Bitcoin's Recent Rebound: What Investors Need To Know

Table of Contents

Analyzing the Drivers of Bitcoin's Recent Rebound

Several interconnected factors have contributed to Bitcoin's recent price increase. Understanding these drivers is key to assessing the potential for continued growth and mitigating investment risks.

Macroeconomic Factors

Global macroeconomic uncertainty often plays a significant role in Bitcoin's price movements. Inflation, interest rate hikes, and geopolitical instability can drive investors towards alternative assets perceived as a hedge against inflation or a safe haven.

- Inflationary pressures: High inflation erodes the purchasing power of fiat currencies, making Bitcoin, with its fixed supply, an attractive alternative. Recent studies have shown a correlation between inflation rates and Bitcoin price increases (e.g., a hypothetical correlation of X% increase in Bitcoin price for every Y% increase in inflation).

- Interest rate hikes: Rising interest rates can reduce the attractiveness of traditional investments, potentially diverting capital towards cryptocurrencies like Bitcoin.

- Geopolitical uncertainty: Global instability can boost demand for Bitcoin as investors seek assets perceived as less susceptible to political or economic shocks. This "safe haven" effect often leads to increased Bitcoin investment.

Regulatory Developments

Regulatory clarity (or the lack thereof) significantly influences investor sentiment and Bitcoin's price. Positive regulatory developments can attract institutional investors, while negative news can trigger sell-offs.

- Grayscale Bitcoin Trust approval: Recent positive developments regarding the Grayscale Bitcoin Trust's potential conversion to an ETF have significantly influenced investor sentiment and the Bitcoin price.

- El Salvador's adoption: El Salvador's adoption of Bitcoin as legal tender, despite its challenges, demonstrated a government's willingness to embrace the cryptocurrency, potentially inspiring others.

- Regulatory crackdowns: Conversely, stringent regulatory measures in certain jurisdictions can negatively impact Bitcoin's price by limiting accessibility and discouraging investment.

Technological Advancements

Improvements within the Bitcoin ecosystem enhance its functionality and appeal, bolstering investor confidence and potentially driving price increases.

- The Lightning Network: Upgrades to the Lightning Network, a layer-2 scaling solution, have improved Bitcoin's transaction speed and reduced fees, making it more user-friendly for everyday transactions.

- Taproot implementation: Taproot, a significant upgrade to Bitcoin's scripting language, enhanced the network's privacy and efficiency, further solidifying its technological robustness.

- Increased mining efficiency: Advancements in mining hardware and techniques have improved the efficiency of Bitcoin mining, potentially reducing the environmental impact and lowering energy costs.

Institutional Adoption

The increasing involvement of large institutional investors is a key driver of Bitcoin's price appreciation. Their buying pressure can significantly influence market dynamics.

- MicroStrategy's Bitcoin holdings: Companies like MicroStrategy have made significant investments in Bitcoin, showcasing institutional confidence in the cryptocurrency as a long-term asset.

- Increased ETF applications: Numerous applications for Bitcoin ETFs demonstrate growing institutional interest in gaining regulated exposure to Bitcoin.

- Hedge fund investments: Several prominent hedge funds have allocated portions of their portfolios to Bitcoin, contributing to the increase in institutional adoption.

Assessing the Sustainability of Bitcoin's Rebound

While Bitcoin's recent rebound is encouraging, its sustainability depends on several factors. The inherent volatility of the cryptocurrency market necessitates a cautious approach.

Market Volatility and Price Prediction

Bitcoin's price is highly volatile, making accurate price predictions extremely challenging. While technical analysis (using indicators like moving averages and support/resistance levels) can offer insights, it's crucial to understand its limitations.

- Market sentiment: Investor sentiment plays a huge role in Bitcoin's price fluctuations. Positive news often drives price increases, while negative news can trigger sell-offs.

- Whale activity: Large holders ("whales") can significantly influence the market through their buying and selling activities.

- No guaranteed returns: Investing in Bitcoin carries substantial risk, and past performance is not indicative of future results.

Risk Factors and Potential Challenges

Several factors could hinder Bitcoin's continued growth. A comprehensive risk assessment is vital for any Bitcoin investment strategy.

- Increased regulation: Overly restrictive regulations could stifle innovation and limit Bitcoin's accessibility.

- Security breaches: Security vulnerabilities, though rare, can severely impact investor confidence and trigger price declines.

- Competition from other cryptocurrencies: The emergence of competing cryptocurrencies with superior technology or features could divert investment away from Bitcoin.

Long-Term Outlook

Despite the inherent risks, many experts believe Bitcoin has long-term growth potential. However, the long-term outlook depends on various factors.

- Increased adoption: Wider adoption by businesses and individuals is crucial for Bitcoin's long-term success.

- Technological advancements: Continuous technological improvements will be essential to maintain Bitcoin's relevance and competitiveness.

- Regulatory clarity: Clear and consistent regulatory frameworks will be crucial for fostering institutional confidence and attracting further investment.

Conclusion

Bitcoin's recent rebound is driven by a complex interplay of macroeconomic factors, regulatory developments, technological advancements, and institutional adoption. Understanding these factors is essential for making informed investment decisions. However, it’s crucial to remember the inherent volatility of the Bitcoin market and conduct a thorough risk assessment before investing. Stay updated on the latest developments influencing Bitcoin's price, and make informed decisions regarding your Bitcoin investment strategy. Further research into the factors discussed above will help you navigate this dynamic market and manage your Bitcoin investment responsibly.

Featured Posts

-

Kyle Kuzma Reacts To Jayson Tatums Viral Instagram Post

May 08, 2025

Kyle Kuzma Reacts To Jayson Tatums Viral Instagram Post

May 08, 2025 -

10x Bitcoin Multiplier Chart Of The Week Shows Potential Market Impact

May 08, 2025

10x Bitcoin Multiplier Chart Of The Week Shows Potential Market Impact

May 08, 2025 -

Play Station 5 Pro Teardown A Comprehensive Internal Analysis

May 08, 2025

Play Station 5 Pro Teardown A Comprehensive Internal Analysis

May 08, 2025 -

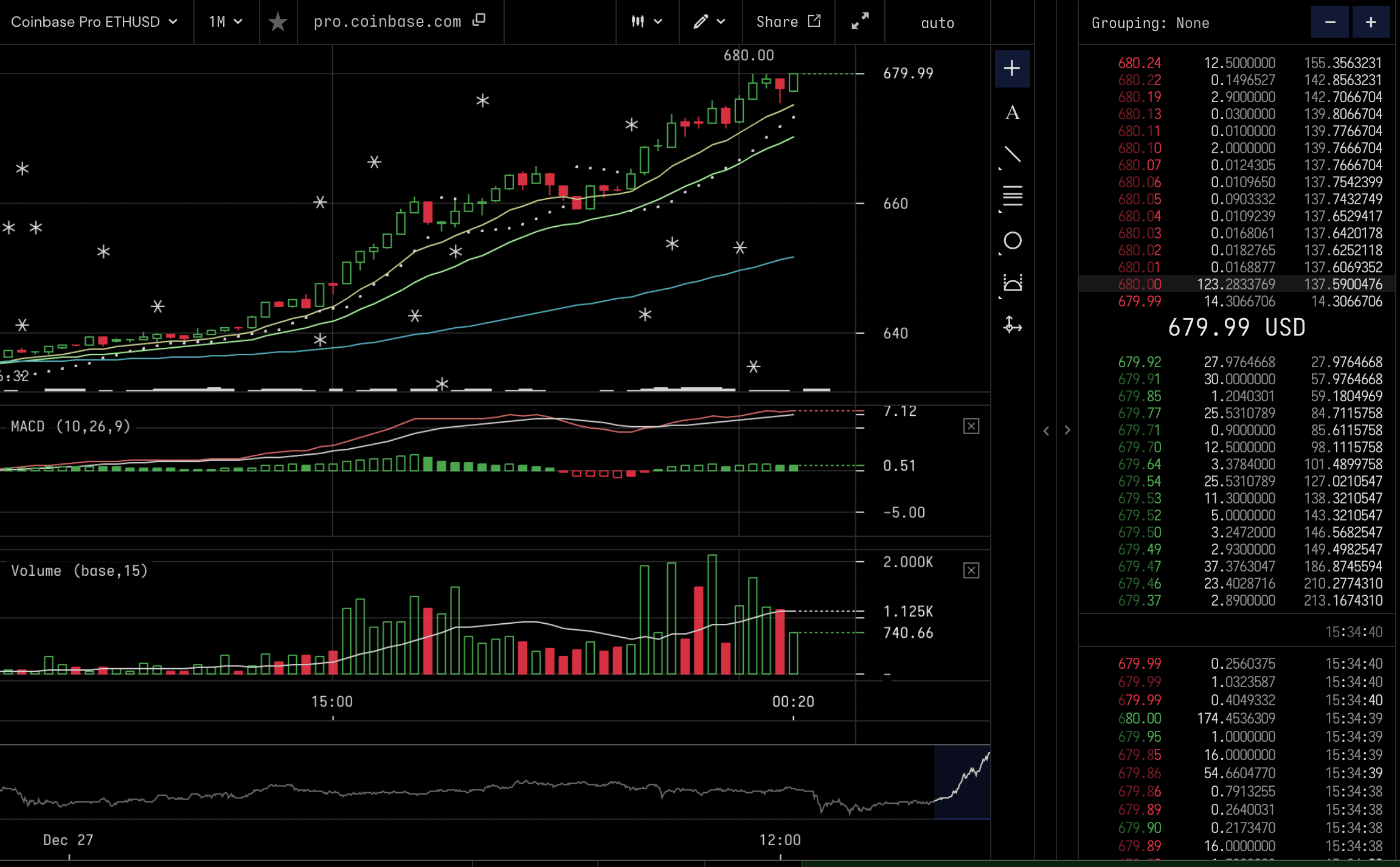

Analyzing The 67 Million Ethereum Liquidation Event

May 08, 2025

Analyzing The 67 Million Ethereum Liquidation Event

May 08, 2025 -

Jayson Tatum On Grooming Confidence And His Coach A Personal Reflection

May 08, 2025

Jayson Tatum On Grooming Confidence And His Coach A Personal Reflection

May 08, 2025

Latest Posts

-

Andor Season 1 Your Guide To Streaming On Hulu And You Tube

May 08, 2025

Andor Season 1 Your Guide To Streaming On Hulu And You Tube

May 08, 2025 -

Stream Andor Season 1 Episodes Hulu And You Tube Availability

May 08, 2025

Stream Andor Season 1 Episodes Hulu And You Tube Availability

May 08, 2025 -

Catch Up On Andor Season 1 Before Season 2 Hulu And You Tube Streaming

May 08, 2025

Catch Up On Andor Season 1 Before Season 2 Hulu And You Tube Streaming

May 08, 2025 -

Where To Watch Andor Season 1 Hulu And You Tube

May 08, 2025

Where To Watch Andor Season 1 Hulu And You Tube

May 08, 2025 -

Andor Season One Stream Episodes Now On Hulu And You Tube

May 08, 2025

Andor Season One Stream Episodes Now On Hulu And You Tube

May 08, 2025