BigBear.ai Holdings, Inc. (BBAI): Penny Stock Potential In The AI Sector

Table of Contents

Understanding BigBear.ai (BBAI) and its Business Model

What does BigBear.ai do?

BigBear.ai provides AI-powered solutions primarily to government and commercial clients. Their services span crucial sectors, including national security, cybersecurity, and intelligence. They leverage advanced AI technologies to offer:

- Data analytics and insights: Processing vast datasets to identify patterns and trends relevant to clients' operational needs.

- Cybersecurity solutions: Protecting critical infrastructure and sensitive data using AI-driven threat detection and response systems.

- Mission support: Providing AI-driven tools and solutions to enhance efficiency and decision-making in diverse mission-critical environments.

BigBear.ai's target market consists of government agencies (federal, state, and local) and large commercial enterprises requiring sophisticated AI capabilities for complex challenges. Their competitive advantage lies in their expertise in integrating AI into these challenging domains, delivering tailored solutions that address specific client needs. Keywords: BigBear.ai services, BBAI business model, AI solutions, government contracts, cybersecurity AI, national security AI.

Analyzing BBAI's Financial Performance and Stock Valuation

Recent Financial Highlights

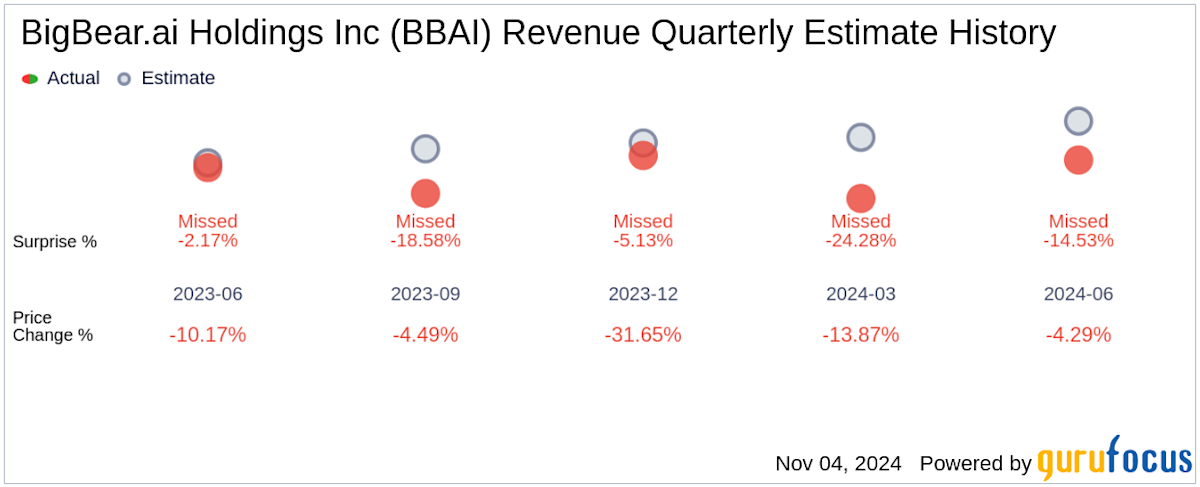

Analyzing BBAI's financial performance requires a careful review of its recent earnings reports and SEC filings. Key metrics to consider include:

- Revenue growth: Tracking the year-over-year increase (or decrease) in revenue is crucial for understanding BBAI's growth trajectory. Examine whether this growth is sustainable and driven by organic growth or acquisitions.

- Profitability: Assessing BBAI's profitability (or lack thereof) provides insights into its financial health. Metrics like gross margin, operating margin, and net income should be analyzed in the context of the company's stage of development. Are they showing improvement?

- Debt levels: High levels of debt can pose risks. Analyzing BBAI's debt-to-equity ratio helps assess its financial leverage and its ability to service its debt obligations.

A comparative analysis against other AI sector companies helps gauge BBAI's performance relative to its peers. Visual representations, such as charts and graphs depicting revenue growth or profitability over time, can effectively convey this financial data. Keywords: BBAI stock price, BBAI financials, revenue growth, profitability, debt-to-equity ratio, AI stock valuation.

Assessing the Risks and Rewards of Investing in BBAI

Potential Risks

Investing in BBAI, like any penny stock, carries substantial risk:

- High volatility: Penny stock prices are notoriously volatile, experiencing significant price swings in short periods.

- Financial instability: BBAI's financial performance may fluctuate, potentially leading to significant losses for investors.

- Competition: The AI sector is highly competitive. BBAI faces competition from larger, more established players, posing a threat to its market share.

- Government contract dependence: If a significant portion of BBAI's revenue relies on government contracts, changes in government priorities or budget cuts could negatively impact its financial performance.

Potential Rewards

Despite the risks, investing in BBAI also offers potential rewards:

- High growth potential: The AI market is experiencing explosive growth, offering significant opportunities for companies like BBAI to expand their market share and increase revenue.

- Significant returns: If BBAI successfully executes its business strategy and delivers on its promises, its stock price could appreciate substantially, generating significant returns for investors.

- First-mover advantage: In certain niche AI applications, BBAI might hold a first-mover advantage, giving it an edge over competitors.

- Positive future outlook: Market trends and BBAI's strategic initiatives suggest a positive outlook, although this is not guaranteed.

Keywords: BBAI risk assessment, penny stock volatility, investment risks, AI market competition, BBAI investment potential, high-growth AI stocks, potential returns, AI market growth.

BigBear.ai (BBAI) Compared to Other Penny Stocks in the AI Sector

Competitive Analysis

A comprehensive analysis requires comparing BBAI to other penny stocks in the AI space. This comparison should consider:

- Business models: How do BBAI's services differ from its competitors?

- Financial performance: How does BBAI's revenue growth and profitability compare to its peers?

- Risk profiles: What are the key risk factors associated with each company?

A table summarizing these comparisons would provide a clear and concise overview, facilitating informed decision-making. Keywords: BBAI competitors, AI penny stocks comparison, competitive landscape.

Conclusion: Is BigBear.ai (BBAI) a Smart Penny Stock Investment?

BigBear.ai (BBAI) presents a compelling yet risky investment opportunity within the rapidly growing AI sector. Its focus on AI solutions for government and commercial clients offers significant growth potential. However, the inherent volatility of penny stocks, coupled with the competitive landscape and potential financial instabilities, necessitates careful consideration. While the potential rewards are substantial, the risks are equally significant.

Before investing in BigBear.ai (BBAI) or any other penny stock, conduct thorough due diligence. Research the company's financials, its competitive landscape, and the overall risk profile. Learn more about BigBear.ai (BBAI) and understand its business model and strategic direction before making any investment decisions. Consider the risks and rewards of BBAI penny stock and only invest what you can afford to lose. Remember, investing in penny stocks requires a high-risk tolerance.

Featured Posts

-

Betalbaarheid Woningen Nederland De Discussie Tussen Geen Stijl En Abn Amro

May 21, 2025

Betalbaarheid Woningen Nederland De Discussie Tussen Geen Stijl En Abn Amro

May 21, 2025 -

Aston Villas Rashford Shines Two Goals Secure Fa Cup Progression

May 21, 2025

Aston Villas Rashford Shines Two Goals Secure Fa Cup Progression

May 21, 2025 -

Kaellmanin Nousu Miten Haen Voi Auttaa Huuhkajia

May 21, 2025

Kaellmanin Nousu Miten Haen Voi Auttaa Huuhkajia

May 21, 2025 -

Half Dome Wins Abn Group Victoria Media Account A Strategic Partnership

May 21, 2025

Half Dome Wins Abn Group Victoria Media Account A Strategic Partnership

May 21, 2025 -

Pasxa Kai Protomagia Sto Oropedio Evdomos Syndyasmos Diakopon

May 21, 2025

Pasxa Kai Protomagia Sto Oropedio Evdomos Syndyasmos Diakopon

May 21, 2025

Latest Posts

-

Dancehall Stars Trinidad Visit Restrictions And Vybz Kartels Support

May 22, 2025

Dancehall Stars Trinidad Visit Restrictions And Vybz Kartels Support

May 22, 2025 -

Bp Ceo Pay 31 Reduction Announced

May 22, 2025

Bp Ceo Pay 31 Reduction Announced

May 22, 2025 -

Understanding The Success Of The Goldbergs A Critical Analysis

May 22, 2025

Understanding The Success Of The Goldbergs A Critical Analysis

May 22, 2025 -

31 Drop In Bps Chief Executives Pay Package

May 22, 2025

31 Drop In Bps Chief Executives Pay Package

May 22, 2025 -

The Goldbergs Behind The Scenes And Production Details

May 22, 2025

The Goldbergs Behind The Scenes And Production Details

May 22, 2025