Bank Of Canada Interest Rate Outlook: Assessing The Impact Of Tariffs On Employment

Table of Contents

The Impact of Tariffs on Canadian Employment

Tariffs, essentially taxes on imported or exported goods, create ripples throughout the Canadian economy, significantly impacting employment. Let's examine the key areas affected.

Reduced Export Demand and Job Losses

Tariffs imposed on Canadian goods by other countries directly reduce export demand. This leads to decreased production and, consequently, job losses.

- Specific Sectors Affected: The agricultural sector (e.g., reduced demand for Canadian lumber, wheat, and dairy products) and manufacturing (e.g., reduced demand for automotive parts and processed goods) are particularly vulnerable.

- Job Losses: According to Statistics Canada (replace with actual data and link), the forestry industry experienced X job losses in Q[Quarter] of [Year] due to tariffs imposed by [Country]. Similar trends are observed in the manufacturing sector.

- Ripple Effect: Job losses in export-oriented industries trigger a ripple effect, impacting related industries like transportation, logistics, and retail. Suppliers and distributors also suffer reduced demand, further contributing to unemployment.

Increased Import Prices and Inflationary Pressures

Tariffs on imported goods increase their prices for Canadian consumers and businesses. This contributes to inflationary pressures, a key concern for the Bank of Canada.

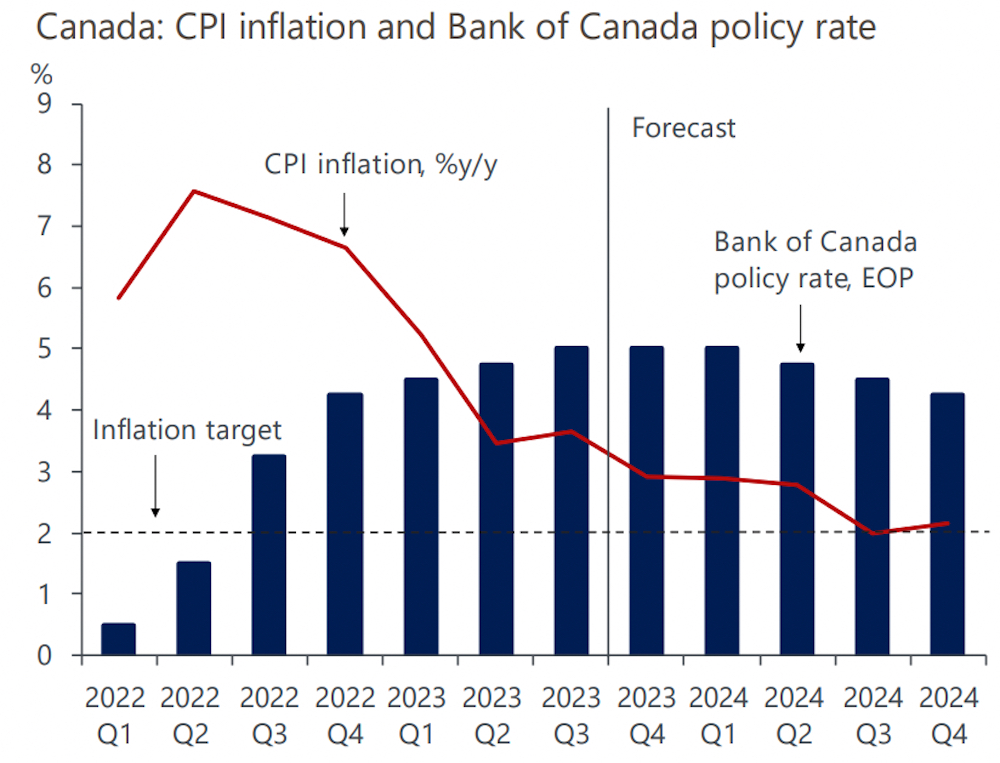

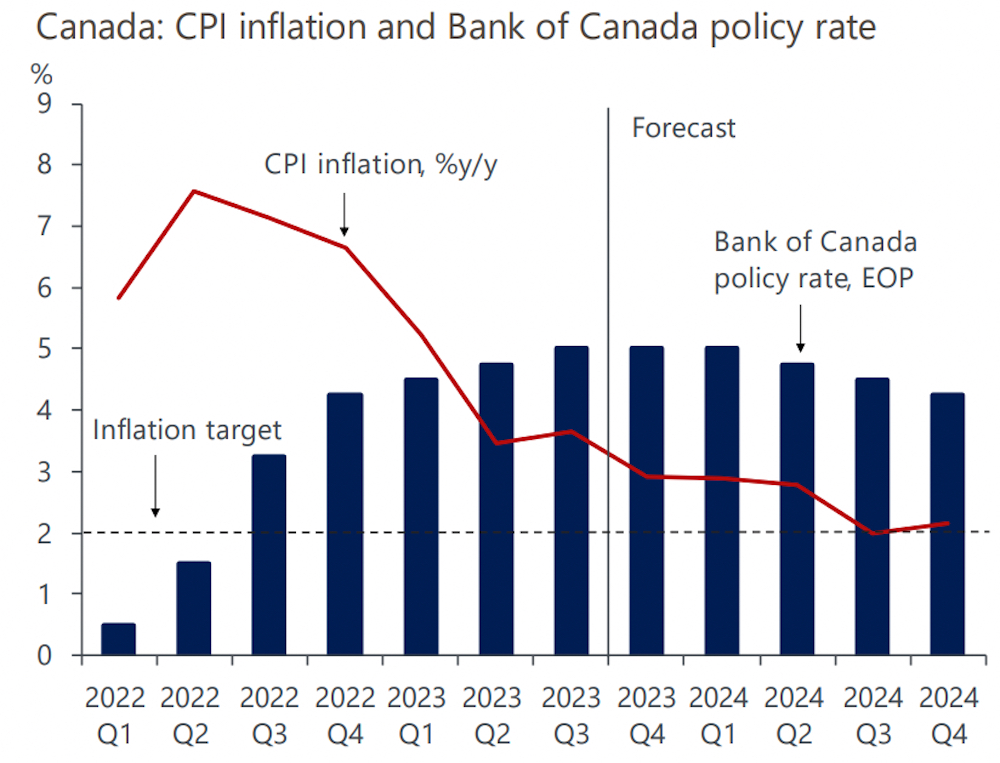

- Inflationary Impact: Higher import costs increase the price of finished goods and raw materials, pushing up inflation. This directly impacts the Bank of Canada's mandate of maintaining price stability. Statistics Canada's Consumer Price Index (CPI) data (replace with actual data and link) shows a correlation between tariff increases and rises in CPI.

- Bank of Canada Response: To control inflation fueled by tariffs, the Bank of Canada might raise interest rates. This makes borrowing more expensive, potentially slowing down economic growth and impacting employment. This represents a significant trade-off.

- Import Costs: The increased cost of imported intermediate goods used in manufacturing can lead to higher production costs and ultimately, higher prices for consumers, further fueling inflation.

Investment Uncertainty and Delayed Hiring

Uncertainty surrounding future trade policies discourages businesses from investing and hiring. This leads to a stagnant or declining employment rate.

- Delayed Expansion Plans: Businesses delay expansion projects and hiring decisions due to unpredictable trade policies, creating a climate of uncertainty. Examples include [cite specific examples of businesses delaying plans due to tariff uncertainty].

- Business Confidence and Consumer Spending: This uncertainty dampens business confidence, impacting investment decisions and consumer spending, creating a negative feedback loop affecting employment across various sectors.

The Bank of Canada's Response to Tariff-Induced Economic Changes

The Bank of Canada must carefully navigate the complex interplay between inflation and employment when responding to tariff-induced economic changes.

Balancing Inflation and Employment

The Bank of Canada's mandate involves maintaining price stability and full employment – often conflicting goals. Tariffs create this very conflict: inflation from increased import prices and unemployment from reduced export demand.

- The Trade-off: Raising interest rates combats inflation but can slow economic growth and increase unemployment. Lowering interest rates stimulates growth and job creation but risks exacerbating inflation. The Bank must find the delicate balance.

Interest Rate Adjustments and Their Impact on Employment

Interest rate adjustments are the Bank of Canada's primary tool for managing the economy.

- Interest Rate Hikes: Hikes curb inflation but can slow down economic activity, potentially leading to job losses, particularly in sectors sensitive to interest rate changes (e.g., housing).

- Interest Rate Cuts: Cuts stimulate economic activity and job creation but risk fueling inflation, potentially negating the benefits of the cuts.

- Historical Examples: The Bank of Canada's response to the [mention past economic crisis or events and their impact on interest rates and employment] offers valuable lessons.

Forecasting and Uncertainty

Accurately forecasting the economic impact of tariffs is challenging for the Bank of Canada.

- Data Analysis and Economic Modeling: The Bank relies heavily on data analysis, economic modeling, and monitoring key economic indicators to make informed decisions.

- Unforeseen Economic Shocks: Unexpected economic events can significantly alter the impact of tariffs and complicate the Bank's forecasting and decision-making process.

Long-Term Implications for the Canadian Economy and Employment

Tariffs can lead to significant long-term structural changes in the Canadian economy.

Structural Changes and Sectoral Shifts

- Sectoral Restructuring: Some sectors might shrink due to decreased competitiveness, while others adapt and grow, creating a need for workforce retraining and adaptation. Investment in reskilling programs will be crucial.

- Economic Diversification: Canada needs to diversify its trade relationships to reduce its reliance on specific markets and mitigate the impact of future tariffs.

Competitiveness and Global Trade

- Maintaining Competitiveness: Tariffs impact Canada's global competitiveness. Strategies to enhance productivity, innovation, and diversification are essential to maintain a strong position in the global market.

- Trade Agreements: Negotiating and maintaining favorable trade agreements is critical to minimizing the negative impacts of tariffs and ensuring access to international markets.

Conclusion

The Bank of Canada's interest rate decisions are intricately linked to the impact of tariffs on Canadian employment. The current trade climate necessitates careful consideration of inflationary pressures and employment levels. Understanding the complex interplay between tariffs, inflation, and employment is crucial for navigating the economic landscape. The Bank of Canada's ongoing assessment of these factors will continue to shape its interest rate outlook. Stay informed on the latest developments regarding Bank of Canada interest rates and their impact on employment to make informed financial decisions. Continuously monitor the Bank of Canada's announcements and economic reports to understand future interest rate changes and their effects on the Canadian economy.

Featured Posts

-

Doom Eternal Dark Ages Location Unveiled On Ps 5

May 13, 2025

Doom Eternal Dark Ages Location Unveiled On Ps 5

May 13, 2025 -

Diskriminacia Pri Prenajme 74 A Cesta K Inkluzivnejsiemu Byvaniu

May 13, 2025

Diskriminacia Pri Prenajme 74 A Cesta K Inkluzivnejsiemu Byvaniu

May 13, 2025 -

Abbotts Epic City Investigations Face Condemnation From North Texas Religious Leaders

May 13, 2025

Abbotts Epic City Investigations Face Condemnation From North Texas Religious Leaders

May 13, 2025 -

Kyle Tucker Trade Rumors A Deep Dive Into Cubs Fan Reactions

May 13, 2025

Kyle Tucker Trade Rumors A Deep Dive Into Cubs Fan Reactions

May 13, 2025 -

Pernyataan Resmi Karding Tidak Ada Penempatan Pekerja Migran Di Kamboja Dan Myanmar

May 13, 2025

Pernyataan Resmi Karding Tidak Ada Penempatan Pekerja Migran Di Kamboja Dan Myanmar

May 13, 2025

Latest Posts

-

Sabalenka Defeats Gauff In Madrid Open Final

May 13, 2025

Sabalenka Defeats Gauff In Madrid Open Final

May 13, 2025 -

Sabalenkas Miami Open Win A 19th Career Title

May 13, 2025

Sabalenkas Miami Open Win A 19th Career Title

May 13, 2025 -

Dansk Melodi Grand Prix 2025 Vaelg Din Favorit

May 13, 2025

Dansk Melodi Grand Prix 2025 Vaelg Din Favorit

May 13, 2025 -

Valg Af Vinder Dansk Melodi Grand Prix 2025

May 13, 2025

Valg Af Vinder Dansk Melodi Grand Prix 2025

May 13, 2025 -

Sabalenka Triumphs Over Pegula In Miami Open Final

May 13, 2025

Sabalenka Triumphs Over Pegula In Miami Open Final

May 13, 2025