BSE Shares To Rise On Strong Earnings: Market Rally Predicted

Table of Contents

Strong Q3 Earnings Fueling the BSE Rally

Positive financial results reported by major BSE-listed companies in the recent quarter are a key driver of the anticipated market rally. These strong Q3 earnings reflect robust corporate profits and significant profit growth, significantly impacting the BSE index and overall stock market performance.

- Exceptional Profit Margins and Revenue Increases: Several prominent companies across diverse sectors have reported exceptional profit margins and substantial revenue increases, exceeding market expectations. For example, [insert example of a company and its performance – e.g., "Infosys exceeded analyst predictions, posting a 20% increase in quarterly profits"]. This strong performance signals a healthy corporate sector and fuels investor confidence.

- Impact on Investor Sentiment and Market Confidence: The positive earnings announcements have boosted investor sentiment, leading to increased market confidence and a more bullish market outlook. This positive sentiment is translating into increased trading volume and higher stock prices across various sectors.

- Outperforming Sectors: The technology, pharmaceutical, and FMCG sectors are among the top performers, showing particularly strong growth in Q3 earnings. These sectors are expected to continue their upward trajectory, contributing significantly to the overall BSE rally.

Positive Economic Indicators Boosting Investor Confidence

Positive economic indicators are further bolstering investor confidence and contributing to the predicted BSE share price increase. Stable economic growth, coupled with reduced inflation and stable interest rates, creates a favorable environment for stock market investments.

- Impact of Government Policies: The government's focus on [mention specific government policies that are positively impacting the economy e.g., infrastructure development or fiscal reforms] is contributing to economic stability and fostering investor confidence. These policies create a positive feedback loop, stimulating economic growth and boosting the stock market.

- Global Economic Conditions: While global economic uncertainty remains, the resilience of the Indian economy and its positive growth trajectory are attracting significant foreign investment, further supporting the BSE's upward trend. Positive global sentiment towards emerging markets is also contributing to this positive outlook.

- Positive Forecasts from Analysts: Leading economic analysts are predicting continued economic growth for India, forecasting a [insert GDP growth forecast] GDP growth for the next fiscal year. These positive forecasts reinforce the bullish market sentiment and support the prediction of a sustained BSE rally.

Technical Analysis Suggests an Upward Trend for BSE Shares

Technical analysis of the BSE index points towards a continuing upward trend for BSE shares. Several key indicators and chart patterns suggest a bullish market outlook.

- Bullish Chart Patterns: The BSE index exhibits several bullish chart patterns, such as [mention specific patterns, e.g., "bullish flags and rising wedges"], which are typically indicative of a sustained upward trend in stock prices. These patterns suggest that the current rally has further momentum.

- Trading Volume and Price Movements: Increased trading volume accompanying the price increases confirms the strength of the rally and suggests strong investor demand for BSE shares. High trading volumes coupled with upward price movements signal a healthy and sustained market trend.

- Support and Resistance Levels: While identifying precise support and resistance levels requires detailed technical analysis, currently, [mention potential support and resistance levels] are key levels to monitor. Breaking above resistance levels would strongly confirm the bullish trend and potential for further gains.

Sector-Specific Analysis: Identifying Top Performers

Sectoral analysis indicates that certain sectors are poised to lead the BSE rally. A detailed examination of individual sectors reveals promising investment opportunities.

- Technology: The technology sector is expected to continue its strong performance due to [mention specific reasons e.g., increased digital adoption and government initiatives]. Specific companies within this sector present compelling investment opportunities.

- Pharmaceuticals: The pharmaceutical sector is benefiting from [mention specific factors e.g., increased demand for healthcare products and government support for the industry]. Strong earnings and a positive outlook suggest continued growth in this sector.

- FMCG: The fast-moving consumer goods (FMCG) sector is showing resilience and growth due to [mention specific reasons e.g., rising consumer spending and a robust domestic market].

Conclusion

The predicted rise in BSE shares is driven by a confluence of factors: strong Q3 earnings, positive economic indicators, and supportive technical analysis. These elements combine to create a compelling case for a significant market rally. The potential for significant market gains is considerable, especially in specific high-growth sectors.

Don't miss out on this potential market boom! Learn more about investing in BSE shares and explore profitable investment opportunities today. [Link to relevant resource]

Featured Posts

-

Office365 Security Breach Executive Inboxes Targeted Millions Stolen

May 07, 2025

Office365 Security Breach Executive Inboxes Targeted Millions Stolen

May 07, 2025 -

Hqayq Ghyr Merwft En Jaky Shan Mn Mshwarh Alsynmayy Ila Hyath Alshkhsyt

May 07, 2025

Hqayq Ghyr Merwft En Jaky Shan Mn Mshwarh Alsynmayy Ila Hyath Alshkhsyt

May 07, 2025 -

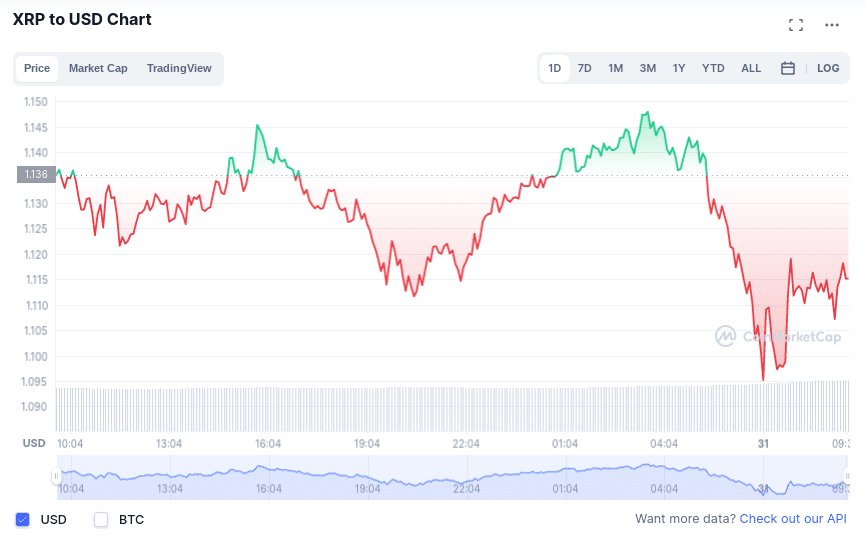

A Comprehensive Guide To Investing In Xrp Ripple

May 07, 2025

A Comprehensive Guide To Investing In Xrp Ripple

May 07, 2025 -

Trumps Crypto Fortune From Scoffing To Millions

May 07, 2025

Trumps Crypto Fortune From Scoffing To Millions

May 07, 2025 -

Xrp Investment Surge Analyzing The Impact Of Trumps Endorsement

May 07, 2025

Xrp Investment Surge Analyzing The Impact Of Trumps Endorsement

May 07, 2025

Latest Posts

-

Timberwolves Vs Lakers Anthony Edwards Injury Report And Game Status

May 07, 2025

Timberwolves Vs Lakers Anthony Edwards Injury Report And Game Status

May 07, 2025 -

Official Rsmssb Exam Calendar 2025 26 Download Now

May 07, 2025

Official Rsmssb Exam Calendar 2025 26 Download Now

May 07, 2025 -

Anthony Edwards Injury Status Latest News On His Availability For Lakers Game

May 07, 2025

Anthony Edwards Injury Status Latest News On His Availability For Lakers Game

May 07, 2025 -

Rsmssb Exam Dates 2025 26 Check The Latest Schedule

May 07, 2025

Rsmssb Exam Dates 2025 26 Check The Latest Schedule

May 07, 2025 -

Anthony Edwards Injury Update Will He Play In Timberwolves Lakers Game

May 07, 2025

Anthony Edwards Injury Update Will He Play In Timberwolves Lakers Game

May 07, 2025