Bitcoin Price Rebound: Is This The Start Of A Long-Term Uptrend?

Table of Contents

Analyzing the Recent Bitcoin Price Rebound

The recent Bitcoin price rebound is a complex phenomenon requiring a multi-faceted analysis. Let's dissect it through technical indicators and macroeconomic considerations.

Technical Analysis of the Rebound

Technical analysis provides valuable insights into short-term price trends. Observing the Bitcoin chart reveals several key aspects of the recent rebound:

- Support Levels: The price has bounced off crucial support levels, suggesting buying pressure at those price points. This indicates strong buyer interest even during periods of market uncertainty. Analyzing these support levels, often visible on Bitcoin chart analysis websites, gives us crucial clues.

- Resistance Levels: Overcoming significant resistance levels further confirms the strength of the rebound. Breaking through these levels often signals a shift in market sentiment. Identifying and analyzing these resistance levels is critical in Bitcoin chart analysis.

- Moving Averages: The behavior of moving averages (e.g., 50-day, 200-day) provides additional confirmation. A bullish crossover, where a shorter-term moving average crosses above a longer-term one, can often indicate a potential uptrend.

- Technical Indicators: Indicators like the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) can signal overbought or oversold conditions, helping to predict potential price reversals or continuations of the current trend.

- Trading Volume: Increased trading volume during the rebound confirms the strength and legitimacy of the price increase. High volume suggests genuine market participation, not just manipulation.

[Insert relevant chart or graph here showcasing support/resistance levels, moving averages, and trading volume.]

Macroeconomic Factors Influencing Bitcoin's Price

Macroeconomic conditions significantly impact Bitcoin's price. Several factors are at play:

- Inflation and Interest Rates: High inflation often drives investors towards alternative assets like Bitcoin, which is sometimes seen as a hedge against inflation. Conversely, rising interest rates can make holding Bitcoin less attractive compared to higher-yielding bonds. The correlation between Bitcoin and inflation is a key factor in predicting future price movements.

- Economic Uncertainty: Global economic uncertainty and geopolitical instability can lead investors to seek safe haven assets, including Bitcoin. This increases demand and can drive the price higher.

- Institutional Investment: The increased participation of institutional investors, such as large corporations and hedge funds, provides a considerable boost to Bitcoin's price. Their substantial investments inject liquidity and stability into the market.

Factors Contributing to a Potential Long-Term Uptrend

While the recent Bitcoin price rebound is encouraging, several factors could contribute to a sustained long-term uptrend.

Increasing Bitcoin Adoption and Institutional Investment

The growing acceptance of Bitcoin across various sectors fuels a potential long-term uptrend:

- Business Adoption: More businesses are accepting Bitcoin as a payment method, boosting its utility and driving demand.

- Institutional Adoption: Continued institutional investment, including the launch of Bitcoin ETFs, provides a stable and significant inflow of capital.

- Global Adoption: Several countries are exploring the potential of Bitcoin as a legal tender or investment asset, further legitimizing it in the global financial landscape.

Regulatory Developments and Their Impact

Regulatory clarity and acceptance are crucial for Bitcoin's long-term growth:

- Positive Regulations: Favorable regulatory frameworks in various jurisdictions can boost investor confidence and attract more capital into the Bitcoin market.

- Negative Regulations: Conversely, overly restrictive regulations can stifle innovation and negatively impact market sentiment. Regulatory uncertainty remains a significant risk factor.

Potential Risks and Challenges

Despite the potential for a long-term uptrend, several risks and challenges remain:

Volatility and Market Corrections

The cryptocurrency market, and Bitcoin in particular, is inherently volatile:

- Market Corrections: Sharp price corrections are common and should be expected. Investors should be prepared for such volatility and manage their risk accordingly.

Regulatory Uncertainty and Geopolitical Events

External factors can significantly impact Bitcoin's price:

- Geopolitical Risks: Global political instability and uncertainty can trigger price fluctuations, as investors react to shifting geopolitical landscapes.

- Regulatory Crackdowns: Unexpected regulatory actions or crackdowns in key jurisdictions could negatively impact the Bitcoin price and market sentiment.

Bitcoin Price Rebound – A Look Ahead

The recent Bitcoin price rebound is promising, driven by a confluence of technical, macroeconomic, and regulatory factors. However, the inherent volatility of the cryptocurrency market, along with persistent regulatory uncertainty and geopolitical risks, necessitates a cautious approach. Thorough research and a balanced understanding of both the potential upsides and downsides are crucial before making any investment decisions. Monitor the Bitcoin price rebound closely, and continue your own research to make informed decisions about investing in this dynamic asset. Follow the Bitcoin uptrend closely, but remember to manage your risk effectively.

Featured Posts

-

Hong Kong Monetary Authority Intervention Hkd Usd And Interest Rate Analysis

May 08, 2025

Hong Kong Monetary Authority Intervention Hkd Usd And Interest Rate Analysis

May 08, 2025 -

Ps 5 Pro Enhanced Top Exclusive Games To Play Now

May 08, 2025

Ps 5 Pro Enhanced Top Exclusive Games To Play Now

May 08, 2025 -

Inter Milan Contracts 2026 Four Players Facing Uncertain Futures

May 08, 2025

Inter Milan Contracts 2026 Four Players Facing Uncertain Futures

May 08, 2025 -

Psg Nantes Heyecan Dolu Beraberlik

May 08, 2025

Psg Nantes Heyecan Dolu Beraberlik

May 08, 2025 -

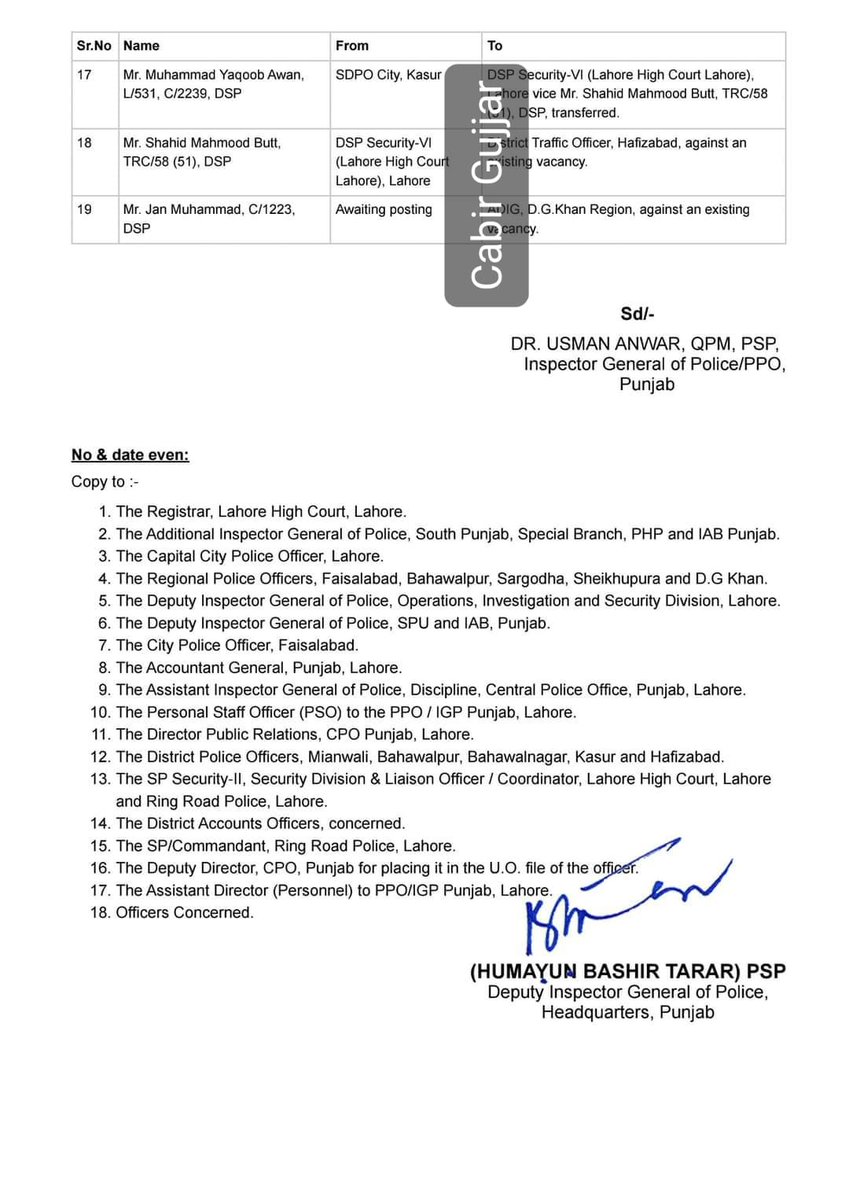

Pnjab Pwlys Myn Bra Fyslh 8 Ays Pyz Awr 21 Dy Ays Pyz Ke Tbadlwn Ka Aelan

May 08, 2025

Pnjab Pwlys Myn Bra Fyslh 8 Ays Pyz Awr 21 Dy Ays Pyz Ke Tbadlwn Ka Aelan

May 08, 2025

Latest Posts

-

Kuzma Weighs In Reaction To Tatums Popular Instagram Post

May 08, 2025

Kuzma Weighs In Reaction To Tatums Popular Instagram Post

May 08, 2025 -

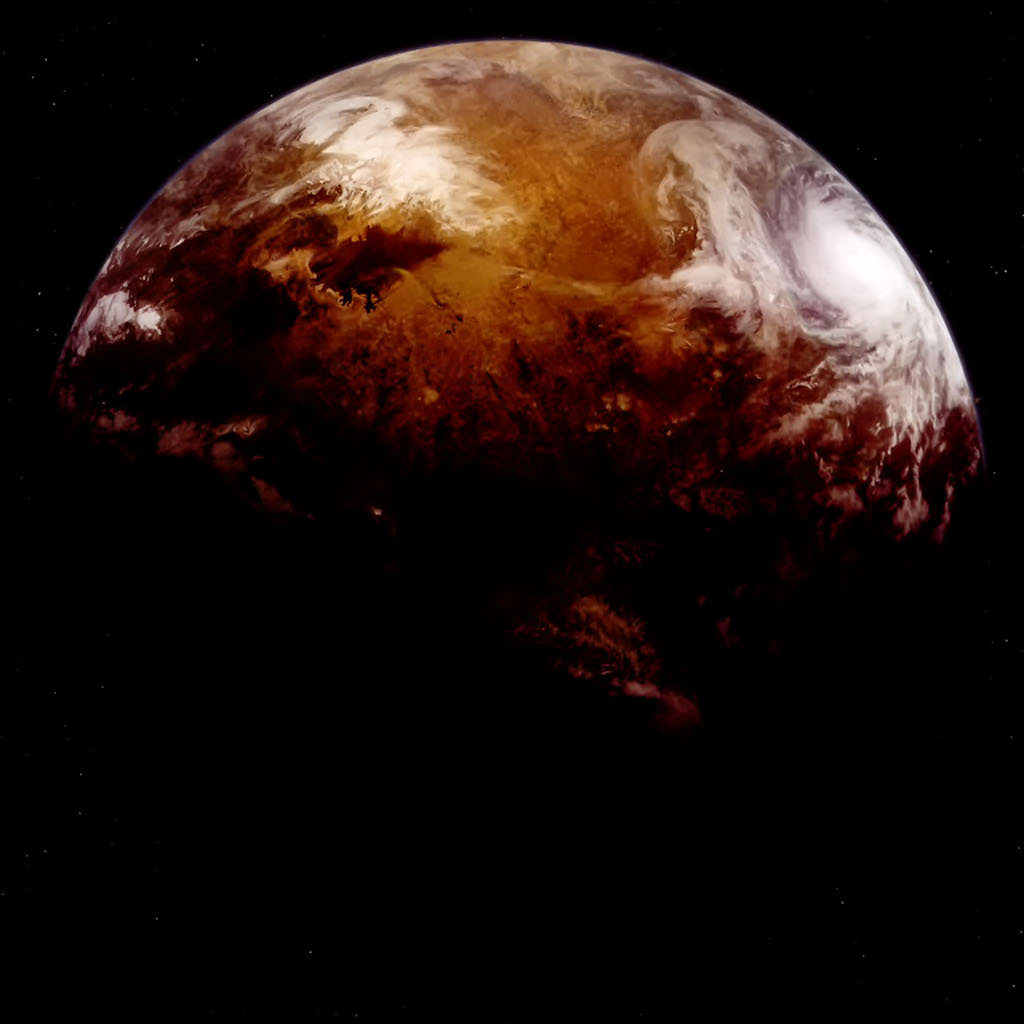

Star Wars 48 Year Old Mystery Planet Is This Finally The Year We See It

May 08, 2025

Star Wars 48 Year Old Mystery Planet Is This Finally The Year We See It

May 08, 2025 -

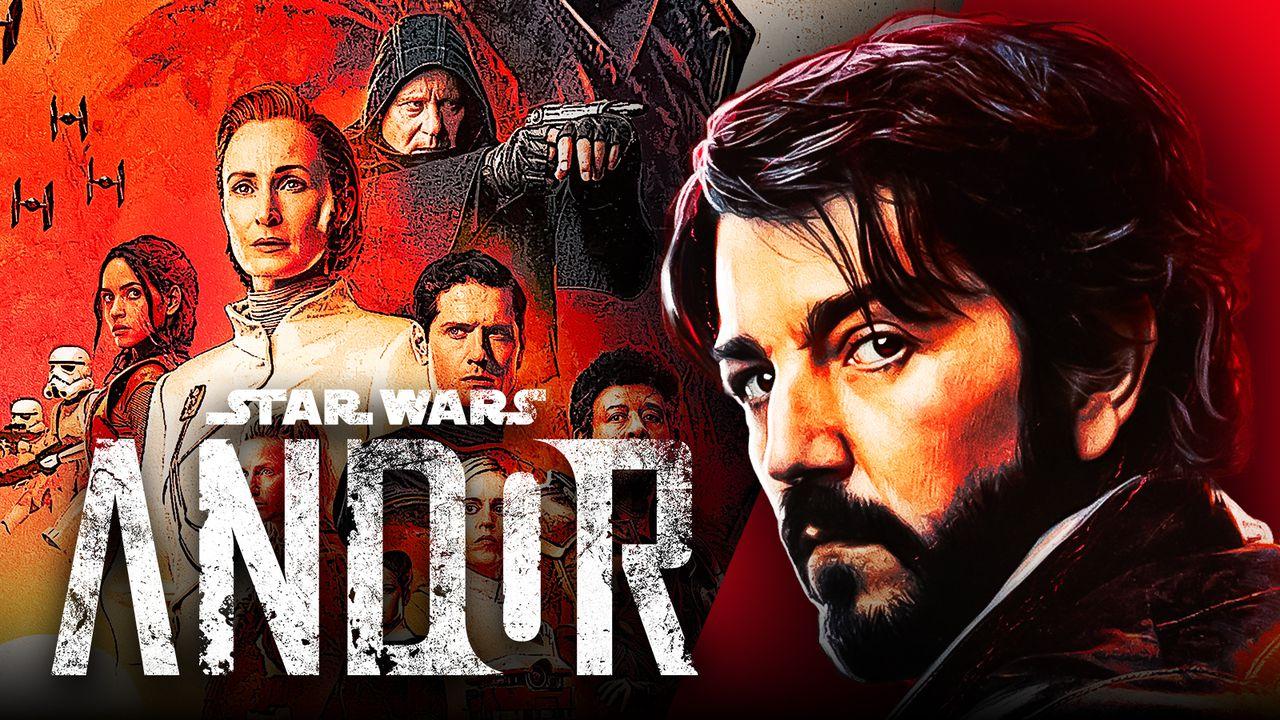

Ai Concerns Lead To Cancellation Of Star Wars Andor Novel

May 08, 2025

Ai Concerns Lead To Cancellation Of Star Wars Andor Novel

May 08, 2025 -

What Did Kyle Kuzma Say About Jayson Tatums Viral Instagram

May 08, 2025

What Did Kyle Kuzma Say About Jayson Tatums Viral Instagram

May 08, 2025 -

Is Star Wars Finally Ready To Reveal The Long Teasd Planet After 48 Years

May 08, 2025

Is Star Wars Finally Ready To Reveal The Long Teasd Planet After 48 Years

May 08, 2025