Are High Stock Market Valuations A Concern? BofA's Analysis

Table of Contents

BofA's Current Market Outlook and Valuation Metrics

BofA's overall assessment of the current market environment often reflects a cautious optimism, acknowledging the elevated levels of high stock market valuations. Their analysis relies heavily on several key valuation metrics to gauge the market's health and potential for future growth or decline. These include, but aren't limited to:

-

Price-to-Earnings (P/E) ratio: This classic metric compares a company's stock price to its earnings per share. A high P/E ratio generally suggests that investors are paying a premium for each dollar of earnings, potentially indicating overvaluation. BofA's analysis often uses this ratio to assess both individual stocks and the broader market.

-

Shiller PE ratio (CAPE): Also known as the cyclically adjusted price-to-earnings ratio, this metric smooths out earnings fluctuations over a 10-year period, providing a more stable valuation measure than the standard P/E ratio. BofA frequently utilizes the CAPE ratio to compare current valuations to historical averages and identify potential overvaluation or undervaluation.

-

Other Metrics: BofA's comprehensive analysis also incorporates other valuation metrics like Price-to-Sales (P/S) ratio, Price-to-Book (P/B) ratio, and various growth-based metrics. These provide a more holistic view of the market’s valuation landscape and help identify potential risks.

BofA's Findings: Recent BofA reports suggest that while some sectors show signs of overvaluation based on these metrics, others remain relatively attractive. They often highlight specific sectors or asset classes that are particularly overvalued or undervalued compared to historical averages and their own internal models. This granular analysis helps investors to fine-tune their portfolios based on BofA's assessment of relative value.

Factors Contributing to High Stock Market Valuations (According to BofA)

BofA's research identifies several key macroeconomic factors contributing to current high stock market valuations:

-

Low Interest Rates: Historically low interest rates have made borrowing cheaper for businesses and individuals, boosting investment and fueling asset price inflation. This cheap money environment has contributed significantly to higher stock prices across various sectors.

-

Strong Corporate Earnings Growth (or Expectations Thereof): Consistent corporate earnings growth, or optimistic forecasts for future growth, fuels investor confidence and drives up stock prices. BofA's analysts carefully scrutinize earnings reports and future growth projections to identify which sectors are most likely to maintain this momentum.

-

Government Stimulus: Government stimulus packages, particularly in response to economic downturns, inject significant liquidity into the market, potentially inflating asset prices. BofA's analyses often consider the impact of past and future government interventions.

-

Technological Advancements: Rapid technological advancements continue to drive innovation and growth in specific sectors, attracting significant investor interest and pushing up valuations in those areas. This influence is a key element of BofA's sector-specific valuation analysis.

-

Geopolitical Events: Geopolitical uncertainties and events can influence market sentiment and investor behavior, impacting stock valuations. BofA incorporates these factors into its overall market outlook and valuation assessments.

BofA's Assessment of the Risks Associated with High Valuations

BofA acknowledges the inherent risks associated with maintaining high stock market valuations. Their analysis highlights potential pitfalls such as:

-

Market Correction or Downturn: High valuations increase the potential for a significant market correction or downturn, potentially leading to substantial losses for investors. BofA's risk models help quantify this probability.

-

Rising Interest Rates: An increase in interest rates can negatively impact stock valuations by making borrowing more expensive and reducing the attractiveness of equities compared to fixed-income investments. This is a key element of BofA's ongoing monitoring and analysis.

-

Vulnerability to Economic Shocks: High valuations increase market vulnerability to economic shocks or negative news, potentially triggering sharp sell-offs. BofA stresses the need for a robust risk management strategy.

-

Asset Bubbles: Sustained high valuations in certain sectors raise concerns about the formation of asset bubbles, which can burst unexpectedly, leading to substantial price declines. BofA regularly assesses different asset classes for bubble-like characteristics.

BofA's Recommendations for Investors

Given the current environment of high stock market valuations, BofA typically advises investors to adopt a cautious yet proactive approach:

-

Diversification: Diversifying investments across different asset classes and sectors is crucial to mitigate risk and reduce exposure to potential market downturns. BofA's recommendations often specify suitable asset allocation strategies.

-

Sector-Specific Strategies: BofA's analysis helps investors identify sectors that are relatively undervalued or demonstrate strong growth potential despite high overall market valuations. These insights assist in building more resilient portfolios.

-

Risk Tolerance Adjustment: Investors should carefully assess their risk tolerance and adjust their portfolios accordingly, potentially shifting towards less volatile assets if concerned about a market correction. BofA's guidance incorporates considerations of investor risk profiles.

-

Navigating a Correction: Having a plan in place for navigating a potential market correction is essential. This may involve identifying potential buying opportunities during a downturn or rebalancing the portfolio to ensure it remains aligned with long-term investment goals.

Conclusion: Are High Stock Market Valuations Still a Concern? BofA's Verdict and Next Steps

BofA's analysis indicates that while high stock market valuations present a legitimate concern, they do not necessarily signal an imminent market crash. However, the elevated valuations warrant a cautious approach and proactive risk management. The key risks identified include potential market corrections driven by rising interest rates, economic shocks, or the bursting of asset bubbles. BofA's recommendations emphasize diversification, sector-specific analysis, risk tolerance adjustments, and preparedness for potential market corrections. Ultimately, BofA considers high stock market valuations a factor requiring careful consideration, not necessarily a reason for immediate panic.

To make informed investment decisions, conduct thorough research, consult a qualified financial advisor, and stay updated on market developments relating to high stock market valuations. For a more detailed understanding of BofA's analysis and recommendations, refer to their official research publications and reports. [Insert links to relevant BofA research here] Remember, understanding high stock market valuations and their implications is crucial for navigating the current market environment effectively.

Featured Posts

-

Waspada Tren Kawin Kontrak Libatkan Bule Di Bali

May 28, 2025

Waspada Tren Kawin Kontrak Libatkan Bule Di Bali

May 28, 2025 -

Mlb News Padre Luis Arraez Sidelined With Concussion

May 28, 2025

Mlb News Padre Luis Arraez Sidelined With Concussion

May 28, 2025 -

Latest Update Padre Luis Arraezs 7 Day Concussion Il

May 28, 2025

Latest Update Padre Luis Arraezs 7 Day Concussion Il

May 28, 2025 -

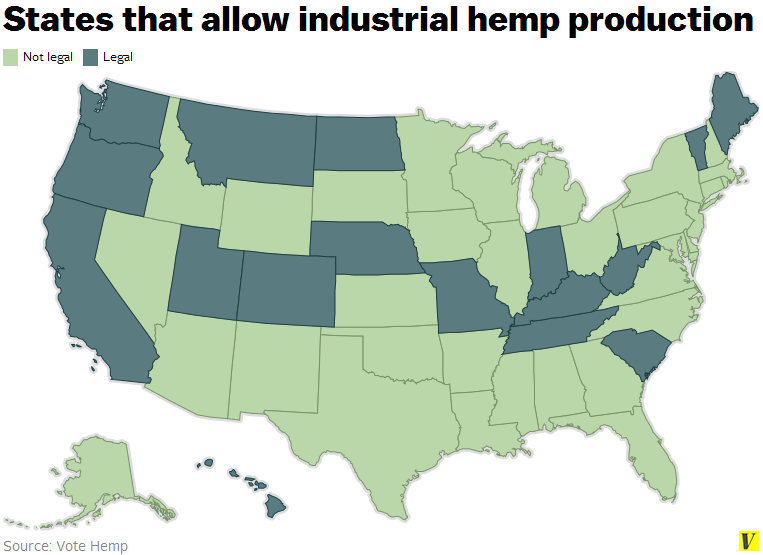

The Current State Of Hemp Laws In Georgia What Consumers Need To Know

May 28, 2025

The Current State Of Hemp Laws In Georgia What Consumers Need To Know

May 28, 2025 -

Bandung Hujan Pukul 1 Siang Cek Cuaca Jawa Barat 22 April

May 28, 2025

Bandung Hujan Pukul 1 Siang Cek Cuaca Jawa Barat 22 April

May 28, 2025