BofA's View: Why Current Stock Market Valuations Shouldn't Deter Investors

Table of Contents

BofA's Positive Outlook: A Foundation for Continued Investment

BofA's overall market prediction is cautiously optimistic. Their analysis suggests continued, albeit potentially slower, growth in the coming years, fueled by several key factors. This positive outlook on current market conditions forms the foundation for their recommendation that investors maintain their positions. Their reasoning is based on a combination of macroeconomic indicators and sectoral analysis.

- Specific predictions: BofA projects average annual market growth of [Insert BofA's projected growth percentage]% over the next three years, with potential for higher returns in specific sectors. (Note: Replace bracketed information with actual data from BofA's reports).

- Promising sectors: BofA identifies technology, healthcare, and renewable energy as particularly promising sectors, citing robust growth potential driven by innovation and increasing demand.

- Supporting economic indicators: BofA's positive outlook is underpinned by predictions of sustained GDP growth (cite specific prediction), a gradual decline in inflation (cite specific prediction), and continued strength in the labor market (cite specific prediction). These indicators suggest a healthy economic environment conducive to stock market growth, despite concerns about current stock market valuations.

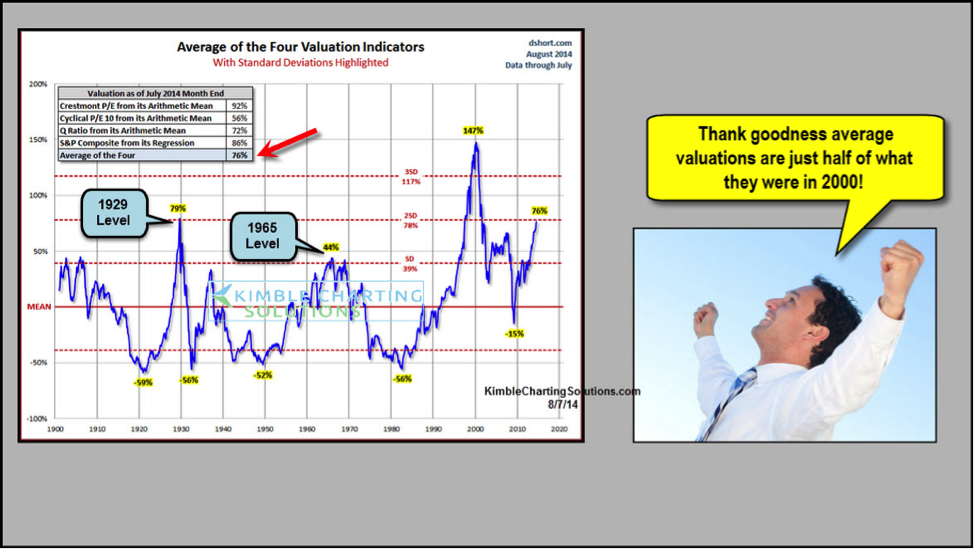

Addressing Concerns about High Stock Market Valuations

The concern about overvalued stocks is valid and widely shared. Many investors are worried about the current market conditions. However, BofA counters this concern by pointing to several factors.

BofA's counterarguments focus on the nuanced interpretation of valuation metrics. While price-to-earnings ratios (P/E) might appear high, the firm argues that these need to be considered in context.

- Low interest rates: Persistently low interest rates continue to impact valuations. Lower borrowing costs encourage companies to invest and expand, leading to higher earnings and potentially justifying higher price multiples.

- Corporate earnings growth: BofA emphasizes the continued, albeit potentially slower, growth in corporate earnings. Strong earnings growth can offset seemingly high valuations, making current prices justifiable in the long term.

- Addressing potential risks: BofA acknowledges potential risks, including inflation volatility and geopolitical uncertainty. However, their analysis incorporates these risks, suggesting that their optimistic outlook remains valid even when accounting for these potential downsides.

The Importance of Long-Term Investing Strategies in the Face of Volatility

The key to successfully navigating current market conditions, and indeed any market cycle, is a robust long-term investment strategy. Short-term market fluctuations, driven by daily news cycles and investor sentiment, should not dictate long-term investment decisions.

- Diversification and risk management: A well-diversified portfolio across different asset classes and sectors mitigates risk and enhances resilience to market corrections.

- Individual financial goals: Investment strategies should align with individual financial goals, risk tolerance, and time horizon. A younger investor might tolerate higher risk for potentially greater long-term returns than someone nearing retirement.

- Weathering market corrections: Having a clearly defined plan for navigating market downturns is crucial. This might include strategies like dollar-cost averaging or rebalancing your portfolio periodically. Understanding how to react to shifts in investor sentiment is critical.

Specific Sectors BofA Recommends for Investment

BofA's analysis highlights specific sectors that are well-positioned for growth, even amidst concerns about stock market valuations.

- Technology: Continued innovation, particularly in areas like artificial intelligence and cloud computing, makes the technology sector attractive for long-term investment. Specific companies mentioned by BofA should be listed here (cite sources).

- Healthcare: An aging global population and ongoing advancements in medical technology fuel consistent demand and growth within the healthcare sector. Mention specific sub-sectors like pharmaceuticals or biotech (cite sources).

- Renewable Energy: The global shift toward cleaner energy sources presents significant opportunities for growth and potential high returns in the renewable energy sector. Mention specific companies or trends within this sector (cite sources). This sector also is less sensitive to many macro-economic factors affecting investor sentiment.

Conclusion: Investing Wisely Despite Current Stock Market Valuations

BofA's analysis suggests that while current stock market valuations might appear high, several factors, including low interest rates, ongoing corporate earnings growth, and a positive macroeconomic outlook, support a cautiously optimistic view. Despite the volatility inherent in the market, BofA's positive outlook on current market conditions suggests that a long-term investment strategy remains a viable approach. Remember to diversify your portfolio, manage your risk effectively, and align your investment decisions with your individual financial goals and risk tolerance. Don't let current stock market valuations discourage you from participating in the market. Conduct thorough research and consult with a financial advisor before making any investment decisions. Learn more about BofA's view on current stock market valuations by visiting [insert link to relevant BofA resources].

Featured Posts

-

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Jan 6th Falsehoods

May 18, 2025

Trump Supporter Ray Epps Defamation Lawsuit Against Fox News Jan 6th Falsehoods

May 18, 2025 -

Kalorama 2025 Pet Shop Boys Fka Twigs Jorja Smith And Father John Misty Lead The Lineup

May 18, 2025

Kalorama 2025 Pet Shop Boys Fka Twigs Jorja Smith And Father John Misty Lead The Lineup

May 18, 2025 -

Suksesi I Granit Xhakes Si Mesfushor Ne Bundeslige

May 18, 2025

Suksesi I Granit Xhakes Si Mesfushor Ne Bundeslige

May 18, 2025 -

Angels Late Game Meltdown Tatis Jr Delivers Walk Off Win For Padres

May 18, 2025

Angels Late Game Meltdown Tatis Jr Delivers Walk Off Win For Padres

May 18, 2025 -

Maneskins Damiano Davids Jimmy Kimmel Live Performance A Radio 94 5 Recap

May 18, 2025

Maneskins Damiano Davids Jimmy Kimmel Live Performance A Radio 94 5 Recap

May 18, 2025

Latest Posts

-

Riley Greenes Historic Night Two Home Runs In The Final Inning

May 18, 2025

Riley Greenes Historic Night Two Home Runs In The Final Inning

May 18, 2025 -

Detroit Tigers Riley Greenes Historic Two Home Run Ninth Inning

May 18, 2025

Detroit Tigers Riley Greenes Historic Two Home Run Ninth Inning

May 18, 2025 -

Riley Greene Mlb History Maker With Two 9th Inning Home Runs

May 18, 2025

Riley Greene Mlb History Maker With Two 9th Inning Home Runs

May 18, 2025 -

White Sox Fall To Angels 1 0 Sorianos Outstanding Performance

May 18, 2025

White Sox Fall To Angels 1 0 Sorianos Outstanding Performance

May 18, 2025 -

1 0 Victory For Angels Sorianos Masterful Pitching Silences White Sox

May 18, 2025

1 0 Victory For Angels Sorianos Masterful Pitching Silences White Sox

May 18, 2025