BofA's Reassurance: Why Current Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Positive Outlook and its Underlying Rationale

BofA maintains a generally positive outlook on the current market, despite the understandable jitters among investors. This optimism stems from several key factors pointing towards sustained, albeit potentially slower, economic growth. Their analysis emphasizes the resilience of the US economy, supported by several significant drivers:

- Robust Corporate Earnings: Many companies continue to report strong earnings, demonstrating adaptability and continued profitability even in the face of economic headwinds. BofA's research highlights a significant number of companies exceeding expectations, suggesting underlying strength in the corporate sector.

- Resilient Consumer Spending: Consumer spending remains a significant pillar of the US economy, showing sustained strength despite inflation concerns. BofA’s models suggest consumer confidence, while fluctuating, remains relatively healthy.

- Projected GDP Growth: BofA's projections for GDP growth, while perhaps more moderate than previous years, still indicate positive expansion, suggesting continued economic momentum. (Specific data points from BofA's latest research report should be inserted here if available).

- Bullish Sectors: BofA's analysis pinpoints specific sectors poised for growth, such as technology (particularly AI-related companies), healthcare, and renewable energy. These sectors are expected to drive future market performance.

- Favorable Economic Indicators: BofA considers several key economic indicators, including employment figures and inflation rates (though acknowledging inflationary pressures), to support their overall positive forecast.

Addressing Valuation Concerns: Why Current Prices Aren't Overblown

While acknowledging investor concerns about seemingly high stock valuations, BofA offers several counterarguments. Many investors worry about Price-to-Earnings (P/E) ratios and other valuation metrics appearing elevated compared to historical averages. However, BofA's analysis emphasizes the following:

- Low Interest Rates (Historically): Historically low interest rates, even if rising, still support higher valuations compared to periods of higher interest rates. Lower borrowing costs allow companies to invest and grow more readily.

- Strong Company Fundamentals: BofA points to strong fundamentals in many companies, including robust balance sheets and consistent cash flows, justifying higher valuations based on intrinsic value.

- Future Growth Potential: BofA's analysis emphasizes the significant long-term growth potential for many companies, particularly in emerging technologies. This potential future growth justifies current, seemingly high valuations.

- Valuation Metrics Context: BofA uses a range of valuation metrics beyond simple P/E ratios, considering factors like Price-to-Sales and Price-to-Book ratios for a more nuanced assessment. Specific examples of companies where BofA sees value despite high P/E ratios should be included here (if available from their reports).

Diversification and Risk Management: BofA's Strategic Recommendations

BofA emphasizes the importance of diversification and risk management in the current market climate. They advocate a well-balanced portfolio that accounts for potential market fluctuations. Their recommendations include:

- Asset Allocation: BofA suggests a diversified portfolio containing a mix of asset classes, including equities (stocks), bonds, and potentially alternative investments like real estate. The specific allocation would depend on individual investor risk tolerance and goals.

- Risk Mitigation Strategies: BofA advises on strategies like dollar-cost averaging (investing regularly regardless of market fluctuations) and hedging (using financial instruments to protect against losses) to reduce risk.

- Long-Term Investment Horizon: BofA strongly recommends a long-term investment strategy, focusing on consistent investing rather than attempting to time the market. This helps weather short-term volatility and capitalize on long-term growth.

Comparing BofA's Analysis to Other Market Perspectives

While BofA presents a positive outlook, it's essential to compare their analysis to other prominent financial institutions. (Insert here a comparison with other reputable financial institutions, such as Goldman Sachs, JP Morgan Chase, etc., highlighting areas of agreement and disagreement, with specific examples if available.) BofA's perspective might be more compelling due to [insert reasons, e.g., their extensive research base, focus on specific market sectors, or a unique analytical methodology].

BofA's Reassurance and Your Investment Strategy

In summary, BofA's analysis suggests that current stock market valuations, while perhaps elevated in some areas, aren't necessarily a cause for widespread alarm. Their positive outlook rests on strong corporate earnings, resilient consumer spending, and projected economic growth. The key takeaway is the importance of diversification and a long-term investment strategy. By understanding BofA's reassurance on current stock market valuations and implementing a well-diversified portfolio, investors can navigate the market's uncertainties more confidently. To assess your investment strategy in light of BofA's positive market outlook and develop a personalized plan that aligns with your risk tolerance, consult with a qualified financial advisor. [Insert link to BofA's relevant report, if available].

Featured Posts

-

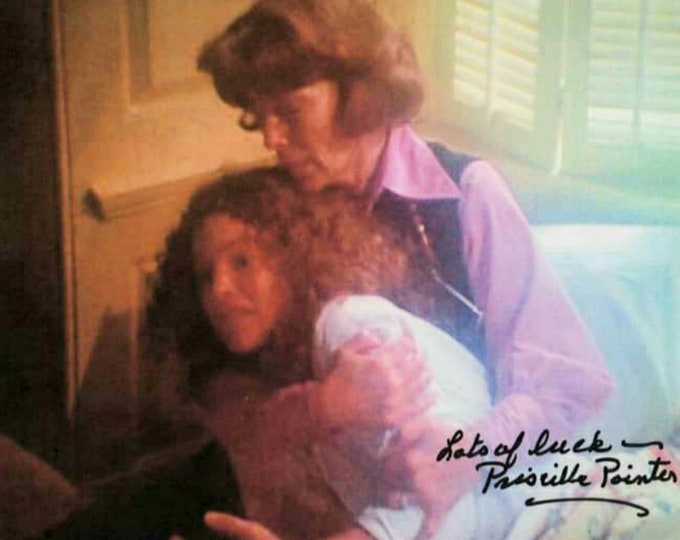

Veteran Actress Priscilla Pointer Star Of Dallas And Carrie Passes Away

May 02, 2025

Veteran Actress Priscilla Pointer Star Of Dallas And Carrie Passes Away

May 02, 2025 -

Bbc Faces Unprecedented Challenges After 1bn Funding Crisis

May 02, 2025

Bbc Faces Unprecedented Challenges After 1bn Funding Crisis

May 02, 2025 -

New Harry Potter Shop Opens In Chicago Must Visit For Fans

May 02, 2025

New Harry Potter Shop Opens In Chicago Must Visit For Fans

May 02, 2025 -

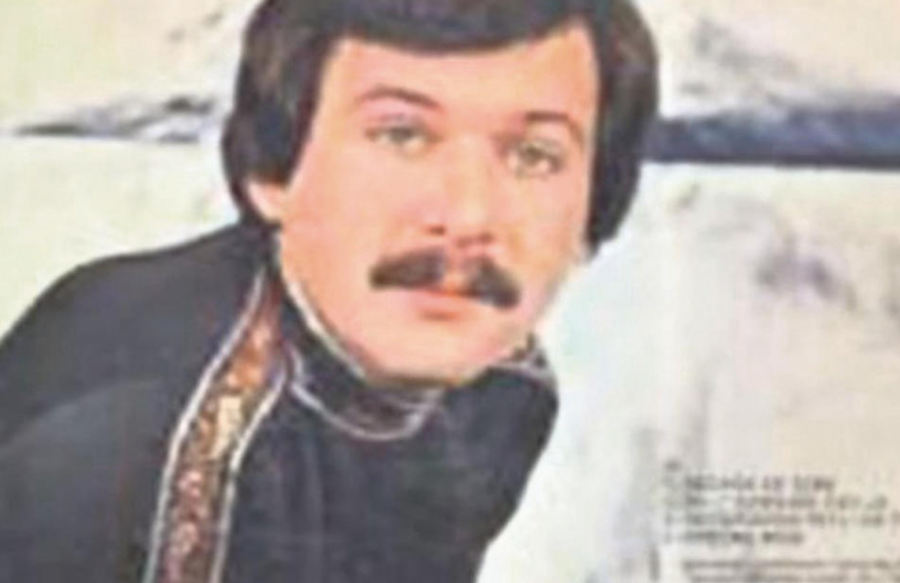

Tragedija I Inspiracija Istina Iza Pesme Kad Sam Se Vratio

May 02, 2025

Tragedija I Inspiracija Istina Iza Pesme Kad Sam Se Vratio

May 02, 2025 -

Eco Flow Wave 3 Review Portable Ac And Heater Performance Tested

May 02, 2025

Eco Flow Wave 3 Review Portable Ac And Heater Performance Tested

May 02, 2025