Bitcoin Price Prediction 2024: Trump's Influence And The Road To $100,000

Table of Contents

Trump's Potential Impact on Bitcoin's Price in 2024

A second Trump term could dramatically alter the regulatory and economic landscape, significantly impacting Bitcoin's price. His past statements and potential policies offer clues to what we might expect.

Pro-Bitcoin Stance: Trump's Cryptocurrency Rhetoric

Trump's past comments on Bitcoin and cryptocurrency have been mixed, generating both excitement and uncertainty within the crypto community.

- Skepticism: While he hasn't explicitly endorsed Bitcoin, his past criticisms of cryptocurrencies have been less harsh than some other politicians.

- Interest in Fintech: Trump has shown interest in financial technology advancements. A pro-innovation stance could indirectly benefit Bitcoin.

- "America First" Policy: His emphasis on domestic economic strength could lead to policies promoting the development of a US-centric cryptocurrency ecosystem, potentially benefiting Bitcoin indirectly.

Analyzing these seemingly contrasting viewpoints reveals a complex picture. A more pro-crypto stance, even if not explicit Bitcoin endorsement, could lead to a more favorable regulatory environment. This could boost investor confidence, increase institutional adoption, and ultimately drive Bitcoin's price upward. Conversely, any harsh regulatory moves could have a significantly negative impact.

Economic Policies and Bitcoin: Navigating the Macroeconomic Landscape

Trump's economic policies, characterized by fiscal spending and trade protectionism, have the potential to create both positive and negative correlations with Bitcoin's value.

- Inflationary Pressures: Expansionary fiscal policies could fuel inflation. Bitcoin, often seen as a hedge against inflation, might benefit from increased demand in such an environment.

- Trade Wars and Geopolitical Uncertainty: Trade disputes could create uncertainty in traditional markets, potentially driving investors towards Bitcoin as a safe haven asset.

- Reduced Investor Confidence: Conversely, protectionist policies could negatively impact global investor confidence, possibly dampening demand for all risk assets, including Bitcoin.

The net impact of Trump's economic policies on Bitcoin remains uncertain and depends on the overall macroeconomic conditions and the specific policies enacted. Careful analysis of these policy impacts on investor sentiment and market stability is crucial for accurate Bitcoin price prediction.

Regulatory Uncertainty: The Sword of Damocles Hanging Over Bitcoin

Regulatory clarity is vital for Bitcoin's growth. A Trump administration could bring either increased scrutiny or a more laissez-faire approach.

- SEC Regulations: The Securities and Exchange Commission's stance on cryptocurrencies is critical. A Trump administration might adopt either a more lenient or stricter approach towards regulation.

- Tax Policies: Tax policies on cryptocurrency gains and transactions could influence investment decisions and overall market activity. Clarity is paramount.

- Stablecoin Regulation: The rise of stablecoins could be influenced by regulatory frameworks. A defined regulatory approach for stablecoins could either benefit or harm Bitcoin's position within the crypto market.

Navigating regulatory uncertainty is a key challenge for Bitcoin investors. Clear and consistent regulations are needed to foster trust and encourage mainstream adoption. Unpredictable or overly strict regulations could trigger market volatility and hinder Bitcoin's price growth.

Factors Beyond Trump: Contributing to a $100,000 Bitcoin Price

While Trump's potential influence is significant, other factors will also contribute to Bitcoin's price in 2024.

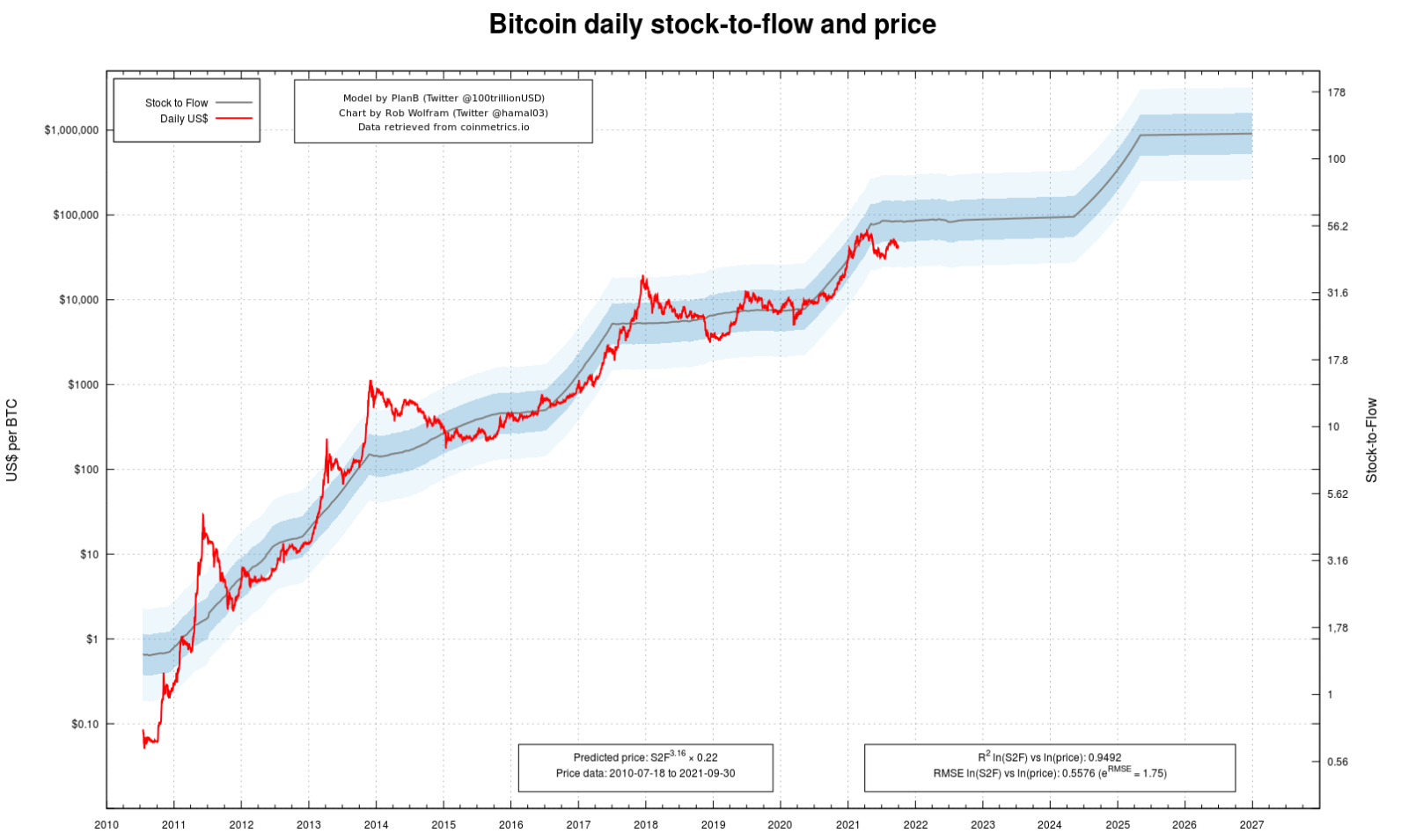

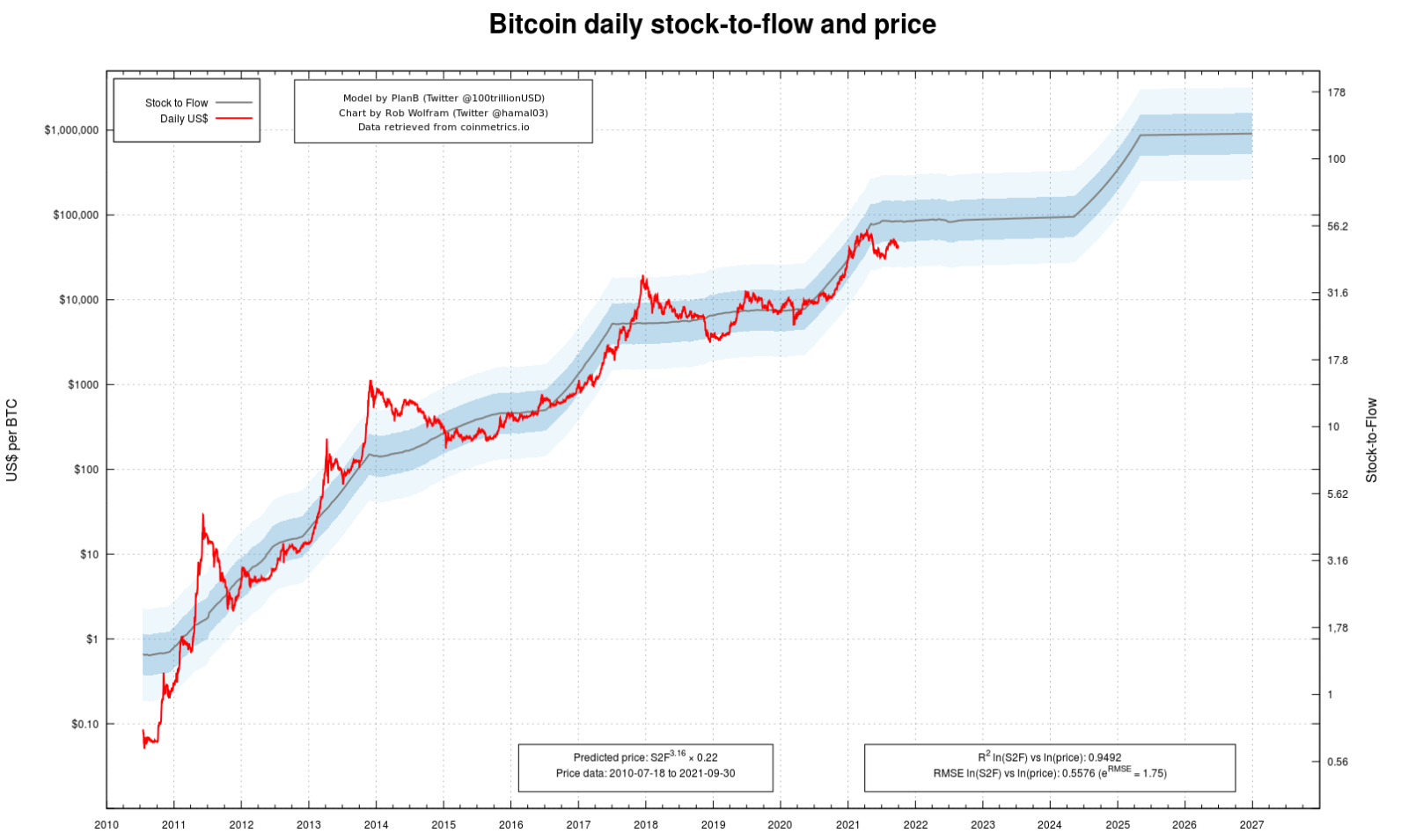

Halving Events: The Scarcity Factor

Bitcoin's halving events, where the reward for miners is cut in half, significantly impact its scarcity and price.

- Historical Data: Past halving events have generally been followed by significant price increases.

- Supply and Demand: Reduced supply coupled with consistent demand often leads to higher prices.

- 2024 Halving: The next halving is expected to occur in 2024, potentially catalyzing another price surge.

Analyzing the historical impact of halving events and projecting its effect on the future Bitcoin price is a fundamental aspect of any comprehensive Bitcoin price prediction for 2024.

Increased Institutional Adoption: Big Money Enters the Game

Institutional investors are increasingly entering the cryptocurrency market, adding legitimacy and liquidity.

- MicroStrategy and Tesla: Companies like MicroStrategy and Tesla have made significant Bitcoin investments.

- Investment Funds: Many institutional investment firms are now offering exposure to Bitcoin through various vehicles.

- Pension Funds: Some pension funds are exploring adding Bitcoin to their portfolios, further bolstering institutional demand.

Increased institutional investment can lead to greater price stability and attract more retail investors, contributing significantly to a potential price increase.

Global Macroeconomic Conditions: The Broader Picture

Global factors such as inflation, geopolitical instability, and central bank policies influence Bitcoin's price.

- Inflation Hedge: Bitcoin's decentralized nature and limited supply make it attractive as a hedge against inflation.

- Geopolitical Risks: Geopolitical instability could drive investors towards Bitcoin as a safe haven asset.

- Central Bank Policies: Central bank actions, such as quantitative easing, can influence the value of fiat currencies and indirectly impact Bitcoin's price.

Understanding these macroeconomic trends is crucial for a realistic Bitcoin price prediction.

Risks and Challenges to Reaching $100,000

Despite the bullish factors, several risks could hinder Bitcoin's ascent to $100,000.

Market Volatility: The Rollercoaster Ride Continues

Bitcoin's price is highly volatile, prone to significant corrections.

- Historical Crashes: Bitcoin has experienced several sharp price drops in its history.

- Market Sentiment: Sudden shifts in investor sentiment can trigger rapid price swings.

- Whale Manipulation: Large holders ("whales") could potentially influence the price through coordinated actions.

Understanding Bitcoin's volatility and the factors driving price corrections is crucial for managing risk.

Regulatory Crackdowns: A Potential Roadblock

Governments worldwide could impose stricter regulations, impacting Bitcoin's price.

- Bans and Restrictions: Some countries have already banned or heavily restricted cryptocurrency activities.

- KYC/AML Compliance: Increased Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations could restrict anonymity and potentially dampen demand.

- Taxation: Heavy taxation on cryptocurrency transactions could discourage investment.

Navigating potential regulatory crackdowns and their market impact is crucial for any realistic Bitcoin price prediction for 2024.

Competition from Altcoins: The Crypto Ecosystem Evolves

The emergence of other cryptocurrencies poses a potential challenge to Bitcoin's dominance.

- Ethereum and Other Altcoins: Alternative cryptocurrencies (altcoins) offer unique functionalities and features, potentially attracting investors away from Bitcoin.

- Technological Advancements: Technological advancements in other cryptocurrencies could lead to increased competition.

- Market Share Erosion: Increased competition could lead to a decrease in Bitcoin's market share, impacting its price.

Considering the competitive landscape and the potential for market share erosion is vital for a comprehensive Bitcoin price prediction.

Conclusion: Navigating the Bitcoin Price Prediction 2024 Landscape

Predicting the precise Bitcoin price in 2024 is a challenging endeavor. However, by considering the potential influence of a Trump administration, halving events, institutional adoption, macroeconomic conditions, and inherent risks like market volatility and regulatory uncertainty, we can gain a more informed perspective on Bitcoin's potential to reach $100,000. While the road to a six-figure Bitcoin price is fraught with challenges, the long-term potential remains significant. Continue your research on the Bitcoin price prediction 2024 and stay informed about this dynamic market. Understanding the interplay of these factors will be crucial in navigating the exciting future of Bitcoin and making informed investment decisions.

Featured Posts

-

De Vid Bekam Na Dobar Na Site Vreminja

May 09, 2025

De Vid Bekam Na Dobar Na Site Vreminja

May 09, 2025 -

Sensex Today 700 Point Surge Nifty Reclaims 18800 Live Market Updates

May 09, 2025

Sensex Today 700 Point Surge Nifty Reclaims 18800 Live Market Updates

May 09, 2025 -

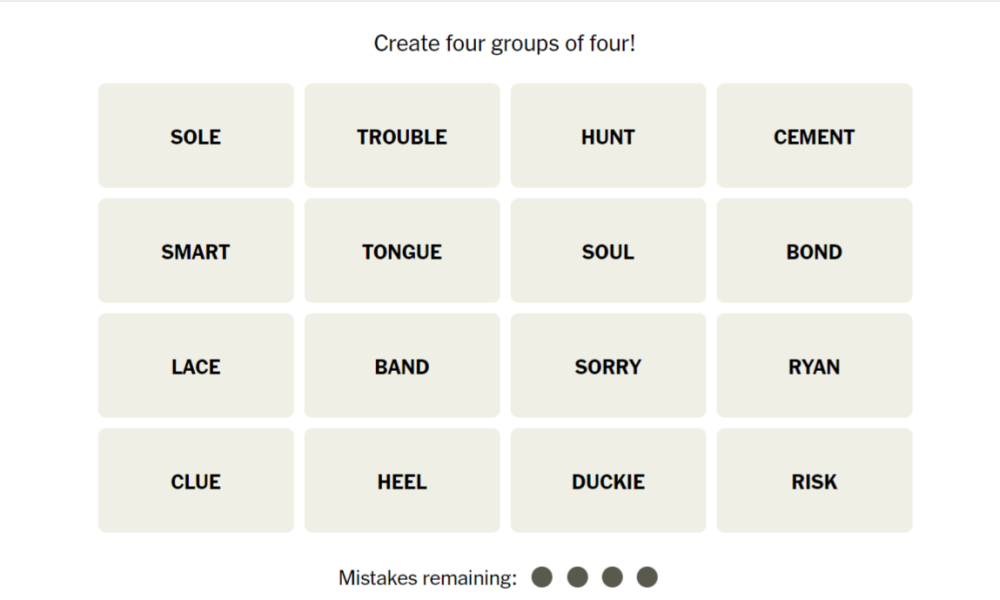

Nyt Strands Today April 12 2025 Clues Theme Hints And Pangram For Saturdays Crossword

May 09, 2025

Nyt Strands Today April 12 2025 Clues Theme Hints And Pangram For Saturdays Crossword

May 09, 2025 -

Bao Mau Tien Giang Tat Tre Noi Dung Loi Khai Chi Tiet

May 09, 2025

Bao Mau Tien Giang Tat Tre Noi Dung Loi Khai Chi Tiet

May 09, 2025 -

Protecting Your Childs Development Considering The Impact Of Early Daycare

May 09, 2025

Protecting Your Childs Development Considering The Impact Of Early Daycare

May 09, 2025