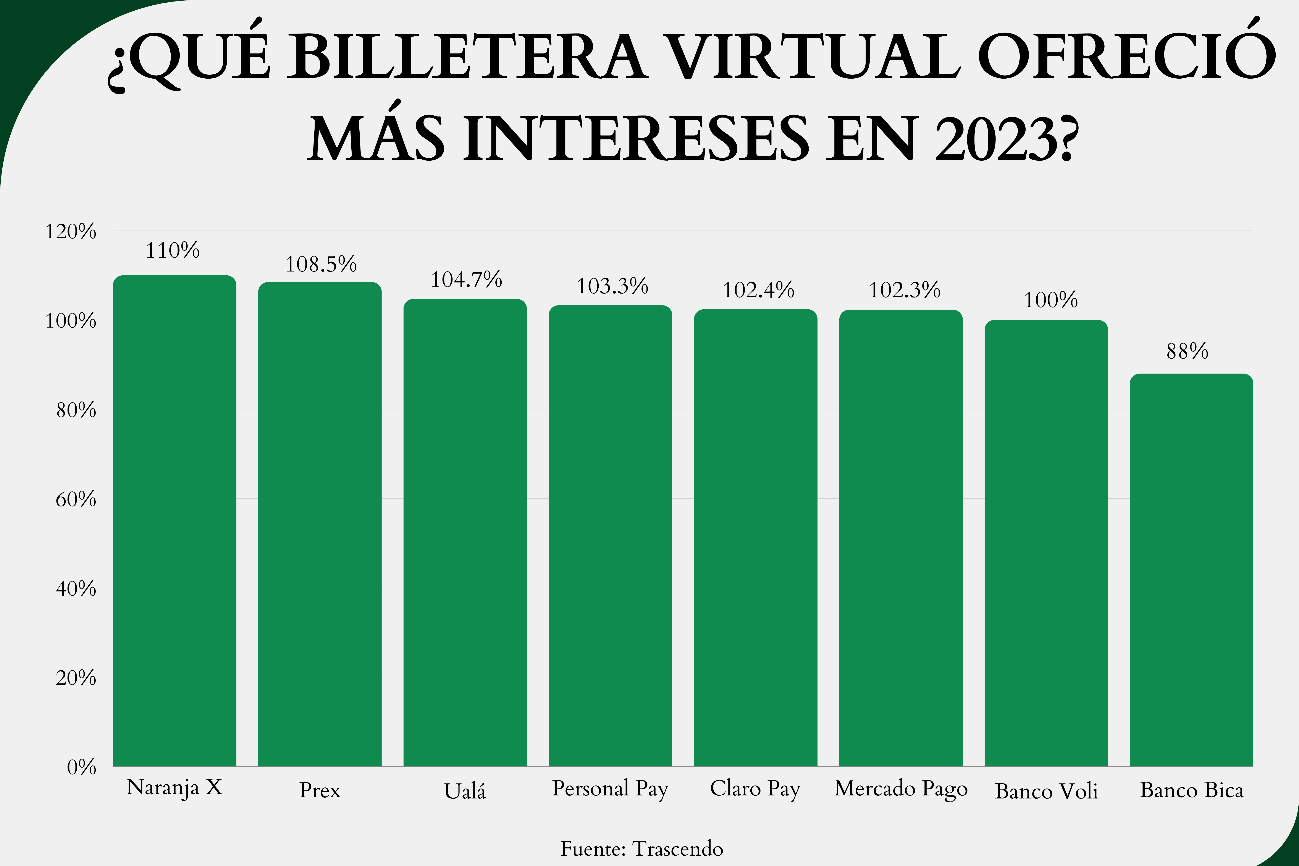

Comparativa De Billeteras Virtuales Uruguayas Con Cuentas Gratuitas Para Argentinos

May 12, 2025

Comparativa De Billeteras Virtuales Uruguayas Con Cuentas Gratuitas Para Argentinos

May 12, 2025 -

Five Indian Soldiers Killed In India Pakistan Border Clash Truce Holds

May 12, 2025

Five Indian Soldiers Killed In India Pakistan Border Clash Truce Holds

May 12, 2025