BMO Report: Recession Fears Dampen Canadian Homebuying Activity

Table of Contents

Key Findings of the BMO Report on Reduced Homebuying Activity

The BMO report paints a picture of a significantly cooling Canadian housing market. Their analysis points to a substantial decrease in home sales and a softening in price growth across many regions.

- Bullet Point 1: The report indicates a X% decrease in home sales compared to the same period last year (replace X with the actual percentage from the report). This represents a marked slowdown from the previous year's robust activity.

- Bullet Point 2: Average home prices saw a Y% increase/decrease (replace Y with the actual percentage from the report), although regional variations are significant. Some areas experienced price drops, while others saw more moderate increases compared to previous years.

- Bullet Point 3: BMO's assessment relies on key indicators such as new listings, days on market, and sales-to-new listings ratio, all pointing towards reduced activity. The decrease in new listings suggests a reluctance among sellers to put their properties on the market.

BMO's analysis utilizes a comprehensive dataset, including data from MLS® Systems across the country, government statistics on building permits and mortgage rates, and consumer surveys gauging market sentiment. While the data provides a robust overview, limitations exist; for instance, the data may not fully capture transactions conducted outside the traditional MLS® system.

Recession Fears as a Primary Driver of the Housing Slowdown

Economic uncertainty is a key driver behind the decreased homebuying activity. Rising inflation and the anticipation of a potential recession have significantly dampened consumer confidence.

- Bullet Point 1: The Bank of Canada's aggressive interest rate hikes to combat inflation have made mortgages considerably more expensive, reducing affordability for many potential buyers. This directly impacts purchasing power and limits the number of buyers who can afford to enter the market.

- Bullet Point 2: Recessionary concerns are leading to increased caution among consumers. Many potential buyers are delaying purchases, waiting for greater economic clarity before committing to such a significant financial investment. This hesitancy is further exacerbated by the uncertainty surrounding job security.

- Bullet Point 3: Government policies aimed at cooling the housing market, coupled with gloomy economic forecasts, contribute to negative consumer sentiment and decreased demand. The overall feeling of economic insecurity is impacting purchasing decisions across the board.

As one leading economist stated, "The current climate of uncertainty is forcing many Canadians to reconsider their homebuying plans, opting for a wait-and-see approach.” This sentiment perfectly captures the shift in buyer behaviour highlighted in the BMO report.

The Impact of Rising Mortgage Rates on Canadian Homebuyers

The significant increase in mortgage rates is directly impacting homebuyer affordability. The Bank of Canada's recent actions have led to a substantial rise in borrowing costs.

- Bullet Point 1: Mortgage rates have increased from Z% to W% in the past year (replace Z and W with the actual percentage change), making monthly payments considerably higher for those with variable-rate mortgages.

- Bullet Point 2: This increase in mortgage payments significantly reduces the purchasing power of potential buyers, potentially pushing them out of the market altogether or forcing them to consider more affordable properties. Stricter lending guidelines are also impacting buyer eligibility.

- Bullet Point 3: First-time homebuyers are especially vulnerable. The higher rates create a significant barrier to entry, making it considerably harder for them to afford a down payment and manage monthly payments.

[Insert chart/graph here visually demonstrating the increase in mortgage rates and their impact on monthly payments for different mortgage amounts.]

Regional Variations in the Canadian Housing Market Slowdown

The slowdown is not uniform across Canada. While national trends are evident, regional variations exist due to differing local market dynamics.

- Bullet Point 1: Certain provinces, like [mention specific provinces with more significant slowdowns], are experiencing more dramatic declines in sales and price growth than others.

- Bullet Point 2: These regional differences can be attributed to factors such as variations in local job markets, population growth rates, and the overall supply and demand dynamics within each region. Stronger local economies tend to experience a less significant impact.

- Bullet Point 3: Based on the BMO report's projections, certain areas are expected to continue experiencing a slowdown, while others might show signs of stabilization or even modest growth in the coming months.

[Insert map here showing regional variations in housing market activity.]

Conclusion

The BMO report clearly signals a significant cooling in the Canadian housing market, primarily attributed to recession fears and increased mortgage rates. This slowdown is not uniform geographically, impacting buyers differently based on location and financial situation. The need for careful consideration and informed decisions is paramount in this evolving real estate landscape.

Call to Action: Understanding the implications of the BMO report on Canadian homebuying activity is crucial for navigating the current market. Stay informed on the latest market trends and consult with a financial advisor before making any major real estate decisions. Learn more about the impact of recession fears on the Canadian housing market by visiting [link to related resource or BMO report].

Featured Posts

-

Why Middle Management Matters Boosting Company Success And Employee Satisfaction

May 07, 2025

Why Middle Management Matters Boosting Company Success And Employee Satisfaction

May 07, 2025 -

Fortnite Skins And Cosmetics A Collectors Guide

May 07, 2025

Fortnite Skins And Cosmetics A Collectors Guide

May 07, 2025 -

Le Lioran Depuis Onet Le Chateau Activites Et Hebergements

May 07, 2025

Le Lioran Depuis Onet Le Chateau Activites Et Hebergements

May 07, 2025 -

How The Pope Is Elected A Guide To The Conclave Process

May 07, 2025

How The Pope Is Elected A Guide To The Conclave Process

May 07, 2025 -

Simone Biles Reflexiones Sobre Su Participacion En Los Angeles 2028

May 07, 2025

Simone Biles Reflexiones Sobre Su Participacion En Los Angeles 2028

May 07, 2025

Latest Posts

-

2 0 2 0

May 07, 2025

2 0 2 0

May 07, 2025 -

2 0

May 07, 2025

2 0

May 07, 2025 -

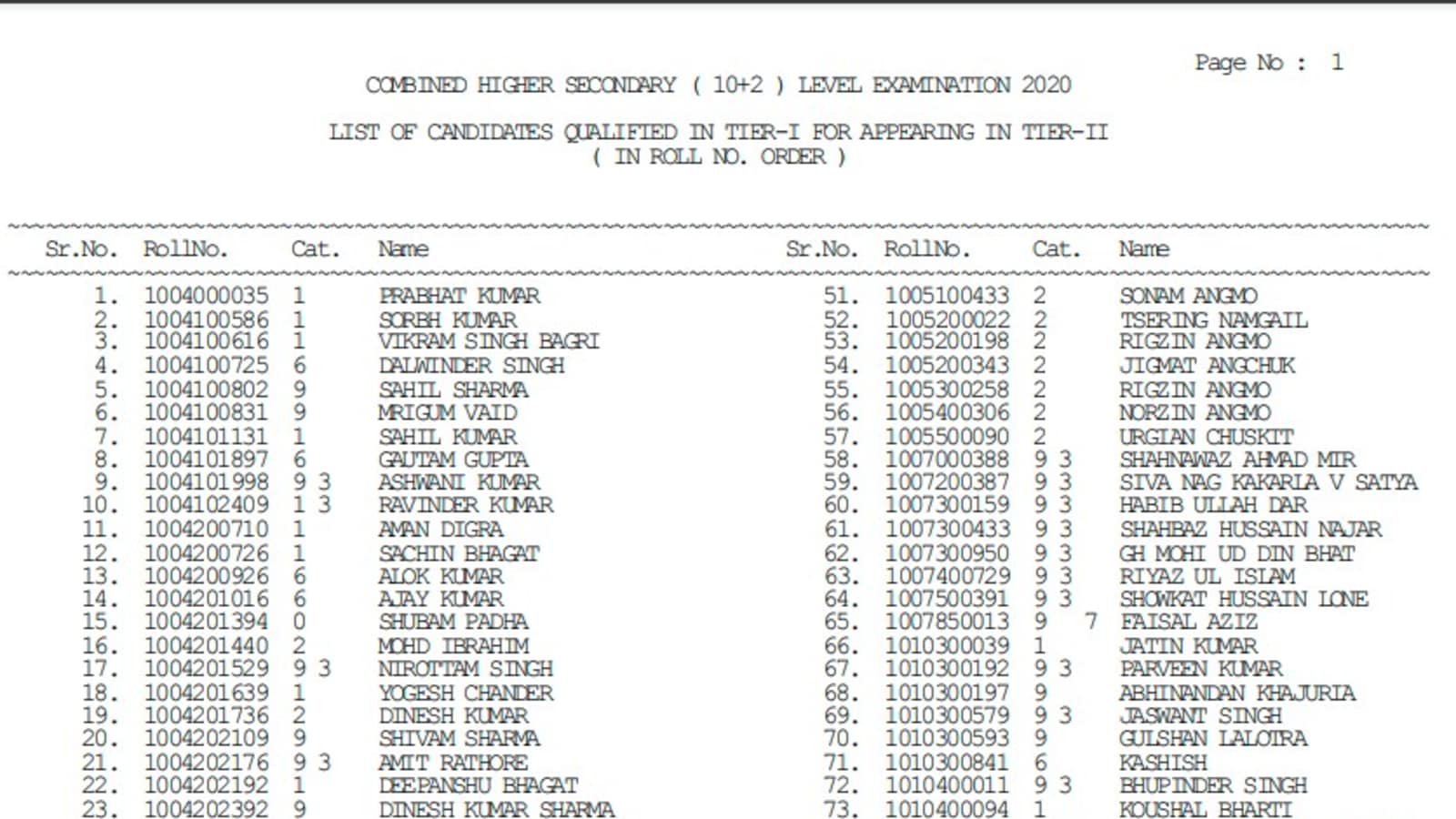

Ssc Chsl 2025 Final Results Cut Off Marks And Merit List

May 07, 2025

Ssc Chsl 2025 Final Results Cut Off Marks And Merit List

May 07, 2025 -

Nba Game Heats Up Anthony Edwards In Shoving Match With Lakers Opponent

May 07, 2025

Nba Game Heats Up Anthony Edwards In Shoving Match With Lakers Opponent

May 07, 2025 -

Ssc Chsl Final Result 2025 How To Check And Download

May 07, 2025

Ssc Chsl Final Result 2025 How To Check And Download

May 07, 2025