BofA On Stock Market Valuations: A Reason For Calm

Table of Contents

H2: BofA's Key Arguments for a Calm Approach

BofA's optimistic outlook isn't based on blind faith; it's rooted in a thorough analysis of several key factors influencing stock market valuations. Their report highlights several crucial arguments supporting a calm investment approach:

H3: Favorable Earnings Growth Projections

BofA predicts continued corporate earnings growth, a crucial factor offsetting concerns about potentially high valuations. Their analysts forecast robust earnings growth across various sectors, suggesting that current market prices are not entirely detached from underlying fundamentals. Key sectors showing strong growth potential, according to BofA, include:

- Technology: Driven by ongoing innovation and digital transformation.

- Healthcare: Benefiting from an aging population and advancements in medical technology.

- Financials: Positioned to benefit from rising interest rates (though this is a double-edged sword, as discussed below).

These projections suggest that despite high valuations in certain areas, future earnings growth could justify current prices and even support further upward movement over the long term.

H3: Inflation's Impact and the Fed's Response

BofA acknowledges the impact of inflation on stock market valuations. However, their analysis suggests that the Federal Reserve's response, while impacting interest rates, is likely to be measured and ultimately contribute to a stable, albeit slower, economic growth environment. The nuances of their predictions include:

- Inflation Peak Passed: BofA anticipates inflation peaking and gradually declining, reducing pressure on the Fed to aggressively raise interest rates.

- Controlled Rate Hikes: The Fed’s approach is expected to be measured, aiming to manage inflation without triggering a recession.

- Economic Soft Landing: BofA forecasts a “soft landing” scenario, meaning a slowdown in economic growth without a full-blown recession. This scenario would be positive for equity markets.

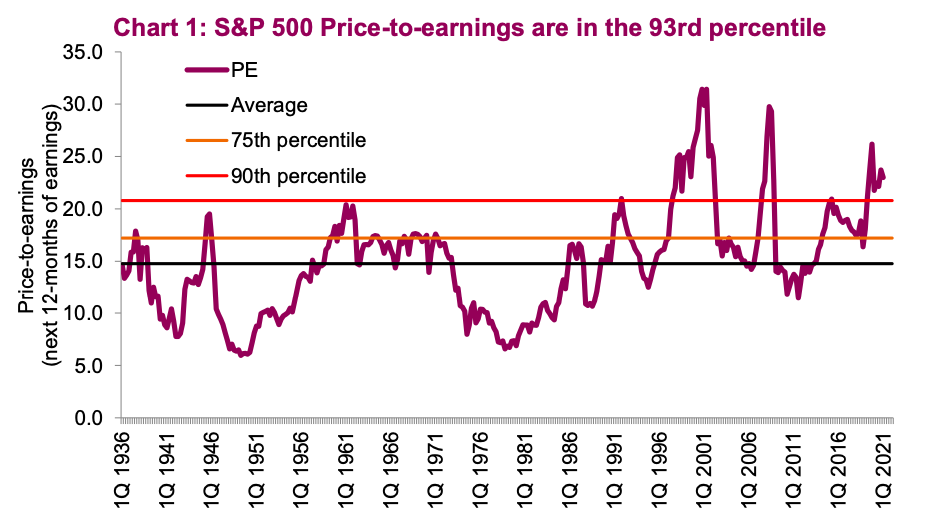

H3: Valuation Metrics: A Balanced Perspective

BofA's assessment of current valuations isn't simply a blanket statement of "everything is fine." They acknowledge the elevated price-to-earnings (P/E) ratios in some sectors. However, they also consider other valuation metrics, including:

- Price-to-Sales Ratios: These offer a broader perspective than P/E ratios, especially for companies with lower or negative earnings.

- Free Cash Flow Yield: This metric considers a company's actual cash generation, providing a more realistic valuation benchmark.

- Discounted Cash Flow Analysis: A more sophisticated model used to assess the long-term value of a company.

By considering a range of metrics, BofA paints a more nuanced picture of market valuations, acknowledging both the high valuations in some areas while maintaining a measured optimism about the overall market outlook.

H2: Understanding the Underlying Data and Methodology

BofA's conclusions are grounded in rigorous market research and analysis. Their methodology involves a combination of quantitative and qualitative approaches:

H3: Data Sources and Reliability

BofA leverages a vast array of data sources, including:

- Company financial statements: Providing fundamental data on earnings, revenue, and balance sheets.

- Economic indicators: Including inflation rates, interest rates, and GDP growth figures.

- Market data: Such as trading volumes, market capitalization, and stock price movements.

The reliability of BofA's data stems from their access to premium data providers and their experienced team of analysts.

H3: Limitations and Potential Risks

It's crucial to acknowledge that any market analysis has limitations. BofA's report acknowledges potential risks, including:

- Unforeseen geopolitical events: These can significantly impact market sentiment and valuations.

- Unexpected changes in monetary policy: The Fed’s actions are subject to change based on economic developments.

- Sector-specific risks: Certain sectors might face unique challenges not captured in broader market analyses.

These limitations highlight the importance of investors conducting their own due diligence and diversifying their portfolios.

H2: Practical Implications for Investors

BofA’s report offers valuable insights that can inform your investment strategies:

H3: Maintaining a Long-Term Perspective

The report reinforces the importance of focusing on long-term investment goals. Avoid knee-jerk reactions to short-term market fluctuations.

H3: Strategic Asset Allocation

BofA's analysis can help you fine-tune your asset allocation. Consider shifting towards sectors with strong growth potential as identified in the report, while maintaining a diversified portfolio.

H3: Diversification and Risk Management

Diversification remains crucial, especially given the identified potential risks. Implement a well-defined risk management strategy, considering your individual risk tolerance.

3. Conclusion:

BofA's report on stock market valuations provides a much-needed dose of calm amidst current market volatility. Their analysis, based on robust data and a balanced perspective, suggests that while risks exist, the outlook isn't entirely bleak. The key takeaways include favorable earnings growth projections, a measured response from the Federal Reserve, and the importance of considering a range of valuation metrics. This information should inform your investment decisions, emphasizing the need for a long-term perspective, strategic asset allocation, and thorough risk management. Review BofA's full report to gain a comprehensive understanding, and remember to consider your own risk tolerance and seek professional advice if needed. Stay calm and informed about stock market valuations with BofA's insights.

Featured Posts

-

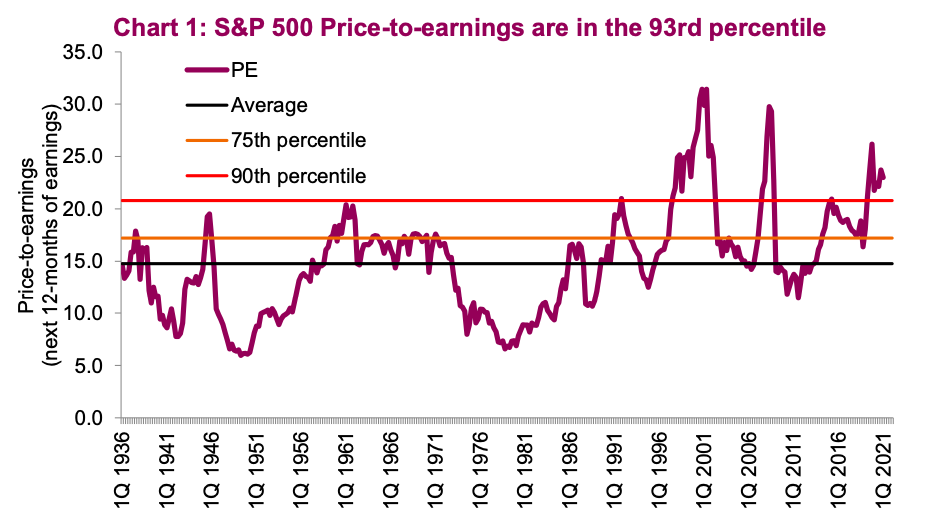

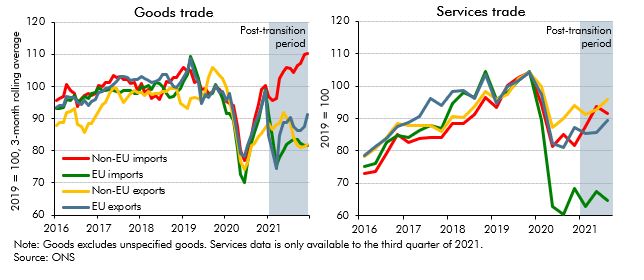

Uk Luxury Sector Brexits Impact On Eu Trade

May 20, 2025

Uk Luxury Sector Brexits Impact On Eu Trade

May 20, 2025 -

Baggelis Giakoymakis Mia Analysi Tis Katastrofis Tis Anthropinis Aksioprepeias

May 20, 2025

Baggelis Giakoymakis Mia Analysi Tis Katastrofis Tis Anthropinis Aksioprepeias

May 20, 2025 -

Wwe Raw Results Winners And Grades For May 19 2025

May 20, 2025

Wwe Raw Results Winners And Grades For May 19 2025

May 20, 2025 -

Burnham And Highbridges Historical Photo Archive Opening Tomorrow

May 20, 2025

Burnham And Highbridges Historical Photo Archive Opening Tomorrow

May 20, 2025 -

Madrid Open Sabalenka Secures Opening Victory

May 20, 2025

Madrid Open Sabalenka Secures Opening Victory

May 20, 2025