Beijing's Economic Vulnerability: The Unseen Costs Of The Trade War With The US

Table of Contents

Disrupted Supply Chains and Manufacturing Slowdown

China's manufacturing sector, the engine of its economic growth for decades, experienced significant disruption during the trade war. The reliance of Chinese manufacturers on US markets and technology became painfully apparent. The imposition of tariffs and trade restrictions created uncertainty, impacting production and investment decisions.

- Specific Sectors Affected: The technology sector, particularly in areas like semiconductors and telecommunications equipment, suffered greatly. Agricultural exports also faced significant challenges due to retaliatory tariffs.

- Impact on Export-Oriented Growth and GDP: The slowdown in exports significantly impacted China's GDP growth. The disruption of global supply chains led to reduced production and increased costs for many Chinese businesses.

- Shift in Investment Strategies: Uncertainty surrounding the trade war caused many foreign and domestic investors to postpone or reconsider investments in China, further hindering economic growth. This led to a reassessment of global supply chain strategies, with some companies diversifying their production away from China.

- Keywords: Chinese manufacturing, supply chain disruption, export slowdown, US-China trade relations, global supply chains, manufacturing slowdown, export decline.

Technological Dependence and the "Chip War"

China's ambition to become a global technological leader faces a significant hurdle: its dependence on US technology. This reliance is particularly acute in critical sectors such as semiconductors and artificial intelligence (AI). The "chip war," a manifestation of broader technological tensions, exposed this vulnerability.

- Impact of US Sanctions and Export Controls: US sanctions and export controls on advanced semiconductor technology have severely hampered China's ability to develop its own cutting-edge chips, impacting its technological advancement across various sectors.

- Technological Self-Reliance ("Technological Independence"): In response, China has launched ambitious initiatives to achieve technological self-reliance, investing heavily in domestic semiconductor research and development. However, this process is long-term and faces significant challenges.

- Implications for Long-Term Economic Growth and Innovation: China's technological dependence creates a significant bottleneck for its long-term economic growth and innovation, hindering its potential to compete effectively in the global technology race. The lack of access to cutting-edge technologies limits its capacity to develop advanced products and services.

- Keywords: technological dependence, semiconductor industry, US sanctions, technological self-reliance, China's tech sector, chip war, technological independence, AI development.

Increased Debt and Financial Instability

The trade war exacerbated existing vulnerabilities in China's financial system, leading to increased government and corporate debt levels. This poses a significant risk of financial instability with potential global ramifications.

- Potential Risks of a Debt Crisis: The high levels of debt make China's economy more susceptible to shocks, increasing the risk of a debt crisis. Such a crisis could have severe consequences for the global economy, given China's size and integration into global markets.

- How the Trade War Exacerbated Existing Vulnerabilities: The trade war's negative impact on economic growth reduced the ability of Chinese businesses and the government to service their debts, increasing the risk of defaults.

- Government's Efforts to Manage Debt and Maintain Financial Stability: The Chinese government has implemented various policies to manage debt levels and maintain financial stability, including measures to deleverage state-owned enterprises and tighten financial regulations. However, the effectiveness of these measures remains to be seen.

- Keywords: Chinese debt, financial instability, debt crisis, economic risks, fiscal policy, debt management, financial regulation, economic vulnerability, state-owned enterprises.

Impact on Foreign Investment and Capital Flight

The trade war negatively impacted foreign direct investment (FDI) in China. The uncertainty created by the trade conflict led many foreign investors to reconsider their investments in China, resulting in decreased FDI inflows. There's also been a concern regarding potential capital flight.

- Decrease in Foreign Direct Investment (FDI): The trade war significantly reduced foreign direct investment (FDI) in China, impacting economic growth and job creation. Businesses became hesitant to invest in an environment marked by trade uncertainty and escalating tensions.

- Potential for Capital Flight and its Impact on the RMB: Concerns about the long-term stability of the Chinese economy have led to speculation about potential capital flight, which could put downward pressure on the RMB (Renminbi) exchange rate.

- Implications for Economic Growth and International Confidence: The decrease in FDI and potential capital flight erode confidence in the Chinese economy, hindering its ability to attract further investment and achieve sustainable economic growth.

- Government Strategies to Attract Foreign Investment and Retain Capital: The Chinese government is actively working to improve its investment climate and attract foreign investment by implementing reforms, improving infrastructure, and promoting economic cooperation. However, the success of these efforts remains to be seen.

- Keywords: Foreign direct investment (FDI), capital flight, RMB exchange rate, economic confidence, investment climate, foreign investment, capital outflow, economic stability.

Conclusion

Beijing's economic vulnerability is a complex issue with multiple interwoven facets. The lingering effects of the trade war have exposed vulnerabilities in supply chains, technological dependence, debt levels, and foreign investment. Disrupted supply chains, the "chip war," rising debt, and decreased FDI all contribute to a precarious economic landscape. Understanding Beijing's economic vulnerability is crucial for global economic stability and informed decision-making. Further research into Beijing's economic vulnerability is essential to anticipate and mitigate future economic risks stemming from trade tensions and global economic shifts. Stay informed about the ongoing evolution of Beijing's economic vulnerability to make well-informed investment and policy decisions.

Featured Posts

-

Fortnite V34 30 Patch Notes Sabrina Carpenter Skin Release Date And Maintenance

May 03, 2025

Fortnite V34 30 Patch Notes Sabrina Carpenter Skin Release Date And Maintenance

May 03, 2025 -

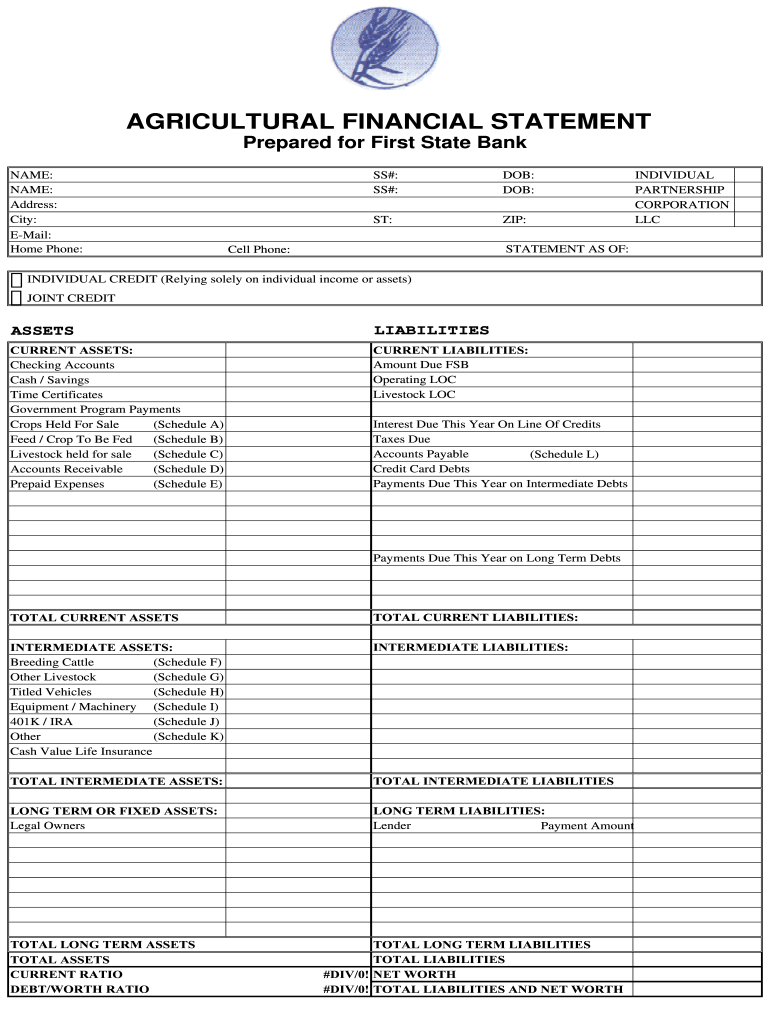

Reform Uks Agricultural Plans A Detailed Examination

May 03, 2025

Reform Uks Agricultural Plans A Detailed Examination

May 03, 2025 -

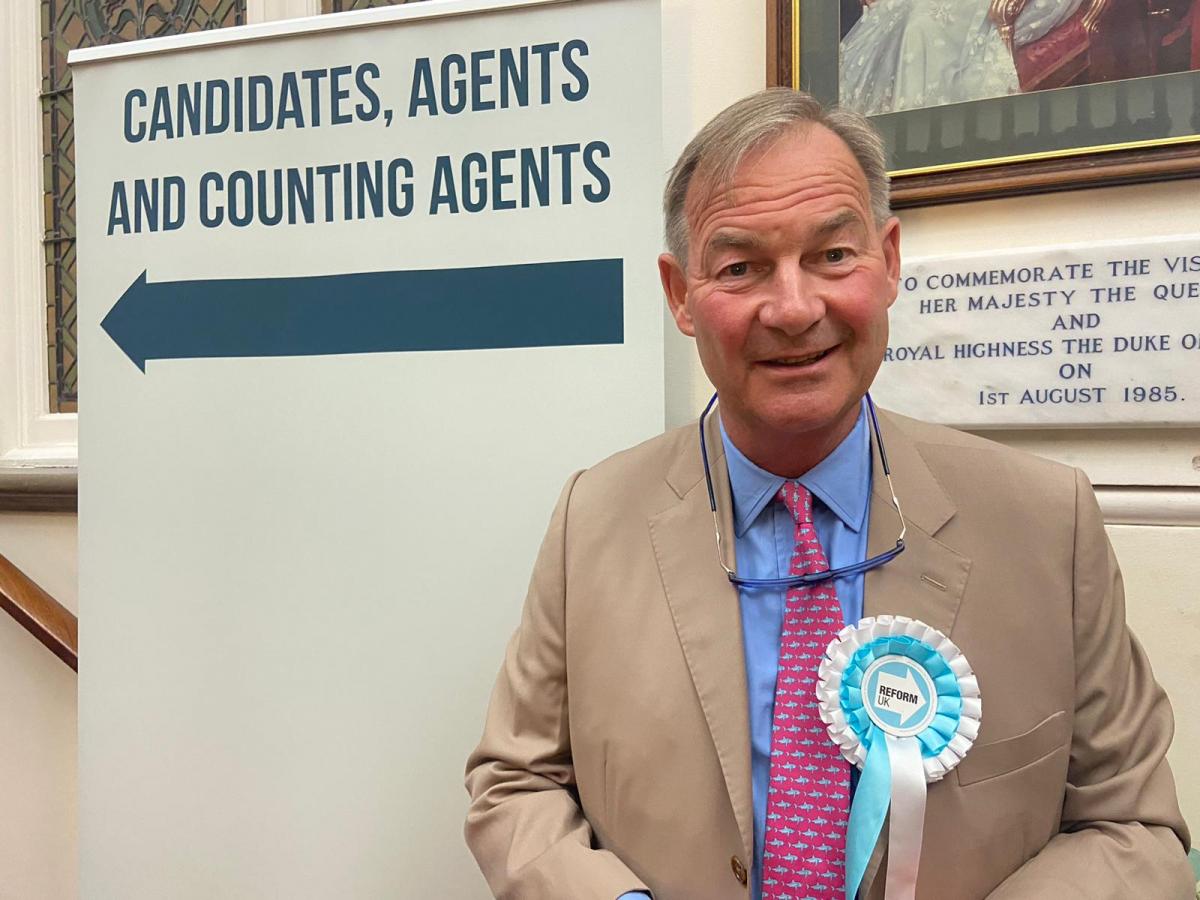

Rupert Lowes Great Yarmouth Commitment After Political Rift

May 03, 2025

Rupert Lowes Great Yarmouth Commitment After Political Rift

May 03, 2025 -

Is Doctor Who Taking A Break Russell T Daviess Comments Explained

May 03, 2025

Is Doctor Who Taking A Break Russell T Daviess Comments Explained

May 03, 2025 -

Uncovered A 2008 Disney Game Now Available On Ps Plus Premium

May 03, 2025

Uncovered A 2008 Disney Game Now Available On Ps Plus Premium

May 03, 2025

Latest Posts

-

Malta Coast Attack Gaza Freedom Flotilla Issues Sos Following Drone Incident

May 03, 2025

Malta Coast Attack Gaza Freedom Flotilla Issues Sos Following Drone Incident

May 03, 2025 -

Gaza Freedom Flotilla Under Attack Sos Signal Issued Near Malta

May 03, 2025

Gaza Freedom Flotilla Under Attack Sos Signal Issued Near Malta

May 03, 2025 -

Gaza Freedom Flotilla Sos Ship Reports Drone Attack Off Malta

May 03, 2025

Gaza Freedom Flotilla Sos Ship Reports Drone Attack Off Malta

May 03, 2025 -

Barrow Afc Fans Take On Sky Bet Every Minute Matters Relay Cycle

May 03, 2025

Barrow Afc Fans Take On Sky Bet Every Minute Matters Relay Cycle

May 03, 2025 -

Mn Hm Aedae Aljmahyr Mwqe Bkra Ykshf En Akthr 30 Shkhsyt Mkrwht Fy Krt Alqdm

May 03, 2025

Mn Hm Aedae Aljmahyr Mwqe Bkra Ykshf En Akthr 30 Shkhsyt Mkrwht Fy Krt Alqdm

May 03, 2025