Bitcoin Price Prediction 2024: Trump's Influence On BTC's Value

Table of Contents

Trump's Stance on Cryptocurrency and its Potential Impact

Past Statements and Actions

Donald Trump's past pronouncements on Bitcoin and cryptocurrencies have been mixed, ranging from dismissive to cautiously curious. While he hasn't explicitly endorsed Bitcoin, his administration’s actions regarding financial regulation offer clues.

- 2019: Trump’s administration issued a report expressing concerns about the use of cryptocurrencies for illicit activities. [Link to credible news source]

- Various Tweets & Interviews: Trump has expressed skepticism about cryptocurrencies in general, often highlighting their volatility and potential for misuse. [Link to credible news source, ideally a compilation]

- Absence of Direct Endorsement: Unlike some other political figures, Trump has not actively championed Bitcoin or other cryptocurrencies.

Analyzing these past statements suggests a potentially cautious, if not skeptical, approach to cryptocurrency regulation under a second Trump term.

Potential Regulatory Changes under a Trump Presidency

A second Trump administration could significantly alter the regulatory environment for cryptocurrencies in the US. Several scenarios are possible:

- Easing of Regulations: A more laissez-faire approach could boost institutional investment and potentially drive up Bitcoin's price. This could involve less stringent KYC/AML requirements and a more permissive stance on stablecoins.

- Increased Scrutiny: Conversely, a focus on combating illicit activities could lead to stricter regulations, potentially hindering growth and impacting the Bitcoin price negatively. This might involve increased scrutiny of decentralized finance (DeFi) platforms and exchanges.

- Protectionist Measures: Trump's history of protectionist policies could extend to the crypto space, potentially favoring domestically developed cryptocurrencies or platforms.

These potential regulatory shifts would significantly impact institutional adoption, the growth of DeFi, and the stability of stablecoins, ultimately influencing the Bitcoin price prediction 2024.

Impact on US Economic Policy and its Ripple Effect on Bitcoin

Trump's economic policies, irrespective of their direct impact on crypto, could indirectly affect Bitcoin's value.

- Inflation and Interest Rates: A return to inflationary policies or changes in interest rate management could impact the dollar's strength and, consequently, the price of Bitcoin, which is often seen as a hedge against inflation.

- Trade Wars and Global Uncertainty: Trump's trade policies could create economic instability, influencing investor sentiment and driving capital into Bitcoin as a safe haven asset.

- National Debt: Rising national debt under a Trump administration could also potentially lead to inflation and weaken the dollar, creating further uncertainty in the market.

Market Sentiment and Speculation Surrounding a Trump Presidency

Investor Confidence and Bitcoin's Price

A Trump presidency, depending on its perceived impact on the US economy and cryptocurrency regulation, could greatly influence investor confidence.

- Institutional Investors: Some institutional investors may view a Trump administration as a risk, potentially leading to a pullback from Bitcoin investments. Others might see opportunities arising from deregulation.

- Retail Investors: Retail investor sentiment is often highly susceptible to news and social media trends. Trump's pronouncements and policy decisions could significantly affect retail investment in Bitcoin.

The Role of Social Media and Public Opinion

Social media plays a pivotal role in shaping market narratives around Bitcoin and politics.

- FUD (Fear, Uncertainty, and Doubt): Negative news related to Trump’s stance on crypto could spread rapidly online, creating FUD and potentially causing price drops.

- Hype and Speculation: Conversely, positive narratives surrounding a potential easing of regulation under a Trump administration could drive significant price increases.

- Influence of Key Figures: Statements by prominent figures on both sides of the political spectrum, including cryptocurrency influencers, could significantly impact public perception and market trends.

Alternative Scenarios and Factors Influencing Bitcoin's Price in 2024

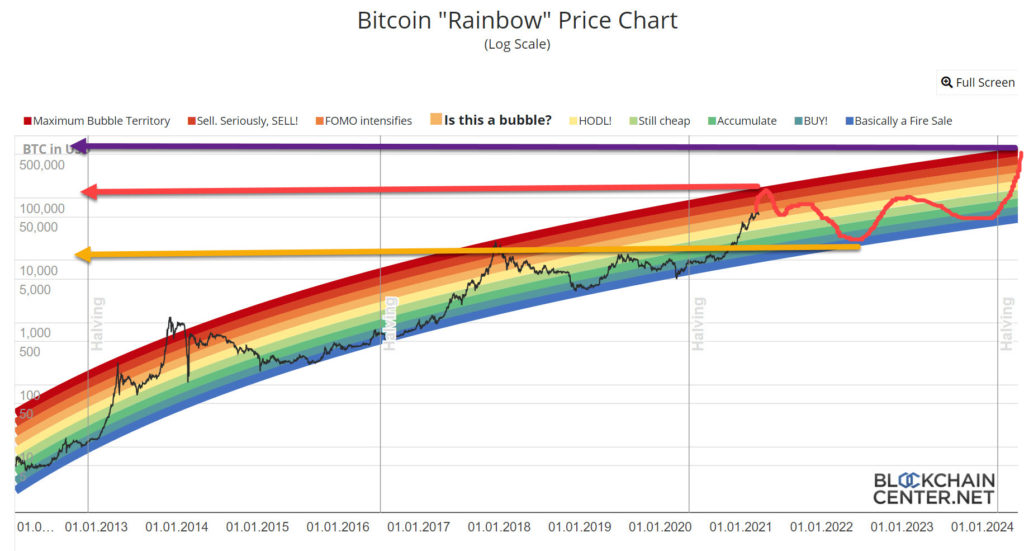

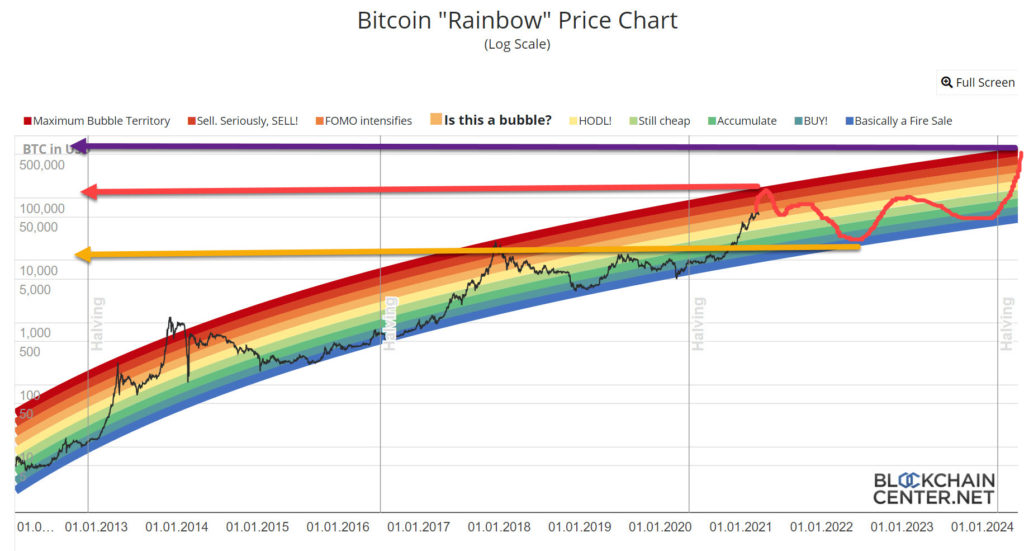

Halving Event and its Impact

The Bitcoin halving event, scheduled for 2024, is a significant independent factor affecting the price.

- Reduced Supply: The halving reduces the rate of new Bitcoin creation, potentially leading to increased scarcity and higher prices. Historically, halving events have been followed by periods of price appreciation.

- Market Dynamics: The actual impact of the halving depends on various factors, including overall market sentiment and investor behavior.

Technological Advancements and Adoption

Technological advancements and broader cryptocurrency adoption will influence Bitcoin's price regardless of political developments.

- Layer-2 Scaling Solutions: Advancements like the Lightning Network improve Bitcoin's scalability and transaction speed, potentially increasing adoption and driving price increases.

- Institutional Adoption: Continued institutional interest in Bitcoin, regardless of regulatory changes, will likely support price growth.

Geopolitical Events and Their Influence

Global events outside of US politics will invariably influence Bitcoin's price.

- Global Economic Slowdown: A global recession could drive investors towards Bitcoin as a safe haven asset, potentially pushing its price higher.

- Geopolitical Instability: International conflicts and political instability can increase Bitcoin’s appeal as a decentralized, less vulnerable asset.

Conclusion: Bitcoin Price Prediction 2024: A Verdict on Trump's Influence

Predicting Bitcoin's price in 2024 is inherently challenging, even without factoring in political variables. A Trump presidency or a Trump-influenced administration could significantly impact Bitcoin’s price, either positively or negatively, through regulatory changes, economic policies, and shifts in market sentiment. However, it's crucial to remember that other factors, such as the halving event, technological developments, and global geopolitical events, will also play significant roles. A comprehensive Bitcoin price prediction 2024 requires careful consideration of all these interacting elements.

Conduct your own research, analyze the different scenarios, and form your informed opinion on the impact of the Trump factor on Bitcoin’s price. Subscribe to our newsletter for future updates and in-depth analysis on Bitcoin price predictions and the ever-evolving cryptocurrency market!

Featured Posts

-

Find The Winning Lotto And Lotto Plus Numbers April 2 2025

May 08, 2025

Find The Winning Lotto And Lotto Plus Numbers April 2 2025

May 08, 2025 -

Rogue The Savage Land 2 Ka Zars Peril And The Need For A Hero

May 08, 2025

Rogue The Savage Land 2 Ka Zars Peril And The Need For A Hero

May 08, 2025 -

Sufian Praises Gcci Presidents Expo 2025 Organization Efforts

May 08, 2025

Sufian Praises Gcci Presidents Expo 2025 Organization Efforts

May 08, 2025 -

Nereden Izleyebilirim Arsenal Psg Macini Sifresiz Canli Yayinla Izleyin

May 08, 2025

Nereden Izleyebilirim Arsenal Psg Macini Sifresiz Canli Yayinla Izleyin

May 08, 2025 -

Uber Auto Service Goes Cash Only Impact And Implications

May 08, 2025

Uber Auto Service Goes Cash Only Impact And Implications

May 08, 2025

Latest Posts

-

The Attorney General And Fox News A Deeper Dive Than The Epstein Case

May 09, 2025

The Attorney General And Fox News A Deeper Dive Than The Epstein Case

May 09, 2025 -

Garlands Fox News Appearances A Sign Of Something Bigger

May 09, 2025

Garlands Fox News Appearances A Sign Of Something Bigger

May 09, 2025 -

Why Is Merrick Garland On Fox News Daily A More Important Question Than Epstein

May 09, 2025

Why Is Merrick Garland On Fox News Daily A More Important Question Than Epstein

May 09, 2025 -

Focusing On The Attorney Generals Media Strategy Beyond Epstein

May 09, 2025

Focusing On The Attorney Generals Media Strategy Beyond Epstein

May 09, 2025 -

Us Attorney Generals Daily Fox News Appearances Beyond The Epstein Narrative

May 09, 2025

Us Attorney Generals Daily Fox News Appearances Beyond The Epstein Narrative

May 09, 2025