BofA's Reassurance: Why High Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Rationale: Understanding the Drivers of High Valuations

BofA's positive outlook, despite high stock market valuations, isn't based on blind optimism. Their analysis points to several fundamental factors driving these valuations, making them less alarming than they might initially appear. These factors include:

-

Low Interest Rates: Ultra-low interest rates significantly impact discounted cash flow models, a key valuation metric. Lower discount rates increase the present value of future earnings, leading to higher valuations for companies, even if their earnings growth isn't exceptionally high. This is a key element of BofA's analysis of high P/E ratios.

-

Strong Corporate Earnings Growth: Many companies have demonstrated robust earnings growth in recent years. This positive trend, particularly in certain sectors, supports higher price-to-earnings (P/E) ratios, justifying, at least partially, the current high valuations. BofA’s analysis highlights the importance of considering this earnings growth when evaluating high P/E ratios.

-

Technological Innovation: Technological advancements continue to drive significant productivity gains and create new growth opportunities across various sectors. This long-term potential for innovation influences investors' expectations for future growth, leading to higher valuations for companies positioned to benefit from these advancements. Keywords: BofA analysis, high P/E ratios, discounted cash flow, corporate earnings, technological innovation, investor confidence.

-

Increased Investor Confidence: Despite market volatility, investor confidence in certain sectors, particularly technology and healthcare, remains relatively high. This confidence fuels demand, further contributing to elevated valuations.

Long-Term Growth Potential: Why BofA Remains Optimistic

BofA's optimism isn't solely rooted in the present; it extends to their projections for long-term economic and market growth. Their analysis suggests continued expansion, although possibly at a moderated pace compared to recent years. BofA identifies several sectors poised for significant growth, including:

-

Technology: Continued innovation in artificial intelligence, cloud computing, and other areas will likely drive substantial growth in this sector.

-

Healthcare: An aging population and advancements in medical technology are fueling demand for healthcare services and related products.

BofA emphasizes that a long-term investment strategy is crucial. Short-term market fluctuations should be viewed within the broader context of long-term growth potential. Keywords: long-term investment, economic growth, market projections, growth stocks, sector analysis.

Managing Risk in a High-Valuation Market: BofA's Recommendations

While BofA maintains a positive outlook, they acknowledge the risks associated with high valuations. They recommend investors adopt several strategies to mitigate these risks:

-

Diversification: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) is crucial to reduce portfolio volatility.

-

Focus on Quality: Prioritize companies with strong fundamentals, consistent earnings growth, and a sustainable competitive advantage. This involves thorough fundamental analysis before stock picking.

-

Regular Rebalancing: Periodically rebalance your portfolio to maintain your desired asset allocation and avoid becoming overexposed to any single sector or asset class.

-

Value Investing: Consider incorporating value investing strategies alongside growth investing, seeking undervalued companies with strong potential for future growth. Keywords: risk management, portfolio diversification, asset allocation, value investing, fundamental analysis, stock picking.

Addressing Common Investor Concerns about High Stock Market Valuations

High valuations naturally trigger anxieties among investors. Common concerns include the fear of a market correction or even a crash. BofA addresses these concerns by highlighting:

-

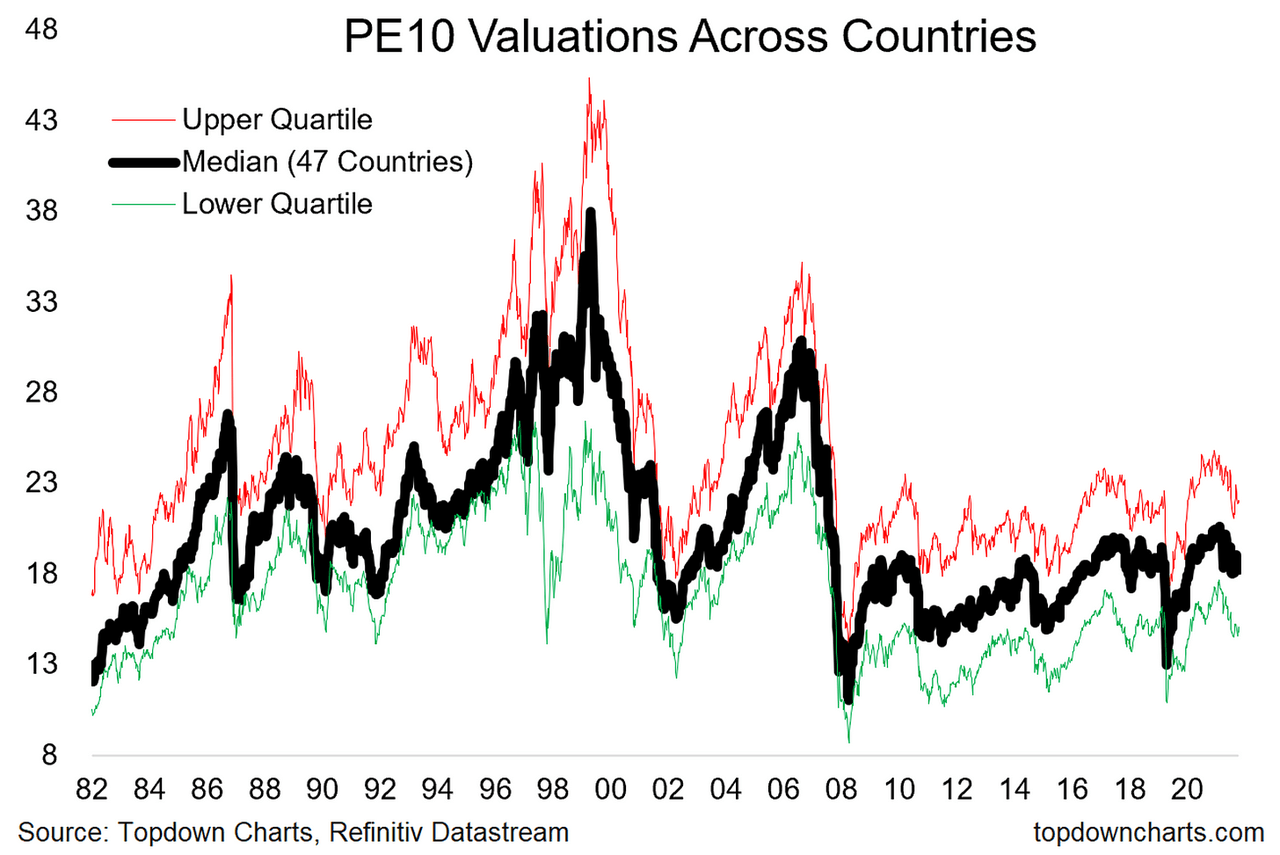

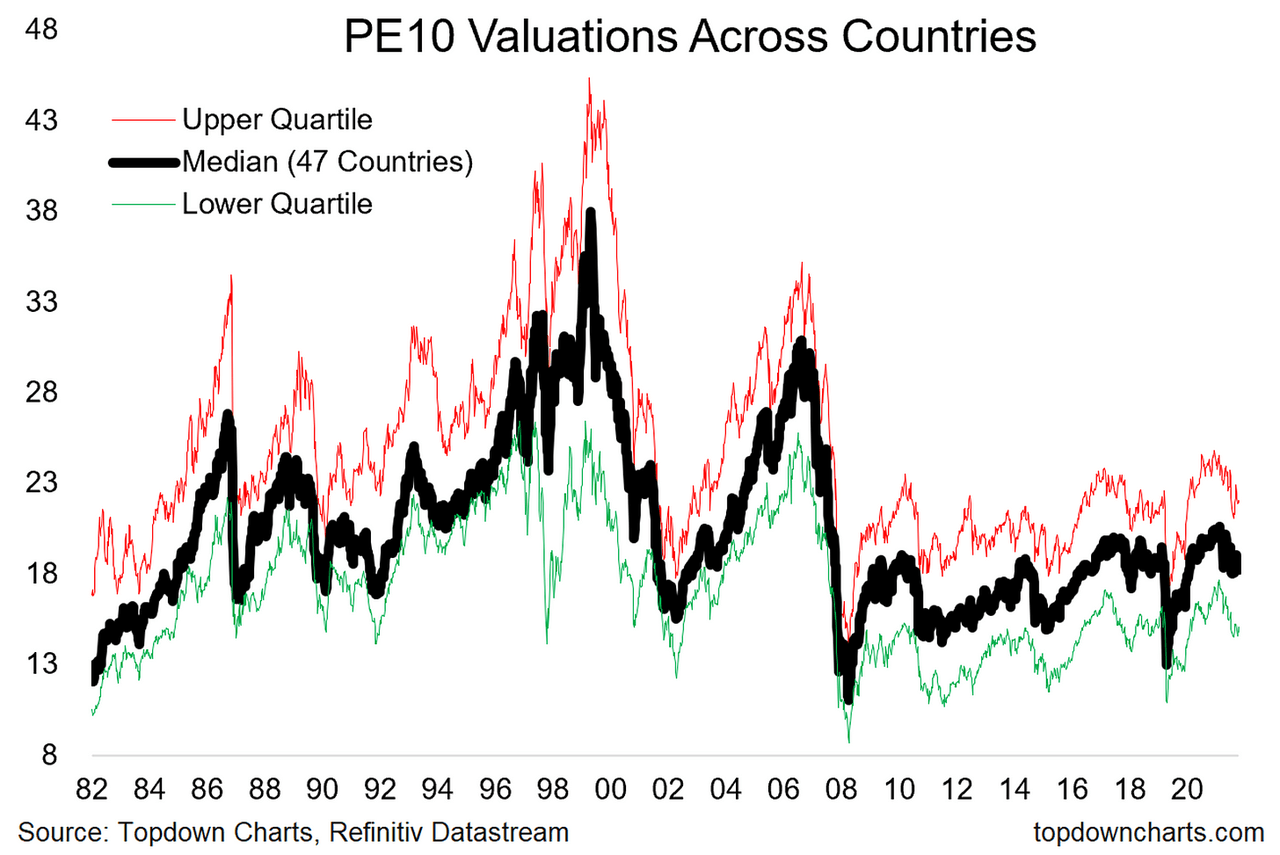

Historical Context: While valuations are high, they haven't reached unprecedented levels in all sectors. BofA's analysis considers historical context to put current valuations in perspective.

-

Long-Term Perspective: Short-term market volatility is inevitable. A long-term perspective is essential for weathering these fluctuations and benefiting from long-term growth.

-

Avoiding Emotional Decisions: Impulsive reactions based on fear are detrimental to long-term investment success. Careful analysis and a well-defined strategy are crucial to avoid emotional investing. Keywords: market volatility, investor anxiety, market correction, long-term investing strategy, emotional investing.

Conclusion: BofA's Reassurance and a Call to Action

BofA's analysis suggests that while stock market valuations are high, they are not necessarily a cause for immediate alarm. Several fundamental factors support these valuations, and the bank remains optimistic about long-term growth potential. However, a robust risk management strategy incorporating diversification, focus on quality, regular rebalancing, and potentially value investing strategies, remains crucial. Don't let high stock market valuations deter you from investing strategically. Understand BofA's analysis and consider your own long-term investment goals. Conduct your own research and consult with a financial advisor before making any investment decisions. Keywords: BofA investment strategy, high valuation stocks, long-term investment strategy, financial advisor, investment planning.

Featured Posts

-

Where To Invest Mapping The Countrys Promising Business Areas

May 09, 2025

Where To Invest Mapping The Countrys Promising Business Areas

May 09, 2025 -

Leon Draisaitl Injury Oilers Star Out Against Winnipeg

May 09, 2025

Leon Draisaitl Injury Oilers Star Out Against Winnipeg

May 09, 2025 -

New Uk Visa Regulations Curbing Misuse Of Work And Student Permits

May 09, 2025

New Uk Visa Regulations Curbing Misuse Of Work And Student Permits

May 09, 2025 -

Xay Dung Moi Truong An Toan Cho Tre Em Tai Co So Giu Tre Tu Nhan Ngan Chan Bao Hanh

May 09, 2025

Xay Dung Moi Truong An Toan Cho Tre Em Tai Co So Giu Tre Tu Nhan Ngan Chan Bao Hanh

May 09, 2025 -

The Posthaste Problem How High Down Payments Affect Canadian Homebuyers

May 09, 2025

The Posthaste Problem How High Down Payments Affect Canadian Homebuyers

May 09, 2025