BofA's Take: Why High Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Rationale: Understanding the Current Market Landscape

BofA's overall assessment of the current economic climate is nuanced. While acknowledging the elevated price levels, they point to several fundamental factors supporting these high stock market valuations. The current landscape isn't solely driven by speculation; rather, several key economic drivers contribute to the current situation.

These influencing factors include:

-

Low Interest Rates: Historically low interest rates make equities a more attractive investment compared to bonds. The low returns offered by fixed-income instruments push investors towards higher-yielding assets, including stocks. This increased demand contributes to higher valuations.

-

Robust Corporate Earnings: Strong corporate earnings are a crucial pillar supporting current price-to-earnings (P/E) ratios. Many companies have demonstrated resilience and even growth, justifying the higher valuations assigned to their stocks. This positive performance bolsters investor confidence.

-

Technological Advancements: Innovation and technological growth are driving future earnings expectations. The continuous advancements in sectors like technology, healthcare, and renewable energy fuel investor optimism about long-term growth potential, supporting higher valuations in these sectors. This expectation of future earnings is a key driver in current market conditions.

Addressing the "Overvalued" Narrative: Why Metrics Can Be Misleading

The narrative surrounding "overvalued" markets often relies on traditional valuation metrics like the P/E ratio and the Shiller P/E (CAPE). However, BofA suggests these metrics may be misleading in the current environment.

-

Limitations of Traditional Metrics: Traditional metrics often fail to account for future growth potential. A high P/E ratio might seem alarming, but if a company is poised for significant expansion, the current valuation might be entirely justified.

-

The Importance of Forward-Looking Metrics: BofA emphasizes the importance of forward-looking metrics, such as discounted cash flow analysis. These methods attempt to predict future cash flows and discount them back to their present value, offering a more nuanced assessment of a company's true worth.

-

Industry-Specific Valuations: General market averages can be deceptive. Instead of focusing solely on broad market indices, investors should consider industry-specific valuations. Certain sectors might be overvalued, while others offer better value propositions. Understanding this nuance is critical for informed decision-making.

The Importance of Long-Term Investing in a High-Valuation Market

Despite the perceived risks associated with high stock market valuations, BofA highlights the crucial role of a long-term investment strategy.

-

Weathering Market Fluctuations: Long-term investors are better equipped to handle market volatility. Short-term fluctuations are less impactful on long-term returns, allowing investors to ride out market corrections and benefit from the eventual growth.

-

Focus on Fundamentals: Instead of reacting to daily market swings, long-term investors should focus on the fundamentals of individual companies—their financial health, competitive advantages, and long-term growth prospects.

-

Dollar-Cost Averaging: Dollar-cost averaging (DCA) is a valuable tool for mitigating the risk of investing in a high-valuation market. This strategy involves investing a fixed amount at regular intervals, regardless of market price, reducing the impact of volatility.

BofA's Strategic Recommendations for Investors

Based on their analysis of the current market and high stock market valuations, BofA suggests a multi-pronged investment approach:

-

Diversification: Diversification across different asset classes (stocks, bonds, real estate, etc.) is crucial to mitigate risk. Don't put all your eggs in one basket.

-

Growth Sectors: BofA encourages consideration of investments in growth sectors with strong future potential, acknowledging that some sectors are naturally valued higher due to future expectations. Thorough research into these sectors is essential.

-

Portfolio Review: Regularly review and adjust your portfolio based on market conditions and your own financial goals. This ongoing evaluation ensures your investment strategy remains aligned with your objectives.

Navigating High Stock Market Valuations with Confidence

In conclusion, while high stock market valuations might initially appear concerning, BofA's analysis reveals a more optimistic outlook. By understanding the factors driving current market conditions, employing a long-term investment approach, and focusing on forward-looking metrics, investors can navigate this market with greater confidence. Remember, managing high stock market valuations successfully involves a sound investment strategy, diversification, and a long-term perspective. Seek professional financial advice tailored to your circumstances and consider BofA's insights when making investment decisions. Understanding high stock market valuations and investing in a high-valuation market successfully requires careful planning and a long-term view.

Featured Posts

-

The Future Of Marvel Addressing Fan Concerns And Expectations

May 05, 2025

The Future Of Marvel Addressing Fan Concerns And Expectations

May 05, 2025 -

Open Ai Faces Ftc Investigation Understanding The Potential Consequences

May 05, 2025

Open Ai Faces Ftc Investigation Understanding The Potential Consequences

May 05, 2025 -

Millions In Losses Fbi Probes Office365 Executive Account Breaches

May 05, 2025

Millions In Losses Fbi Probes Office365 Executive Account Breaches

May 05, 2025 -

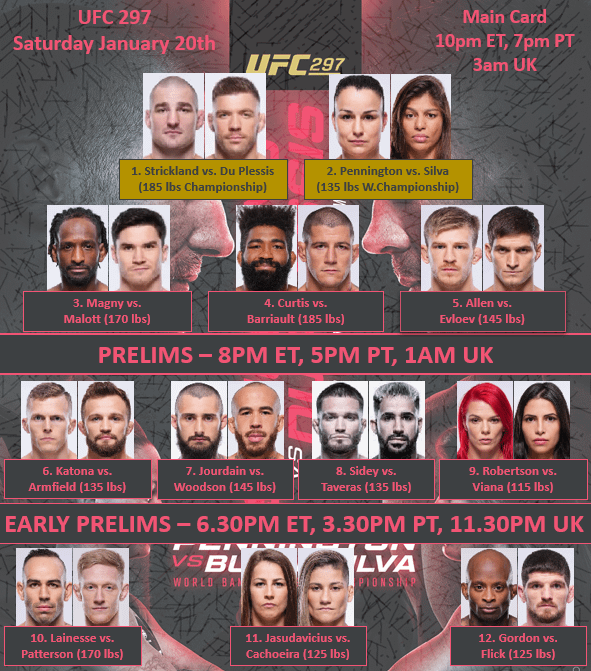

Ufc 314 Official Bout Order For Main Card And Prelims Revealed

May 05, 2025

Ufc 314 Official Bout Order For Main Card And Prelims Revealed

May 05, 2025 -

Narco Submarines And High Potency Cocaine Driving The Global Epidemic

May 05, 2025

Narco Submarines And High Potency Cocaine Driving The Global Epidemic

May 05, 2025

Latest Posts

-

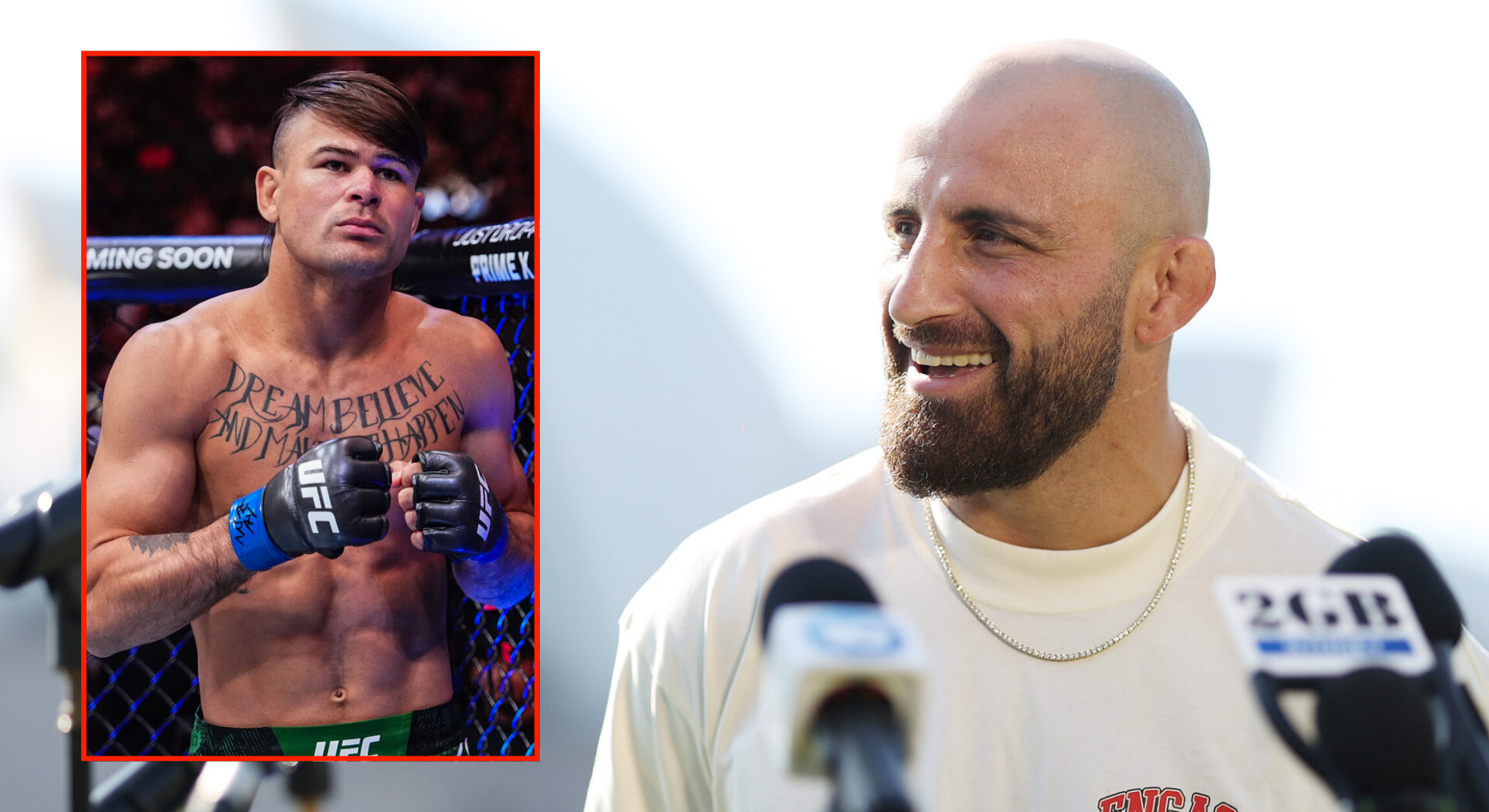

Pimblett Raises Concerns About Chandlers Conduct Before Ufc 314 Bout

May 05, 2025

Pimblett Raises Concerns About Chandlers Conduct Before Ufc 314 Bout

May 05, 2025 -

Ufc 314 Pimbletts Pre Fight Concerns About Chandlers Fighting Style

May 05, 2025

Ufc 314 Pimbletts Pre Fight Concerns About Chandlers Fighting Style

May 05, 2025 -

Paddy Pimblett Calls Out Michael Chandlers Dirty Fighting Ahead Of Ufc 314

May 05, 2025

Paddy Pimblett Calls Out Michael Chandlers Dirty Fighting Ahead Of Ufc 314

May 05, 2025 -

Ufc 314 Ppv Card Changes Prates Vs Neal Fight Cancelled

May 05, 2025

Ufc 314 Ppv Card Changes Prates Vs Neal Fight Cancelled

May 05, 2025 -

Volkanovski Vs Lopes Ufc 314 A Complete Breakdown Of The Results

May 05, 2025

Volkanovski Vs Lopes Ufc 314 A Complete Breakdown Of The Results

May 05, 2025