Bitcoin's Future: Analyzing A 1,500% Growth Prediction

Table of Contents

Factors Potentially Driving a 1,500% Bitcoin Price Surge

Several factors could contribute to a significant rise in Bitcoin's value, although a 1,500% increase is undeniably ambitious. Let's explore these key elements influencing the Bitcoin forecast:

Increased Institutional Adoption

- Growing acceptance by large financial institutions: More and more established financial players are recognizing Bitcoin's potential.

- Hedge funds increasing Bitcoin holdings: Hedge funds are increasingly allocating a portion of their portfolios to Bitcoin, recognizing its potential as an asset class.

- Corporate treasuries diversifying into crypto: Some corporations are adding Bitcoin to their treasury reserves, hedging against inflation and exploring new investment opportunities.

The impact of institutional adoption is significant. Companies like MicroStrategy and Tesla have made substantial Bitcoin purchases, injecting significant capital into the market and lending credibility to Bitcoin as a legitimate asset. This increased institutional involvement boosts market liquidity and can contribute to greater price stability over time, although short-term volatility remains a characteristic of the Bitcoin market. This influx of institutional money can significantly impact the Bitcoin price prediction.

Global Economic Uncertainty and Inflation

- Bitcoin as a hedge against inflation: Many investors view Bitcoin as a hedge against inflation, believing its limited supply protects its value during periods of economic instability.

- Flight to safety during economic downturns: In times of economic uncertainty, investors often seek safer havens, and Bitcoin, despite its volatility, is increasingly considered such an asset.

- Growing distrust in traditional financial systems: Growing concerns about the stability and future of traditional financial systems are driving investors towards alternative assets like Bitcoin.

Historically, Bitcoin's price has shown a correlation with periods of economic instability. As traditional assets lose value due to inflation or economic downturns, investors often turn to Bitcoin as a potential store of value, increasing demand and driving up the price. This factor significantly influences any Bitcoin forecast.

Technological Advancements and Network Upgrades

- Layer-2 scaling solutions: Solutions like the Lightning Network are improving Bitcoin's transaction speed and reducing fees, making it more user-friendly.

- Improved transaction speeds and lower fees: These improvements increase the efficiency and usability of Bitcoin, broadening its appeal.

- Development of new applications built on Bitcoin's blockchain: The Bitcoin blockchain is becoming the foundation for new applications, expanding its utility and potential value.

Technological advancements enhance Bitcoin's functionality, increasing its appeal and usability. The development of Layer-2 solutions, such as the Lightning Network, addresses scalability issues and improves transaction efficiency, potentially attracting a wider user base and driving demand. These improvements are crucial to consider within any Bitcoin investment strategy and contribute to the overall Bitcoin forecast.

Growing Regulatory Clarity

- Improved regulatory frameworks in different jurisdictions: As governments worldwide grapple with regulating cryptocurrencies, clearer and more consistent frameworks could increase investor confidence.

- Increased legitimacy of Bitcoin: Clearer regulations lend legitimacy to Bitcoin, making it a more attractive investment for institutional and individual investors alike.

- Reduced uncertainty for investors: Regulatory clarity reduces the uncertainty surrounding Bitcoin investment, encouraging greater participation in the market.

Positive regulatory developments are essential for the long-term growth of the Bitcoin market. A clearer regulatory landscape reduces uncertainty for investors, fostering greater participation and driving price appreciation. However, overly restrictive regulations could have the opposite effect.

Counterarguments and Potential Risks

While a 1,500% Bitcoin price surge is possible, several factors could hinder or negate such dramatic growth.

Regulatory Crackdowns

- Potential for stricter regulations hindering Bitcoin adoption: Governments worldwide are still developing their regulatory approaches to cryptocurrencies, and stricter regulations could stifle growth.

- Increased scrutiny from governments: Increased government scrutiny can lead to increased regulation, potentially impacting Bitcoin's price.

- Risks associated with regulatory uncertainty: Uncertainty surrounding future regulations remains a significant risk for Bitcoin investors.

Stringent regulations or outright bans in major economies could significantly impact Bitcoin's price. The regulatory landscape remains dynamic, and potential crackdowns pose a substantial threat to any bullish Bitcoin price prediction.

Market Volatility and Price Corrections

- The inherent volatility of the cryptocurrency market: The cryptocurrency market is notoriously volatile, and Bitcoin is no exception.

- Potential for significant price corrections: Large price corrections are a regular occurrence in the cryptocurrency market, posing substantial risk to investors.

- Risks of investing in volatile assets: Investing in highly volatile assets like Bitcoin requires a high-risk tolerance.

The inherent volatility of the cryptocurrency market is a significant risk factor. Significant price corrections are expected, and investors should be prepared for potential losses. Risk management and diversification are essential strategies for navigating the volatile Bitcoin market.

Competition from Altcoins

- Emergence of new cryptocurrencies with potentially superior features: New cryptocurrencies with improved technology or unique features could compete with Bitcoin for market share.

- Competition for market share: The cryptocurrency space is competitive, and Bitcoin faces ongoing competition from newer projects.

- Impact on Bitcoin’s dominance: Competition could erode Bitcoin's dominance, affecting its price.

The emergence of altcoins with potentially superior technologies or use cases presents a challenge to Bitcoin's long-term dominance. Competition for market share is a reality in the cryptocurrency space, and investors need to consider this dynamic when assessing the Bitcoin future.

Conclusion

A 1,500% increase in Bitcoin's price is a bold prediction, heavily reliant on several factors aligning favorably. While increased institutional adoption, global economic uncertainty, technological advancements, and regulatory clarity could fuel substantial growth, potential regulatory crackdowns, inherent market volatility, and competition from altcoins represent significant risks. A balanced perspective, acknowledging both the potential for growth and the significant risks, is crucial when considering such a dramatic Bitcoin price prediction.

Call to Action: Before investing in Bitcoin or any cryptocurrency, conduct thorough research and understand the inherent risks. Careful analysis of the factors influencing Bitcoin's future price, considering both the potential for growth and the significant risks involved, is essential for informed decision-making. Remember, a realistic Bitcoin price prediction requires careful consideration of all the influencing factors.

Featured Posts

-

Rusya Merkez Bankasi Kripto Para Islemleri Hakkinda Uyarida Bulundu

May 08, 2025

Rusya Merkez Bankasi Kripto Para Islemleri Hakkinda Uyarida Bulundu

May 08, 2025 -

Toronto Home Sales Plunge 23 Drop Year Over Year Prices Down 4

May 08, 2025

Toronto Home Sales Plunge 23 Drop Year Over Year Prices Down 4

May 08, 2025 -

Nereden Izleyebilirim Psg Nice Maci Canli Yayin Bilgileri

May 08, 2025

Nereden Izleyebilirim Psg Nice Maci Canli Yayin Bilgileri

May 08, 2025 -

Andor Season 2 Will It Surpass The First Season Diego Lunas Bold Claims

May 08, 2025

Andor Season 2 Will It Surpass The First Season Diego Lunas Bold Claims

May 08, 2025 -

Champions League Inter Milans Shock Win Against Bayern Munich

May 08, 2025

Champions League Inter Milans Shock Win Against Bayern Munich

May 08, 2025

Latest Posts

-

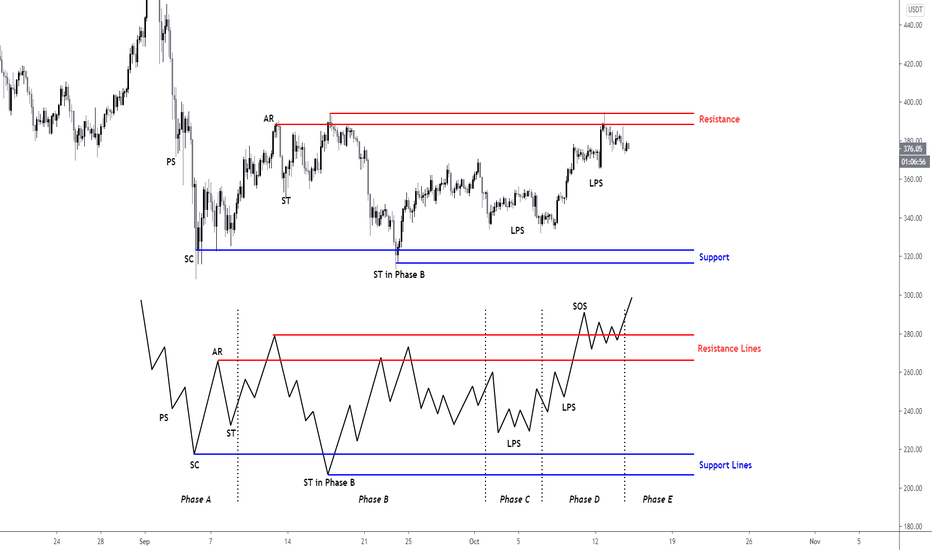

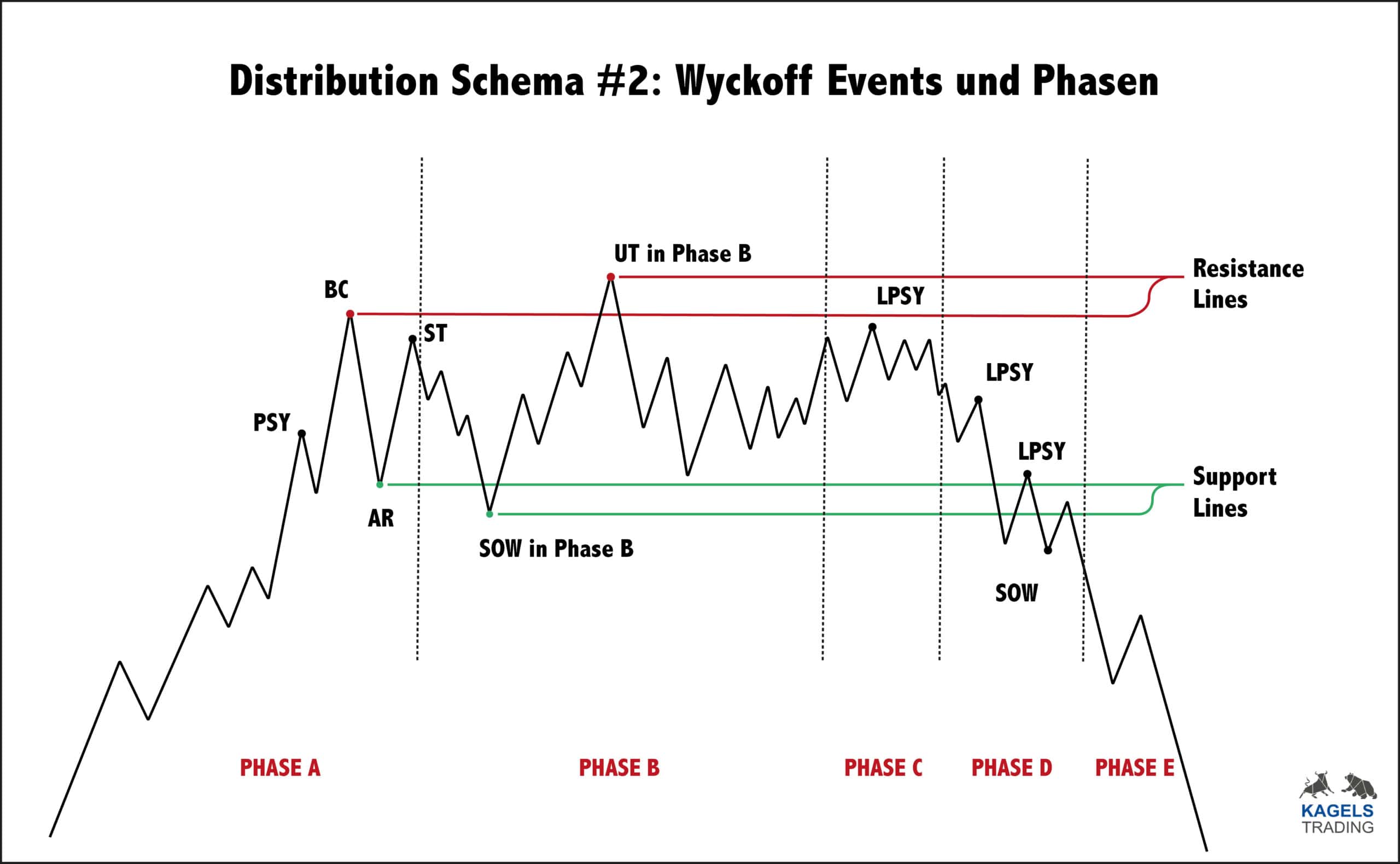

Is 2 700 The Next Ethereum Price Target Wyckoff Accumulation Signals

May 08, 2025

Is 2 700 The Next Ethereum Price Target Wyckoff Accumulation Signals

May 08, 2025 -

New Trump Media Etfs With Crypto Com What It Means For Cro Investors

May 08, 2025

New Trump Media Etfs With Crypto Com What It Means For Cro Investors

May 08, 2025 -

Ethereum Price Prediction 2 700 On The Horizon As Wyckoff Accumulation Concludes

May 08, 2025

Ethereum Price Prediction 2 700 On The Horizon As Wyckoff Accumulation Concludes

May 08, 2025 -

Trump Medias Crypto Com Etf Collaboration Analysis Of Cro Price Surge

May 08, 2025

Trump Medias Crypto Com Etf Collaboration Analysis Of Cro Price Surge

May 08, 2025 -

Trump Media And Crypto Com New Etf Partnership Sends Cro Soaring

May 08, 2025

Trump Media And Crypto Com New Etf Partnership Sends Cro Soaring

May 08, 2025