BRB's Banco Master Acquisition: A Challenger Emerges In Brazil's Financial Landscape

Table of Contents

BRB's Strategic Rationale Behind the Banco Master Acquisition

BRB's acquisition of Banco Master is not a random move; it's a carefully calculated strategy aiming for significant growth and market dominance. Several key factors drove this decision.

Expanding Market Share and Geographic Reach

BRB, a prominent player primarily in the Brasilia region, recognized the need for national expansion. The BRB Banco Master acquisition provides immediate access to Banco Master's established client base and extensive branch network across Brazil. This significantly accelerates BRB's growth plans and ambitions.

- Increased customer base in new geographic areas: Access to new markets expands BRB's potential customer base exponentially.

- Access to a wider range of banking products and services: Banco Master's existing product portfolio complements and expands BRB’s offerings, creating a more comprehensive suite for customers.

- Enhanced brand recognition and market visibility: The acquisition instantly boosts BRB's brand awareness and visibility nationwide, elevating its status as a major financial player.

Synergies and Operational Efficiencies

The BRB and Banco Master merger is expected to generate considerable synergies, leading to improved operational efficiencies and cost savings. This is a key driver behind the acquisition's strategic value.

- Reduced operational costs through consolidation: Combining infrastructures, streamlining processes, and eliminating redundancies leads to significant cost reductions.

- Improved technological infrastructure and digital banking capabilities: Integrating technological resources creates a more robust and efficient digital banking platform for customers.

- Enhanced customer service and support through combined resources: A larger workforce and combined resources allow for improved customer service and quicker response times.

Strengthening BRB's Competitive Position

The BRB Banco Master acquisition significantly strengthens BRB's competitive position against larger, more established Brazilian banks. This acquisition provides the resources and expertise to better compete for market share.

- Increased competitive pricing and product offerings: A larger scale allows BRB to offer more competitive pricing and a wider range of financial products.

- Improved ability to attract and retain customers: A stronger brand and wider service offering makes BRB a more attractive choice for customers.

- Enhanced innovation and product development capabilities: Access to Banco Master's expertise and resources fosters innovation and accelerates product development.

Impact on the Brazilian Financial Market

The BRB Banco Master acquisition has significant implications for the broader Brazilian financial market.

Increased Competition and Consumer Benefits

Increased competition is a major consequence of the BRB Banco Master merger. This benefits consumers through improved products, services, and pricing.

- More competitive interest rates on loans and savings accounts: Increased competition forces banks to offer more attractive rates to customers.

- Wider range of financial products and services: The combined entity offers a wider variety of financial products catering to diverse customer needs.

- Improved customer service and responsiveness: Increased competition encourages banks to improve customer service and responsiveness.

Potential Consolidation and Restructuring

The BRB Banco Master acquisition could trigger further consolidation within the Brazilian banking sector. Other institutions might seek similar mergers to enhance their competitive positions.

- Potential for future mergers and acquisitions within the sector: This acquisition sets a precedent, likely encouraging other mergers and acquisitions.

- Increased regulatory scrutiny of banking activities: Increased consolidation might lead to more stringent regulatory oversight.

- Potential impact on employment within the banking industry: Consolidation may result in restructuring and potential job displacement in some areas.

Future Outlook for BRB and Banco Master

The success of the BRB Banco Master acquisition hinges on effective integration and a clear long-term strategy.

Integration Challenges and Opportunities

Integrating Banco Master into BRB’s operations presents both challenges and opportunities. Successful integration is key to realizing the deal's full potential.

- Challenges in integrating different IT systems and processes: Harmonizing different IT systems and operational processes requires careful planning and execution.

- Opportunities to leverage Banco Master’s expertise and resources: Banco Master's established expertise and resources provide valuable opportunities for BRB.

- Need for effective change management and employee communication: Clear communication and effective change management are crucial for a smooth transition.

Long-Term Growth Strategy

The BRB Banco Master acquisition is a cornerstone of BRB's long-term growth strategy, aiming to establish it as a leading financial institution in Brazil.

- Continued expansion into new markets and customer segments: BRB is poised for further expansion based on the success of this acquisition.

- Investment in new technologies and digital banking solutions: Investing in technology will further enhance efficiency and customer experience.

- Focus on delivering exceptional customer experiences: A customer-centric approach will be crucial for continued success.

Conclusion

BRB's acquisition of Banco Master represents a significant development in Brazil's dynamic financial landscape. The BRB Banco Master acquisition positions BRB as a formidable competitor, offering potential benefits to consumers through increased competition and a broader range of financial services. While integration challenges exist, the acquisition presents considerable opportunities for long-term growth and market leadership for BRB. To stay informed about the latest developments in this evolving market, continue to follow updates on the BRB Banco Master acquisition and its impact on the Brazilian financial sector. Understanding the implications of the BRB and Banco Master merger is crucial for anyone interested in the future of Brazilian finance.

Featured Posts

-

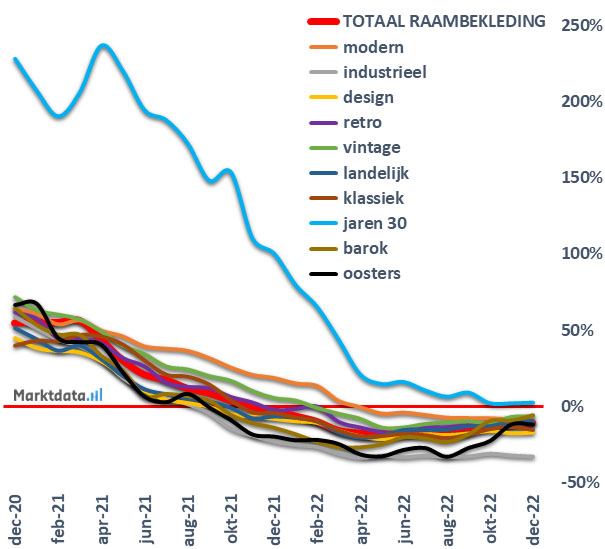

Live Marktdata Kapitaalmarktrentes En Euro Dollar Koersanalyse

May 25, 2025

Live Marktdata Kapitaalmarktrentes En Euro Dollar Koersanalyse

May 25, 2025 -

Discover The Top R And B Songs Leon Thomas And Flos New Music

May 25, 2025

Discover The Top R And B Songs Leon Thomas And Flos New Music

May 25, 2025 -

Porsche Classic Art Week Indonesia 2025 Seni Dan Otomotif Berkolaborasi

May 25, 2025

Porsche Classic Art Week Indonesia 2025 Seni Dan Otomotif Berkolaborasi

May 25, 2025 -

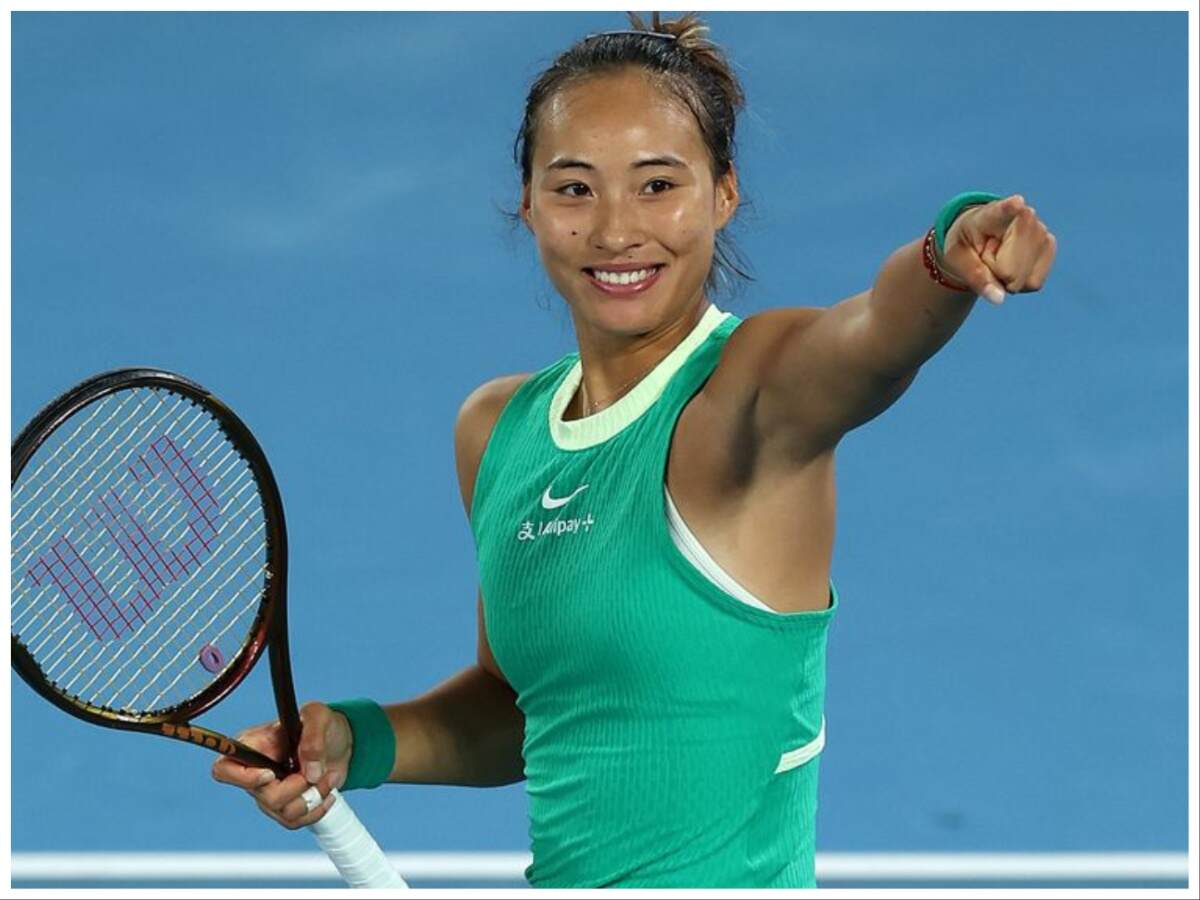

Italian Open Zheng Qinwens Semifinal Run After Sabalenka Upset

May 25, 2025

Italian Open Zheng Qinwens Semifinal Run After Sabalenka Upset

May 25, 2025 -

National Rallys Le Pen Support Rally A Disappointing Turnout

May 25, 2025

National Rallys Le Pen Support Rally A Disappointing Turnout

May 25, 2025