Best Tribal Loans For Bad Credit: Direct Lender Guaranteed Approval?

Table of Contents

Understanding Tribal Loans

Tribal loans are short-term loans offered by lending institutions owned or operated by Native American tribes. These loans differ from traditional bank loans in several key aspects, primarily in their regulatory framework. Because they are often based on tribal sovereignty, they may operate under different regulations than state-licensed lenders. This can mean higher acceptance rates for individuals with bad credit, but it also carries potential implications regarding interest rates and consumer protections.

Advantages and Disadvantages of Tribal Loans:

- Higher Acceptance Rates: Tribal lenders often have less stringent credit requirements than traditional banks, making them a potential option for those with bad credit. This is a key draw for many seeking quick cash.

- Higher Interest Rates: A significant drawback is that tribal loans typically come with much higher interest rates than traditional loans. This can quickly lead to a debt trap if not managed carefully. Always calculate the total cost before borrowing.

- Regulatory Differences: The regulatory environment surrounding tribal lenders varies considerably, and consumer protection laws might not be as robust as with state-licensed lenders. This makes thorough research crucial.

- Misconceptions: Beware of misleading marketing. Not all tribal lenders are predatory, but some exploit borrowers with high fees and unfavorable terms. Be wary of "guaranteed approval" claims – this is rarely true for any responsible lender.

Finding Reputable Tribal Lenders

Choosing a legitimate and trustworthy lender is paramount when considering tribal loans for bad credit. Predatory lending practices are unfortunately prevalent in the short-term loan industry, and it's essential to protect yourself.

Tips for Identifying Reputable Tribal Lenders:

- Transparent Fee Structures: A reputable lender will clearly outline all fees associated with the loan, including origination fees, late payment penalties, and APR. Hidden fees are a red flag.

- Verify Licensing and Registration: Check if the lender is properly licensed and registered with the relevant tribal authorities. Independent verification is crucial.

- Read Online Reviews and Testimonials: Thoroughly examine online reviews and testimonials from previous borrowers. Look for patterns and be wary of overwhelmingly positive reviews without any negative feedback.

- Avoid Guaranteed Approval Promises: Any lender promising guaranteed approval without properly assessing your financial situation is likely operating unethically. Responsible lending involves a thorough credit check and assessment of your repayment ability.

The Application Process for Tribal Loans

Applying for a tribal loan generally involves several steps:

Steps in the Application Process:

- Gather Financial Documents: You'll need to provide proof of income (pay stubs, bank statements), identification, and possibly other financial documentation.

- Complete the Online Application: Most tribal lenders offer online applications, requiring you to fill out personal and financial information accurately.

- Understand the Loan Terms: Carefully review all terms and conditions, including interest rates, repayment schedule, and any fees before signing.

- Potential Processing Fees: Be prepared for potential processing fees, which can vary between lenders.

Guaranteed Approval: Fact or Fiction?

The claim of "guaranteed approval" for tribal loans for bad credit is largely a marketing tactic. While tribal lenders may have higher approval rates due to less stringent credit checks, no legitimate lender can guarantee approval. Responsible lending practices require an assessment of your creditworthiness and repayment ability.

Responsible Borrowing Practices:

- Check Your Credit Report: Review your credit report for errors and understand your credit score before applying.

- Assess Your Repayment Ability: Make sure you can realistically afford the loan repayments without putting yourself into further financial hardship.

- Compare Lenders: Don't settle for the first offer you receive. Shop around and compare interest rates, fees, and terms from different lenders.

Alternatives to Tribal Loans for Bad Credit

If tribal loans don't seem like the right fit, explore these alternatives:

Alternative Lending Options:

- Credit Unions: Credit unions often offer more flexible loan options and lower interest rates than traditional banks, particularly for members with less-than-perfect credit.

- Peer-to-Peer Lending: Platforms connect borrowers with individual lenders, potentially offering more personalized terms.

- Credit Counseling Services: Credit counseling can help you improve your credit score, manage debt, and explore options for consolidating high-interest debt.

Conclusion

This article explored the landscape of tribal loans for bad credit, emphasizing the need for caution and responsible borrowing. While tribal lenders might offer higher approval rates than traditional banks, "guaranteed approval" is rarely a realistic promise. Thorough research and careful consideration of alternatives are crucial. High interest rates and potential regulatory ambiguities necessitate a cautious approach. If you're considering tribal loans for bad credit, proceed with caution. Research thoroughly, compare lenders, and understand the terms before signing any agreement. Remember, responsible financial planning is key to managing your finances effectively, even with bad credit. Find the best tribal loans for bad credit that suit your needs, but prioritize responsible borrowing above all else.

Featured Posts

-

Jennifer Lopezs American Music Awards Hosting Gig Confirmed Las Vegas Venue

May 28, 2025

Jennifer Lopezs American Music Awards Hosting Gig Confirmed Las Vegas Venue

May 28, 2025 -

Ray Epps Sues Fox News For Defamation Jan 6th Capitol Attack Falsehoods At The Center

May 28, 2025

Ray Epps Sues Fox News For Defamation Jan 6th Capitol Attack Falsehoods At The Center

May 28, 2025 -

Angels Sweep Dodgers In Freeway Series

May 28, 2025

Angels Sweep Dodgers In Freeway Series

May 28, 2025 -

Alfoeldi Talajnedvesseg Kritikus Pont A Magyar Noevenytermesztesben

May 28, 2025

Alfoeldi Talajnedvesseg Kritikus Pont A Magyar Noevenytermesztesben

May 28, 2025 -

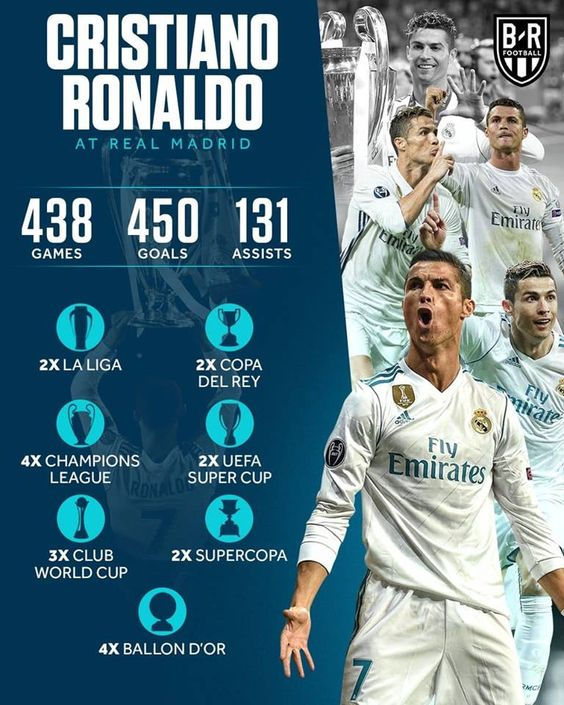

Cristiano Ronaldo Nun Marka Degeri Nasil Bu Kadar Yueksek

May 28, 2025

Cristiano Ronaldo Nun Marka Degeri Nasil Bu Kadar Yueksek

May 28, 2025