Belgium's Merchant Energy Market: Challenges And Opportunities For 270MWh BESS Financing

Table of Contents

Understanding Belgium's Energy Landscape and Regulatory Framework

Current Energy Mix and Renewable Energy Targets

Belgium, like many European nations, relies heavily on energy imports, creating vulnerability to price fluctuations and geopolitical instability. The country is aggressively pursuing renewable energy targets, aiming for significant reductions in greenhouse gas emissions. The integration of large-scale BESS projects is paramount to achieving these ambitious goals.

- Specific renewable energy sources: Wind (onshore and offshore), solar PV, biomass.

- Targets for 2030 and beyond: A significant increase in renewable energy share in the overall energy mix, specific targets are detailed in Belgium’s national energy and climate plan.

- Government policies supporting renewable energy: Feed-in tariffs, tax incentives, and supportive legislation for renewable energy projects, including BESS.

Regulatory Landscape for BESS Deployment

Navigating the regulatory landscape for deploying large-scale BESS projects in Belgium requires careful planning and expertise. Obtaining necessary permits and ensuring seamless grid connection are crucial steps.

- Key regulations: Specific regulations concerning grid connection, safety standards, and environmental impact assessments for BESS installations. Consult Elia's guidelines for detailed information.

- Permitting timelines: Understanding the timeframes involved in obtaining all necessary approvals is critical for project planning and financial modeling.

- Grid connection fees and processes: Analyzing the grid connection costs and the procedures for connecting a 270MWh BESS system to the Belgian grid is essential.

Market Participation and Ancillary Services

BESS systems can actively participate in Belgium's merchant energy market, generating revenue streams through the provision of ancillary services.

- Types of ancillary services: Frequency regulation, voltage support, spinning reserves, and black start capabilities.

- Revenue streams for BESS operators: Payments received for providing ancillary services to Elia, the Belgian transmission system operator.

- Market access requirements: Understanding the processes and criteria for participating in the ancillary services market is crucial for maximizing revenue potential.

Challenges in Financing 270MWh BESS Projects in Belgium

Capital Expenditure and Return on Investment (ROI)

Financing large-scale BESS projects like a 270MWh system requires substantial capital expenditure. Securing adequate financing hinges on demonstrating a strong ROI.

- Cost breakdown (hardware, installation, permitting): Detailed cost estimations for batteries, inverters, transformers, installation labor, and permitting fees.

- Potential revenue streams: Ancillary services, energy arbitrage, capacity market participation.

- Payback periods: Accurately projecting the payback period for the project is essential for attracting investors.

Risk Assessment and Mitigation

Several risks can impact the financial viability of a 270MWh BESS project in Belgium.

- Technology risks and solutions: Battery degradation, system failures, and technological obsolescence. Mitigating these risks requires selecting reliable technology and incorporating robust maintenance plans.

- Political and regulatory risks: Changes in government policies, regulatory uncertainties, and permitting delays. Thorough due diligence and proactive engagement with regulatory bodies are crucial.

- Market risk hedging strategies: Strategies to manage price volatility in the electricity market, such as utilizing financial derivatives.

Securing Project Financing

Attracting investors requires a comprehensive financing strategy encompassing various options.

- Bank loans: Traditional bank financing, often requiring strong collateral and creditworthiness.

- Private equity: Investment from private equity firms specializing in renewable energy projects.

- Government subsidies and grants: Exploring available government incentives and funding opportunities for BESS projects.

- Green bonds: Issuing green bonds to attract investors focused on sustainable investments.

Opportunities for 270MWh BESS Projects in Belgium's Merchant Energy Market

Growth of Renewable Energy and Grid Stability Needs

The increasing share of renewable energy in Belgium's energy mix creates a growing need for grid stabilization services.

- Projected growth of solar and wind energy: Forecasts for the growth of renewable energy capacity in Belgium.

- Challenges of intermittency: The inherent variability of renewable energy sources necessitates effective grid management solutions.

- The role of BESS in grid balancing: BESS systems can provide crucial grid support, ensuring frequency and voltage stability.

Revenue Streams from Ancillary Services and Energy Arbitrage

BESS projects can generate substantial revenue through diverse market participation strategies.

- Revenue from frequency regulation: Income generated by providing frequency regulation services to Elia.

- Revenue from energy arbitrage: Profits from buying energy at low prices and selling it at higher prices.

- Potential for stacking services: Simultaneously providing multiple ancillary services to maximize revenue streams.

Environmental, Social, and Governance (ESG) Investing

BESS projects are increasingly attractive to ESG investors seeking sustainable and responsible investments.

- Alignment with sustainability goals: BESS contributes to reducing carbon emissions and promoting renewable energy integration.

- Reduced carbon emissions: The role of BESS in reducing reliance on fossil fuels and lowering greenhouse gas emissions.

- Positive social impact: Job creation, local economic development, and improved grid reliability.

Conclusion: Unlocking the Potential of Belgium's Merchant Energy Market with 270MWh BESS Financing

Financing 270MWh BESS projects in Belgium presents both challenges and significant opportunities. While high capital expenditures and market risks necessitate careful planning and risk mitigation strategies, the potential for substantial revenue streams from ancillary services and energy arbitrage, coupled with the growing demand for grid stability and the attractiveness to ESG investors, make BESS a compelling investment. The success of these projects is vital to supporting Belgium's energy transition goals and creating a more sustainable and resilient energy system. We encourage you to explore investment opportunities in BESS projects in Belgium or contact us for further information on financing 270MWh BESS projects within Belgium's merchant energy market. Contact us at [Your Contact Information/Link to Relevant Resources].

Featured Posts

-

Dac San Qua Xua 60 000d Kg Huong Vi Doc Dao Duoc Dan Thanh Pho Yeu Thich

May 03, 2025

Dac San Qua Xua 60 000d Kg Huong Vi Doc Dao Duoc Dan Thanh Pho Yeu Thich

May 03, 2025 -

Understanding Riot Platforms Riot Stock Performance A Comprehensive Guide

May 03, 2025

Understanding Riot Platforms Riot Stock Performance A Comprehensive Guide

May 03, 2025 -

Nigel Farage Condemned For Remarks On Zelenskyy

May 03, 2025

Nigel Farage Condemned For Remarks On Zelenskyy

May 03, 2025 -

La Seine Musicale Saison 2025 2026 Evenements Pour Tous Les Ages

May 03, 2025

La Seine Musicale Saison 2025 2026 Evenements Pour Tous Les Ages

May 03, 2025 -

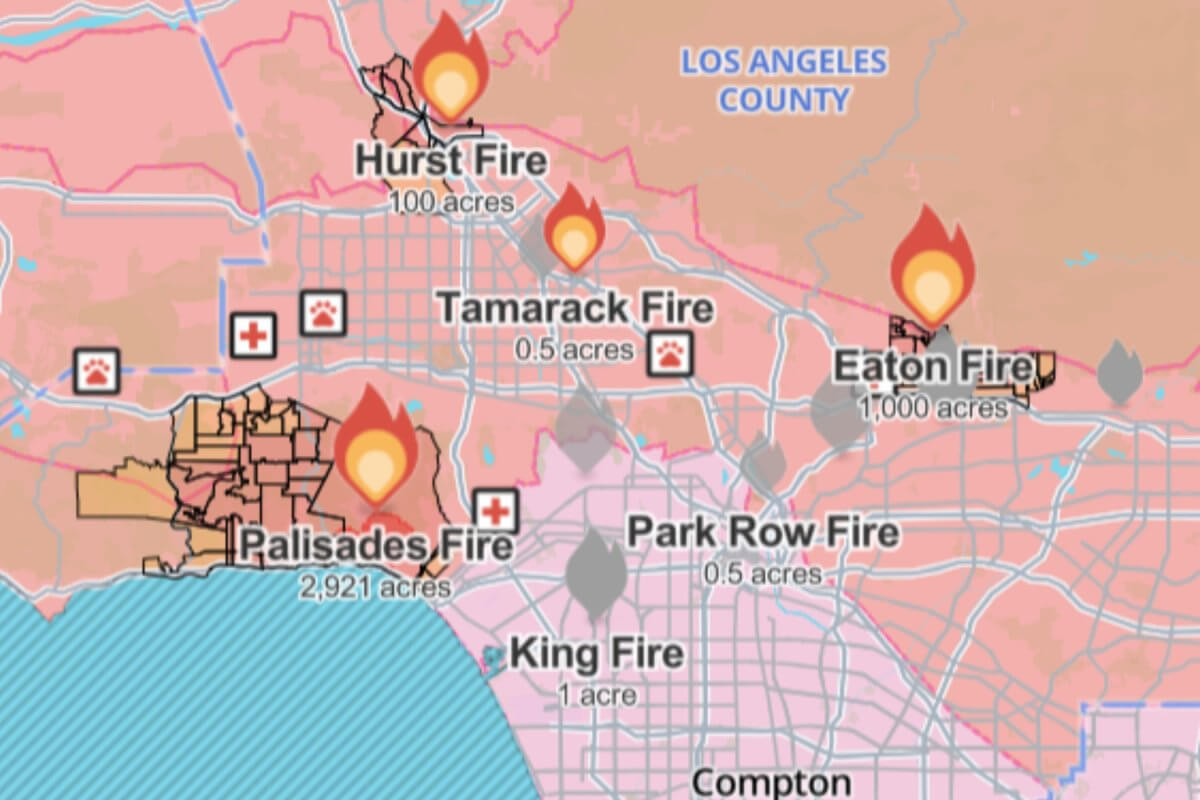

The Rise Of Disaster Betting Examining The Market For Los Angeles Wildfires

May 03, 2025

The Rise Of Disaster Betting Examining The Market For Los Angeles Wildfires

May 03, 2025

Latest Posts

-

Analysis Of Maines Initial Post Election Audit Pilot Program

May 03, 2025

Analysis Of Maines Initial Post Election Audit Pilot Program

May 03, 2025 -

Deciphering Ap Decision Notes The Minnesota Special House Election Explained

May 03, 2025

Deciphering Ap Decision Notes The Minnesota Special House Election Explained

May 03, 2025 -

National Award Honors Nebraskas Voter Id Campaign Excellence

May 03, 2025

National Award Honors Nebraskas Voter Id Campaign Excellence

May 03, 2025 -

Maines Pilot Post Election Audit Process And Implications

May 03, 2025

Maines Pilot Post Election Audit Process And Implications

May 03, 2025 -

Overwhelming Public Trust In South Carolinas Elections 93

May 03, 2025

Overwhelming Public Trust In South Carolinas Elections 93

May 03, 2025