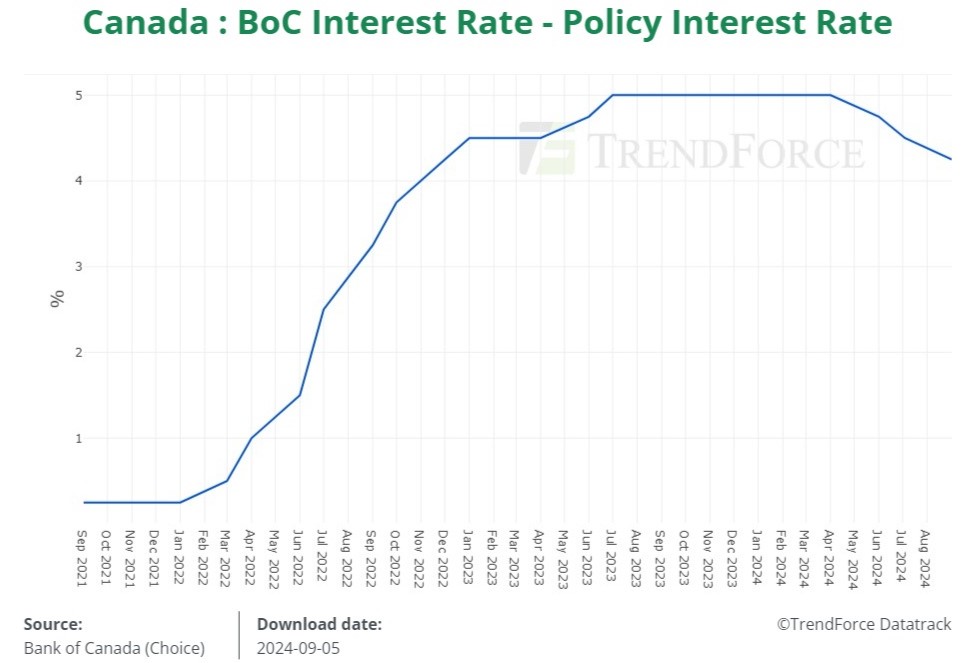

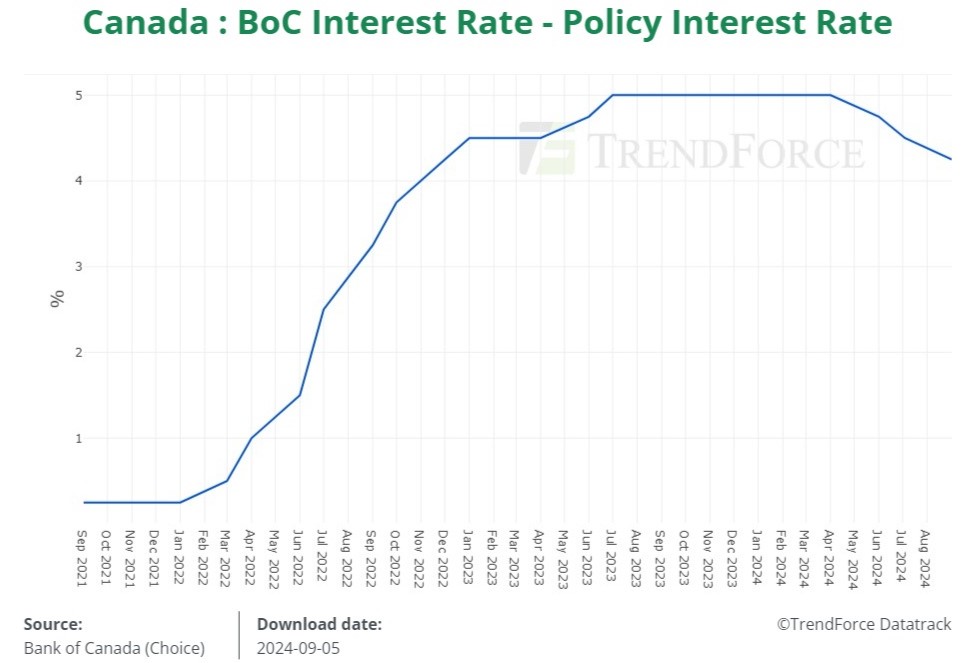

Bank Of Canada Rate Cuts: Desjardins Predicts Three More

Table of Contents

Desjardins' Rationale for Predicted Rate Cuts

Desjardins' prediction of three additional Bank of Canada rate reductions stems from a confluence of concerning economic indicators. Their analysis points to a softening inflation rate, slowing economic growth, and a heightened risk of recession. These factors, collectively, are influencing their belief that further monetary policy easing is necessary.

-

Key Economic Indicators: Desjardins likely considered several key indicators in formulating their prediction. This includes the Consumer Price Index (CPI) to gauge inflation, Gross Domestic Product (GDP) growth to assess the overall health of the economy, and employment figures to understand the labor market's strength. A persistent decline in these indicators, even after previous interest rate cuts, would support their forecast.

-

Concerns About Economic Slowdown: Desjardins likely highlights concerns about a potential economic slowdown or even a recession. Factors such as weakening consumer confidence, reduced business investment, and global economic uncertainty could contribute to this concern, signaling the need for further stimulus through rate cuts.

-

Influence on Bank of Canada's Monetary Policy: The Bank of Canada's primary mandate is to maintain price stability and full employment. Desjardins' analysis suggests that the current economic climate necessitates a shift towards a more accommodative monetary policy. By lowering interest rates, the Bank of Canada aims to stimulate economic activity, boost consumer spending, and encourage business investment.

Impact of Potential Bank of Canada Rate Cuts on Consumers

Lower interest rates, as predicted by Desjardins, will likely translate into reduced borrowing costs for Canadian consumers. This could lead to significant changes in personal finance.

-

Mortgage Payments and Affordability: A reduction in interest rates would directly impact mortgage payments, making homes more affordable for prospective buyers. This could lead to increased activity in the real estate market.

-

Consumer Spending and Economic Growth: Lower borrowing costs may encourage consumers to increase spending, driving economic growth. This is particularly true for larger purchases like automobiles and home renovations, which are often financed through loans.

-

Potential Downsides: While lower rates offer benefits, there are potential downsides. One risk is increased inflation, as lower borrowing costs can fuel demand and put upward pressure on prices. Another concern is the possibility of asset bubbles forming in certain sectors, particularly real estate.

Implications for the Canadian Economy as a Whole

The predicted Bank of Canada rate cuts will have far-reaching consequences for the Canadian economy beyond consumer spending.

-

Businesses and Investment: Lower interest rates can stimulate business investment, as borrowing becomes cheaper. This could lead to increased job creation and economic expansion.

-

Canadian Dollar Exchange Rate: Lower interest rates might weaken the Canadian dollar relative to other currencies. This can boost exports by making Canadian goods more competitive internationally but can also increase the cost of imports.

-

Government Borrowing Costs: While lower interest rates benefit consumers and businesses, they also reduce the government's borrowing costs, freeing up funds for other priorities.

Comparing Desjardins' Prediction to Other Forecasts

Desjardins’ prediction isn't the only one in the market. Other financial institutions and economists offer their own perspectives on the Bank of Canada's future monetary policy.

-

Other Forecasts: Major players such as Royal Bank of Canada (RBC), TD Bank, and Scotiabank also offer economic forecasts and predictions regarding interest rates.

-

Comparison of Predictions: While there might be consensus on the direction of interest rates (i.e., further cuts), the timing and magnitude of those cuts could vary significantly among different institutions. These differences reflect varying interpretations of economic data and future projections.

-

Reasons for Diverging Opinions: Disagreements stem from differing assessments of economic indicators, inflation expectations, and the potential impact of global events on the Canadian economy.

Conclusion

Desjardins' forecast of three additional Bank of Canada rate cuts reflects a growing concern about the state of the Canadian economy. Lower interest rates are intended to stimulate economic activity, making borrowing cheaper for consumers and businesses. While this could boost economic growth and consumer spending, it also carries risks, such as increased inflation or asset bubbles. Understanding the potential impacts of these Bank of Canada rate cuts is vital for informed financial decisions. Stay informed about future Bank of Canada monetary policy announcements and continue to monitor economic forecasts from reputable sources to make informed financial decisions. Understanding these Bank of Canada rate cuts and their potential implications is crucial for navigating the current economic climate.

Featured Posts

-

The Karate Kid Part Ii Locations Fighting Styles And Cultural Significance

May 23, 2025

The Karate Kid Part Ii Locations Fighting Styles And Cultural Significance

May 23, 2025 -

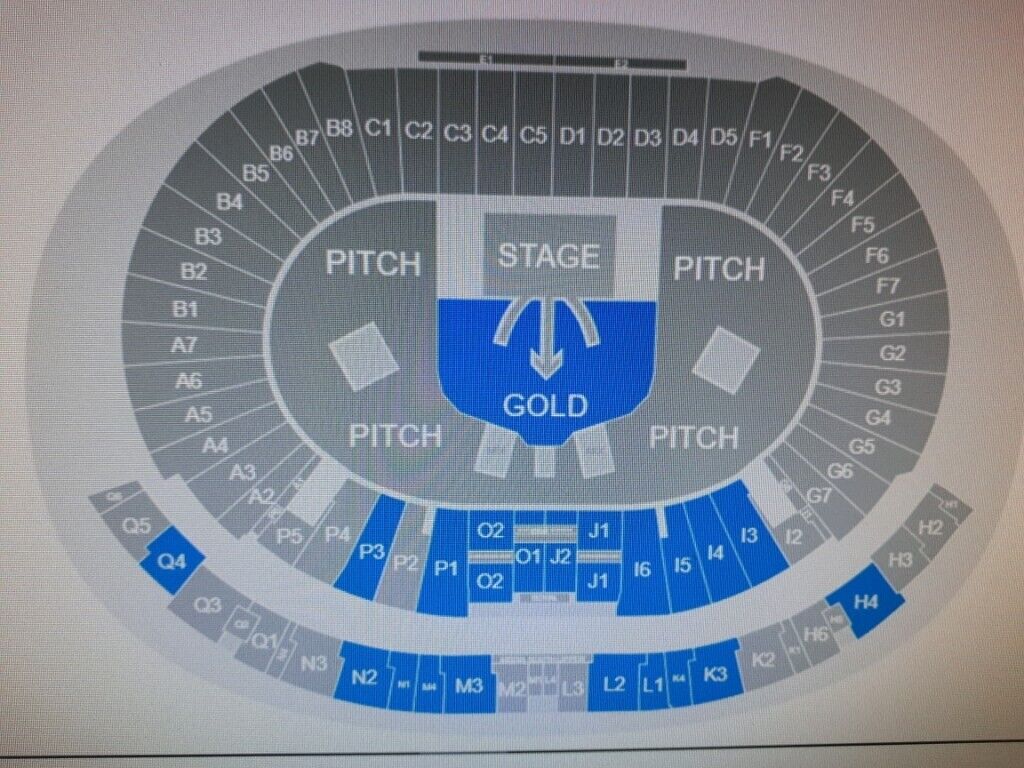

Get Metallica Glasgow Hampden Tickets A Complete Guide

May 23, 2025

Get Metallica Glasgow Hampden Tickets A Complete Guide

May 23, 2025 -

Top Gear Crash Freddie Flintoffs Face Injury Update

May 23, 2025

Top Gear Crash Freddie Flintoffs Face Injury Update

May 23, 2025 -

Englands Squad Announced Zimbabwe One Off Test

May 23, 2025

Englands Squad Announced Zimbabwe One Off Test

May 23, 2025 -

Egan Bernals Miraculous Recovery Medical Research Paper Details Crash Injuries And Rehabilitation

May 23, 2025

Egan Bernals Miraculous Recovery Medical Research Paper Details Crash Injuries And Rehabilitation

May 23, 2025