BofA On Stock Market Valuations: Why Investors Can Stay Calm

Table of Contents

BofA's Key Findings on Current Stock Market Valuations

BofA's assessment of current stock market valuations employs a range of established metrics, including the Price-to-Earnings ratio (P/E) and the cyclically adjusted price-to-earnings ratio (CAPE), also known as the Shiller P/E ratio. These metrics compare current market prices to historical earnings, providing a context for evaluating whether the market is overvalued or undervalued.

Their analysis, based on extensive data, reveals specific findings: While some sectors show signs of elevated valuations, the overall picture, according to BofA, isn't one of extreme overvaluation. They acknowledge the market's recent performance, but suggest that factors beyond simple valuation metrics need consideration.

- P/E Ratio: BofA's report (you would insert the specific data here from the BofA report – e.g., "placed the current P/E ratio at 22, slightly above the long-term average of 17.")

- CAPE Ratio: (Insert specific data from the BofA report – e.g., "The CAPE ratio stood at 30, higher than its historical average, but not exceptionally so compared to other periods of market uncertainty.")

- Sectoral Analysis: (Insert specific data from the BofA report – e.g., "The technology sector shows signs of relative overvaluation, while the energy sector appears undervalued based on BofA's projections.")

Understanding BofA's Rationale for a Calm Approach

BofA's measured outlook isn't solely based on valuation metrics. They consider several crucial economic factors:

- Interest Rate Expectations: BofA incorporates the Federal Reserve's interest rate policies and their potential impact on corporate earnings and investor sentiment into their analysis.

- Inflation: The report assesses the influence of inflation on corporate profits and its effect on market valuations. Their analysis likely weighs the impact of inflation on future earnings forecasts.

- Corporate Earnings Growth: BofA's analysis likely projects future corporate earnings growth, considering various economic factors, and uses this projection to contextualize the current market valuations.

Key economic indicators and their impact on stock valuations are central to BofA's reasoning. For example, a slowing inflation rate, even if still elevated, may lessen pressure on the Federal Reserve to continue raising interest rates, potentially boosting market confidence. BofA’s forecast for future earnings growth – even if slower than previous years – could support current valuations. The potential for market corrections is acknowledged, but their severity, according to BofA's assessment, might be less dramatic than some fear.

Factors Contributing to Market Volatility (and Why Not to Panic)

Investor anxiety is often fueled by legitimate concerns:

- Geopolitical Uncertainty: Global events create uncertainty and can impact market sentiment.

- Inflation Concerns: Persistent inflation erodes purchasing power and raises concerns about corporate profitability.

However, BofA argues that many of these anxieties are either already factored into current market prices or are manageable within the context of their broader economic outlook. Their analysis likely accounts for the impact of geopolitical events on specific sectors and assesses the overall market's resilience to these shocks. The argument regarding inflation usually includes the point that inflation expectations are already priced into the market.

BofA's Investment Strategies and Recommendations (Optional)

(This section should be included only if BofA's report provides specific investment recommendations. Replace the bracketed information below with the actual recommendations from the report.)

Based on their valuation analysis, BofA might suggest specific investment strategies:

- Recommendation 1: [Insert specific recommendation from BofA's report, e.g., "Increased allocation to value stocks."] Rationale: [Insert rationale from BofA's report]

- Recommendation 2: [Insert specific recommendation, e.g., "Maintaining a diversified portfolio."] Rationale: [Insert rationale]

- Recommendation 3: [Insert specific recommendation, e.g., "Considering long-term investment horizons."] Rationale: [Insert rationale]

Maintaining Calm Amidst Market Fluctuations Based on BofA's Insights

BofA's analysis suggests that while current stock market valuations aren't necessarily at historically low levels, they also don't necessarily indicate imminent collapse. The firm considers a multitude of economic factors beyond simple P/E ratios, demonstrating that market anxieties, while valid, might be overstated. Factors contributing to market volatility, such as geopolitical risks and inflation, are acknowledged but deemed, in their analysis, to be mostly priced into the market or manageable.

Understand BofA's perspective on stock market valuations and develop your own informed investment strategy. Stay calm and make well-informed decisions based on thorough research. Remember that this is just one analysis; always conduct your own due diligence before making any investment decisions.

Featured Posts

-

Parasal Sans Nisan Ayinda Zengin Olmaya En Yakin Burclar

May 24, 2025

Parasal Sans Nisan Ayinda Zengin Olmaya En Yakin Burclar

May 24, 2025 -

From Bishop To Viral Sensation A Tik Tokers Unexpected Pope Leo Story

May 24, 2025

From Bishop To Viral Sensation A Tik Tokers Unexpected Pope Leo Story

May 24, 2025 -

Accessibility In Games Feeling The Pinch Of Industry Cutbacks

May 24, 2025

Accessibility In Games Feeling The Pinch Of Industry Cutbacks

May 24, 2025 -

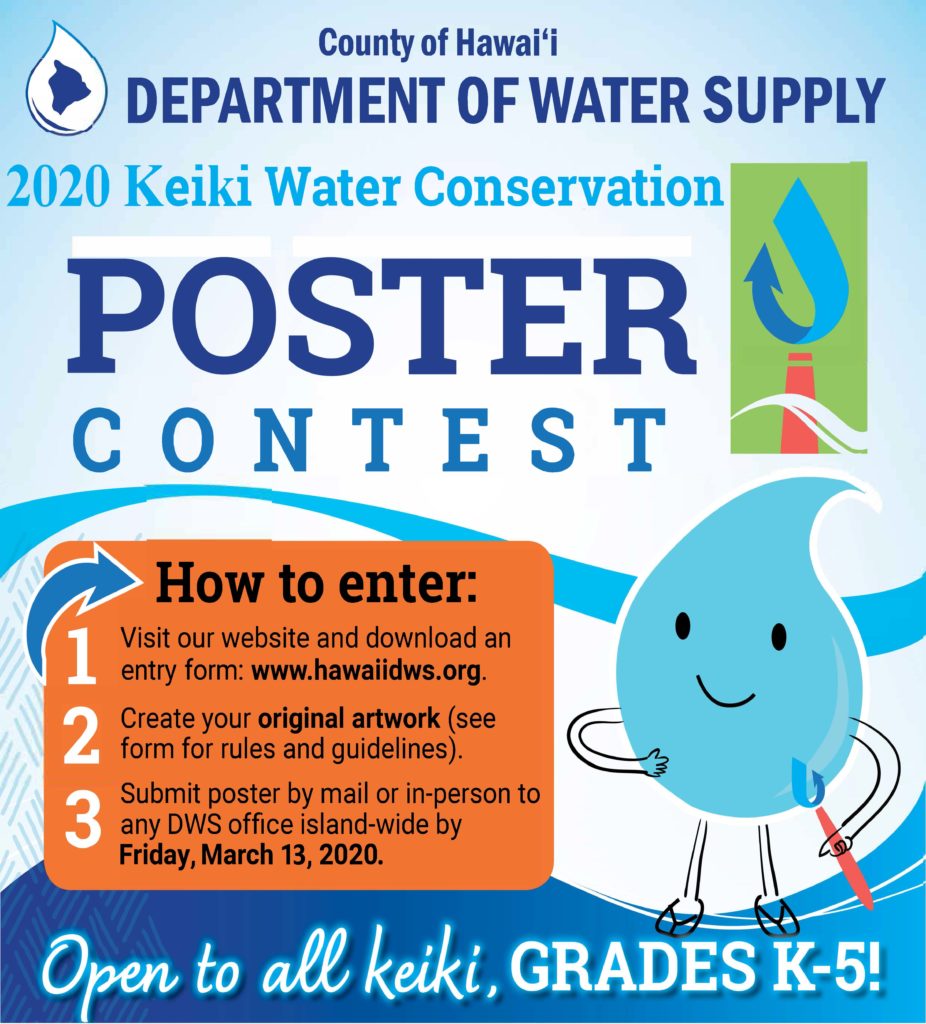

Sew A Lei Hawaii Keiki Poster Contest For Memorial Day

May 24, 2025

Sew A Lei Hawaii Keiki Poster Contest For Memorial Day

May 24, 2025 -

Finding Tranquility Your Escape To The Country Awaits

May 24, 2025

Finding Tranquility Your Escape To The Country Awaits

May 24, 2025