Bitcoin Price Prediction: Could Trump's 100-Day Speech Push BTC Past $100,000?

Table of Contents

Trump's Potential Economic Policies and Their Influence on Bitcoin

A hypothetical Trump administration's economic policies could significantly influence the Bitcoin price. Several key areas warrant consideration:

Fiscal Policy and Inflation

Expansionary fiscal policies, such as increased government spending or substantial tax cuts, could fuel inflation. Historically, periods of high inflation have seen investors seek alternative assets to preserve their purchasing power. Bitcoin, often viewed as a hedge against inflation, could benefit from this scenario.

- Inflation's Impact on Bitcoin: High inflation erodes the value of fiat currencies, making Bitcoin, with its fixed supply, a relatively more attractive investment.

- Historical Examples: Previous instances of high inflation in various countries have often correlated with increased Bitcoin adoption and price appreciation.

- Expert Opinion: Many financial analysts believe that a sustained inflationary environment would drive significant demand for Bitcoin as a store of value.

Regulatory Changes and Their Impact on Crypto

A Trump administration's approach to cryptocurrency regulation could drastically alter the landscape. Looser regulations could boost institutional investment and widespread adoption, driving the BTC price higher. Conversely, stricter regulations could stifle growth and depress the price.

- Deregulation and Increased Adoption: Reduced regulatory barriers could lead to increased institutional investment and broader mainstream acceptance, pushing the Bitcoin price upwards.

- Stricter Regulation and Decreased Price: Conversely, increased regulatory scrutiny could lead to reduced investor confidence and lower Bitcoin adoption, potentially impacting its price negatively.

- Impact on Institutional Investment: Regulatory clarity is crucial for large institutional investors. Favorable regulations would likely encourage greater institutional participation, boosting demand and potentially the Bitcoin price.

Geopolitical Instability and Safe-Haven Assets

Geopolitical instability and uncertainty often drive investors towards safe-haven assets. Bitcoin, with its decentralized nature, could see increased demand during times of global turmoil. A Trump administration's foreign policy decisions could contribute to such uncertainty.

- Uncertainty and Bitcoin Investment: Periods of uncertainty in traditional markets can drive capital flows into Bitcoin, increasing demand and pushing prices up.

- Historical Examples: Bitcoin has historically shown resilience and even growth during periods of significant geopolitical instability, reinforcing its status as a potential safe-haven asset.

Expert Opinions on Bitcoin's Price Trajectory

The cryptocurrency market is full of diverse opinions, and Bitcoin's price prediction is no exception.

Bullish Predictions and Supporting Arguments

Many analysts remain bullish on Bitcoin, predicting prices far exceeding $100,000. Their arguments often center on:

- Increased Adoption: Growing mainstream adoption and institutional investment are key drivers of bullish sentiment.

- Technological Advancements: The development of the Lightning Network and other scaling solutions enhances Bitcoin's usability and transaction speed.

- Limited Supply: Bitcoin's capped supply of 21 million coins is seen as a deflationary mechanism that supports its long-term value. (Note: Include links to reputable sources supporting these predictions)

Bearish Predictions and Counterarguments

Conversely, some analysts remain cautious, citing potential risks:

- Regulatory Hurdles: Unfavorable regulatory changes could dampen growth and negatively affect the Bitcoin price.

- Market Manipulation: Concerns about market manipulation and price volatility persist.

- Macroeconomic Factors: Global economic downturns or significant shifts in monetary policy could impact Bitcoin's performance. (Note: Include links to reputable sources supporting these predictions)

Technical Analysis and Market Sentiment

Technical analysis and market sentiment are crucial in Bitcoin price prediction.

Chart Patterns and Indicators

Analyzing Bitcoin's price charts using technical indicators like moving averages, Relative Strength Index (RSI), and support/resistance levels can offer insights into potential price movements. (Note: Include charts and graphs if possible.)

- Moving Averages: Analyzing short-term and long-term moving averages can help identify trends and potential breakouts.

- RSI: The RSI indicator helps assess whether the Bitcoin price is overbought or oversold, providing potential buy or sell signals.

- Support and Resistance Levels: Identifying key support and resistance levels can help predict potential price reversals.

Social Media Sentiment and Investor Confidence

Social media sentiment plays a role in shaping investor confidence and, consequently, Bitcoin's price. Positive news and widespread adoption often lead to price increases, while negative news or regulatory uncertainty can trigger sell-offs.

- Impact of News and Events: Positive news, such as increased institutional adoption or technological advancements, usually results in bullish sentiment and price increases. Conversely, negative news like regulatory crackdowns or security breaches can cause significant price drops.

- Influence of Key Figures: The opinions and actions of influential figures in the crypto space can also significantly impact market sentiment and subsequently, the Bitcoin price.

Conclusion: Bitcoin Price Prediction and the Future of BTC

The question of whether a hypothetical Trump policy shift could push Bitcoin beyond $100,000 is complex. While his potential economic policies could influence the crypto market significantly – through inflation, regulatory changes, or geopolitical impacts – the ultimate trajectory of the BTC price depends on a confluence of factors. Expert opinions are divided, with both bullish and bearish predictions supported by valid arguments. Technical analysis and market sentiment add further layers of complexity to the forecast. It's crucial to remember that Bitcoin price prediction is inherently speculative.

Therefore, stay updated on Bitcoin price predictions, conduct your own thorough research, and consider all perspectives before making any investment decisions. Follow the latest Bitcoin price forecasts and learn more about Bitcoin’s potential. The crypto market is dynamic, and staying informed is key to navigating its complexities.

Featured Posts

-

Carneys White House Stand Canadas Sovereignty Not Negotiable

May 08, 2025

Carneys White House Stand Canadas Sovereignty Not Negotiable

May 08, 2025 -

Us Presidents Article Boosts Xrp Analyzing The Trump Effect On Ripple

May 08, 2025

Us Presidents Article Boosts Xrp Analyzing The Trump Effect On Ripple

May 08, 2025 -

Vesprem Slavi Desetta Pobeda Vo L Sh Pobeda Nad Ps Zh

May 08, 2025

Vesprem Slavi Desetta Pobeda Vo L Sh Pobeda Nad Ps Zh

May 08, 2025 -

Impact Of Pro Shares Xrp Etfs Price Movements And Market Analysis

May 08, 2025

Impact Of Pro Shares Xrp Etfs Price Movements And Market Analysis

May 08, 2025 -

2026 Contract Expiry Four Crucial Inter Milan Players

May 08, 2025

2026 Contract Expiry Four Crucial Inter Milan Players

May 08, 2025

Latest Posts

-

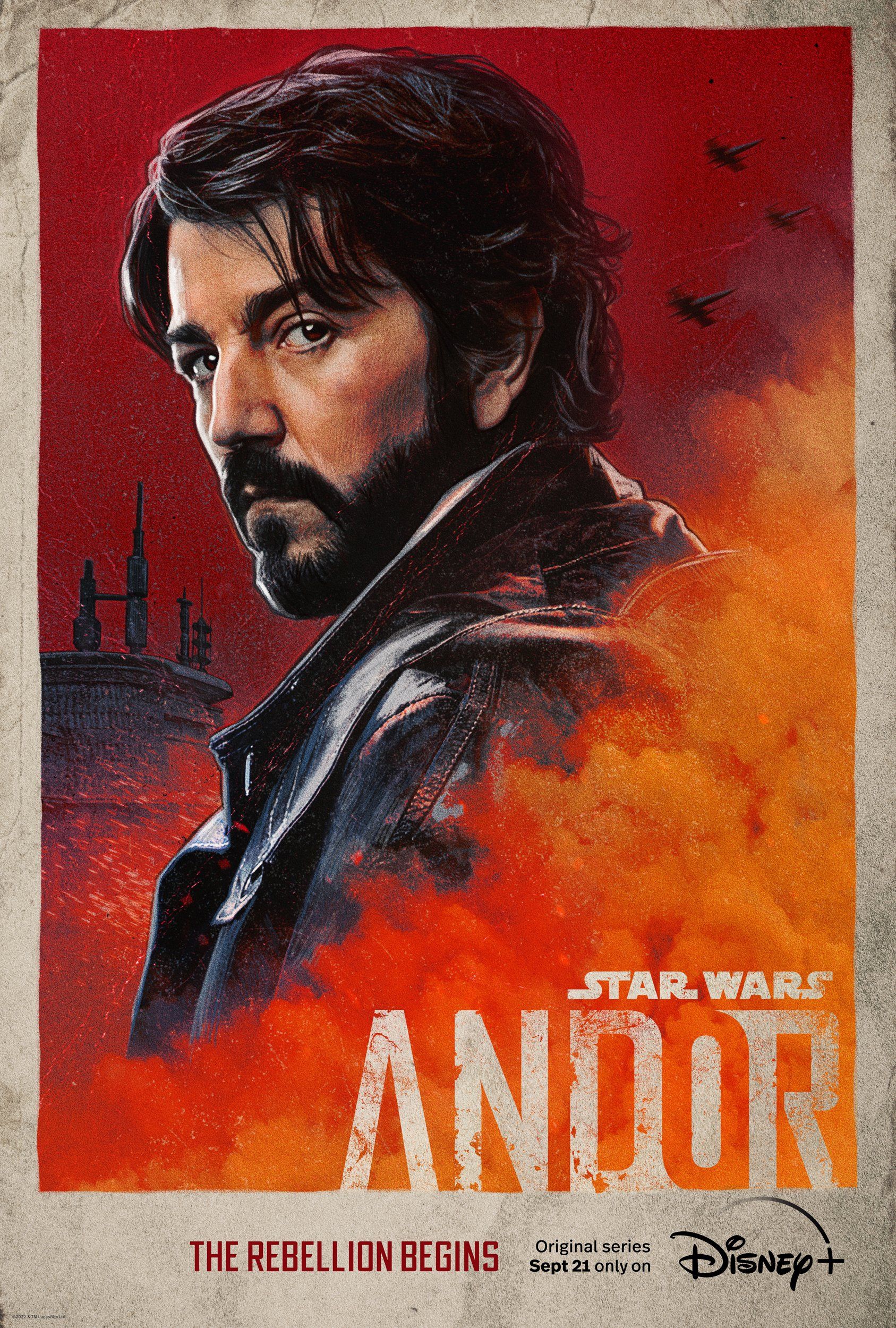

Andor Returns This Month Your Essential Guide To Season 2

May 08, 2025

Andor Returns This Month Your Essential Guide To Season 2

May 08, 2025 -

Star Wars Andor A Look Back With Creator Tony Gilroy

May 08, 2025

Star Wars Andor A Look Back With Creator Tony Gilroy

May 08, 2025 -

Get Ready For Andor Season 2 Key Plot Points And Character Recaps

May 08, 2025

Get Ready For Andor Season 2 Key Plot Points And Character Recaps

May 08, 2025 -

Tony Gilroy On The Challenges And Rewards Of Creating Andor

May 08, 2025

Tony Gilroy On The Challenges And Rewards Of Creating Andor

May 08, 2025 -

Andor Season 2 Everything You Need To Know Before Watching

May 08, 2025

Andor Season 2 Everything You Need To Know Before Watching

May 08, 2025